Introduction

Back in December we published an Article called “Democratic Primaries: A markets perspective” in which we provided an overview of the most significant Democratic candidates, namely Berny Sanders and Elizabeth Warren from a more liberal, left-wing side and Joe Biden and Michael Bloomberg from a more moderate centrist side, and their proposed legislations. We continued to form an opinion on how markets would react if said candidates would become the democratic candidate given their proposed legislation regarding markets. In this second part we will look into the developments of the Democratic Primaries and the Democratic Nomination as well as evaluating our predictions from the first part

Democratic Nomination before the Super Tuesday

The Democratic Primaries started on the 3rd of February with the Iowa caucuses who awarded 49 delegates. The start to the democratic primaries was chaotic with a break down of the Democratic Parties communication app with which the results were to be reported centralized. An initial result was published with a 3 day delay. After requesting recounts of specific precincts by both the campaign of Buttigieg and Sanders the results were officially published on the 27th of February and certified by the state committee on the 29th of February. The results showed Buttigieg winning over Sanders by 0.08 State Delegate Equivalents (SDEs). The number of pledged national convention candidates is then assigned proportionally to the nationally SDEs won. Bernie Sanders had won 26.5% of the votes followed by Buttigieg with 25.1% and Biden trailing in 4th place with 13.7%. However, more state delegates were given to Buttigieg with 14 than Sanders with 12 despite Sanders having the popular vote. Joe Biden won 6 delegates.

Despite Iowa results still finalizing the New Hampshire primary was held on the 11th of February, awarding 33 delegates. Both Buttigieg and Sanders were able to build on their momentum with Buttigieg narrowly losing to Sanders in the votes, receiving 25.6% and 24.3% respectively but both receiving 9 delegates. Biden was unable to meet the threshold of votes to receive any delegates and thus left New Hampshire with 0 delegates.

With two more caucuses to go before the Super Tuesday Nevada followed New Hampshire on February 22nd. In Nevada Joe Biden managed for the first time to edge out Pete Buttigieg. Nonetheless both lost by a strong margin to Bernie Sanders starting the fear in the more centrist camp of the Democratic Party that Sanders might receive the nomination. Democratic strategist fear that if Sanders would be nominated it would repel key centrist swing voters and make it easier for Donald Trump to win the election.

The last primary before the Super Tuesday was in South Carolina on February 29th. This was a major test for many of the candidates since the voting population of South Carolina was substantially different from the first primaries and caucuses. While the first states were primarily white voters, 60% of the South Carolina Democratic Voters are African Americans. It was a test whether the candidates could appeal to a more diverse Democratic base on a nationwide basis. Here Joe Biden became the leading force with 48.7% of the votes and winning by a strong margin against the runner up Bernie Sanders who only received 19.8% of the votes in second place. Pete Buttigieg and Amy Klobuchar, another centrist candidate, received 8.2% and 3.1% respectively.

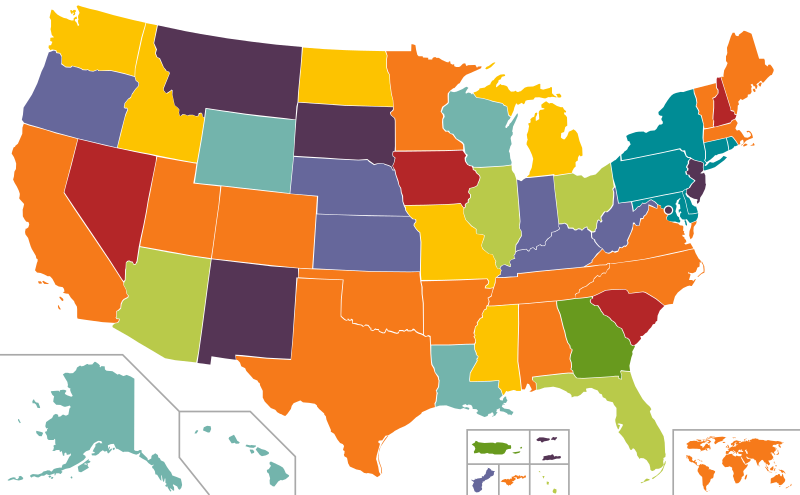

Super Tuesday

Source: Wikipedia, 2020 Democratic Primaries

Super Tuesday is the day on which ⅓ of all delegates are assigned on one day. It is often the day on which the field whittles down to two candidates. The states up for grabs were: Alabama, American Samoa, Arkansas, California, Colorado, Maine, Massachusetts, Minnesota, North Carolina, Oklahoma, Tennessee, Texas, Utah, Vermont and Virginia. These include the population heavy states which have many delegates such California with 415 delegates, Texas with 228 delegates and North Carolina with 110 delegates.

With falterting support among a more diverse background of voters both Pete Buttigieg and Amy Klobuchar withdrew from the race for the White House. Pete Buttigieg the next day on March 1st and Amy Klobuchar just hours before voting for the Super Tuesday started. Both threw their support behind Joe Biden whose campaign had gained strong momentum from the South Carolina primary. Now joining the race was Micheal Bloomberg though who had skipped the first states in order to focus his campaign on the Super Tuesday states. The main competitors on Super Tuesday were now Bernie Sanders, Joe Biden, Micheal Bloomberg as well as Elizabeth Warren who had stayed in the race despite lagging support.

The results of the Super Tuesday were pretty decisive when it comes to whittling down the field of candidates. The results were as followed (please note that both Buttigieg and Gabbard received one delegate each but have not been shown below)

Super Tuesday Results

| State/Candidate | Biden | Bloomberg | Sanders | Warren |

| Alabama | 40 | 1 | 7 | 0 |

| American Samoa | 0 | 4 | 0 | 0 |

| Arkansas | 17 | 5 | 9 | 0 |

| California | 154 | 29 | 210 | 7 |

| Colorado | 9 | 9 | 20 | 1 |

| Maine | 11 | 0 | 9 | 4 |

| Massachusetts | 36 | 0 | 29 | 23 |

| Minnesota | 38 | 0 | 26 | 10 |

| North Carolina | 65 | 1 | 35 | 2 |

| Oklahoma | 21 | 3 | 13 | 0 |

| Tennessee | 29 | 8 | 15 | 1 |

| Texas | 81 | 5 | 72 | 1 |

| Utah | 1 | 2 | 9 | 0 |

| Vermont | 5 | 0 | 11 | 0 |

| Virginia | 66 | 0 | 31 | 2 |

| Super Tuesday Results | 573 | 67 | 496 | 51 |

| Total Results (including pre-Super Tuesday states) | 627 | 67 | 556 | 59 |

Source: Using data from Wikipedia, 2020 Democratic Primaries

With the support of the moderate democrats who dropped out of the race at an earlier date or right before the Super Tuesday Joe Biden was able to use his momentum of the South Carolina Primary to win the Super Tuesday against his main contender Bernie Sanders. However, there is no final winner yet between the two and the following primaries will prove important to see who receives the nomination. The most notable next date will be March 10th. The campaign from Michael Bloomberg faltered despite record spending of $500m on his campaign. The day after the Super Tuesday, on March 4th, the campaign of Micheal Bloomberg decided to drop out of the race. Many hope that, as his initial reason to join the field of contenders was Joe Bidens lagging support in the fall of 2019, that his campaign resources which count as the most high-tech and organized one will be used to support Joe Bidens campaign.

The effects of the Super Tuesday on markets

In our previous article we talked about the potential effects on different industries of a “market friendly” and a “non-market friendly” candidate being chosen by examining their potential legislation. We will now focus just on the two candidates left, Sanders and Biden. Our proposition was that Sanders nomination would be highly problematic for healthcare, financial and technology stocks. However, we mentioned “Assuming no other major market event…we expect meaningful market volatility around Super Tuesday”. No need to mention that this week was in no way without any other meaningful market event. With fear of the coronavirus Sars-CoV-2 having a significant impact on the health of the economy spreading market volatility had increased since mid-February around the time of the outbreak in Europe. With tourism, transport and event firms suffering earning losses of unprecedented magnitude. It is estimated that the aviation earnings lost due to the virus will be greater than the effect of 9/11. In response to this the Federal Reserve cut interest rates by 0.5 percent to 1-1.25% in an emergency meeting on Tuesday the 3rd of March.

Lets start looking at the volatility around Super Tuesday. Back in December in our first article we looked at the VIX future term structure to see that the spread between February 20th and March 20th was thinner than any of the other two consecutive months. This presented an opportunity for investors looking at market volatility around the Super Tuesday.

The VIX had a value of 13.62 with a long term average around 16. The February 20th VIX future had a volatility index of 17.51 while the March 20th one had a volatility of 17.63. The VIX closed on February 20th with 15.56. Looking at the current position of the VIX at market close on the 6th of March we have a closing value of 41.94. This is a sharp increase from any predicted value, outside the range of the entire term structure back in december and well above the long term average.

The current term structure of VIX is inverted showing that investors believe that the current volatility caused by the virus will likely fade out over April and May and that markets will return to slightly above long term average volatility in the end of the summer of 2020.

Due to this immense volatility and the fact of an emergency rate cut on the day of the Super Tuesday it has become very hard to decipher exactly the effect that the primary had on the individual sectors. With the rate cut both tech and financial firms were hit hard. Financial firms will likely report lower earnings due to their interest margins decreasing. Bank of America with its vast retail operations plunged 5% on the day of the rate cut. This eliminates the possibility of us to analyze the effect of the primary on the Financial and Tech sector.

The last sector we mentioned in Part 1 back in December was healthcare. On Tuesday afternoon trading the healthcare sector rallied with a 5.8% gain. This was their best day since 2008. Especially two healthcare insurers Anthem and Cigna led the rally with 16% and 11% advances respectively. While we cannot exclude that the rally was partially due to the higher medical expenses due to the virus outbreak in our opinion these rallies were likely due to the strong performance from Joe Biden. With Biden and Sanders having fundamentally different views on healthcare. Biden proposing an expansion of the healthcare program to compete with private insurers while Sanders wants to make a single-payer national health insurance programme. This would to some extent eliminate private insurers. Thus the rally in health care can effectively be traced back to the results of the Super Tuesday.

To conclude our idea of increased volatility around the Super Tuesday and using the spread of the VIX February 20th and March 20th future would have yielded significant positive results to investors. However, while we were right we were so for the wrong reasons and almost all of the volatility can be related to the Sars-CoV-2 impact on the economy and industry earnings.

0 Comments