Markets

A Practical Guide to Pricing Weather Derivatives

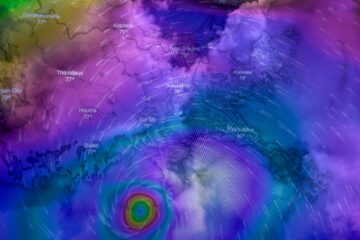

Download PDF Introduction Weather conditions play a fundamental role in the dynamics of the world economy, with estimates revealing that nearly 30% of economic activities and an overwhelming 70% of businesses encounter susceptibility to weather-related fluctuations. This substantial impact underlines the critical necessity to hedge the risk associated with weather. Read more…