Introduction

This article will analyze the significance of the systemic risk in the current economic environment, delving into the Evergrande crisis and its impact on the Chinese economy and investigating the potential loopholes from the private credit sector. Finally, we will present some econometric methods applied towards systemic risk.

Systemic risk refers to the danger or likelihood of systemic failures rather than failures in individual parts or components of a system. It can be interpreted as comovements among most parts of a system. As a result, high correlation and clustering of bank failures in a country, region, or globally indicate systemic risk in banking. We can observe systemic risk also in other sections of the financial sector, such as in securities markets, as indicated by simultaneous price decreases in a significant number of assets in one or more markets in a single nation or across countries.

Evergrande saga

Given that the real estate sector accounts for almost a quarter of the Chinese economy, the natural question that pops into our mind is how this crisis will affect the Chinese and global economy. Evergrande had to pay tens of millions of dollars in the past weeks for bond payments but is still far from getting on safe ground. To support a business strategy that relies on borrowing money to build homes, the corporation has continued to finance its debt at constantly growing short-term debt, a model that ultimately proved unsustainable. As the financial problems became crystal clear this year, its stock has fallen by more than 80% YTD, not giving any recovery signs yet. According to WSJ, Evergrande offloaded two of its private jets to meet vital bond payments in October, an action further highlighting its desperate situation. As a result of this ongoing uncertainty, the rating agencies downgraded the bonds.

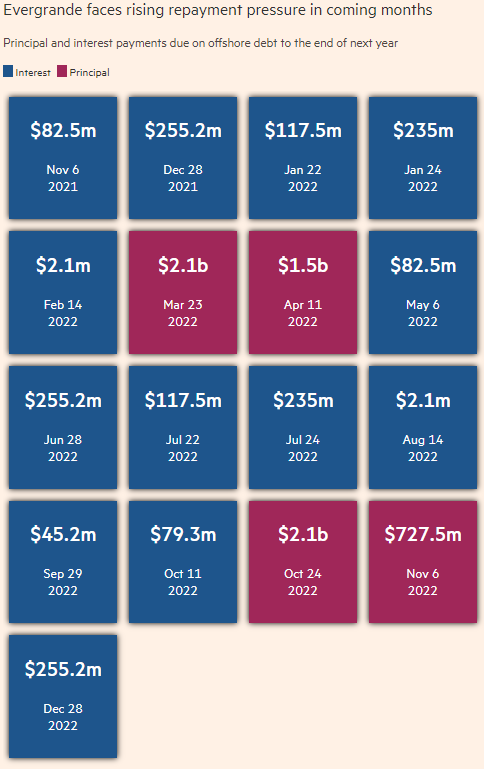

Although the People’s Bank of China reports that the spillover risks are under control, the debtholders are not convinced by this declaration, considering that the Chinese behemoth still faces several critical deadlines (see the figure below). An issue bothering the creditors is the opaque debt structure and the lack of transparency in the ability of the company to pay future coupons. Besides, Hong Kong’s Financial Reporting Council raised concerns about the reliability of the 2020 audits done by PwC (the regular auditor of Evergrande: their collaboration dates back to 2009), posing further questions around the trust in its accounting figures. Last year, the audited financial statements assessed Evergrande as a going concern (i.e., having the necessary resources for operating one more year), a judgment that contradicts the current reality.

Source: Financial Times

A potential Evergrande default would have far-reaching and long-lasting consequences. The real estate disorder would hit many parties, such as the consumers which will lose part of their trust in the Chinese authorities and the money on prepaid apartments. Suppliers and contractors of the real estate firm could go extinct in the absence of major future deliverables, whereas the financial system could also suffer. BBC reports that Evergrande allegedly owes money to around 171 domestic banks and 121 other financial firms. Thus, in a potential default case, a spillover effect is quite probable, given that the debt is unequally split among the banks and a high portion is owned by two commercial banks: Ping An Bank and Minsheng Bank. This possible collapse would lower the credit size made available by international investors and increase the cost of debt, making the Chinese investment opportunities less favorable and slowing down the growth of the communist country.

The issues of the Chinese real estate and financial sector, such as investment opaqueness, were raised a long time ago by economists (see this BSIC article); still, regulators didn’t adopt appropriate measures on time. In contrast, last year, the authorities introduced new rules aimed to control the capital owned by the major developers. As a response, Evergrande sold its properties at a discount to assure it had enough capital inflows. The main takeaway from this case is that regulators should better estimate the forces of the opaque economy and further promote transparency to obtain a clear overview of the financial system.

Private credit

Recently, Moody’s has pointed out the potential “systemic risks” from the private credit markets, while S&P global has also cautioned the public of “heightened risks” in the same sector. Thus, we decided to discuss where these risks could come from and how they could be mitigated.

Since the pandemic started, the private credit industry’s financing to buyout groups has continuously expanded, overcoming the threshold of $1 trillion. The boom in the private equity markets, limited financing from the banks, and high-growth conditions can explain the growth of alternative credit. The type of businesses that buy-side firms appeal to is small-sized ones that do not have access to the usual financing sources, such as US corporate bonds, but even some larger companies start to prefer direct lending. Below you can see a comparison between the two financing sources to understand the role played in the last decade as higher sources of returns in the portfolio allocation and as a way to raise debt for growing companies.

Source: Institutional Investor

The danger of the rise in private lending hides in the increasingly high leverage of the small companies that might not afford the harsher credit conditions once the rates go up. Furthermore, the development of private credit might stem optimal conditions for systemic risk, as regulators can rarely gain objective information about the private markets. Thus, it becomes harder to prevent a meltdown of the industry, as the data reliability will mostly be questionable. Furthermore, some parallels might be drawn to the past mortgage-based securities crisis that originated from a lack of transparency and dubious off-balance sheets agreement. Nonetheless, the recommendations of the two rating agencies should be taken with a grain of salt, given that they regularly compete with private lenders in their core business.

Econometric model

There are two main ways to assess the interconnections between financial institutions: a statistical analysis based on the financial series of the studied institutions and a mathematical model based on the banks’ financial statements figures, such as interbank liabilities.

Here we will consider the paper written by J. Etesami et. al. called ” Econometric Modeling of Systemic Risk: Going Beyond Pairwise Comparison and Allowing for Nonlinearity”. Using a nonlinearly modified Granger causality network, the authors build an econometric framework of the interaction between financial institutions. Through a time-varying network of links, the technique allows the presence of nonlinearity and provides predictive potential over future economic activity. It can quantify the interconnections between financial institutions. It is also illustrated how the model improves systemic risk monitoring and explains how the Granger causality network and the generalized variance decompositions network are linked.

Results

Below you can see the companies to which the proposed methods were applied with the scope to identify how connected were the financial institutions between 2006-2016.

Next, we can analyze the study results in terms of the connectedness of the institutions over the years. We can observe that the majority of connections were between insurance companies and banks between 2006 and 2011, while in the period 2011-2016, the majority switched to interbank connections. Moreover, we can notice that the interbank connectedness is in constant growth and that the brokerage sector tends to have the least connections. For more insights into the theory of the model, we recommend you read the entire paper.

Bibliography

[1] Jalal Etesami, Ali Habibnia, and Negar Kiyavash, Econometric Modeling of Systemic Risk: Going Beyond Pairwise Comparison and Allowing for Nonlinearity

[2] George G. Kaufman, and Kenneth E. Scott, What is Systemic Risk, and Do Bank Regulators Retard or Contribute to It?

0 Comments