Introduction

One of the most basic tools used by traders to manage risk is a simple order given to a machine, the stop-loss order. Despite being accessible to all retail traders through their online brokers, it is often neglected or misused.

In the first part of this article we give an introduction to its advantages and disadvantages and then we present the different types and strategies. In the second part we dive deeper into the topic by reviewing existing literature to find evidence on which return-generating processes stop-loss increase expected returns and we compare the returns using different types of stop-loss.

Advantages and disadvantages

The main advantage that we want to mention is the one that could partially solve most retail investors’ problems: emotions.

To be profitable in the long-run, one must systematize one’s trading strategy and stick to the plan. After having done your research and made a decision, setting a stop-loss helps to be objective regardless of whatever happens in the markets. Indeed, another advantage related to behavioral finance is that after having set a stop-loss, you can avoid monitoring your portfolio constantly and that is convenient and helpful to tackle the problem we just discussed. As John Wooden once said: “The score will take care of itself when you take care of the effort that precedes the score”.

One of the disadvantages is that the price at which you sell or buy (in case of short-selling) may be very different from the stop price. This may be due to fast-moving markets, slippage and/or other factors. Implementing a stop-limit order could solve the problem, but in the case in which the stock skips the stop-limit price and does not recover, the outcome would be even worse. Another disadvantage is that short-term fluctuation, especially in highly volatile stocks, could very easily trigger tight stop-loss. Higher thresholds are in that case required to avoid incurring in redundant commissions.

Types and strategies

The basic stop order, known as stop-loss order, is an order to sell or buy once the price of a stock reaches a certain price. However, the stop price is not the guaranteed execution price for a stop order, the stock price is just a trigger that converts the stop order into a market order. The market order will then sell or buy the stock immediately at the market price that will likely be near the current bid or ask price.

On the other hand, by placing a stop-limit order, once the stop price is reached, the stop-limit order becomes a limit order that will be executed at a specified price or better. The benefit to control the price at which the order can be executed comes at a cost: if the stock price moves away from the specified limit price, the order may not be executed and the stop-loss would be useless in limiting losses.

A more advanced stop order is the trailing stop order. This time, the stop order is not at a specific price but is at a percentage or dollar amount below or above the current market price of the security. Suppose we are long and have set a sell trailing stop order, the dynamic would work as follows: if the stock price moves up, the trailing stop price adjusts accordingly by the specified percentage or dollar amount. However, if the stock price decreases, the trailing stop price stays fixed. The stop order will be triggered once the security’s price reaches the last trailing stop price set. In the case of being short, everything would be the contrary. Trailing stops are therefore designed to lock in profits. The following figure should help to understand the dynamics just explained.

Source: economics.stackexchange.com

The last type of stop order is a combination of the trailing stop order and the most basic stop-loss order. To set this type of stop order, an investor needs to set a percentage or dollar amount for the trailing stop order and another one for the stop-loss order. To get a clear understanding we show an example: suppose we set the trailing stop order and the stop-loss order at 5% and 4% respectively below the current stock price. We purchase a stock at $100 with a stop-loss at $96 and an initial trailing stop price at $95. Initially, we consider the basic stop price as the relevant one since it is the highest between the two. However, as the stock price increases, the trailing stop price will exceed the fixed basic stop-loss and will become the relevant one, making the stop-loss at $96 redundant. Although this goes against the rule of keeping percentage or dollar amounts intact after entering a trade, if the investor wants to secure a breakeven trade, it could tighten the trailing stop price at 6.5% below the stock price when the latter reaches $107 ($107*0.935 = $100).

Besides relying on a fixed percentage or dollar amount, another option is to apply a stop-loss order or stop-limit order following technical indicators such as supports and resistances, moving averages and many other measures. Another interesting alternative is a dynamic stop-loss level that is based on the daily volatility in the previous month. First, the daily volatility is estimated at the beginning of a month based on the daily stock prices of the past month. Then, a stop-loss order is set at two or three standard deviations away from the prior month-end close price. All the strategies mentioned are easily modifiable and there is not a right or a wrong one, the best thing is to try different ones in different contexts and see which one yields the highest adjusted-risk returns.

Literature review

We now review three different papers to show what academics have found about the environment in which stop-loss actually stops losses and which strategy is the most efficient one in terms of higher return and lowest standard deviation (highest Sharpe ratio).

The first paper we review is “When Do Stop-Loss Rules Stop Losses?” by Kaminski and Lo (2007). The analysis is conducted by applying a stop-loss policy to a buy-and-hold strategy in U.S equities and the stop-loss asset is U.S. long-term government bonds. Stop-loss are activated after a specific threshold is reached and the cashflow is allocated to risk-free rates assets. After some level of gains is achieved in the security previously sold, it is repurchased and enters again into the portfolio.

Before jumping to the empirical analysis, authors derive strong conclusions using a simple framework under several return-generating processes. The difference between the return on risk-free assets during stopped out periods and the return on the equities during the same periods multiplied by the probability of stopping out, is defined as “stopping premium” and will be our measure to test portfolio’s return under different return-generating processes.

As expected, the authors find that if the portfolio follows a random walk, i.e. IID returns, stopping premium is always negative. Indeed, the fact that the theoretical motivation for the Random Walk Hypothesis is stronger than the empirical reality, might contribute to explain the limited presence of academic studies on stop-loss rules. Under empirically more plausible non-random-walk portfolios, such as in portfolio returns characterized by mean reversion, the stop-loss policy hurts expected returns. On the other hand, if the return generating process exhibits momentum. then stop-loss rules can stop losses yielding a positive stopping premium. Lastly, under regime-switching models with a transition from one state to another following a time-homogeneous Markov process, stop-loss policy can be a source of potential added-value only if equity investment in the low-mean regime has a lower expected return than the risk-free rate.

An empirical analysis using numerous time windows, stop-loss thresholds and re-entry thresholds is performed. Monthly CRSP value-weighted returns index and long-term government bond return from Ibbotson and Associates from 1950 to 2004 are used as a sample. By running the simulation through approximately 660 monthly returns, authors show that stopping premiums are positive and that the volatility differences are also negative. This overperformance of the portfolio implementing stop-loss policies relative to the buy-and-hold one is motivated by persistent negative performance of equity and excess performance of long-term bonds during stopped-out periods. Thus, these results suggest elevated levels of momentum associated with large negative returns.

Another interesting paper is “Performance of Stop-Loss Rules vs Buy and Hold Strategy” by Snorrason and Yusupov (2009). The authors use daily equity returns data for stocks listed on the OMX Stockholm 30 Index during the time period between January 1998 and April 2009 and they take long-positions with a predefined stop-loss level and the same position without stop-loss. However, proceeds are not reinvested but held in cash until the next holding period. Return on the equally weighted portfolios are calculated for each three months holding period.

By testing traditional stop-loss and trailing stop-loss, they find that both strategies outperform the buy-and-hold portfolio in both expected returns and risk-adjusted returns. The results are in line with Kaminski and Lo (2007) and they suggest that positive autoregressive process in the short term (3-12 months) and a negative autoregressive process in the longer term (3-5 year) are a better approximation of the stock return processes with respect to the Random Walk Hypothesis. To support their findings, they mention Jegadeesh, Titman (1993, 1999) as past evidence for short term momentum.

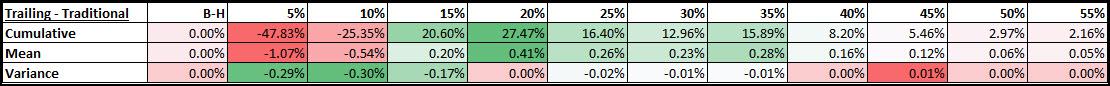

Furthermore, they go further and find that by comparing the average return and the variance of the traditional stop-loss portfolio and the trailing stop-loss, the latter perform significantly better at almost all stop loss levels. A table with the difference between trailing stop loss and traditional stop-loss measures is shown below.

After having discussed the presence of momentum in the short term and how stop-loss can help benefit from it, we review “Taming Momentum Crashes: A Simple Stop-Loss Strategy” by Han, Zhou and Zhu (2016). The paper gives evidence of the added-value of stop-loss under a momentum strategy and compares the result under different circumstances.

Authors use daily prices of all common stock listed on the NYSE, AMEX and Nasdaq stock markets. They implement a momentum strategy where they buy stocks with the highest cumulative returns and sell those with the lowest cumulative returns during the past six-month. Skipping the part where results show greater performance when applying stop-losses, they also find that the stop loss momentum has an average return much higher than the original stop loss momentum. By interpreting this difference as break-even transaction costs, they confirm that stop-loss momentum can still generate performance even after taking into account transaction costs.

Furthermore, they notice that the performance of the momentum strategy increases as illiquidity increases and size decreases. Regarding strategies, the analysis exhibits the highest Sharpe ratio with the dynamic stop-loss based on daily volatility of the previous month mentioned previously.

Conclusion

Besides introducing stop-loss in the most clear manner possible, the purpose of this article was to support the use of this simple tool with academic papers and to grasp some key concepts from the back testing conducted.

- If implemented correctly, stop-loss can be extremely useful if you are a retail trader

- Momentum is necessary to create breeding ground for stop-loss to help you tame losses and achieve higher risk-adjusted returns

- Trailing stop-loss yields much better returns than traditional stop-loss

- Dynamic stop-loss based on daily volatility is a very effective strategy that you may want to implement in your trading.

Bibliography

Narasimhan Jegadeesh and Sheridan Titman, “Return to Buying Winners and Selling Loses: Implications for Stock Market Efficiency”, March 1993

Narasimhan Jegadeesh and Sheridan Titman, “Profitability of Momentum Strategies: an Evaluation of Alternative Explanations”, June 1999

Kathryn M. Kaminski and Andrew W. Lo, “When Do Stop-Loss Rules Stop Losses?”, January 2007

Bergsveinn Snorrason and Garib Yusupov. “Performance of Stop-Loss Rules vs Buy-and-Hold Strategy”, 2009

Yufeng Han, Guofu Zhou and Yingzi Zhu, “Taming Momentum Crashes: A Simple Stop-Loss Strategy”, September 2016

0 Comments