Disclaimer: This article is intended solely for informational purposes. Bocconi Students Investment Club does not endorse any political candidate or party.

Introduction

Millions of Americans this week have cast their ballot for the presidential election, which has been undoubtedly one of, if not the most important event of the year, impacting all major asset classes.

The 2024 presidential election has been one of the most divisive in modern US history, as Republicans and Democrats have been at the opposite ends of the spectrum on many areas. For instance, regarding corporate taxation, in the past months, Trump has been advocating for the reduction of corporate tax rate, whereas, Kamala, in opposition, proposed to raise the federal corporate tax rate, coupled with an increase in stock buyback tax. Another highly polarized area has been trade policies, and the “tariffs” has been the spell that Trump casted everywhere he went for his rallies. Trump promised to impose aggressive tariffs for Chinese imports together with a potential universal tariff on all goods imported by the US. Kamala instead, pledged to stand up against unfair trade practices, but in essence, the ultimate goal is to stabilize international trade.

This year’s presidential election has also been characterized by political turmoil and historic events, including two attempted assassinations, one Iranian plot to eliminate Trump, alongside the shocking July withdrawal of President Joe Biden from the race which paved the way for Harris’s candidacy. All of this compounded with the influence of high-profile endorsements and widespread activism from celebrities and public figures. Key endorsements rolled in for both sides. Kamala received support from music stars including Taylor Swift and Lady Gaga, rallying younger voters and using their platforms to promote messages of equality and social justice. Meanwhile, on Trump’s side, support was influential figures like Elon Musk, who praised his business policies, and Mike Tyson.

The election was expected to be a very tight race between the two candidates. At the time when we first started writing of this paragraph (November 2nd, 2024), the latest electoral polls show a neck-to-neck battle, according to FT Kamala was leading Trump by only 1%, whereas according to FiveThirtyEight, Kamala is leading by 1.4%. Betting markets instead were favoring Trump, with the following prices for $1 “YES” contract on the former president: Polymarket 59¢, Kalshi 55¢, and PredictIt 54¢. Betting markets are likely to display a Republican bias, as Democrats tend to more risk averse, as explained by Nate Silver, founder of FiveThirtyEight, during the web conference on Citi Velocity. Nevertheless, in hindsight, prediction markets were quite successful at forecasting the re-election of Trump and the outcome in the “swing states” compared to traditional pollsters, although they did not predict correctly that Trump would win also popular vote.

Now that elections results have been announced, what can we expect from the Trump’s second presidential term? What would be the potential effect of the proposed policies?

The article will be structured in the following way: we will (i) debrief on the US elections outcome, and how markets reacted to the result; then we will analyze the (ii) potential impact of the upcoming Trump administration regarding policies on taxes, trade, regulation, and government spending; we will conclude by providing our own (iii) economic outlook for the US under Trump administration 2.0.

The Aftermath

The 2024 tumultuous US presidential election season finally reached to an end on November 6th, 2024, with the re-election of former 45th POTUS Donald J. Trump, thus the first president after Grover Cleveland, to secure two non-consecutive terms, defeating the Democratic candidate, Vice President Kamala Harris.

The decisive battleground for elections, the so-called “swing states” were Arizona (11), Georgia (16), Michigan (15), Nevada (6), North Carolina (16), Pennsylvania (19), Wisconsin (10). By early morning of November 6th (2:30 ET/8:30 CET), Trump was able to secure for himself the key three swing states of North Carolina, Georgia, and most importantly Pennsylvania, which brought its total electoral votes to 267, thus giving Trump enough confidence to declare victory during his speech at his Mar-a-Lago resort in Florida before the official announcement that came after he won the 10 electoral seat of Wisconsin 3 hours later.

Moving to the Congress, at the time of writing, it appears to us that the most probable outcome of the elections is a Republican sweep, with control of both chambers. The party managed to take control of the Senate, currently holding 52 seats, against Democrats holding 44 seats, with 4 seats which still remain uncalled. Whereas control of the US House of Representatives is “too close to call”, with Republicans and Democrats having secured respectively 212 and 204 seats in the House. 12 key races have not been called yet, the Republicans need 6 more House seats to secure a majority, while the Democrats need 14. Given the current situation of the uncalled races, we believe that it is likely that Republicans will successfully secure control of the House.

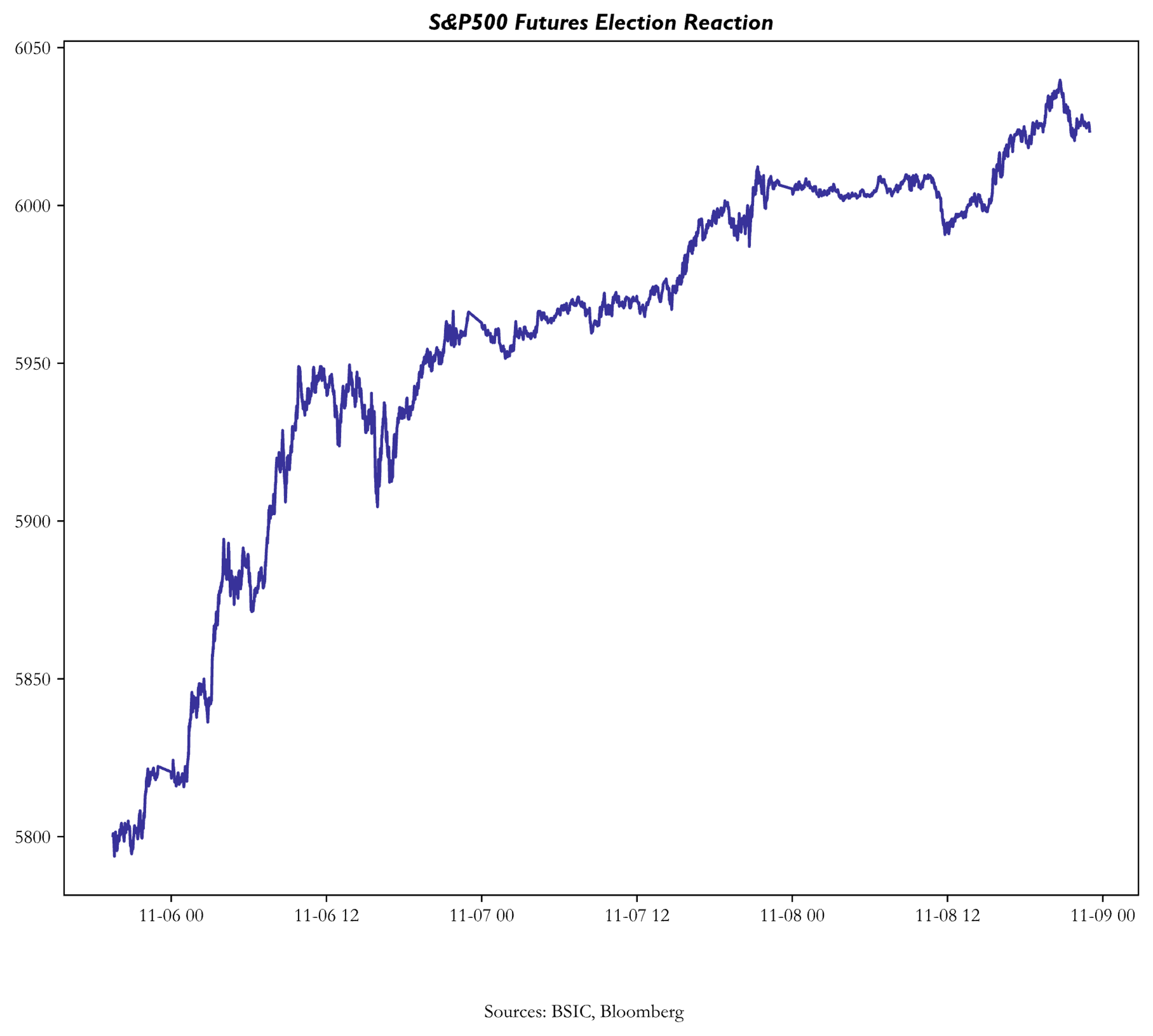

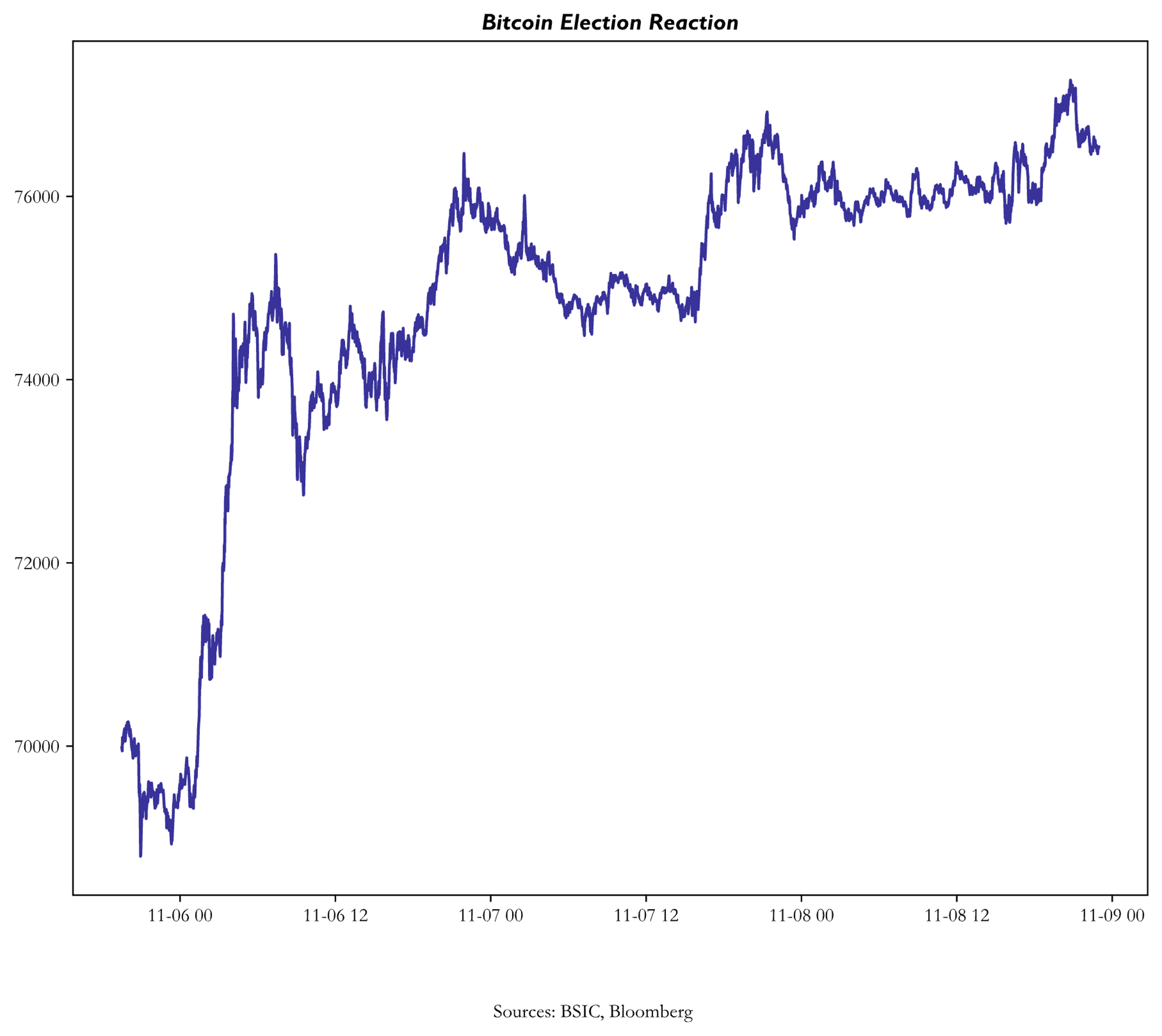

As results began to roll in and key battleground states started to lean toward Trump, asset classes reacted swiftly. Initially, US equity markets were mixed as investors anticipated a close race with unpredictable policy outcomes. However, once Trump’s lead in states like North Carolina and Georgia became evident, equities and crypto markets rallied. Down below we can observe the performance of E-Mini S&P500 Futures and BTC between November 5th 11:00 PM and market close on Friday November 8th. The S&P500 experienced a swing of over +200 points, briefly trading above the 6,000 level, whereas BTC reached new all-time highs, now trading above the 76,000 level.

Conversely, bond markets reflected a more cautious sentiment, with Treasury yields rising on the election night due to the potential for increased fiscal spending and inflationary pressures under Trump’s economic plans. The US 10-year treasury yield increased by around 20bps during European trading hours, then closing at 4.44% (+15.5bps). However, this upward movement saw some retracement following Thursday’s FOMC meeting, where Fed Chair Jerome Powell stated that “in the near term, the election will have no effect on policy”, effectively calming inflation expectations associated with Trump’s potential impact on the economy.

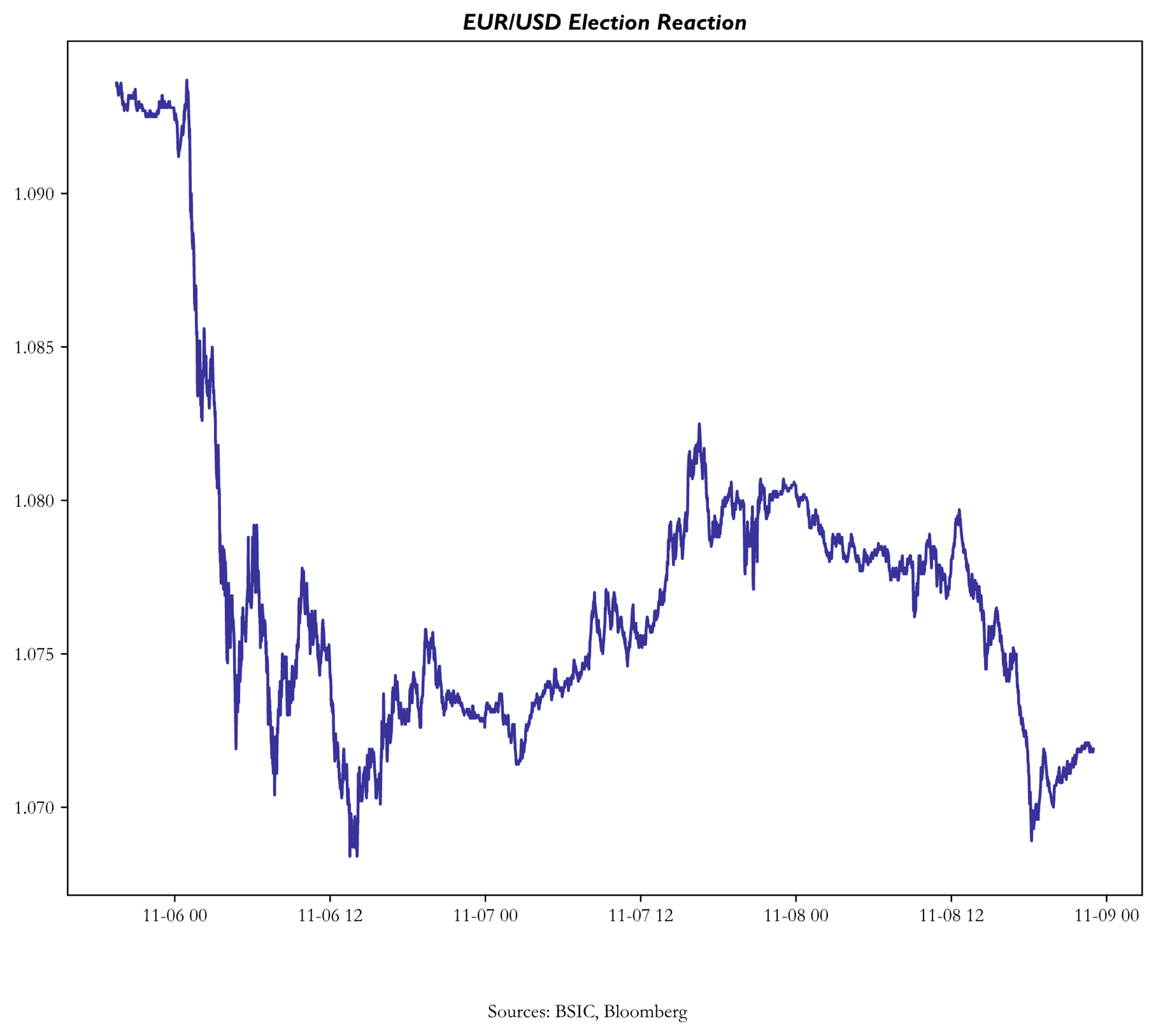

In the FX space the US dollar also strengthened against major currency pairs, reflecting the inflation risk in the US due to the potential tariffs. EUR/USD dropping by more than 200pips, reaching the 1.06 handle, then retracing temporarily back to the 1.08 handle before dropping again by 110pips. Interesting were the performances of the greenback against offshore yuan and the Mexican peso – the currencies most sensitive to potential Trump tariffs, given his intent to impose the majority of trade restrictions on China and Mexico. The dollar strengthened by 1.34% against offshore yuan since the election date, currently USDCNH is trading at 7.1955, whereas USDMXN saw volatile swings but ultimately closed Friday at 20.1710 nearly unchanged from its pre-election level.

Trump Administration 2.0

The nature of a Trump presidency 2.0 depends on the composition of Congress. In fields like trade and immigration, the president holds greater authority (although not absolute), whereas on fiscal matters, it very much depends on whether the government is divided or whether there is Republican sweep. In the latter case, which we deemed to be the most likely scenario, we have the situation of a one-party control, under which there is the possibility to pass sweeping legislation via the so-called “budget reconciliation” process. The budget reconciliation process is a legislative tool used by the U.S. Congress to expedite the passage of bills with a simple majority in the Senate, bypassing the 60-vote filibuster requirement, thus enabling the majority party to enact major policies without bipartisan support in the Senate. Bills described as reconciliation bills can pass the Senate by a simple majority of 51 votes or 50 votes plus the vice president’s vote. Please note that because of the Byrd Rule adopted in 1985, (i) the bill cannot increase the deficit after 10 years, (ii) reconciliation can be adopted only for budget-related bills which have direct fiscal impact, and (iii) Social Security are specifically prohibited from passing via reconciliation.

With the possibility of one-party control, Trump’s second term could see a more aggressive push to enact his policy agenda. The use of the reconciliation process would allow for sweeping reforms across various areas, including fiscal policy, taxation, and immigration. Let’s now explore the key policy changes Trump is expected to implement in his next administration:

1) Trade Policy

When thinking of Donald Trump, it’s almost instinctive to associate him with terms like “tariffs,” and “trade wars”. His first term was marked by aggressive trade policies, particularly focusing on tariffs imposed against Chinese goods as part of his broader strategy to address what he perceived as unfair trade practices. This time, the situation seems that it will be no different, as Trump repeatedly emphasized his commitment to tariffs during his electoral campaign. More specifically, Trump is considering: (i) higher tariffs on imported Chinese goods, of at least 60%; (ii) a universal baseline tariff between 10-20% on all imports; (iii) 100% tariffs on countries that move away from dollar-denominated trade; and (iv) 100/200% tariffs on US companies that move production to third countries. Among the proposed tariffs, the ones on Chinese goods and the universal baseline tariff are among the most significant.

The Tariff Man can follow again the playbook from his first term, that is by using as a legal basis Section 301 of the Trade Act of 1974, which grants the POTUS power to take action (without the need for Congressional approval) against foreign countries that engage in unfair trade practices or violate trade agreements; and also Section 232 of the Trade Expansion Act of 1962, historically used for issues like steel and aluminum imports, which gives the president the authority to unilaterally impose tariffs or other trade restrictions if they are deemed necessary for national security. In 2018 Trump used Section 301 to impose tariffs on Chinese goods based on grounds of unfair trade practices and used Section 233 to impose steel and aluminum imports from China, Norway, Switzerland and Turkey based on grounds of national security concerns. However, the justification for actions taken under national security were and remain highly controversial, furthermore, the tariffs were also against WTO rules because they were in violation of the Most-Favoured Nation (MFN) rule. The status of Most-Favoured Nation (MFN) – in the US this is called Permanent Normal Trade Relations (PNTR) – is granted to all members. Under the MFN rule, individual countries shall treat all other countries equally, and under the WTO agreements, in normal circumstances, countries cannot discriminate between their trading partners, meaning it is not possible to impose arbitrary tariffs on imports without applying the same rules to all WTO members. Nevertheless, this is not really an obstacle for Trump, as he already solved the issue at its root back in December 2019, when he blocked all judicial appointments to the WTO’s Appellate Body (AB), a group of seven judges that hears appeals regarding WTO rulings made about disputes. With no judges to hear appeals, the WTO basically stopped functioning, and since then many disputes are in a state of limbo.

In the case of China, another way in which tariffs can be imposed is by revoking the PNTR/MFN status, meaning that the US would be able to impose any tariff rate without being bound by the trade agreements. However, such action would have the worst outcome in terms of US-China diplomatic ties.

The repercussion of tariffs on the US will first come in the form of retaliatory tariffs by major trading partners, as seen during the 2018-2019 trade conflict, when China responded by imposing tariffs targeting US agricultural products. Moreover, tariffs would likely lead to higher inflation, as demonstrated by numerous studies on tariffs imposed by Trump during his first term. They found that these costs fell entirely on US businesses and consumers because domestic producers can take advantage of tariffs to raise their prices.

Our view here is that Trump will likely use tariffs as a negotiation tool. We believe Trump is planning to use tariffs as a threat so that the US can pressure trading partners to make concessions or to adopt more US-friendly policies. In particular the universal baseline tariff which Trump is considering, we deem that their implementation is very unlikely, especially if we consider that these tariffs will go against the Free Trade Agreements (FTAs) that US has with various countries, like Canada, Mexico, and South Korea. FTAs “[…] strengthen the business climate by including commitments on the reduction and elimination of tariffs and the elimination of a variety of non-tariff barriers that restrict or distort trade flows”. Imposing a blanket tariff would directly violate these terms, as FTAs are specifically designed to facilitate trade by lowering or removing tariffs between signatory countries.

2) Immigration

Immigration has been at the fulcrum of Trump’s electoral campaign, and he promised that he will crack down on illegal migration and implement the “largest mass deportation plan in US history”. While Trump’s intentions and objectives are clear, the details of his approach are not. Trump claims that these actions will help the US economy by freeing up housing and through job openings. However, such policy, if implemented, would likely create a labor shortage. The effect will be particularly pronounced for the food industry, agriculture, and construction where immigrants make up a significant share of the workforce. Typically, these jobs are physically demanding, involving low wages, and that have minimal benefits, thus making them unattractive to the average US citizen. Overall, a labor shortage has the potential to drive up prices, thus leading to further inflationary pressures in the US.

3) Taxation

One of the most likely tax proposals to be implemented would be the extension of the Tax Cuts and Jobs Act (TCJA), which Trump signed into law during his first administration back in 2017, most of which are set to expire at the end of 2025. The TCJA lowered the corporate tax rate to 21% from 35%, reduced individual income tax rates, and increased the standard deduction. We expect that under Trump’s second-term, before the expiration he will push to extend the TCJA. Economists at the University of Pennsylvania estimate that a permanent extension of the TCJA would cost $4tn over the first decade, of which $3.4tn revenue loss coming from revenue from lower individual tax payments, and the remainder, $600bn resulting from a reduction in corporate taxes paid. In addition, we deem likely a further reduction in individual taxes and a cut in corporate tax rate (as promised during the electoral campaign) from 21% to 15% only for companies that manufacture products in the US, in an attempt to help domestic manufacturers.

Another tax proposal Trump may pursue is eliminating federal income taxes on tips. This change could encourage other industries, possibly even white-collar sectors, adopt tipping-based compensation structures to reduce tax obligations. Such a shift could reduce federal revenue and destabilize wage structures if businesses opt to pay lower base wages, expecting employees to rely on (tax-free!) tips. Given the significant fiscal impacts, we believe it’s unlikely that the new administration would eliminate taxes on tips without introducing some restrictions.

Trump has also pledged to make Social Security income tax-free for seniors. Eliminating this tax would offer significant relief to seniors but would also result in a sizable revenue loss for the federal government, potentially increasing the national deficit or necessitating offsetting spending cuts. While the previous two proposals can be passed through reconciliation, as we mentioned before, changes to Social Security cannot, therefore it would require a bipartisan support.

4) Energy

On the energy front, under the new administration the focus will be shifted from energy transition to energy security. Under Trump 2.0 we expected him to pull out once again from the Paris Agreement, also to end the leasing of federal lands and waters for offshore wind projects, and at the same time incentivizing oils and gas extraction on federal property, with the aim of boosting fossil fuel production in order to fulfill his “drill, baby, drill” promise. Nevertheless, our view is that the upside for US oil production will be limited. Expanding drilling projects to boost supply would put downward pressure on oil prices, which could ultimately reduce revenue for American producers, thus disincentivizing further drillings. We also believe that Trump will likely repeal Biden’s Inflation Reduction Act (IRA), which allocated half a trillion dollars for green projects such as clean tech, hydrogen and renewable energy. Ending the IRA would eliminate key tax credits, posing significant challenges for renewable energy companies that rely on these incentives for growth and project funding.

5) Geopolitics

Ukraine – During the campaign, Trump repeatedly criticized the amount of aid for Ukraine and said he could end the war between Russia and Ukraine “in a day”. Although the one-day resolution should not be taken literally, we believe that Trump’s goal is to end the involvement of the US in the war at some point. This objective will likely be achieved by making Ukraine sign an uncomfortable ceasefire agreement which would mean the loss of some of its territory with the threat of ceasing any military and financial support. In the event of a peace agreement between Ukraine and Russia, we believe it could exert downward pressure on food and energy price inflation in Europe. However, the timing of this effect is uncertain, as it will depend on the pace and extent of the normalization of relations with Russia.

Middle East – For the Israel-Hamas, throughout his campaign, President-elect Trump has promised to get the conflict “settled and fast”, specifically, he told Israel to finish up the war because it is losing support. Although he has not specified how he would approach the Israel-Hamas war, or the way in which his policies would differ from Biden’s. Instead, regarding the Israel-Hezbollah conflict we think that Trump’s unwavering support for Israel is likely to shape his policy decisions. During his campaign, Donald Trump has expressed a strong desire to end the ongoing war in Lebanon, however Trump’s approach is to push for the elimination of Hezbollah’s influence in Lebanon. This could mean that Trump would continue to encourage Israeli military operations in Lebanon. On Iran, Trump has consistently viewed Tehran as a direct threat to both the US and its allies in the region. We believe that he is likely to pursue a “maximum pressure” campaign, focusing on strict enforcement of sanctions, particularly on Iranian oil exports. While Trump may seek to avoid direct military confrontation with Iran, his policies are expected to reinforce economic isolation, aiming to weaken Tehran’s influence in the region without escalating into full-scale war.

Conclusion

The 2024 US Presidential election, culminated with the so called “Red Wave”. The victory of President Trump, and the Republican victories in the House and the Senate were welcomed with open arms by US equity markets with Nasdaq and S&P500 reaching all-time highs after the results had been announced. Russell 2000 made even more impressive gains in the aftermath, up more than 8.0% since the election. US Treasuries markets faced a different fate, as a bear steepening saw yields rise by double digit bps across the curve, before normalizing back down the next day after the FOMC meeting.

Both these movements in fixed income and equity markets were fueled by the notion that high tariffs coupled with a range of tax cuts would be bullish for growth, especially for US manufacturers, but also very inflationary. These changes in policy will be implemented gradually, and will come with a lag, much like many other macro-regime shifting changes to the economy. It is well understood by market participants that the eventual implementation of these policies will likely lead to a higher medium-term r* for the USA which will be necessary to navigate the higher inflationary pressures. In the short term however, these variables should not have an effect over the economy.

Despite this, during the aftermath we saw a repricing of the Fed’s interest rate trajectory, also in the short term, with dozens of bps of cuts that were priced being eliminated. At the time of writing this article, around 16bps of cuts are priced for the December 18th FOMC meeting. We make our case for a 25bps cut during this meeting.

The latest NFP data was very dovish with only 12,000 new jobs, although it should be partially ignored as weather disasters and strikes affected last month’s employment cycle in the USA very heavily. Revisions for last month’s print were -31k. ISM Manufacturing also came in below consensus on November 1st, at 46.5 vs 47.2 expected. This is the ninth consecutive month this has occurred, supporting the dovish narrative. Overall, we think the latest Macroeconomic data supports the rate path envisioned by market participants before the election in the short term, which is why we think betting on 25 basis point December cut is a coherent idea. The main risks to this trade would be related to next week’s inflation print. CPI is projected to come in at 2.6%. A heavy upwards surprise could steer the Fed away from a third consecutive cut and could lead them to a more gradual descent to r*, With the economy showing signs of partial slowing with the latest NFP and ISM Manufacturers data we do not expect inflation to be very hot respective to its consensus figure.

In conclusion, we expect that if Trump’s tariff and tax policies are implemented, the USA will face a higher interest rate environment in the medium term, but we argue that the data still supports the market’s pre-election convictions of a 25 basis point cut in the next FOMC meeting.

References

- York E., “Tariff Tracker: Tracking the Economic Impact of the Trump-Biden Tariffs”, Tax Foundation, June 26th, 2024

- “A majority of Americans say immigrants mostly fill jobs U.S. citizens do not want”, Pew Research Center, June 10th, 2020

- “Betting Markets Tend to Get Elections Right – With Some Notable Exceptions”, WSJ, November 1st, 2024

- “Brave new world’: Donald Trump’s victory signals end of US-led postwar order”, FT, November 8th, 2024

- “Least Favored Nation: What it means if the US revokes PNTR with China”, February 27th, 2024

- “Penn Wharton Budget Model’s – Guide to the 2024 Presidential Candidates’ Policy Proposals”, University of Pennsylvania, 2024

- “Trump 2.0”, Pillsbury Winthrop Shaw Pittman, November 7th, 2024

- “What would the Trump Tariffs mean for World Trade?”, Herbert Smith Freehills, October 29th, 2024

- “WTO says Trump’s steel tariffs violated global trade rules”, Politico, September 12th, 2022

0 Comments