Introduction

On October 3rd, pharmaceutical giant Eli Lilly and Company [LLY:NYSE] announced its plans to strengthen its collection of cancer drugs through the acquisition of POINT Biopharma [PNT:NASDAQ] for $1.4bn, representing a premium of almost 90%. The firm’s purchase of POINT, a clinical-stage radiopharmaceutical company with a focus on innovative radioligand therapy for fighting cancer, stands as one of Lilly’s numerous acquisitions this year as the firm aims to stay at the forefront of cutting-edge medical treatments. This article dives into the details of Lilly’s recent acquisition, its implications, and the wider landscape of next-generation cancer treatments.

About Eli Lilly

Eli Lilly and Company is a globally recognized pharmaceutical powerhouse rooted in a rich history. The company operates in 18 countries, with its products available in over 125 nations. Established by Colonel Eli Lilly in 1876 in Indianapolis, Indiana, it has evolved from a modest pharmaceutical laboratory into a prominent player in the pharmaceutical industry.

Eli Lilly has a steadfast commitment to discovering, developing, and manufacturing pioneering medications and healthcare solutions. Among its remarkable achievements is the mass production of insulin, a groundbreaking accomplishment that solidified its leadership in pharmaceutical manufacturing. In 1923, they introduced Iletin, the first commercially available insulin product in the U.S., granting them a monopoly on insulin sales in the country for nearly two years.

As the pharmaceutical landscape shifted during the 1970s and 1980s, Eli Lilly diversified its portfolio to include agricultural chemicals, animal health products, cosmetics, and medical instruments. The company faced a setback in January 2009 when it encountered the largest criminal fine in U.S. history—totalling $1.415bn—for the illegal marketing of its top-selling product, the antipsychotic medication, Zyprexa.

Between 1971 and 2013, Eli Lilly embarked on several mergers and acquisitions, including the uncharacteristic but ultimately profitable acquisition of cosmetic manufacturer Elizabeth Arden, Inc., in 1971. Eli Lilly’s strategic moves in 2023 include the acquisition of POINT, marking its fourth significant acquisition of the year. Others include the $2.4bn buyout of Dice Therapeutics, the $1.93bn purchase of privately held Versanis, and Siglon, acquired for approximately $310m. The addition of Vernasis enhances Eli Lilly’s portfolio, incorporating Versanis’ lead asset, a treatment for adults with obesity, which is serving a rapidly growing market.

Eli Lilly’s robust financial performance is evident, with Q2 2023 revenue surging by 28% YoY, primarily driven by the success of their breast cancer treatment Verzenio, and the firm’s diabetes treatments Mounjaro and Jardiance (as well as $579.0m generated from the sale of Baqsimi rights). Excluding Baqsimi revenue and 2022’s COVID-19 antibodies revenue, Q2 2023 revenue increased by 22% YoY. In the second quarter of 2023, the company reported a net income of $1.76bn, an impressive 85% increase compared to the same period in 2022. Q2 2023 earnings per share (EPS) on a reported basis amounted to $1.95, marking an 86% surge from $1.05 in Q2 2022. Notably, the company has revised its 2023 financial guidance, with revenue projected in the range of $33.4bn to $33.9bn. Additionally, the EPS on a reported basis is expected to fall within the range of $9.20 to $9.40, affirming the company’s strong growth prospects.

Although Eli Lilly has faced challenges in recent years, particularly in the immunology space where several blockbuster drugs have emerged, the acquisition of DICE is positioned to help Eli Lilly close the competitive gap. While Pfizer, Merck, and Sanofi have spearheaded the M&A resurgence in 2023 with multibillion-dollar acquisitions, Eli Lilly has carved its niche in areas like weight-loss drugs, type 2 diabetes treatments, and more recently, oncology, through its acquisition of POINT Biopharma.

About POINT Biopharma

POINT Biopharma Global Inc. is a clinical-stage pharmaceutical company, founded in 2017, with a specific focus on the development and commercialization of radioligand therapies for cancer treatment. Radioligand therapy offers precise targeting of cancer by enabling the delivery of radiation directly to cancer cells while minimizing harm to healthy tissue. POINT’s lead programs have advanced to the late-phase development stage. In addition to its cutting-edge research, POINT operates a substantial 180,000-square-foot radiopharmaceutical manufacturing facility in Indianapolis and maintains a radiopharmaceutical research and development centre in Toronto. The company is actively engaged in clinical trials, including FRONTIER, a phase 1 trial for PNT2004, a pan-cancer program.

POINT has strategically partnered with Athebio AG to develop and commercialize DARPin-targeted radioligands. This partnership provides POINT with exclusive access to Athebio’s intellectual property and capabilities in DARPin development for radioligand therapy. Additionally, POINT has joined forces with Advancell to develop a global 212Pb radioisotope and radioligand supply chain and drug manufacturing network. These partnerships further highlight POINT’s leading position in the development and production of innovative radioligand cancer treatment.

Until 2022, POINT had not generated any revenue due to its focus on drugs in various developmental phases. In December 2022, POINT received a significant $250m upfront payment from Lantheus for PNT2002, with the potential for an additional payment of up to $250m upon U.S. regulatory approval. They are also entitled to royalties of 20% on all net sales and the possibility of additional net sales milestone payments of up to $1.3bn. For PNT2003, POINT received a $10m upfront payment and stands to receive up to an additional $30m upon U.S. regulatory approval, along with royalties of 15% on net sales and potential additional net sales milestone payments of up to $275m.

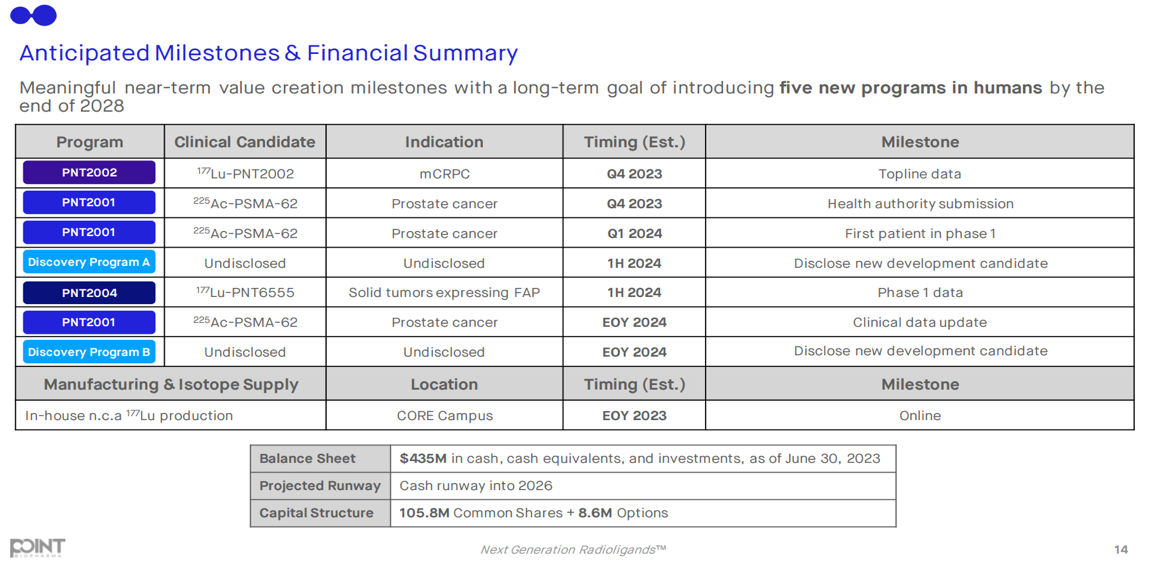

Source: POINT Biopharma

The company maintains robust cash holdings, concluding 2022 with a cash and cash equivalents balance of $286.4m, increasing to $365.9m by June 2023. Notably, key institutional investors in POINT include BVF, Blackrock, and Vanguard Group.

Pharmaceutical Industry

The pharmaceutical and life sciences sector has continued to leverage mergers and acquisitions as a strategic instrument for driving growth and bolstering product pipelines throughout the first half of 2023. Large-cap pharmaceutical companies are actively seeking investments in midsize biotech firms to address gaps in their product pipelines. Furthermore, portfolio reviews and divestitures of non-core assets remain central to their strategies.

Although the value of M&A activity saw a 30% decline in Q2 2023 compared to the preceding quarter, it rose by 77% in comparison to Q2 2022. Concurrently, the deal volume increased by 18% in Q2 2023 in contrast to the previous quarter and surged by 151% compared to Q2 2022. The biotech sector, which experienced substantial M&A activity in 2018 and 2019 and maintained momentum during the initial phase of the pandemic, saw a noticeable decrease in deal activity in 2021 and 2022. This decline can be attributed to a combination of factors including low industry confidence, resulting in fewer deals. However, there is an expectation that a resurgence in deal activity is imminent as the valuation gap between buyers and sellers narrows. It is also fuelled by the fact that interest rates have likely reached their peak and inflation is now cooling leading to more business and investment confidence. Eli Lilly’s recent acquisition spree serves as a promising indicator of the sector’s revival.

The pharmaceutical industry continues to prioritize the development of cancer treatments, particularly in immuno-oncology, targeted therapies, and precision medicine. Several novel cancer treatments have received regulatory approval. Amid challenges, M&A activity in the healthcare sector is poised for a revival, with the potential for acceleration in the latter part of 2023, as valuation gaps between buyers and sellers continue to shrink. In recent years, pharmaceutical M&A reached record highs, with prominent companies repeatedly turning to innovative young biotechs. These acquisitions were frequently centred on areas such as cancer, rare diseases, and immune system disorders, given the major clinical breakthroughs and substantial profits that resulted from treatments entering the market. This trend is anticipated to persist as these areas of drug research continue to achieve significant successes in clinical trials, leading to the potential for substantial profits.

Deal Structure

Lilly will commence a tender offer to acquire all outstanding shares of POINT for a purchase price of $12.50 per share in an all-cash deal, resulting in approximately $1.4bn payable at closing. The transaction has been approved by the boards of directors of both companies.

Although POINT’s shares had fallen almost 68% from their peak in February 2021, as investors cooled on early-stage biotech stocks, the company was offered a large premium. The purchase price payable at closing represents a premium of approximately 87% to POINT’s closing stock price on Oct. 2, 2023, the last trading day before the announcement of the transaction, and 68% to the 30-day volume-weighted average price. Such a high premium may be justified by the fact that POINT’s shares traded above $16 two and a half years ago and POINT held about $434.8m in cash, cash equivalents and investments at the end of June. Additionally, the biotech company has promising radioligand therapy candidates and great facilities for further development.

The transaction is expected to close near the end of 2023, and it is not subject to any financing conditions. However, it is subject to customary closing conditions, including the tender of a majority of the outstanding shares of POINT’s common stock, and license transfer approval from the U.S. Nuclear Regulatory Commission. Following the successful closing of the tender offer, Eli Lilly will acquire any remaining shares through a second-step merger at the same consideration as the initial offer. The board of directors unanimously recommended to POINT’s stockholders to tender their shares.

Lilly’s exclusive financial advisor is Goldman Sachs & Co. LLC, and its legal counsel is Kirkland & Ellis LLP. For POINT, Centerview Partners LLC is acting as exclusive financial advisor and Skadden, Arps, Slate, Meagher & Flom LLP is acting as legal counsel.

Deal Rationale

The main rationale behind Eli Lilly’s acquisition of POINT is to expand its drug pipeline by getting access to POINT’s experimental therapies that enable precise targeting of cancer. POINT is currently testing two radioligand therapy candidates, PNT2002 and PNT2003, in late-phase development. Radioligand therapy can enable the precise targeting of cancer by linking a radioisotope to a targeting molecule that delivers radiation directly to cancer cells, enabling significant anti-tumour efficacy while limiting the impact on healthy tissue. PNT2002 is a prostate-specific membrane antigen-targeted radioligand therapy in development for patients with a specific form of prostate cancer after progression on hormonal treatment. Topline data from this study are expected in the fourth quarter of 2023 which will allow Eli Lilly to compete with Swiss company Novartis [NOVN:SIX], the developer of radioligand therapy for prostate cancer, Pluvicto, which has been available in the U.S. since 2022. The second development, PNT2003, is a somatostatin receptor-targeted radioligand therapy for the treatment of patients with gastroenteropancreatic neuroendocrine tumours (tumours that occur in the gastrointestinal tract). Beyond the late-stage clinical pipeline, POINT has several additional programs in earlier stages of clinical and preclinical development.

Lilly, the Indianapolis-based pharma group has been bolstering its pipeline through small deals as its cancer therapy Alimta faces fierce competition from copycat versions. The first copycat came from Eagle Pharmaceuticals in February 2022. Other generic drugmakers, for their part, needed to wait until May 2022, when the last of Alimta’s so-called “vitamin regimen patent” ran out, opening the gates for generic rivals from Viatris and Apotex. Back in 2017, Lilly’s intellectual property helped fend off Teva Pharmaceutical. The patent covered the cancer medication’s use alongside vitamin B therapy. The loss of Alimta’s exclusivity was hurting Lily’s sales in recent years, which is why expanding the pipeline through small deals seemed like a required solution. As a result of completing a spate of acquisitions, Eli Lilly has become the second major drugmaker after Novartis in radioligand therapy investments, and the company does not plan to stop. Jacob Van Naarden, president of the company’s oncology division Loxo@Lilly, said that the acquisition of POINT would be the beginning of the company’s investment in developing multiple meaningful radioligand therapies for hard-to-treat cancers.

Additionally, this is a small deal for a large company like Eli Lilly and now is a good time for cash acquisitions as the current market environment has pushed down valuations. The current market value of some publicly listed biotechs is even less than their cash reserves. The Nasdaq Biotechnology index has crashed nearly a third from its 2021 peaks. A once-popular fund, the SPDR S&P Biotech ETF, has lost 14% of its value this year, falling 60% from its highs. Shares in POINT had fallen almost 68% from their peak in February 2021, as investors cooled on early-stage 2020 biotech stocks.

Moreover, Eli Lilly will get access to the 180,000-square-foot POINT Biopharma’s Indianapolis manufacturing plant for radiopharmaceuticals, as well as to the radiopharmaceutical research and development centre in Toronto. These facilities will be utilized alongside POINT’s extensive network of supply chain partners for sourcing radioisotopes and their precursors.

Market Reaction and Outlook

Lilly’s success over the last two years with its new Alzheimer’s and obesity drugs has led to the firm’s share price surging by over 80% in the last year, making the drugmaker the largest by capitalisation. Following the announcement of the deal Lilly’s stock fell by around 3% whereas shares of POINT soared 85%.

Many analysts see this deal as highly prospective because of the rapid growth of the radioligand therapy market which was valued at $7.61bn in 2022 and is predicted to reach $13.56bn by the end of 2031 at a 6.8% CAGR during the forecast period. Such rapid growth is driven by an increase in cancer prevalence around the world and significant investment in the needed treatments. Umer Raffat, an analyst at Evercore ISI, praised Lilly for picking assets carefully and “not dropping tens of billions on overpriced deals”. He said the POINT acquisition was an example of “very smart M&A”. Indeed, this can be considered a good acquisition for Eli Lilly as the company will get access to POINT’s manufacturing plant and R&D centre, radioligand therapies PNT2002, PNT2003 and some other drugs on earlier stages of development. All this will expand Eli Lilly’s pipeline and give the company an advantage in competition with Novartis.

There is little risk of regulators blocking the deal as POINT and Lilly have no overlapping therapies in development. It is necessary to add that POINT’s acquisition can arguably be seen as highly prospective due to the low valuations in the biotech sector. POINT’s management also seems satisfied with the deal, with Joe McCann, the current CEO stating that “The combination of POINT’s team, infrastructure and capabilities with Lilly’s global resources and experience could significantly accelerate the discovery, development, and global access to radiopharmaceuticals.”

Conclusion

To conclude, Eli Lilly’s $1.4bn acquisition of POINT Biopharma represents the firm’s continued strategy of expanding its portfolio in new innovative medical therapies, in this case in radioligand cancer treatments. The deal is characterized by a significant premium, demonstrating the value seen in POINT’s pipeline of therapy developments and the current low valuations in the biopharma sector. This deal is key in increasing the firm’s competitiveness in the oncology space after the patent for their cancer treatment has expired. With the upcoming release of data from POINT’s late-stage trials, Lilly is set to be a key competitor in providing cancer treatments, being the second major drugmaker after Novartis to invest in radioligand therapy.

0 Comments