Caterpillar Inc; Market Cap (as of 13/11/2015): $39.96bn

Introduction

On October 22, Caterpillar Inc. presented its 3Q group results, which caused further depression of its stock price due to its latest poor financial performances. Unluckily, the firm confirmed the bad market sentiment as the profit per share fell from $1.63, hitting the value of $0.62. Third-quarter 2015 sales also marked a decrease vis-à-vis third quarter results of 2014, further confirming the bleak financial results. What’s wrong?

Company overview

Few companies have been capable to leverage their brand name on their product in the way the Caterpillar did. Originating one identity through the so-called process “popularization of the brand,” this name recollects a yellow-enormous bulldozer, consisting of the mainframe and undercarriage, primarily fabricated from low carbon structural steel plates and a giant casting.

Caterpillar is the world’s leading manufacturer of diesel and natural gas engines, construction and mining equipment, diesel-electric locomotives and industrial gas turbines. The company principally operates through its three product segments – Construction Industries, Resource Industries and Energy & Transportation. It also provides financing and related services through its Financial Products segment. Caterpillar has been participating actively in these markets since 1925, making it one of the most long-lasting manufacturers worldwide.

One of the key aspects that led this company to success is its strategy of intense acquisitions performed since its origins. Just in the last twenty years, it made more than twenty acquisitions including Electro-Motive Diesel Inc., MWM Holding GmbH and Pyroban Group Ltd. Caterpillar made the external growth its main route on the way to sales maximization. However, lately this giant has been facing a massive slowdown in its productivity as well as its financial performance consequently undermining its well-established supremacy.

Stock performances

Caterpillar Inc. (NYSE:CAT) stock is a component of the Dow Jones Industrial Average.

During the last year, Caterpillar share price constantly underperformed the Down Jones Industrial Average, losing 26.8% of its value on a one-year basis. Company reached the 52-week high during November 2014 raking up $107.12 per share.

However, since the end of 2014, this positive trend sharply swung, the share price hit the 52-week low- hitting $62.99 price tag in September 2015. This has marked a 41.1% loss of their value in less than a year. As of November 13, shares of Caterpillar are at $69.63 signing a slightly positive recovery.

Financials: Historical Trend

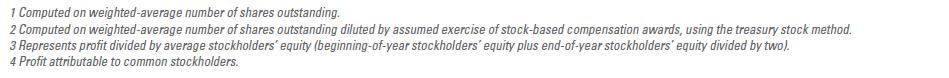

Share price performance drop was caused mainly by the latest poor financial performance of the company. From 2012 to 2014, sales dropped 8.5% CAGR. Furthermore, the Return on Equity registered a huge slump since 2011, from 41.4% of 2011 to 37.2% of 2012, finally landing at 19.6% at the end of 2014. Moreover, the slower growth outside the US, where Caterpillar makes most of its revenues, has been an additional reason that is worrying investors.

Share price performance drop was caused mainly by the latest poor financial performance of the company. From 2012 to 2014, sales dropped 8.5% CAGR. Furthermore, the Return on Equity registered a huge slump since 2011, from 41.4% of 2011 to 37.2% of 2012, finally landing at 19.6% at the end of 2014. Moreover, the slower growth outside the US, where Caterpillar makes most of its revenues, has been an additional reason that is worrying investors.

The negative trend was confirmed by 3Q-2015 results. Earnings per share was $0.62, or $0.75 excluding restructuring costs. Total sales were $10.96bn in the third quarter of 2015 – 19% less than the corresponding figure of $13.55bn in 3Q-2014.

The picture does not improve going forward. For 2016 the forecasts are even worse: the company announced last month that 2016 was likely to mark an unprecedented fourth year of falling sales due to expected lower sales volumes. Moreover, since 2012, the company has shut down 20 manufacturing facilities and has cut 31,000 jobs, implementing the reshape of the work force in order to cut costs and avoid further erosion in profit margin.

If Caterpillar is struggling this could mean that the entire industrial demand could currently be very unstable, as it is neither the quality of the company’s product nor any scandal connected with Caterpillar in the centre of the bad performance. After all, the orders of the famous yellow construction vehicles are prime indicator of the performance of heavy industries – predominantly mining, energy and construction. Indeed, main driver of Caterpillar’s poor performance is mainly the victim of the depressed oil prices, which is also followed by the sluggish construction revenues.

Positive indicator that the poor performance is due to the factors not imputable to this yellow giant is the fact that through their cost saving program they managed to reach the highest profit margins in last two years. Furthermore, Caterpillar is still giving its best effort to further cost cutting as it is considering another 10,000 layoffs by 2018 and optimization of PP&E that represents a big chunk of their balance sheet. This could at least send the message to the market that Caterpillar is fighting to remain competitive in such a macroeconomic environment. The weak demand is also caused by the lower capex for mining, energy and construction companies that instead of reinvesting the money are increasingly giving it back to the shareholders. It is obvious that Caterpillar is on the forefront whenever the mining, energy and construction sector has been hit, as well as at times when the economic results fail the expectations.

The other machinery companies have also seen better days, which consequently brought analysts to mark further downgrades. Namely, Deer& Co has marked 30% fall in half year earnings and their share price plummeted 23.2% from $97.14 down to $74.6.

Financials: Global Performance Breakdown by Region

As sales declined in every region and industry in 3Q-2015 it is important to understand the impact stemming from each of them, in order to spot where the biggest issue relies:

- In North America, sales decreased 17%, primarily due to lower end-user demand across all the Energy & Transportation applications and for construction equipment.

- In EAME, sales declined 13%, mostly due to the unfavorable impact of currency, as sales in euros translated into fewer dollars, as well as lower end-user demand for products used in mining equipment and power generation applications.

- Asia/Pacific sales declined 25%, primarily due to lower end-user demand for mining and construction equipment as well as products used in oil and gas applications. In addition, the impact of currency was unfavorable as sales, mostly in Australian dollars and Japanese yen, translated into fewer U.S. dollars.

- Sales decreased 31% in Latin America, primarily due to widespread economic weakness across the region, which had a negative impact on demand for construction equipment and spending. The most significant decrease was in Brazil.

The shadow of the Colossus

As announced in September, $1.5bn cost-reduction plan, cutting jobs, lowering SG&A and spinning off unprofitable assets would be a life jacket for a rotten business strategy. But are we really sure that Caterpillar’s strategy is so bad?

It is undeniable that part of these bad performances is due to the inefficiencies of the firm itself, but we believe that market forces have played an important role as well. As a matter of fact, the three main segments where the company operates are well-known as cyclical sectors and all of them have undergone difficult times after the financial crisis, particularly the Construction sector. Keeping this in mind, it is hard to believe that revenues in all these sectors are declining due to a perceived lower quality of Caterpillar’s products. A far more reasonable explanation could be found if we consider the current economic environment affecting the company’s main markets: weak economic growth in the United States and Europe. U.S. construction activity is particularly impacted by low infrastructure investment and continued headwinds from oil and gas. Even more important is to consider that more than 60% of Caterpillar pre-tax profits are coming from outside the US. The Brazil recession together with recent China’s slowdown further affecting all the EM world are all factors that contribute to the overall revenues slump and, together with extremely weak commodity prices, are making hard times for the company.

Following this line of reasoning, the company’s future might look a bit brighter than what appears. If indeed in the short term the outlook is quite disheartening everywhere and especially in EM countries that are likely to experience further capital outflows which, in turn, will reduce real investments; the long run prospects are expected to change. According to a recent study published by BMI forecasts, the global construction sector including infrastructure, energy and transportation will expand in real terms by an annual average of 3.2% to a nominal value of more than $6tn between 2015 and 2024.

While North America and Western Europe will expand at a relatively slow pace, the driving force behind this global growth is the Asian construction market. This will cement the region’s position as the largest construction market in the world over the next decade growing at an average of 4.1% over the forecasted period. One of the reasons for this is the effort of the governments to develop infrastructure that has seen years of underinvestment and thus unlock more sustainable economic growth. Other regions such as Latin America, Central Eastern Europe, the Middle East and North Africa as well as Sub-Saharan Africa will register robust growth, as governments remain committed to infrastructure investment.

Asia remains the most attractive market also if we consider the energy segment, expanding by an annual average of 7.1% in nominal terms over the period, mainly due to the region’s need to address its severe power deficit. Lastly, within Asia’s transport sector, roads and railways will be particular bright spots. Indonesia’s road segment, for example, is expected to grow by an annual average of 12.8% between 2015 and 2024 in nominal terms. Other key markets are, of course, China and India, expanding by an annual average of 5.1% and 8.9% respectively between 2015 and 2019.

If it is true then that the recent slowdown could be mainly attributed to market forces affecting the company’s main markets rather than to firm-specific factors, there is a far less harmful solution for the company instead of cost-cutting. This includes refocusing the company’s operations towards geographies (e.g. Asia) expected to increment infrastructure and energy investment going forward. And doing it in a timely manner to secure Caterpillar a great slice of the new opportunities that these countries have yet to offer.

[edmc id= 3190]Download as PDF[/edmc]

0 Comments