Introduction

Structured products are complex OTC derivatives which offer a glance into some of the deeper aspects of pricing; they are hedged with vanilla products where possible, almost always leaving basis risk, the management of which is the art of making markets in SPs. These products are very useful to express highly specific ideas about the distribution of prices and returns which would be much more unwieldy to trade in their absence.

In this article we’ll explain the basic theory underlying structured credit products called ‘Constant Maturity Swaps’ and propose a trade using them to profit from our view that a steepening of the Euribor swap curve is likely due to the ECB winding down its pandemic emergency purchase program (PEPP).

The Theory

An interest rate swap is an agreement to exchange streams of interest payments on a notional amount at regular intervals. A typical swap exchanges a fixed rate a.k.a. the “swap rate” for a floating rate based on a benchmark e.g., 3-month LIBOR + 25bps, with the swap rate being set such that the swap has NPV = 0 i.e. PV(fixed rate cash flows) = E(PV(floating rate cash flows)), which are implied by the forward LIBOR curve as there must be no arbitrage with forward rate agreements, therefore the swap rate is a geometric average of the forward rates.

The price of the swap then varies as expectations for forward rates change, with a decrease benefitting the fixed receiver and vice versa. To exit a long (short) swap position the trader must enter a short (long) position in the same swap, but at the new swap rate, thereby locking in profits or losses and hedging their exposure.

The swap curve plots the swap rate for a given swap e.g., a 10-year treasury swap, for each tenor (maturity) available for said swap. It reflects forward rate expectations and any counterparty credit risk, so it generally has the same shape as the underlying yield curve.

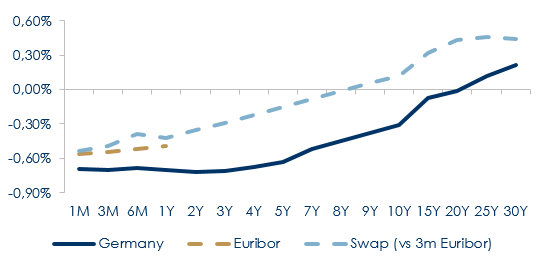

European yield curves comparison – Still space for steepening

Source: Bloomberg

A constant maturity swap (CMS) takes the prevailing swap rate at a specified (constant) tenor as the reference rate for at least one of its legs, allowing us to trade the swap and yield curves very directly. In a steepening (e.g. long-term swap rates increase past forward expectations) one would want to receive the CMS rate, while in a flattening one would want to pay it.

The value of a CMS is more complicated than that of a vanilla swap, due to their unnatural payment schedule (a longer maturity swap rate is exchanged at shorter time intervals), introducing convexity. Thus, pricing a CMS over time (a spread is added to the rates s.t. swap value is zero at inception) requires an interest rate model (to account for forward rates’ volatilities and correlations), or at least a convexity adjustment.

A CMS can be hedged with swaptions but not vanilla swaps due to its convexity, but to do so we need to simulate every yield curve scenario according to some interest rate model. This means that since swaption prices are available in the market, the price of CMS derivatives will be consistent with other instruments and will price the same implied volatilities and skew as the swaptions. [1]

Another way to look at a CMS is as a series of Differential Interest Rate Fixes, which are effectively OTC cash-settled forwards on the difference between two points on a yield curve. A CMS can be thought of as the proportion of present value weighted average of the compatible DIRFS. For example, if a 6mo DIRF between 3y swap and 10y swap is 100bp, and a 12mo DIRF 3y vs. 10y is 150bp, a 1yr CMS 3y vs. 10y would be priced at around 117bp.

The Trade – Rationale

On September 9th the ECB decided to slow PEPP, the move was widely anticipated but marks a significant moment as peak QE is now in the past. The ECB opted for a ‘moderately lower’ pace of PEPP than the c. €80bn during Q2 and Q3, this likely translates into a monthly target pace of around €70bn, while to fully use the €1.875bn PEPP a monthly average of €73bn would be required (so it can’t increase.) The dovish market reaction was probably caused by expectations that were skewed towards €60bn/mo rather than €70bn/mo.

There will likely be a further reduction in PEPP pace during Q1-22 towards a monthly €60bn to smooth the transition to APP alone. At that point APP could double to €40bn, but even then, this implies a huge drop in asset purchases in Q2-22. The combined PEPP/APP pace would fall from around €100bn in Q3-21, to €90bn in Q4-21 to €80bn in Q1-22 to €40bn in Q2-22. The bigger decisions were deferred to December, as was widely expected. In our view, the market is not currently looking far ahead, and it is likely it will refocus on the potential cliff in asset purchases in the run up to that meeting, therefore a selloff could occur in late Q4-21/ Q1-22.

There is still downside to the trade as, despite Lagarde’s clear decision to end PEPP, the discussion on how to end it has been deferred to December, as well as the ‘terms & conditions’ for APP from then on, including issuer limits and the capital key.

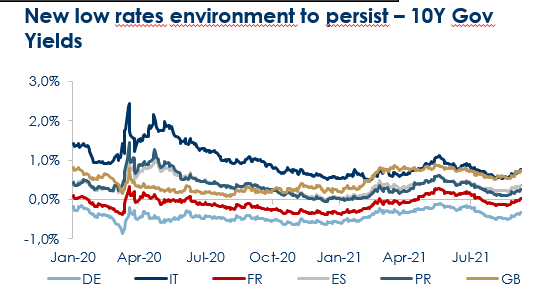

10Y Gov yields – Surely the low rates will persist, but for how long?

Source: Bloomberg. Red zone highlights rising breakevens

Another key piece of support to our thesis is rising inflation expectations. Still, the upward revision of the core inflation forecast keeps any thoughts of rate hikes firmly off the radar, further confirmed by Lagarde’s proclamation that policy tightening is “far away”. The decision to moderately reduce the pace of asset purchases was not justified merely on the ground of easier market conditions, but also very explicitly based on an improvement in the inflation outlook, we believe this could drive the long end higher. Though, that improvement is questionable if one considers the small increase in the end point of the ECB staff’s own inflation projection (still well short of the 2% statutory objective).

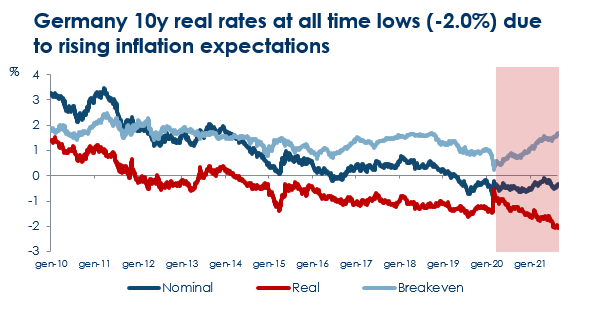

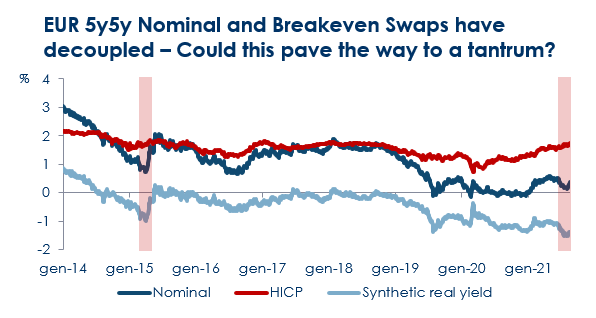

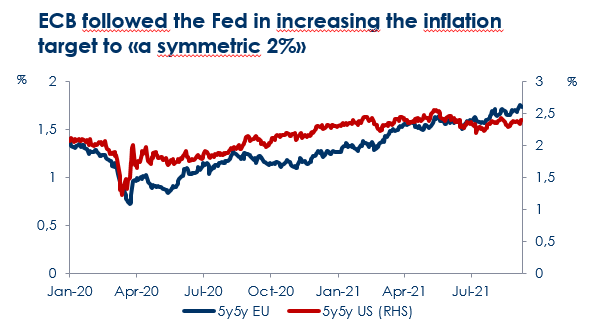

Breakevens have continued to grind higher, pushing both spot and forward real yields to historical lows. Markets expect higher inflation in future and Euro area breakevens have continued their relentless rally, led by the short end. Furthermore, 5y5y HICP swaps are currently trading at 1.75%, the higher end of their range since the end of 2014. Additionally, 5y5y nominal swaps have risen during the last month, now they trade at 0.42% from the lows of 0.14% of last month. We believe 5y5y HICP at elevated levels leaves the door open to another potential tantrum. In particular, a reversal in US duration could act as a catalyst in the absence of clarity regarding the future of PEPP/APP.

5y5y swaps – Synthetic real yields at historical lows

Source: Bloomberg. Red zones highlight the last tantrum and the current pattern

Surely, the ECB reinforced guidance creates an environment where nominal yields move very little until inflation embarks on a sustained path towards the 2% target, leading to a convex relationship between nominal yields and breakevens. The issue is the market prices a decent amount of forward inflation already, and the absence of reaction in nominal space so far does not mean yields will remain insensitive to a further rally in breakevens forever. Moreover, the FT recently reported that the ECB expects to hit its 2% inflation target by 2025, according to unpublished internal models that suggest it is on course to raise interest rates in just over two years. This would be at least a year earlier than most economists expect. The FT also reported that ECB’s longer term inflation outlook, which its chief economist Philip Lane discussed in a private call with the economists of German banks, would imply that a rate rise is likely by the end of 2023.

The ECB’s idea is to assign a less ambitious objective to asset purchases than interest rate policy, and more generally the role of asset purchases in monetary policy is becoming more marginal. The July meeting minutes reported that a “large majority” of members supported an amended version of the proposal put forward by ECB Board member Lane, which strengthened the criteria for rate lift-off. A few members dissented, noting insufficient safeguards against persistently overshooting the new inflation target. The new guidance was judged to potentially prolong the time until lift-off, while entailing the risk of a rapid increase in policy rates during an overshooting period. However, the Council judged these risks to be proportionate and expressed a clear preference for rate guidance over significant additional asset purchases or further rate cuts to attain the desired inflation impulse. Following the revision of rate guidance, we expect the front-end to be strongly anchored while as mentioned the risk remains for the long end into the December meeting.

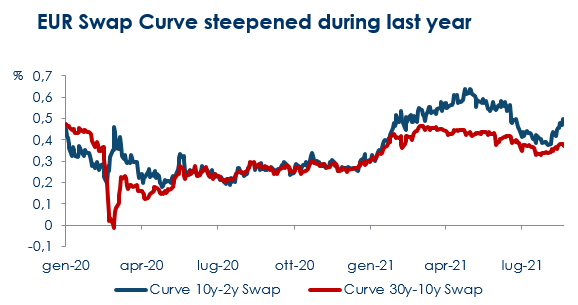

EUR Swap Curve steepened during 2020 – We believe this trend will persist

Source: Bloomberg

Another point is that, against the market’s expectations, the EU did not increase its 2021 long term funding target this week. It affirmed the €80bn target leaving it only c. €36bn of long-term funding to issue before the year-end. This implies that the EU’s long-term issuance will have to increase significantly next year. In 2021 EU’s total funding needs will likely amount to €170bn, of which c. €140bn will be funded with long-term debt, increasing pressure on long term yields.

Lastly, assuming an upsize in monthly APP pace to €40bn from April 2022 and €200bn in net TLTRO take-ups over September and December, liquidity would peak at more than €5tn in March 2022. Bidders of all TLTRO tranches will have the chance to repay ahead of the respective three-year expiries starting from June 2022, which also marks the end of the so-called ASRP – the period over which banks meeting their lending standards get to receive up to 100bp of interest on funds borrowed from the ECB. Following this, it is estimated that Q2 next year will most likely mark the beginning of a declining trend in the Eurosystem’s balance sheet for the first time since 2015, again driving the steepening of the yield curve.

The Trade – Pricing and Scenarios

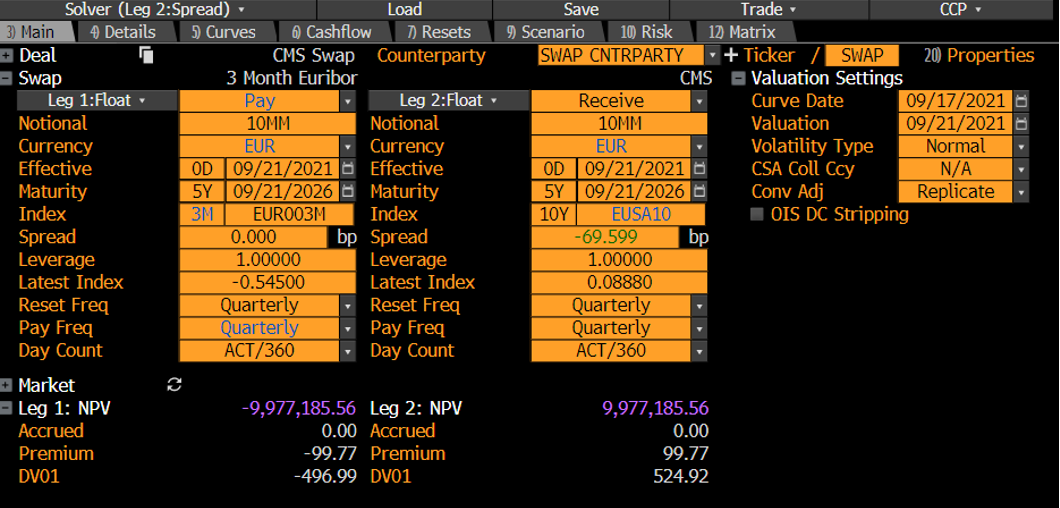

We propose entering a 5y CMS with quarterly resets and payments. The swap has null PV, so zero entry costs. The trade is shown on the following Bloomberg screen (at an indicative size of €10m) and has two floating legs:

- Pay 3m Euribor (EUR003M) + 70bps spread. 3m Euribor is currently at -55bps

- Receive the reference 10y swap rate for 6m Euribor (EUSA10), which now stands at 9bps

- The net (6bps) will be exchanged through the parties. With the current legs a quarterly P&L loss of around €1,500 will be accounted

Source: Bloomberg

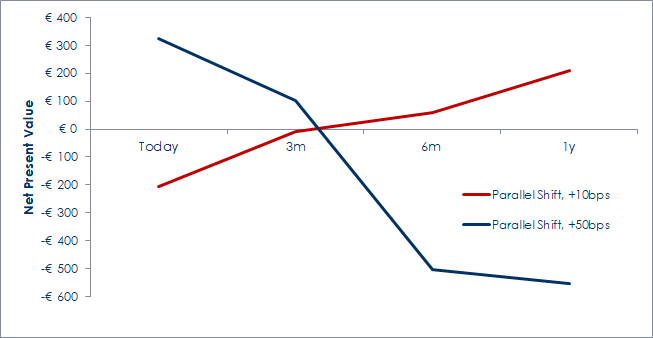

As shown both above and in the following simulations CMS is a highly efficient instrument to hedge against future interest rate rises. The CMS is not sensitive to parallel shift of the curve, given that both floating legs of the swap reset each period. It follows that CMS have limited DV01 (the dollar increases in value after a 1bp rise in rates) and their P&L derives mostly from the change in slope of the yield curve.

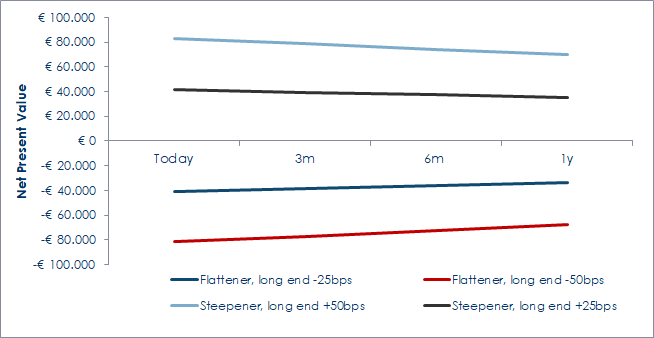

We analyze present value change because of steepening/flattening on various time horizons. The test is performed directly by Bloomberg predetermined shocks: a 25/50bps shock is described as a gradual steepening/flattening of the curve with final increase in the 30y+ region. More in detail, the BBG standard +50bps steepening long end shock implies: flat 3m Euribor; +8bps on 5y; +17bps on 10y; +25bps on 15y; +33bps on 20y; +50bps from 30y onwards. A +50bps steepening of the curve would increase the PV of the CMS by €70k-€83k (0.70% – 0.83% of the notional) depending on when it happens, while a – 50bps flattening would imply a loss between €68k-€82k (due to the CMS’ convexity.)

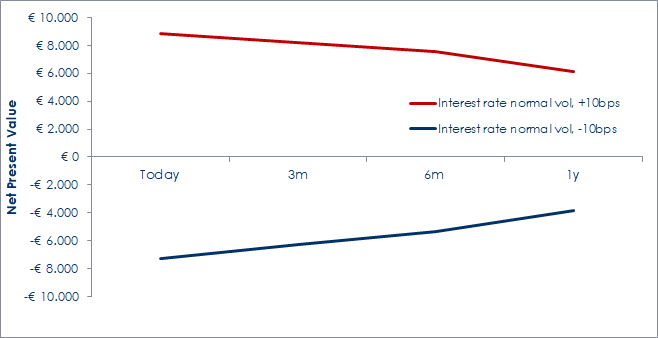

CMS are long rates implied volatility, in this case Vega is +€808/bp. The following scenario analysis shows a 10bps increase in interest rate vol increases the price of the CMS by €6k-€9k (depending on timing). The DV01 in this case is almost none at €28 on €10m notional, this is proved in the following simulations where the DV01 changes sign but is almost absent (a +50bps move implies <€500 move).

Simulations regarding the impact on Present Value at various time horizons – €10m notional

Source: Bloomberg

[1] A Review of CMS Swap Pricing Approaches by Marin Decaudaveine

0 Comments