Introduction

Once again, we are approaching the end of the year, but this time, perhaps more than ever,

the takeaways to bring home look exceptionally valuable: living in a world full of uncertainty due to the spread of COVID-19 pandemic represents indeed an increasingly demanding challenge for market participants at any level, from retail investors to fund managers.

In this article, along with a brief review of COVID-19 pandemic effects on financial markets, we would try to give an answer to the question: is the pandemic identified as a black swan?

In order to do so, we shall outline the peculiar features of black swans and introduce to white swans and grey rhino, descriptions of somehow rare and unpredictable events which have come to light only recently.

Black swan’s different nuances

As it has been cited over and over in the course of 2020, “Black Swan” is a term introduced by the academic and former Wall Street Trader Nassim Nicolas Taleb to describe an extremely unpredictable event characterized by the following features:

- it is an outlier, in the sense that it is truly unexpected, since no past events can give a clue about its actual possibility to occur;

- its consequences are extreme and it impacts causing severe shocks;

- in retrospect, it is seen as explainable and predictable.

Analyzing the first element, the COVID-19 pandemic seems not to adhere strictly to the definition of an outlier. In fact, in January 2020, many health experts via their scientific papers and WHO reports warned about the not so far possibility of a devastating outbreak of the COVID-19 pandemic; furthermore, in order to be prepared to any eventuality, many governments had already prepared emergency plans in the past and conducted simulations in response to prior similar infectious threats.

The odds were not as low as one may expect, particularly if we consider the increasing connections fostered by economic globalization.

Few investors come up with strategies aimed to incorporate the occurrence of such not so rare events described by Taleb as “fat tails”, representing statistical distributions with an unexpected thickness at the tails of the curve, as we described in our article titled “Tail wind for tail-risk hedge funds” nearly 2 months ago.

In other words, it did not take us completely by surprise, although the appropriate measures were adopted by governments and financial institutions across the world only after the Italian breakout that sadly marked its spread in Europe right away.

Yet, there is no doubt that the COVID-19 pandemic impact on world economies and financial markets has been severe and its effects will reverberate for many years, as we shall see later on.

Now, on the grounds of this brief review, we know what the current pandemic is not. So, how can we classify such a devastating event?

During the early 2020, a new metaphoric term emerged on the scenes: The Grey Rhino.

We are talking about a massive weight animal that points our way with its horn and bears down on us, strikingly evident to our eyes and whose enormous impact can be easily predicted.

According to the world economy expert Michele Wucker, Grey Rhinos are, along with the Grey Swan defined by Taleb, highly probable, high-impact yet neglected threats.

Here the caveat that changes completely the perspective relies on the word “neglection.”

Surely, the precise outcome of these types of events may be hardly foreseeable, but that does not mean that countermeasures cannot take place to potentially manage them, regardless of how improbable they might appear.

In the case of COVID-19, it implies that policy makers and financial actors were definitely aware of the risks they might have faced with, but, overlooking and underestimating to some extent, did not elaborate them while planning their strategies. That is to say, even though it would have been extremely difficult to the participants in the financial industry knowing beforehand the suddenness and the severity of the spread of the SARS-CoV-2, their performance would have been better if the risk had been mitigated building portfolios resilient to extremely disruptive events (i.e. climate change, geopolitical clashes, pandemics). The takeaway is that it is surely better off looking at a Grey Rhino ahead than a Black Swan in retrospective.

It is also worth to mention that the other face of the coin is that lower risk often means lower exposure and many would have missed on years of substantial and attractive uptrends of the market.

The last piece needed to complete the puzzle is the White Swan: a very predictable occurrence with moderate-little impact. For instance, US-China cold war and international cyber warfare are examples of white swans outlined prior to the outbreak of the pandemic by the economist and academic Nouriel Roubini.

Covid-19 & future scenarios

One may compare the pandemic effects to those of the global financial crisis that started in 2007.

However, this time is different. First and foremost, it is a health crisis, which in turn has quickly affected the global economic and financial systems.

Self-distancing measures, closure of factories and non-essential shops, and bans on group activities have determined a catastrophic economic crisis reducing the industrial production and the household incomes. Since the demand has plunged, on the one hand, people are struggling to earn their usual income and are frightened of the future, freezing even more the real economy.

On the other hand, the block of the supply chain experienced in China, has determined negative consequences to Western Markets that depended on it massively, slowing down further the flow of the real economy.

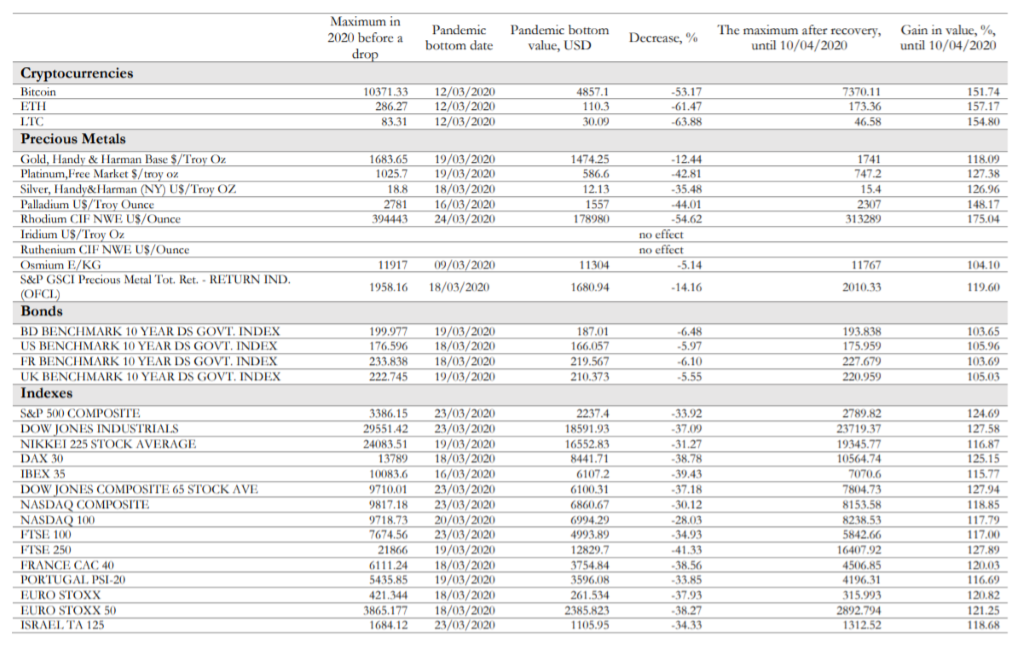

Financial market prices are built mostly on expectations of the participants of the industry, so it appears clear how devastating the magnitude of the effects of such a terrible event on financial markets was in March 2020. [1]

Table 1: Price dynamics in the main financial markets: pre-pandemic vs. pandemic

Source: Yarovaya et al. (2020), “The COVID-19 black swan crisis: Reaction and recovery of various financial markets”

In March, the financial crisis led the prices to reach the bottom very quickly, as the panic spread and financial intermediaries experienced unprecedented difficulties to match bid & ask, due to the liquidity crisis that arose parallelly to the contagion of fear in such a very short time span.

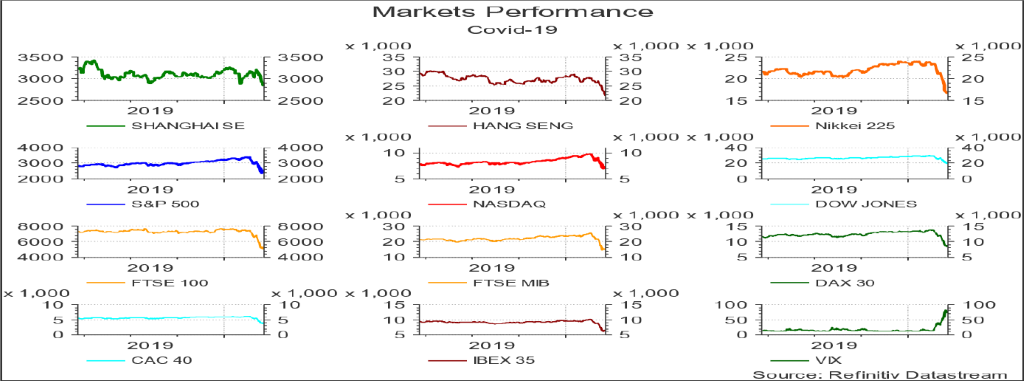

However, it is deemed important to point out an interesting fact about when the markets started adjusting the expectations about the future economic outlook. Indeed, this did not occur following the outbreak of SARS-CoV-2 in China, not even when over 60M people from the Wuhan region were under the most severe lockdown that the human being has ever assisted to. Markets only awoke to the virus global threat when Italy registered its first cases, with the Italian stock market being the one that activated European fears. From that point in time onwards global uncertainty escalated to reach a worldwide financial dimension with global markets entering in free fall by the end of February 2020 due to the lack of effective and harmonized responses from politicians and monetary authorities.

Figure 1: Global Stock Markets Indexes

Source: Morales & Andreosso- O’Callaghan (2020), “Covid19: Global Stock Markets “Black Swan”.”

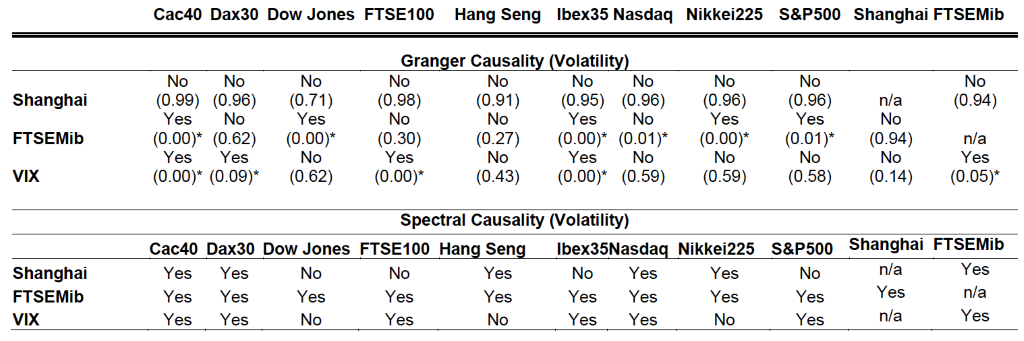

Many statistical studies have been conducted with the aim of analyzing forms of causality between the Shanghai Se A Share Index, the FTSE MIB index, the VIX index and the global stock markets. It is here being reported explicitly a research paper carried out by Lucía Morales from the University of Dublin and Bernadette Andreosso-O’Callaghan from the University of Limerick who have tried to empirically prove the previously stated fact. [2] They undertook two different types of statistical studies, both a Spectral Causality and a Granger Causality. The former entailed bidirectional causality tests which allowed them to capture market dynamics across variables, while the latter provided them with a static dimension ensuring that they could focus on studying the unidirectional causality effects of interest. The results of their research were the following.

Table 2: Causality Findings

Source: Morales & Andreosso- O’Callaghan (2020), “Covid19: Global Stock Markets “Black Swan”.”

As it can clearly be inferred by the output of the Granger Causality’s analysis, one can confidently come to the conclusion that, overall, the performance of the Italian FTSEMib proved to be a far more reliable factor than the Shanghai index in determining the ensuing effects on the other global stock markets at the onset of the pandemic. These conclusions were drawn on the basis of a strong statistical significance, corroborated by the respective p-values, often characterizing a 1% significance level.

Moving now forward in time, it is undeniably true that it is thanks to the containment of the first wave and some promising early trials that showed the effectiveness of few vaccine candidates that markets have been able to recover in between the first and the second wave.

However, despite the measures applied by central banks and political leaders to restore public confidence and stabilize economy, the demand is still very far from the pre-pandemic levels and the world has been experiencing an ongoing puzzling global recession.

Academics and economic analysts do not agree on the shape and intensity of the recovery of global economies. But as of December 2020, one thing can be clearly inferred. The V-shape recovery so long-awaited did not materialize yet and it is probably not going to happen in the way it was predicted. One exception is definitely China, which has not been hit as hard by a coronavirus second wave as all the other major industrial powers, and which in 2020 was the only major economy that managed to stay on the good track for achieving a GDP positive growth rate of approximately 1.9%. On the contrary, all the Western countries are assumed to experience more like a W-shape recovery since after the strong rebound of Q3, there is expected to be a significant contraction in the fourth quarter of FY20, which nonetheless it will still be better than the disastrous second quarter of the same year. Concerning the onset of fiscal year 2021, analysts worldwide seem to agree on the prediction of a quite weak Q1, but from Q2 onwards and along with the rosy expectations of the Pfizer’s and Moderna’s vaccines on their way to worldwide distribution, they appear to expect a strong rebound for global economies which are forecasted to achieve an overall growth in global GDP of roughly 6% in 2021. Only time will tell whether or not they were too optimistic in their view of the future economic outlook.

Wrap-up

The odds of experiencing challenging and unforeseeable events might be not so low as one tends to expect, and should be indeed valued to help in harnessing the uncertainty and learning from mistakes to disincentive the neglection of the involved risk.

It may be easily inferred that the existence of extreme events challenged the validity of traditional portfolio theories in favor of new methodologies such as the Extreme Value Theory (EVT).

The latter helps investors framing a more realistic world in which returns are not assumed to be normally distributed, and provides them with the proper tools for quantifying the potential outcomes and damages of black swans.

Yet, given that the frequency of such events is generally low, the debate is still open and market agents find themselves on the two opposite sides of the discussion.

References

[1] Yarovaya et al. (2020), “The COVID-19 black swan crisis: Reaction and recovery of various financial markets”

[2] Morales & Andreosso- O’Callaghan (2020), “Covid19: Global Stock Markets “Black Swan”.”

0 Comments