Introduction

On the 31st of October 2022, Emerson [EMR: NYSE] announced a definitive agreement under which it would sell a majority stake in its Climate Technologies company to private equity funds managed by Blackstone [BX: NYSE] in a deal valued at $14bn. Emerson will keep a non-controlling ownership interest in the brand-new standalone joint venture while receiving upfront, pre-tax cash proceeds of almost $9.5bn. In an effort to consolidate its operations, Blackstone will purchase a 55% stake in the subsidiary alongside the sovereign wealth funds of Abu Dhabi (ADIA) and Singapore (GIC).

The main attraction in the transaction is the market-leading Copeland compressor business and the whole portfolio of goods and services for all HVAC and refrigeration end-markets which are part of the standalone Climate Technologies business. The business is projected to generate sales of almost $5bn in the fiscal year 2022.

About Blackstone

Blackstone is the world’s largest alternative asset manager. Through several investing strategies aimed to generate long-term value and beneficial economic impact. The company’s focus is on adaptable finance to assist businesses in finding solutions. Their main investment vehicles include real estate, public debt and equity, infrastructure, life sciences, growth equity, non-investment grade credit, real assets and secondary funds with a global focus on private equity which makes up the company’s $951bn in assets under management. The Blackstone Group was founded in 1985 by Stephen A. Schwarzman and Peter G. Peterson with an initial investment of $400,000. For Blackstone Capital Partners I, LP, the company’s first private equity fund, Schwarzman was successful in raising $800m in 1987. General Motors Company [GM: NYSE] and Prudential Financial Inc. [PRU: NYSE] were two of the fund’s biggest initial investors. The main strategy that was implemented was leveraged buyouts, which were utilized to buy the companies with the funds raised.

Blackstone has a track record of making investments in renewable energy and counteracting climate change. Blackstone has invested more than $15bn since 2019 in projects that the company feels are consistent with the larger energy transformation. Blackstone believes there is a chance to invest roughly $100bn in energy transition and climate change mitigation initiatives over the following ten years across all its companies. The company invested around $3bn in Invenergy Renewables, the biggest North American developer of renewable energy projects. It also invested in Altus Power, a solar energy firm that offers clean electricity and energy storage to commercial and residential customers across the United States and used that money to finance over 350 MW of solar across 18 states. Additionally, Blackstone invested in ClearGen, a business that offers commercial and industrial clients flexible funding for microgrids and other energy transition solutions. One of the company’s most relevant investments includes a stake in Transmission Developers Inc. for the construction of the Champlain Hudson Power Express, a 339-mile-long underground power transmission line between Canada and New York City. New York City, which still relies on fossil fuels for about 85% of its energy needs, will receive 1250 MW of clean power from the project.

About the Abu Dhabi Investment Authority (ADIA)

The sovereign wealth fund for Abu Dhabi, United Arab Emirates, is managed by the Abu Dhabi Investment Authority, a government-owned investment company. The ADIA sovereign wealth fund, with $709bn in assets, was ranked the third largest sovereign wealth fund in the world in 2022 by the Sovereign Wealth Fund Institute. It is one of the biggest institutional investors in the world. The vast oil reserves of Abu Dhabi are the main source of the enormous wealth handled by the ADIA. Since the ADIA strives to maintain its secrecy, little is known about its investment process or holdings portfolio. The annualized rates of return for the ADIA portfolio in 2019 and 2020, evaluated in US dollars and computed on a time-weighted basis, were -2% and +21%, respectively. Performance was based on underlying audited financial data. “Sustain the long-term prosperity of Abu Dhabi by wisely expanding wealth through a disciplined investing strategy and committed personnel who embody ADIA’s cultural values,” is the stated objective of ADIA.

More than 20 different asset classes and subcategories make up the global investment portfolio that the ADIA oversees. More than 65 different nationalities are represented among the fund’s 1,700 employees. Indexed funds, internal and external stocks, fixed income and treasury, alternative investments, real estate and infrastructure, and private equities are among the major asset classes it invests in. The fund manages about 45% of its assets, with about 55% under its control including the aforementioned asset classes. The ADIA employs high-level managers to evaluate investments across the risk spectrum, from actively managed mandates to index-replicating mandates, and normally the ADIA claims to cater each investment to their unique requirements and internal policies.

About Singapore Investment Corporation (GIC)

Singapore’s sovereign wealth fund is managed by the government-owned Government of Singapore Investment Corporation (GIC). The fund’s full name is now GIC Private Limited. Established in 1981, the GIC invests the sovereign wealth fund more aggressively and over a longer investment horizon in asset classes that offer better yields. The GIC currently has $690bn in assets under administration as of June 2022 and is said to oversee the eighth-largest sovereign wealth fund in the world.

Implementing the sustainability framework and addressing environmental, social and governance (ESG) issues is the responsibility of the GIC’s Sustainability Committee, which is made up of senior officials from the GIC’s investment, risk and corporate areas. Regular discussions between the Group Executive Committee and Board Committees are held regarding major developments and trends that may have an impact on the GIC’s portfolio, as well as the ongoing implementation of GIC’s sustainability framework, which is centred on seizing opportunities, safeguarding their portfolio and pursuing investments and partnerships. Although the GIC does not disclose details on the size of the deals, investments and partnerships have been undertaken with climate technology companies including AC Energy, Climeworks, Divert and InterContinental Energy.

About Emerson

Emerson is a multinational technology and software corporation that offers cutting-edge solutions for the most vital industries in the world. Through its unrivalled automation portfolio, which includes a majority share in “AspenTech”, Emerson aims to process hybrid and discrete manufacturers, optimize operations, safeguard workers, lower emissions, and accomplish its sustainability goals.

Emerson was first founded as the Emerson Electric Company and has been in operation since 1890. 76,500 people were employed by Emerson as of 2018 and there are more than 200 industrial plants around the world under the company’s purview. Emerson, a Fortune 500 business headquartered in St. Louis, Missouri made $19.6bn billion in sales in 2022 which was a 7.6% increase on 2021. Emerson is composed of five primary business segments: Network Power, Process Management, Industrial Automation, Climate Technologies (HVAC), and Commercial & Residential Solutions (Tools and Storage). Industries served by Emerson Process Management, which includes oil and gas, pulp and paper, pharmaceuticals, food and beverage, and engineering accounted for 38.4% of total revenue. Emerson’s Industrial Automation arm accounted for 15.8% of total revenue.

Emerson Climate Technologies provides heating & air conditioning products and services in the industrial, commercial, and residential markets. Additionally, refrigeration systems in trucks and supermarkets all around the world use its technology. Fiscal 2022 net sales of $5bn and pre-tax earnings of $1bn were recorded by the Climate Technologies branch. Climate Technologies is valued at $14bn as part of the purchase, which is 12.7x the fiscal 2022 EBITDA, including standalone costs.

Industry Analysis

The climate technology market is predicted to grow between 2022-2032 at a 24.2% compounded annual growth rate (CAGR), according to a recent study conducted by Future Market Insights (FMI). According to the study, by the end of 2022, the global market is predicted to be worth approximately $16.9bn. Due to the rising usage of cutting-edge technologies to monitor various types of pollution, the market for climate technology is anticipated to expand quickly. By component, it is predicted that by 2032, the solutions category will hold 81.7% of the global market for climate technology.

In 2021, the U.S. held roughly 81.3% of the market share for climate technology in North America. Between 2017A – 2021A the sector saw a CAGR of about 17.5% for the global market for climate technology. As people and businesses become more aware of the harmful effects of climate change, the worldwide market for climate technology is expected to grow quickly. In order to reduce pollution and provide the next generation a better future, several nations are concentrating on adopting renewable energy sources. Major nations across the globe are pouring enormous quantities of money into renewable energy initiatives to promote the development of several industries, including transportation. To support growth, government organizations are also working to promote green technologies.

The introduction of technology in various businesses was expedited by Covid-19. This is the same with regard to the Climate Technology industry. According to a study conducted at the London Tech Week in June 2022, the pandemic accelerated climate technology investment by 25%, raised the possibility of achieving sustainability objectives by 38% and increased awareness of the sector by 43%. Leaders in the Climate Technology industry are urging the government to support technology firms that fight fugitive contaminants like CO2, support for eco-friendly innovation, increase spending on renewable energy, invest in environmentally friendly transportation and invest in green urban development and housing.

Deal Structure

Blackstone will purchase a 55% stake in the subsidiary alongside the sovereign wealth funds of Abu Dhabi (ADIA) and Singapore (GIC) paying $9.5bn for 55% of Emerson’s Climate Technology Division, valuing the business unit at $14bn, representing a 12.7X EBITDA multiple, however lower than the 14X at which Emerson was trading last year. In addition to receiving $9.5bn in upfront, pre-tax cash proceeds and a $2.3bn billion note at the close, Emerson will also keep 45% of the common equity ownership in the standalone Climate Technologies company, which will be a joint venture between Emerson and Blackstone, until it is eventually sold or goes public. Blackstone will contribute $4.4bn in cash to the acquisition, while the remaining $5.1bn will be provided by third-party debt financing, with The Royal Bank of Canada and Wells Fargo providing a revolving credit facility and a term loan A, respectively, while the remaining portion will come from direct lenders.

Emerson would hand control of the division to a more focused owner, similar to the deal Blackstone struck with Thomson Reuters in January 2018 for a controlling stake in the Canadian media group’s data business Refinitiv, but would not give up the chance of profits if the business unit is successful, keeping a 45% minority stake. In terms of timing, the deal is expected to close in the first half of FY2023, subject to regulatory and customary closing conditions.

Deal Rationale

Since the beginning of 2021, Emerson has been involved in an intense M&A and divestiture process, in order to refocus on its automation business. In terms of divestiture, the company sold non-core assets such as Insinkerator, its food waste disposal business, to appliance maker Whirpool for $3bn, Climate Technologies to Blackstone and Therm-O-Disc. Using the liquidity from the recent divestitures, Emerson is spending $9bn on strategic acquisitions of companies such as Aspen Technology and Micromine in order to build a portfolio of high-growth, cohesive pure-play automation serving diverse end-markets. The transaction will allow Emerson to partially monetize the Climate Technologies business at an attractive valuation of $14bn and provide significant upfront cash proceeds to invest in growth, while also allowing Emerson to participate in Climate Technologies’ upside potential upon a potential sale or IPO, monetizing the remaining non-controlling position.

For Blackstone, the Climate Technology Division is positioned for rapid expansion as it pioneers the transition of consumers and businesses to more energy-efficient heating and cooling equipment as part of their carbon-reduction initiatives. The acquisition is organic for Blackstone, which has recently focused on extending its portfolio of climate environmental companies such as Legence, an energy transition accelerator for buildings, and Desotec, a producer of circular filtration solutions. With the new division operating in the Heating, ventilation, and air conditioning (HVAC) industry and under the strong management of Blackstone, the company will have the potential to reach in the next years the $35bn mark valuation of its peers such as Carrier, Trane, and Johnson Controls.

The collaboration between Blackstone and The Sovereign Funds comes at a time when banks have been less willing to provide debt financing for large leveraged buyouts due to difficulties in underwriting the debt. In order to access the required liquidity Blackstone has partnered with the Abu Dhabi Sovereign Fund and private lenders such as Apollo Management, Sixth Street, and Goldman Sachs Asset Management to finalize the transaction.

Market Reaction

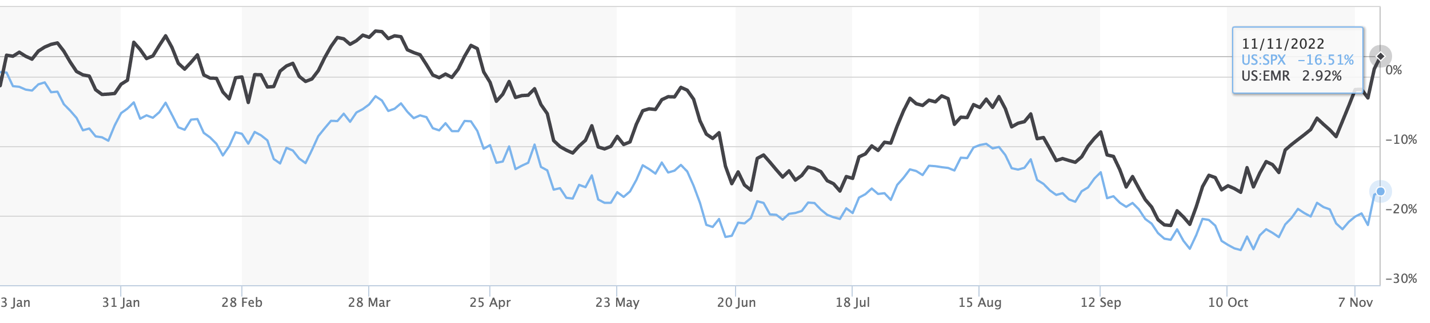

After the deal has been announced Emerson shares were trading at $87,7, up 0.4% on Oct. 31, and as of Nov. 11 the stock is trading at $96,07 up 3% in 2022. Emerson has outperformed the S&P 500 throughout the year, with the company constantly beating earning expectations. With the change in stock price the market cap of Emerson Electric raised to $55.5bn from $53.8bn at the beginning of 2022.

Source: Refinitiv

Deal advisors

Emerson is advised financially by Goldman Sachs LLC and Centerview Partners LLC, and its legal counsel is Davis Polk & Wardwell LLP. Guggenheim Securities LLC, Evercore, and Barclays are among the banks that assist Blackstone, while Simpson Thacher & Bartlett LLP is Blackstone’s legal counsel.

0 Comments