Over the past seven days the macroeconomic spotlight has been dominated by three themes: (1) diverging central‑bank moves, with the Fed on pause but the Bank of England embarking on its first cut of this cycle; (2) signs of a tariff‑driven movement in global trade flows, most visibly in a stronger-than‑expected Chinese export print and front‑loaded German manufacturing; and (3) mixed U.S. data that still show labour‑market resilience even as investors digest bigger Treasury funding needs. Together these developments set the tone for global markets, keeping the dollar firm, yields choppy and recession talk alive.

USA

On May 7, the FOMC left the target range at 4.25–4.50%, reiterated that “inflation and unemployment risks have risen,” and kept quantitative‑tightening runoff unchanged. Chair Powell’s press conference stressed policy “patience” until the tariff shock becomes clearer.

Source: Trading Economics, Bocconi Students Investment Club

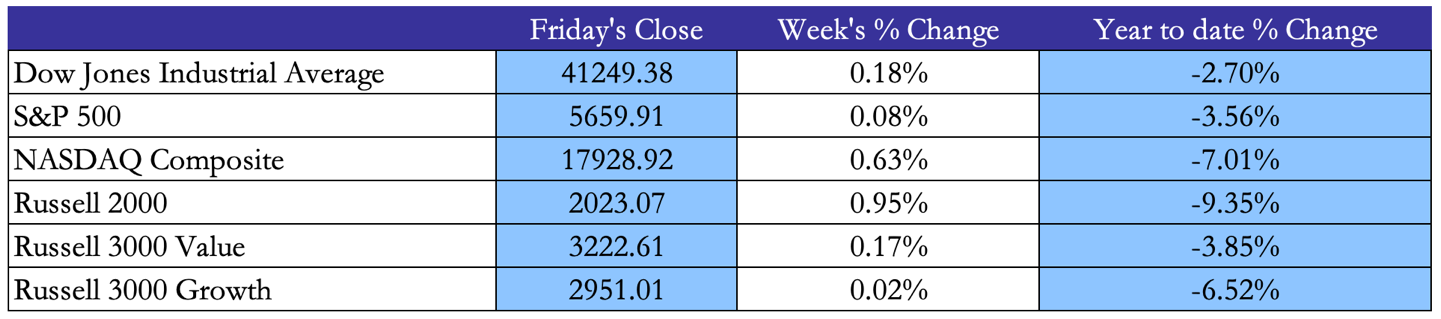

The Fed’s decision to “stay on hold and watch”, the Treasury’s larger‑than‑expected funding need but well‑received auctions, and data showing a still‑resilient services sector and labor market kept the 10‑year note anchored near 4.37% while the 2‑year slipped to 3.90%, gently steepening the curve. Global cross‑currents—especially a surprise Bank of England rate cut and tariff‑driven trade gyrations—added noise but did not derail the higher‑for‑longer narrative.

Source: Trading Economics, Bocconi Students Investment Club

Europe and UK

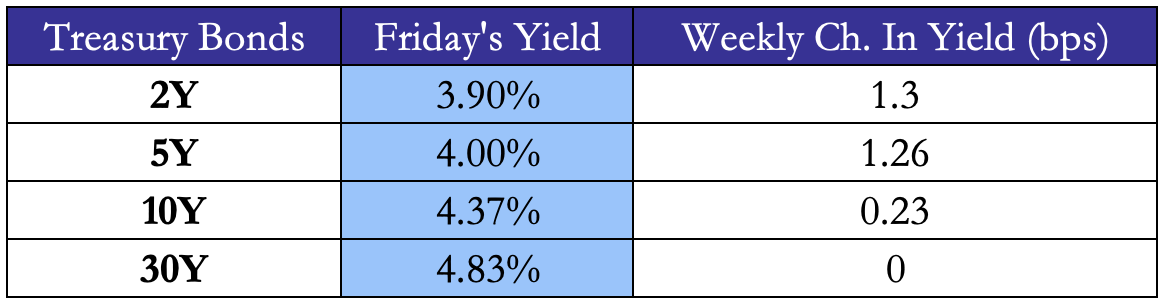

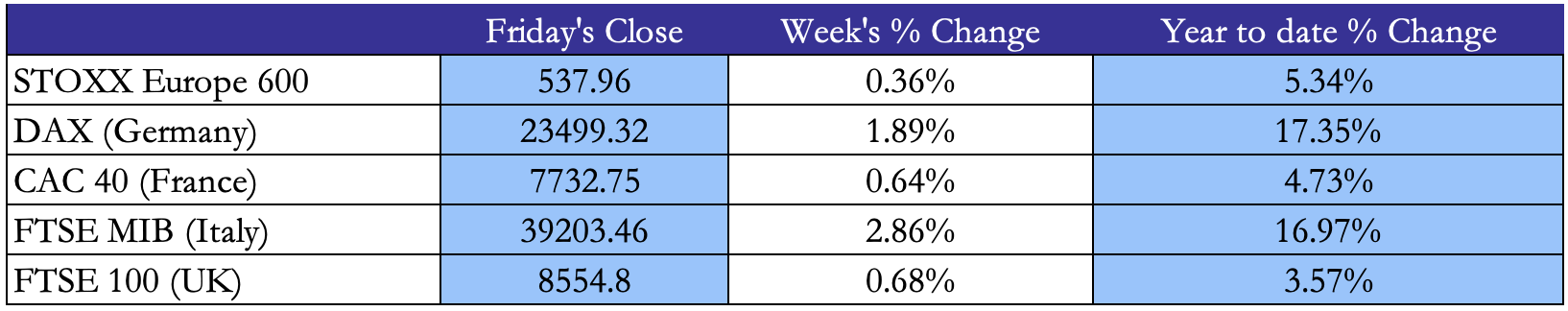

A steadier‐than‑feared macro backdrop kept continental equities on the front foot. Euro‑area consumer inflation held at 2.2% YoY in April, quelling talk of an immediate ECB rate cut, while a punchy 3.6% jump in German industrial orders hinted that manufacturing may be bottoming despite tariff headwinds. That mix of contained prices and flickers of growth helped the STOXX 600 eke out a fourth straight weekly gain, ending up 0.29% at 537.96 on Friday as investors switched into defensive stocks such as healthcare and resources ahead of the next wave of U.S.–China trade talks. Optimism was especially visible in Frankfurt, where the DAX touched a record high on stimulus hopes and export‑sensitive stocks rallied on signs the tariff future might get better.

Across the Channel, the Bank of England delivered a quarter‑point cut to 4.25% but the unusually split 5‑2‑2 vote tempered expectations of a rapid easing cycle. At the same time, the UK services PMI slid into contraction territory at 49.0, hinting at a tariff‑induced slowdown in domestic demand and also prompting analysts to trim growth forecasts. Even so, equity investors were largely unstirred: the FTSE 100, cushioned by its global earners and commodity giants, finished the week flat at £8,554 after a 16‑day winning streak that had already put it near record levels.

Source: Trading Economics, Bocconi Students Investment Club

Government‑bond markets told a subtler story. Ten‑year Bund yields edged up to about 2.56% as data outweighed the calm inflation print, yet solid demand for €12bn of long‑dated OATs and a narrowing BTP–Bund spread to 105 bp underscored appetite for carry within the bloc. In the UK, gilts underperformed: the hawkish flavour of the BoE’s “dovish cut” and a £4.25bn reopening of the 2035 gilt drove the 10‑year yield up to roughly 4.57% by Thursday before a holiday‑thinned pull‑back on Friday. For investors, that leaves Euro‑area curves drifting inside familiar ranges while UK yields remain vulnerable to a heavy debt‑management calendar and any upside surprise in next week’s CPI data.

Source: Trading Economics, Bocconi Students Investment Club

Rest of the World

The most interesting news this week was the sudden escalation on the sub‑continent. After India said it had struck militant camps inside Pakistan, both sides unleashed volleys of drones, missiles and artillery across the Line of Control, leaving about 50 people dead, forcing mass evacuations in Kashmir and blacking‑out cities as far apart as Jammu and Lahore. Many domestic flights were halted, while New Delhi ordered thousands of social‑media accounts blocked in an effort to stem misinformation. The financial fallout was immediate: the Rupee slid almost 1% to a one‑month low near ₹85.8 per dollar before RBI support, the Sensex dropped 880 points (‑1.1 %) on Friday, and Karachi’s KSE‑100 index swung violently after a four‑day, 9% slide, clawing back only a small portion of its losses as investors weighed the risk of a wider war.

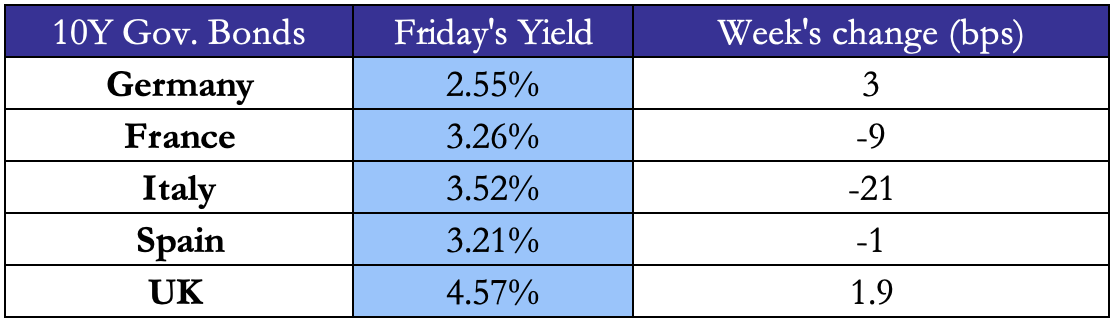

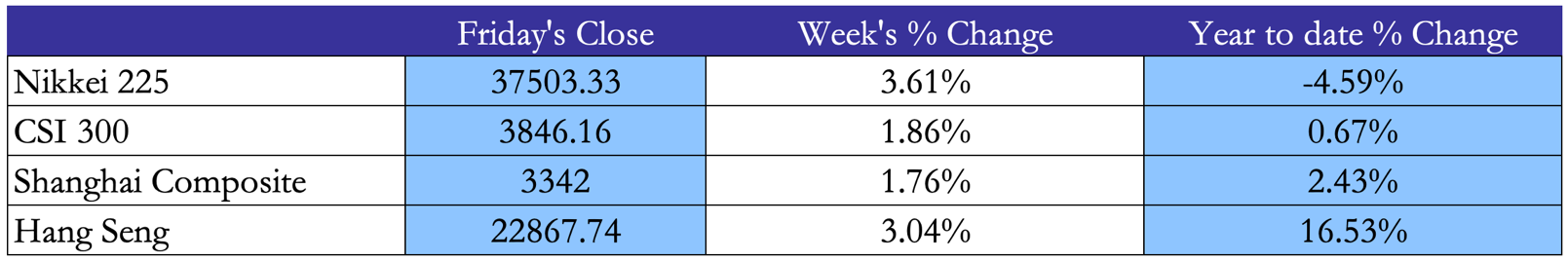

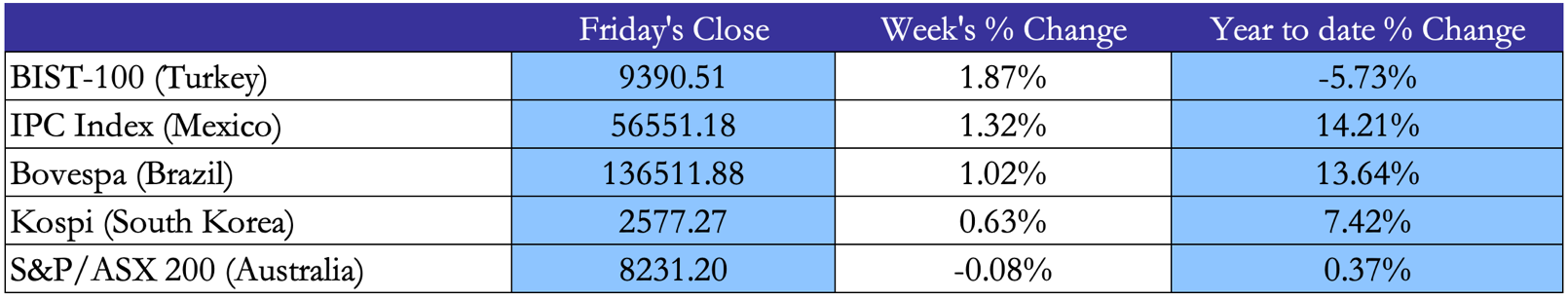

Further from that border, Asia’s major markets largely kept their composure. The Nikkei added almost 2% on the week to close at 37,503, a six‑week high, helped by a soft Yen and relief that the Bank of Japan’s growth‑forecast downgrade came with no policy tightening. On the mainland the CSI 300 and Shanghai Composite rose roughly 1.8% after April exports beat expectations, while talk of fresh stimulus and upcoming U.S.–China tariff talks lifted Hong Kong’s Hang Seng more than 3%. South Korea’s Kospi inched higher as the Bank of Korea openly signalled a near‑term rate cut, and Australia’s ASX 200 logged a 3% weekly gain to a two‑month peak on trade‑deal optimism. For now, investors appear more focused on trade policy and central‑bank cues than on the sub‑continent’s flare‑up, though any further military misstep could quickly shatter that calm.

Source: Trading Economics, Bocconi Students Investment Club

Beyond Asia, Brazil’s central bank surprised investors with a fresh 50‑bp hike to 14.75%, warning that sticky inflation over 5% leaves only “limited space” for pausing even as their Congress tries to get its landmark tax‑reform through. In Ankara, the Turkish central bank executed a surprise 350‑bp hike to 46%, briefly lifting the lira and pushing the BIST‑100 to its best day in two months before profit‑taking set in.

Source: Trading Economics, Bocconi Students Investment Club

FX and Commodities

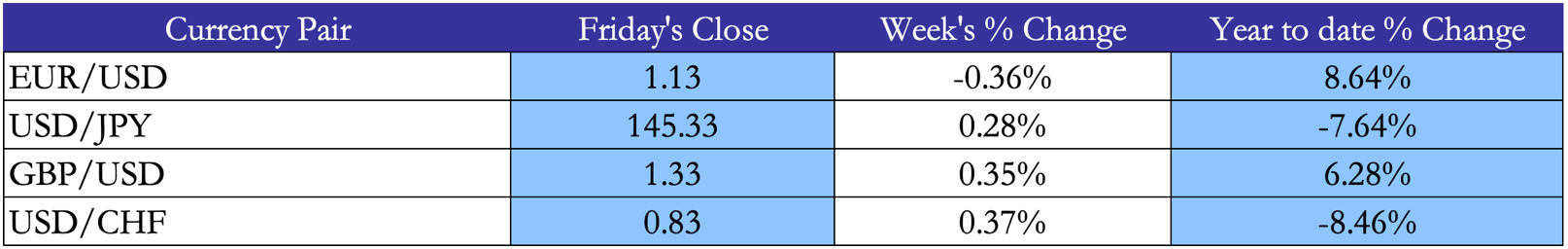

In FX, the U.S. Dollar re‑asserted itself, the DXY Index touching a one‑month peak of 100.86 as fading hopes of near‑term Fed cuts and fresh U.S.–China tariff drama sapped the euro, yen and sterling; the single currency slid to $1.12 while USD/JPY poked above 145 yen. The week’s outlier was South Asia: India’s rupee tumbled to a seven‑month low near ₹86 per dollar after the cross‑border flare‑up with Pakistan, whereas Mexico’s peso punched a new 2025 high below 19.45 on firm carry inflows and Banxico‑cut talk; Bitcoin, meanwhile, jumped back through the $100,000 mark what looks like a spike in risk appetite.

Commodities painted a similar picture. Gold extended its record run to fresh highs above $3,330/oz as investors looked for a hedge against both tariffs and a widening deficit, while copper prices stayed close to March’s all‑time peak amid lingering bets that looming U.S. import duties will tighten supply in the U.S. relative to the UK.

Energy markets found a footing: Brent crude logged its first weekly gain in three weeks, up roughly 8.12% to $63.91/bbl thanks to optimism around Sino‑U.S. negotiations and continued OPEC+ restraint, and U.S. natural‑gas futures climbed more than 4% as early‑summer heat lifted demand. In agriculturals, weather‑hit West African crops propelled cocoa back above $9,300/t, whereas Malaysian palm‑oil futures retreated on expectations of a production rebound, and iron‑ore prices notched another modest loss as tariff uncertainty cooled Chinese buying.

Source: Trading Economics, Bocconi Students Investment Club

Source: Trading Economics, Bocconi Students Investment Club

Next Week Main Events

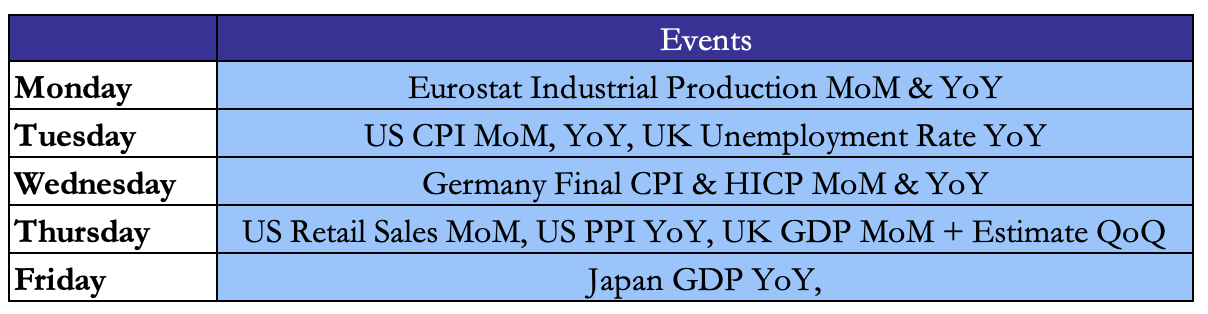

Next week is all about the data that decides whether the “higher‑for‑longer” rate story lives on: headline inflation numbers out in the U.S. and Germany, first‑quarter growth checks in the UK and Japan, and a trio of wage‑ and jobs‑heavy releases in Australia and the UK should give investors a cleaner read on how global demand is holding up after the tariff shock. Bond desks will also keep an eye on Thursday’s U.S. retail‑sales/producer‑price double‑header, which arrives just before another heavy coupon auction cycle and could shake term‑premium expectations.

Brain Teaser #35

There are 51 ants on a square with side length of 1. If you have a glass with a radius of 1/7, can you put your glass at a position on the square to guarantee that the glass encompasses at least 3 ants?

Solution

To guarantee that the glass encompasses at least 3 ants, we can separate the square into 25 smaller areas. Applying the generalized Pigeon Hole Principle, we can show that at least one of the areas must have at least 3 ants. So we only need to make sure that the glass is large enough to cover any of the 25 smaller areas. Simply separatethe area into 5 x 5 smaller squares with side length of 1/5 each will do since a circle with radius of 1/7 can cover a square with side length 1/5.

Brain Teaser #36

On Tuesday night a White‑House leak says President Trump will slap a 200% “liberation‑year tariff” on all Chinese electric cars at Friday’s press conference. Two well‑known market pundits tweet independently about the rumour:

@TruthfulTony gets the call right 85% of the time. He tweets: “Tariff coming!”

@ScepticalSue gets the call right 75% of the time. She tweets: “No tariff, just noise.”

Before any tweets, traders thought the tariff had a 40% chance of actually happening.

Assuming the pundits’ calls are independent conditional on the truth, what is the probability the tariff really will be announced, given Tony says Yes and Sue says No?

0 Comments