Recently, there has been a slew of deals in the commercial real estate sector, with Blackstone being the most notable player. However, before analysing the reasoning behind these developments it is necessary to first understand the workings of the real estate private equity industry in its current form. Globally, real estate private equity firms (REPEs) operate in the same vein as traditional PE firms. REPEs leverage external Limited Partners’ capital to initially acquire existing or develop new properties. Going forward they then perpetually operate and enrich them to turn a profit within an average timespan of 4-6 years, an accelerated format in contrast to the “upwards [of] 7-10 years” Blackstone characterises as typical for private equity firms in the macro. REPEs are active in next to all segments of real estate ranging from office buildings to multifamily, but generally operate sans single-family and smaller scale residential projects. A notable exception to their aversion to these types of projects are large scale groupings of single-family properties in communities which can be bought and rented while also benefiting from appreciation, but this is to some extent niche. This is similar to some commercial projects such as grocery anchored real estate, which, as the name indicates, are characterised by a major grocery store as the largest tenant along smaller shops or in-line tenants, and are very commonly seen in the northern US.

With the property type of office, we see a mix of suburban, urban, garden-esque and high-rise projects and with the industrial type we see warehouse distribution, R&D, and flexible office/industrial space. In retail we see shopping centres, neighbourhood and community centres, and finally with multifamily we see apartments – both garden and high rise as well as condominium developments.

Investors in REPE include both accredited and non-accredited institutional (sovereign wealth funds, pension funds, foundations, etc.) and individual (either accredited through minimum net worth requirements or not) investors, which are primarily active through non-securitized partnerships. Despite this wide range of participants in the market, the firms that dominate are the same as in the majority of PE subdivisions, with top firms such as Blackstone, the largest player in real estate and private equity as a whole and Brookfield, who tends to rank second after Blackstone, leading the pack and leaving the largest solely real estate dedicated PE firm, Starwood, consistently in third place.

There are 4 standard strategy models that REPE firms let guide their investments, core, core-plus, value added and ‘opportunistic’ strategies. The first, core, has a very low (0-30% at maximum) reliance on leverage and thereby generates the least amount of returns out of the aforementioned strategies, but it has the upside of also being the least risk intensive. Core funds will normally invest in already stable/fully-leased properties in strong commercial metropolitan areas. The second, core-plus focuses on a similar subset but with more leverage (i.e., core ‘plus’ leverage), hovering around the 30-50% range. The third strategy, value added investing, carries a much higher risk than the aforementioned two, primarily due to the physical location where it invests in real estate. They tend to acquire properties that are not only mispositioned, but also require some amount of improvement (whether it be operation, physical, etc…) They then attempt to address the resolvable issues and sell it off in a restored state, which, in alignment with its risk, carries a much higher potential for return. Value added funds focus on deals that are largely debt (40% – 60%).The fourth and final strategy that REPE uses is the ‘opportunistic’ strategy. One fixed characterization is that it often uses debt levels of above 60%, but other than this fact the only commonality of such transactions is that they are high-risk to high-reward. The properties will often need a great deal of refurbishment, be in “niche property sectors”, or even just be raw land. These deals tend to be extremely tactical, and many even end up being designed to work out complicated financial structures from previous firms who had incorrectly leveraged portfolios as opposed to going after something new.

As with most asset classes, institutional investors began with ‘core’ investments involving little to no leverage, but with the market conditions in the early 1990s causing a massive decrease in property prices due to uncontrollable interest rates hitting even up to 14% in the latter half of the 1980s, they began to move up from core to core-plus, then to value added, and then culminating to the ‘opportunistic’ strategy.

We have seen markets continuing their post pandemic recovery run even into 2022, with some (such as multifamily) even posting record gains. Overall global transaction values are at approx. $292bn (up 77% y-o-y), posting levels 4% over 2019, thus showing large increases but just barely touching post-pandemic levels. Sporadic travel restrictions and a general increase in WFH saw an initial spike of purchasing but have now reduced and caused limited growth in cross-border investment (up 46% y-o-y but 15% off pre-covid). In contrast, sectors such as hotels, following the relaxation of limitations in Europe, saw occupancy improve in key European cities, although it remains in the 20% to 36% range as far as recovery goes. In the third quarter, border closures and travel restrictions in Asia Pacific continued to have an impact on the hotel business, albeit China was a bright light in the market, fueled by interior demand and a general isolation from the global market.

Trends Shaping the Real Estate Industry

Commercial real estate has always been considered one of the most reliable and stable ways of investing but, due to the pandemic, the industry faced some challenges which lead to higher volatility in the market. However, it is interesting to notice that despite, or maybe thanks to, the pandemic, some real estate assets have experienced significant growth. With inflation rising over the past months, investors started to perceive commercial real estate as an inflation hedge. In fact, despite the complications brought about by the pandemic, the industry is still perceived as one of the safest investment alternatives because of its tangibility and stability. Assuming that real estate investment firms, such as private equity, take up debt reasonably and responsibly, this debt erodes with inflation and the amount owed becomes less impactful, making commercial real estate a “safe harbour” during inflationary times. Another trend stemming from rising inflation is that landlords are leaning increasingly towards shorter leases as long-term contracts might create problems with high inflation. Meanwhile, the contracts lasting longer periods are seeing an intensification in the contractual clauses that directly link annual rent prices to annual inflation to protect landlords.

Nonetheless, shares of real estate firms are underperforming showing that some investors are focusing more on the damages that rising interest rates might bring instead of the value of the investment as an inflation hedge. Increases in interest rates lead to higher financing costs that might eventually erode the property value. This hesitation regarding the role of real estate investments in the following months is resulting in uncertainty and higher volatility in the market reflected by the stock prices. Over the past months, the investors who have been more devoted to real estate have been pension funds that are attracted by the high yields some commercial properties have been delivering in 2021. This increase of such investments in real estate led to more equity capital in the sector, while the focus of real estate companies on recapitalising and refinancing properties has resulted in an increase in debt capital. Overall, the industry has seen an incrementation in liquidity which will be beneficial for future growth and expansion.

Another interesting trend that has emerged over the past months is the activity of venture capital firms in the real estate industry. Traditionally, real estate has always been perceived as a slow industry when it comes to adopting new technologies but during the pandemic many such companies have adapted quickly to the new realities and thus captured the interest of venture capital investors. According to reports, real estate companies collected 34% more venture funding than in 2019. The trend that best explains this new interest is proptech, the acronym of property and technology. Commercial real estate is, in fact, trying to solve all the issues the industry is facing through the development of new technologies that would make real estate a more dynamic and efficient sector in the eyes of consumers and investors. Proptech is beneficial to routine activities such as tracking asset maintenance, storing and managing information. An automated infrastructure ensures efficient communication and payments through AI, and underwriting is quicker and more reliable. The gains proptech can bring is reflected by the total amount of investment in the field of $32bn in 2021.

The e-commerce sector experienced a boom during the pandemic as more and more people started purchasing online and now, despite the easing in lockdown restrictions, customers are likely to stay faithful to their new habits of getting products delivered at home. As a result, companies are evolving and adapting to these changes by demanding more last-mile delivery properties. In fact, over the past months, the real estate industry has experienced a massive demand for warehouses, which explains why many investors are shifting to this type of real asset rather than offices. Simultaneously, during the pandemic companies, mainly those producing manufacturing goods, found themselves with high levels of unsold inventory and lack of space to store it. This led to a further increase in demand for warehouses and has also resulted in the rise of very expensive short-term leases.

One final trend reflected by the real estate industry is closely related to the labour and material shortages the world has been facing. Commercial real estate companies and investors, such as private equity firms, have focused more on the refinancing and recapitalisation of existing properties rather than building new ones. This is because constructing a new property would be costly both in terms of time and money due to these shortages and would not allow the real estate company to meet the current demands the industry is facing. This results in more M&A and restructuring activity in the industry rather than investment in building new properties. This also explains the establishment of a new asset class: mixed-use zoning. For the reasons highlighted above, companies are repurposing and repositioning existing assets aiming at adding value to their current investments for the next several years instead of investing money in construction.

Differences Between the US and European Markets

Investors still consider European commercial real estate small when comparing it with the US and Asia but, in recent years, the industry has undergone significant growth and changes. On an unleveraged basis, the global real assets worldwide account for €26.82tn and the European market is currently holding €7.27tn, around 27% of the total. Simultaneously the US market, which is leading the industry as the most advanced and largest market, accounts €8.54tn of the total assets. The explanation behind this difference is that the US market has always benefited from having a single fiscal jurisdiction and a high number of sector-focused REITs, real estate investment trusts. Like all the rest of the industries, the European commercial real estate sector was not immune to the effects of the pandemic. However, it must be acknowledged that the European market has experienced an expansion over the past years and is slowly catching up. According to reports, the total commercial real estate investment volume in Europe has increased 21.7% from 2020 to 2021. The expansion of the industry is mainly due to new EU real estate companies obtaining REIT status and the rise of non-traditional properties, such as health care and self-storage, which are experiencing steady growth. Out of the total assets under management in the commercial real estate industry, in 2021, 49.52% of them were distributed in the US while Europe counted for 33.69% of the total.

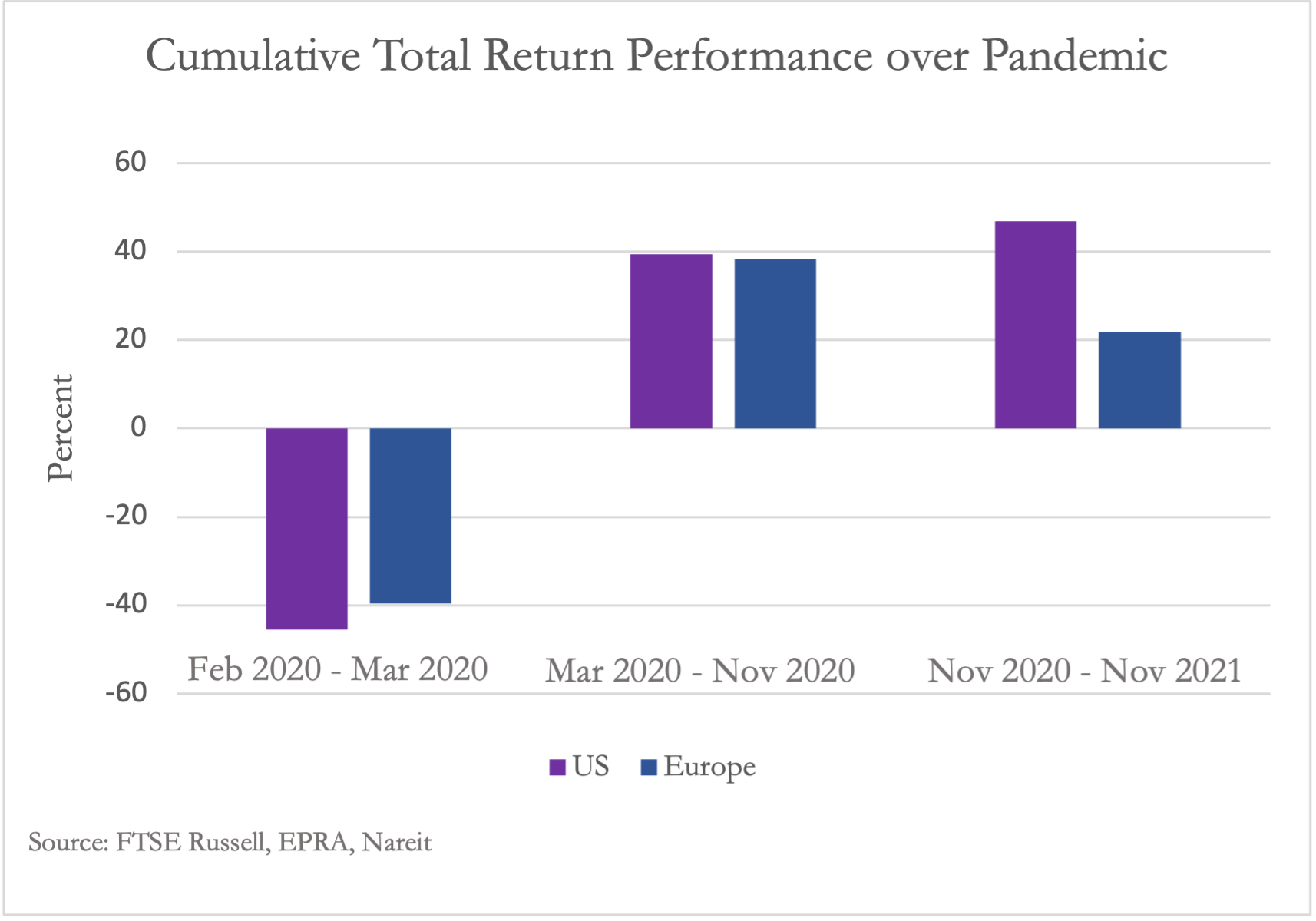

To establish the strength of commercial real estate in Europe and the US, it is interesting to see how the REITs of each region have reacted to the pandemic. As shown in the chart, in the first phase of the pandemic, the two global regions have responded similarly. However, over the second wave of the pandemic, in 2021, the regions reacted differently. The US, probably thanks to the stability of its market, has been able to reach a total return of 46.9%, while European REITs only achieved 21.9%. It is also worth noticing how the single-sector REITs that have a large impact on the industry have behaved during the pandemic. In the US, all the five highest weighted sectors were positive over the pandemic. Respectively, they counted total returns of 18.2% for residential, 12.4% for infrastructure, 49.8% for industrial, 4.1% for retail, and 21.4% for data centres. Conversely, Europe’s results were mixed with the diversified sector as the highest weighted sector with a -5.0% total return while the next two highest weighted sectors, residential and industrial, reached positive returns of 8.2% and 61.4%. The sector of retail reflects the differences between the two regions. In the US the recovery of the stock began at the beginning of 2020, while the European sector started recovering only after November 2020. The data about the REITs reflect what has already been mentioned above regarding the two markets. US commercial real estate is an established and stable industry which has the ability and resources to respond quickly to difficulties. On the other hand, the industry in Europe is still growing and therefore more vulnerable to challenges.

0 Comments