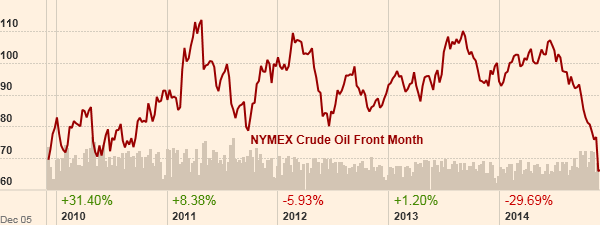

The recent OPEC’s meeting amplified the downward trend in Oil price as the counsel decided not to cut Oil supply. The cartel decided – tough not unanimously – to leave the current OPEC supply target at 30 million barrels per day. The target was actually not respected for the last 6 months (latest figures of 30.5 million barrels per day), increasing the supply further. Expectations from the meeting were not too much different: investors did not expect any relevant changes in OPEC’s stance on oil production that would have boosted the commodity price from its level of $80,50 per barrel.

Source: FT

Simply looking at the 30-days implied volatility on the USO (United States Oil Fund), it can be argued that the Oil price is currently highly volatile, having risen to a multi-year high of 36% from September 2014.

The recent events regarding the commodity heavily impacted the number of outstanding put option contracts with a strike price of $35 and $40 with expiration scheduled for December 2015. These derivative securities were completely out of the radars six months ago, not even considered by investors, but after the Oil price slumped, the number of put options with a strike price of $40 quadrupled in the past two weeks reaching the number of 880,000 contracts, while the number of put options with $35 as strike price peaked at 669,000 contracts from none.

According to several investment managers and analysts in the energy industry, the growth in the number of put option contracts does not reflect a quantitative or fundamental study, which could possibly demonstrate a further fall in Oil prices before December 2015 but it can be seen as a lottery: a high-payoff bet on a drastic fall in Oil value. With high probability the premium paid for the contract will result in a small loss, but assuming a lucky case the writer would gain – win – a huge amount of money.

The premium to pay for this kind of options with a strike price at $35 and $40 on WTI Crude Oil are quite low, respectively the premium for the first is $160 while for the latter stands at $370.

Raymond Carbone, president of the New York based broker Paramount Options commented on the recently released data about put options: “You’re a genius if you are right. And if you are wrong it will not ruin your lifestyle”.

However, a remarkable consequence of the increasing number of these derivatives is that the investors who bought these options back in November ’14 have already made a profit, as the value of $35 and $40 put options more than doubled compared to one month ago.

We are skeptical that the Oil price will further drop to $35 or $40 per barrel, and also the market perceives this event as unlikely. For each bearish position in WTI futures and options there are three bullish positions, according to the Commodity Futures Trading Commission. Nevertheless there are at least two events that could bring the Oil price to the levels above: a particularly warm winter in the Northern regions of the planet, that could drastically reduce the demand and the consumption of fuel used for heating facilities, and the second is a high rate of refinery maintenance in the US Gulf of Mexico oil hub, which would temporarily slow the demand for crude, as Jean Stuart, global energy economist at Credit Suisse, predicted.

[edmc id=2326]Download as PDF[/edmc]

0 Comments