The First Reaction

One of the first institutional proposals for a reform of LIBOR came from the Weathley Review of LIBOR. Commissioned in late June 2012 by the UK Chancellor of the Exchequer, it has been driven by Martin Weathley, former managing director of the Financial Services Authority (“FSA”) and former chief operating officer of Federal Conduct Authority (“FCA”). With a document called the “Initial Discussion Paper”, the Review asked market participants, regulators and academics to submit proposals and solutions to strengthen the rate and restore its reliability. After one month, the Wheatley Review published the Final Report, in which the results were summarized.

The Review considered the structure on which the submission process relied upon. The graph below displays the LIBOR model that existed at the time. Banks submitted LIBOR quotes to BBA LIBOR LTD; then, they were communicated to Thomson Reuters, which published the final rate checking possible misstatements with the help of a set of parameters provided by the Foreign Exchange and Money Markets Committee (FX&MM). This last institution also had the responsibility to design and control the entire process, being in charge of checking submissions and taking action against breaches. Nevertheless, it lacked transparency since neither its members nor arising problems were publicly disclosed. Indeed, the entire process fell short of robustness and resilience. Firstly, BBA LIBOR did not provide a rigorous methodology, nor specific requirements and instructions for banks to follow. Secondly, there was also no obligation to join the LIBOR panel; in fact, only a few banks provided the rate, whereas the remainders did not, avoiding potential risks and an unrewarding activity. Thirdly, submitting banks could use different providers to gather data (money brokers, derivatives market, etc.), and the determination of the rate could be subjective. In essence, the non-transaction-based approach could lead to the submission of quotes rigged by private incentives. The Review recognized banks to suffer from an inner conflict of interests: at the same time, they were (and they still are) market participants, contributors and users of the rate. Hence, traders had incentives to profit from particular trading positions and in underestimating it to signal better creditworthiness during periods of market stress. Soon after, the Review published a second document, the Final Report, which strongly recognized the necessity to maintain and enhance the rate. Even if there were proposals for substitution of LIBOR, market participants suggested a change could “pose an unacceptably high risk of significant financial instability, and risk of large-scale litigation between parties holding contracts that reference LIBOR”: as the market still widely uses it, a replacement would have brought about a massive effort in terms of changing the contracts’ provisions. Nevertheless, the adoption of a transaction-based methodology was recognized as necessary, even if this could entail the elimination of some tenors and currencies. Based on this strong assumption, the Review proposed a pathway for substantial reforms to prevent other cases of misconduct and restore the reliability of the rate. The first issue considered regarded the administration of LIBOR and its regulatory regime. The BBA proved to be incapable of governance, and a new institution had to address its limits to restore the rate’s credibility. The Financial Conduct Authority should have had the power to oversight on this new institution. Panel banks then had to adhere to a new code of conduct that would have ensured the application of best practices and transparency. These new rules, drafted by market participants and then revised by the FSA, would have targeted both the submission procedures and the internal system and control policies. For example, to limit the incentives to alter the submissions during periods of financial stress, they proposed to publish individual submissions only after three months Reuters receives the data.

Secondly, market participants identified the priority to change the submitting rules with a new code of conduct: the calculation methodology had to be based on transaction data rather than on judgements, following a hierarchic procedure in case of scarcity of information. Such variation could suppress the calculation of the rate in some currencies and maturities. In such a case, an announcement should have to be set with proper advance, giving operators the possibility to arrange an alternative solution for contracts referencing them.

In the following months, the UK Government began the implementation of the Wheatley Review’s recommendation: through a revision of the Financial Services Bill, the FCA was attributed with more powers, the Financial Services and Markets Act 2000 was extended to benchmark-related activities, and new criminal offences related to misreporting were created. The enhancement continued with the substitution, in February 2014, of the BBA with Intercontinental Exchange. This private company has undertaken a process to make LIBOR more robust to manipulation and transactional scarcity, providing new rules for submission and a new Waterfall Methodology for calculation.

The LIBOR model. Source: The Weathley Review of LIBOR

An Economics Problem

Even if from a regulatory point of view the Review addresses essential aspects of the case, from an economic one it fails to consider the consequences of a trend having a massive impact on the sustainability of the rate: the market underlying LIBOR almost dried up during the 2008 financial crisis and the 2010 Euro debt. This means that there were no enough transactions for the calculation of the rate. The situation has not changed, and, as we will see, transaction volumes in its underlying market are still too low. Therefore, even if the rate has become more robust and resilient, concerns about its sustainability as a mostly referred benchmark have driven the work of several institutions.

As a matter of fact, LIBOR was considered almost a risk-free rate before the crisis. This quality did not arise from blind faith in the banks’ creditworthiness. Indeed, it was appointed by the market itself, which priced LIBOR almost as much as the overnight index swaps. OIS contracts involve two parts, each responsible for paying a sum of money to the other at one or more specified dates. One’s payment (the floating leg) is accrued as the geometric average of an overnight rate, therefore, it is not knowable in advance. The other’s payment (the fixed leg) is fixed and corresponds to the expected compound average of the overnight rate at maturity. In our case, the overnight rate used in OIS is the effective Federal Funds Rate (EFFR). This is computed as the weighted average rate at which institutions trade Federal Funds, money reserves held at Federal Reserve Banks. Similarly to LIBOR, the Fed Funds Rate arises from short term banks’ funding necessity. Also, it is a monetary policy rate, to the extent that the Federal Reserve influences it through open market operations to align it with its target rate. Therefore, the fixed OIS rate (i.e. the overnight indexed swap rate) measures the expectations of the FED’s policies and it is not subjected to other influences: counterparty risks are offset by the necessity to post collateral to the party for which the swap becomes a liability, whereas liquidity premia are virtually irrelevant as there are no initial cash flows. For these reasons OIS rate is considered a very low-risk rate.

Absent credit risk and transaction costs, OIS rate and LIBOR should align for the same maturity. Otherwise, an arbitrageur could profit from a mismatch between the two: for example, bank A could lend a sum of money to bank B for three months, charging 3-month LIBOR (fixed at the beginning). To fund the loan, Bank A could borrow on the overnight fed funds market the same amount of money, paying the floating overnight fed funds rate. After, to hedge against the floating rate, bank A could enter into an OIS, paying the fixed expected 3-months rate at maturity and receiving the floating EFFR daily. Bank’s A payoff is equal to:

3month LIBOR − overnight EFFR + (swap payoff)

That is:

3month LIBOR − overnight EFFR + overnight EFFR − 3month EFFR

Namely:

3month LIBOR − 3month EFFR

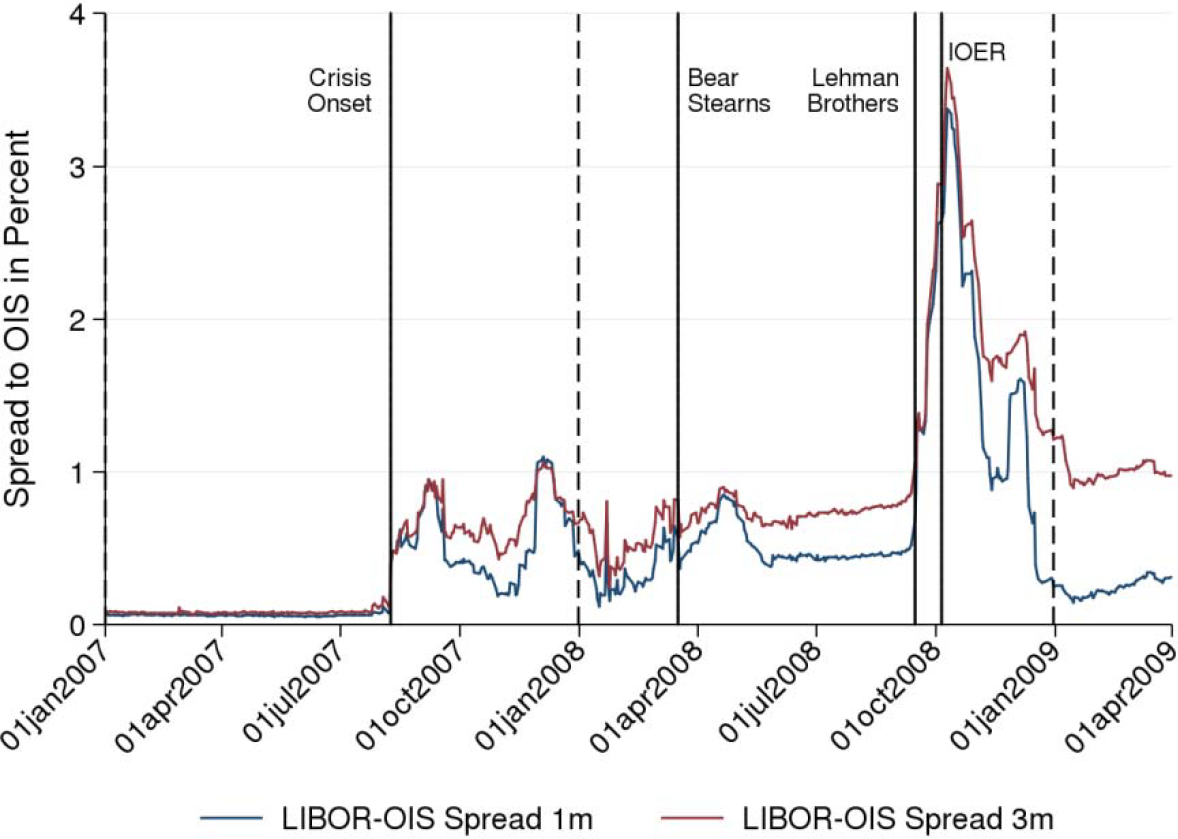

Before August 2007, arbitrageurs have kept this difference below 10bps. Nevertheless, in July 2007, the spread between the two widened. The graph below shows the sudden surge in the differential, which surpassed 300bps after the collapse of Lehman Brothers on September 15, 2008. In three days, 3-month LIBOR passed from 2.82% (Friday, September 12, 2008) to 3.21% (Friday, September 19, 2008). From that point, LIBOR became more heavily referred to as an indicator of a bank creditworthiness and as an overall measure of the banking system’s health. As the former FED chairman Alan Greenspan stated, “LIBOR-OIS remains a barometer of fears of bank insolvency.” The significance relies on the facts that happened in those years: banks proved to be less solid than thought.

LIBOR-OIS Spread, Jan 2007 to April 2009. Source: Kuo et al. (2013)

Indeed, this interpretation, reliable and true, does not express all the causes of the spread spike. As we mentioned above, interest rates embed different premia; scholars have tried to disentangle them to understand which was the most relevant in LIBOR, but without coming to a univocal explanation.

Some of them have focused on a unique determinant premium: Frank, Gonzalez-Hermosillo, and Hesse (2008), Taylor and Williams (2009), Heider, Hoerova, and Holthausen (2015) and In, Cui, and Maharaj (2012) have recognized counterparty risk as to the principal source of the spread. Instead, others (Michaud and Upper (2008), Imakubo, Kimura, and Nagano (2008) and Poskitta (2011) consider liquidity premia to be the most relevant drivers of the LIBOR-OIS differential. Especially in the first period of the crisis and for the shorter tenors, liquidity has proved to be more important than other risks in the determination of the rate (Sarkar (2009), Gefang, Koop, and M. 2011)). This means LIBOR increased because of funding necessity rather than credit risk aversion. Nevertheless, disentangling liquidity needs from credit premium is not easy, since during a financial crisis they could be quite correlated: banks’ need for liquidity can arise in times of heightened systemic risk and default risk can be the result of financial distress. Supporting the latter positions, Acharya and Skeie (2011) propose an interesting model for explaining how the liquidity issue affected market operators. Starting from the work of Kuo et al. (2013), they recognized the fact that the surge in LIBOR rates which occurred since August 2007 was accompanied by a fall in lending maturities during the same period. Precisely, the average maturity of interbank lending, fell from above 40 days to below 20 after the collapse of Lehman Brothers (September 2008). At the same time, also the term lending declined, especially for maturities of 3 months or more, while loans with tenors between 8 and 29 days increased. As far as the authors are concerned, this phenomenon can be explained by hypothesizing the existence of a banks’ precautionary demand for liquidity. In normal market conditions a bank would try to lend all its surplus liquidity. But if an external shock occurs, as it happened in 2007-2008, the bank’s assets could both depreciate and become more illiquid. Such an event could reduce the amount of cash-flow coming in from the sale of those assets. In addition, depreciation would erode revenues, and the bank could sustain losses. Therefore, a leveraged bank would see its debt-capital ratio increase. Such a situation could lead the bank to sustain a roll-over risk, i.e. the inability to renew its short-term debt, both because of a damaged financial equilibrium and worse perceived creditworthiness. The model shows that the roll-over risk impairs the bank lending activity: since it now feels the necessity to hold some liquidity to sustain the short term financing, the bank is willing to lend just a portion of its liquidity, based on its own credit risk, diminishing the long term lending. Actually, the bank acts in a risk-averse fashion in its portfolio choices, contrary to what the corporate finance literature sustains. Traditionally, traders were believed to act in a short-run interest-bearing excessive risk in case of financial distress. Still, empirical analysis has displayed this did not happen during the crisis. Effectively, regulatory capital requirements and value-at-risk constraints impose the institution to conform to risk-averse principles: the former wants the portfolio to be rebalanced with regard to equity capital to ease the financial distress risk, the latter obliges trading positions’ probability of large default to adapt to a certain threshold (Krishnamurthy 2010). Also, if the roll-over risk is sufficiently high, the bank could look for additional liquidity in the market as precaution. In the aggregate, this attitude entails an surge in the interbank rate, which sits above the credit risk value. Therefore, as the authors recognize, the OIS-LIBOR spread has increased in the lender’s leverage, its asset illiquidity, and uncertainty about its asset quality. The borrower’s behavior has this effect on the spread too: to the extent that he would be charged with a higher rate, he could face roll-over risk as well. Thus he exhibits precautionary hoarding. What the model introduces is that the rate paid by the borrower in the interbank market is directly linked to the lender’s credit and liquidity risks, all other things being equal. For these reasons, the market could face a total freeze: even if healthy banks could profit from new investment opportunities, they have to bypass them, since they are unable to access funding. This lack of supply originates from the lenders’ balance sheet, which is too leveraged and illiquid. Effectively, proof of this mechanism can be found in Acharya and Merrouche (2012): soon after the beginning of the crisis, especially following the collapses of Northern Rock (September 2007), Bear Stearns (March 2008) and of the asset-backed commercial paper market (August 8, 2007), UK banks seemed to behave in this way: they increased their reserve balance target with the Bank of England (hoarding for liquidity), especially those which had relied more on overnight funding and suffered from high equity losses. At the same time, there was an upsurge in the interbank lending market rate. Similar results have been highlighted by Ashcraft, McAndrew, and Skeie (2011). In the US market, banks had to increase their reserves as a result of payments shocks in the asset-backed commercial papers market, since their revenues were linked to it. At the same time, these banks decreased their interbank lending activity, as a consequence of their higher necessity of liquidity. But this model is also consistent with Gorton and Metrick (2011), who adopt an interesting point of view in explaining what happened during the crisis. In the debt market, an institution needs to raise money before buying a security, through selling assets, increasing capital or borrowing funds. The last option is the most common, since it is faster and easier than the other. Thus, investment banks, hedge funds, insurance companies, dealers and brokers buy securities with borrowed money. Still, they also secure the funding with the securities themselves: they operate in a securitized fashion. At maturity, to refund the loan, they sell the security. Therefore, securities’ value is fundamental in the investment activity of an institution. This mechanism is called repurchase agreement or repo. Loan collateralization makes the repo market attractive for cash investors seeking short-term opportunities. It is not casual that its development took place during the early ’70s, when high-interest rates obliged bank deposits to have a minimum maturity of 30 days. In addition, repurchase agreements both hedge against the default risk of the counterparty and are a safe-harbor in case of bankruptcy: in fact, they are not subjected to the automatic stay injunction. This legal feature provides the debtor with the right to halt the creditors’ actions, but in this case it does not work, meaning they can unilaterally enforce the termination provisions. These are the reasons for which financing through repurchase agreements has become a common practice in the debt market. As of March 4, 2008, the Federal Reserve estimated the fixed income securities with repo amounted to $4.5 trillion 17. Other estimates report an amount reaching $10 trillion in 2007 (Hördahl and King 2008).

A repo is characterized by an interest rate, namely the price of the loan, and a haircut, that is the positive difference between the value of the deposited security and the effectively borrowed amount. Of course, these values are adjusted on the basis of the counterparty default risk, but they also depend on the recovery rate the lender would realize in case of default. The magnitude of the haircut has a specific effect on the purchasing activities of the operators: indeed, the money borrowed is always less than the value of the collateral; therefore, it is necessary to fund the remaining amount in a different way to finalize the purchase, e.g. with risk capital. In this sense, it is the haircut that determines trading volumes. If the disposable risk capital does not change (assume it is $5) and the haircut increases from 5% to 10%, the maximum value the institution can invest in decreases from $100 to $50. At the beginning of the financial crisis, repo haircuts started soaring, especially the structured finance products’ ones. In this situation, even the borrowers faced a counterparty risk, because if they had declared bankruptcy, they would have had to embark on a lengthy proceeding trying to recover the difference between the collateral’s value and the borrowed amount. Therefore, as this gap was mounting, the reliance on repos faltered. At the same time, the value and liquidity of securities used as collateral were tumbling cyclically: the less they were traded, the higher the haircut and vice versa. In such a situation, the markets expressed preferences to short-maturities and liquid assets.

Proved that the market expressed preferences for short term maturities, transaction volumes in the longer ones lowered consistently, and LIBOR-OIS spread rose exaggeratedly, there is still one thing to be noticed. As shown by the graph below, the median daily transaction volume in the unsecured market is slightly higher than $1bn for the 1-month tenor, lower than $1bn for the 3-month and even lower than $500m for the 6-month one. Daily transaction volumes in the 3-month USD LIBOR are just around $500m, an inappropriate number for the number of contracts referencing the rate. Such a situation facilitates attempts of manipulation and does not assure LIBOR will continue to be produced for long.

Indeed, these reasons led the FCA not to compel panel banks to submit it after 2021. At that point, the rate could almost definitely be a relic of the past.

Distribution of daily unsecured funding volumes of the G-SIB firms post money-market fund reform. Federal Reserve staff calculations based on daily aggregate volumes across Fed Funds, Eurodollar, certificates of deposit, and unsecured commercial paper transaction of the 30 global systemically important banks with tenors between 25 and 35 calendar days (1-month tenor), 80 and 100 calendar days (3-month tenor), or 150 and 210 calendar days 8 (6-month) over the period October 15, 2016 to June 30, 2017.

Source: The Alternative Reference Rate Committee

0 Comments