Introduction

Once again, the United States are at a crossroad. Pitted against each other, American citizens will have to cast a vote on what many political observers believe to be one of the most divisive elections in recent times. As the ballots roll in, financial markets will adjust accordingly. In this article, we try and take a view on the most likely scenarios following a Trump or Biden victory.

Macroeconomic scenarios

It is widely accepted that the stock market and the real economy are not one and the same. However, robust macroeconomic stability is surely an important driver of performance in equity markets. This is why it is important to try to forecast and understand the possible scenarios that will materialize after the election, depending on its possible outcomes.

Rating agency Moody’s has attracted large media attention and coverage when it published its report “The Macroeconomic Consequences: Trump vs. Biden” on September 23, with Democratic candidate Joe Biden even mentioning their findings during one of the two presidential debates. Moody’s Analytics, much like all other consultancies and bank research divisions who have published reports on the election, focuses on four main scenarios: a Democratic sweep, with Joe Biden winning the presidency and the Democratic party taking back the Senate; the status quo, with Donald Trump, reconfirmed as president and the GOP keeping control of the Senate, a Republican sweep, with the GOP controlling Congress and the split outcome in which the Democratic party wins the White House but not the Senate (seen as most likely).

It is Moody’s contention that a Democratic sweep would lead to the most favourable macroeconomic outlook, with more jobs being created and a major stream of deficit-financed government spending on the horizon. On the other hand, a Republican sweep, in which not only does the GOP keep the White House and the Senate, but it also wins back the House of Representative, is seen as the weakest macroeconomic outlook, due mainly to less spending directed at lower-to-middle class families, opposition to immigration and conflict with foreign trade partners. Split congress scenarios are seen unenthusiastically by Moody’s, which maintains that stimulus would take more time to be passed and any agreement would probably not be as satisfactory as in a sweep scenario.

Of a similar position is Oxford Economics, which points out that US Senate rules require 60 votes for legislation to be passed in Congress, and since neither party is likely to surpass that threshold, the consultancy envisions moderate legislation being passed in either split scenario. Moreover, Oxford Economics contends that a Biden win without a strong majority in the Senate would still result in remarkable GDP growth, greater employment and spending in infrastructure, education and healthcare. Finally, a very relevant point made by the consultancy firm is that possible economic drawback of a corporate tax increase under a Biden administration would be offset by better foreign trade relations and stronger consumption.

Overall, it seems fairly clear that a scenario where Biden wins the election and is allowed to govern – maybe with a weak majority at the Senate, thus not having to rely exclusively on executive orders – would lead to a strong rebound of the economy and to significant long-term growth, due to enhanced spending directed at consumers and households. Should President Trump be reconfirmed, and the GOP keep control of the Senate, it is unclear whether the economy would benefit from it, and in which way it would. Certainly, without the COVID pandemic, the consensus view would be the Trump presidency was at least moderately good for employment and GDP growth, if unsatisfactory for the quality of jobs created. But in absence of a clearly laid out vision in terms of economic policy for the President’s second term in office – with the exception of promises of further tax cuts – it is difficult to make precise macroeconomic forecasts, especially when considering that the trade war with China and oppositional foreign relations will most likely continue.

Equity markets

There is general agreement between operators in the financial industry that more than one’s candidate success, the overall outcome of the election – including the House and the Senate – is a better predictor of equity markets’ performance during the next four years.

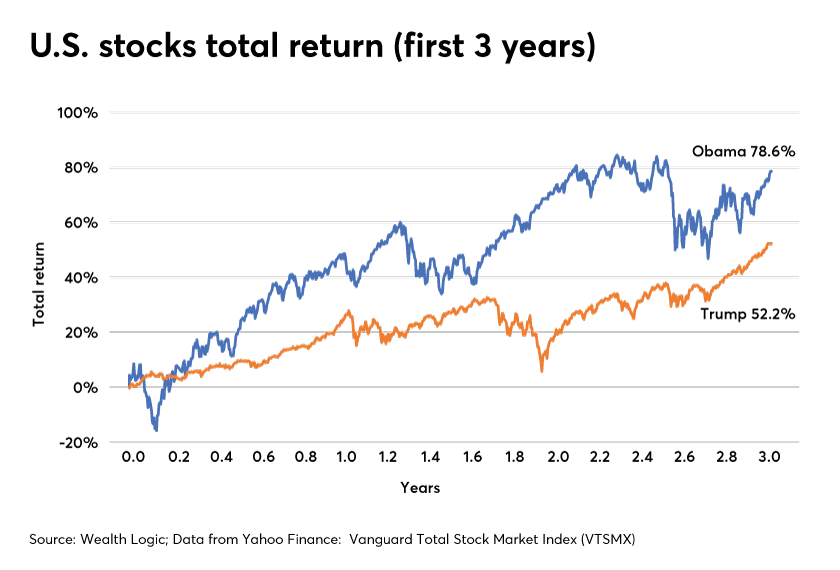

It is conventional to think that a Democratic sweep is bad for equities. The rationale is that Democrats are more likely to favor increases in corporate tax and fiscal pressure in general, while Republicans are expected to champion deregulation and lower taxation. Whether Democrats are actually bad for equities is entirely up for debate, since it is clear that there exist several instances in which such contention is more akin to fiction than fact, an example being the Obama presidency (during which Democratic candidate Joe Biden was Vice President).

Morgan Stanley Research suggests that a dem sweep would initially lead to a drop in the S&P 500 but reassures that such pessimism would be short-lived as market cycles are stronger drivers of equity performance than policy in the longer term. On one hand, that is surely a possibility, due to Biden promising increased corporate tax rates. On the other hand, however, a Biden presidency is expected to lead much to less conflictual international relations – with some political observers believing however that the Democratic candidate will maintain a strong stance against China – and to bring about greater stimulus and significantly larger public spending, which could offset the corporate rate hike’s effect on equity.

In fact, stimulus talks have been possibly the strongest driver of the S&P 500 in the past months. When talks stalled, the S&P slid, when they showed promise and an agreement seemed within reach, the index soared, therefore it is only fair to assume, as UBS and many others have pointed out, that few days after the election, investors’ attention will be focused again on the economic measures taken by Congress to address the pandemic-induced crisis.

Split outcomes, being the most likely, are of great interest for our analysis. In particular, it is likely that a reiteration of the status quo, namely a Trump victory with the GOP keeping the Senate but not regaining the House, would not lead to great changes in the market. Investors are by now well acquainted with such a political scenario and know what to expect, both in terms of stimulus and policy. A different conclusion should be drawn in case former Vice President Biden were to win the election, but Democrats did not win the Senate. That would drastically limit would-be President Biden’s ability to pass any substantive stimulus without a long and probably acrimonious congressional negotiation. Furthermore, in such a framework it is difficult to imagine Biden being able to meaningfully advance his agenda, as Republicans are likely to oppose increases in spending, especially if aimed at establishing a public healthcare option, and tougher regulation in any form.

Another important factor making a split outcome undesirable for markets and their participants are political uncertainty in itself. It is known, in fact, that political uncertainty is not good for equities, whose prices tend to be more volatile as a policy would become more unpredictable.

Moving on to specific sectors, forecasts become even more polarized. Trump’s reelection should push investors to take long positions in sectors such as telecommunications, energy and financial services, anticipating less regulation. While the Trump administration would most likely not subsidize further renewables and energy innovation, their taking over the energy sector in the upcoming years is rightly seen as inevitable by most, due to their increasing economic convenience. An even more favourable scenario for that sector is envisioned in case of a Biden victory, as candidate Biden has promised that under his administration the US would rejoin the Paris agreement and adopt if allowed by Congress, a series of environmental measures inspired by the Green New Deal.

If Vice President Biden were to win the election and to secure a majority in Congress, investors might want to consider shorting pharmaceutical stocks at a certain point of his tenure in office, should he be able to grant Medicare the power to negotiate prescription drug prices. Moreover, a more bearish outlook is expected for financials, if Biden were to succeed in imposing a bank liability tax, alongside a higher corporate rate. A rather bullish scenario is envisioned, instead, for the materials sector, due to Biden’s the ambitious infrastructure spending plans, which range in the trillions, and in consumer discretionary, driven by a potential increase in the minimum wage to $15/h.

Commodities

As far as commodities are concerned, all eyes are already pointed to gold and oil prices. 2020 has been a drastically volatile year for oil prices, which have not recovered from the ongoing COVID pandemic, while it has led gold to reach new highs, currently being up 30% for the year.

The precious metal is widely considered a safe haven in times of crisis and uncertainty. Investors turn to gold to get protection, as gold is largely uncorrelated with the business cycle. Despite gold prices having reached very high levels, it is likely that they will keep rising, especially if the outcome of the election is not immediately clear. However, investors should keep in mind, in the months to come, that the election will likely not be the strongest driver of gold prices, which will depend more significantly on the evolution of the pandemic and its impact on global markets.

As far as oil is concerned, it is more difficult than expected to form a consensus view on its price in case of a Biden win, as opposed to a Trump reelection scenario. However, we would like to present a possibly surprising position, namely that a Biden victory might be bearish for oil initially but bullish in the longer term. As many analysts have pointed out, candidate Biden intends to rejoin the Iran nuclear agreement, reducing sanctions on OPEC barrels and thus increasing supply. In such a scenario, the WTI is likely to dip after the election. However, a Biden presidency would also mean greater regulation inspired by the Green New Deal and the US rejoining the Paris Agreement, which sets standards for the reduction in US reliance on fossil fuel energy. Furthermore, while candidate Biden has repeatedly confirmed that he does not plan to ban fracking, he has stated that, if elected, he will ban drilling on federal land. Finally, a stricter regulatory environment would lift the cost of capital for oil producers. For these reasons, our view is that supply will decrease faster than demand, thus causing oil prices to increase in the course of the Biden presidency.

Interest rates

Given the current economic environment, predictions on interest rates have not been hogging the limelight after the 13 lending facilities that the Federal Reserve has provided in March. Contrary to 2016, on the verge of a presidential election and a recovering economy that could politically put the Federal Reserve in a troubling situation to show its neutrality, this time, chairman Jerome Powell’s actions are undisputed. Speaking at the Jackson Hole Symposium on August 27, 2020, Powell stated that the Federal Reserve is not even thinking to raise interest rates, and instead proposed the flexible use of “average inflation targeting”, which enables monetary policy to aim to achieve inflation moderately above 2 percent for some time, following periods when inflation has been below that level. Beyond that, his current stint at the Federal Reserve mirrors the actions of Bernanke in early 2008, when he acted swiftly to provide liquidity in the financial markets, but later urged Congress for fiscal stimulus to get the Federal Reserve off the political hook. As a result, while the federal funds rate is expected to remain low until 2023, the medium-term outlook can change according to the elected president.

One of the main tail risks, for instance, would come with the election of President Biden and a Democratic sweep in both chambers of Congress, the so-called “Blue Wave”. In this case, Morgan Stanley portfolio manager Jim Caron warns that a generous fiscal stimulus would bring a rate hike by the Fed in from 2024 to 2025 to maybe 2023 to 2024. At the same time, this reflationary outlook possibly leads to higher yields and a steepening of the nominal yield curve. This suggests that investors with a medium to long-run horizons should reduce portfolio duration and consider other hedges for risky assets.

In the case of a Trump win, the US economy will still be trying to surge with the help of a fiscal stimulus, but this time, over the medium-term, the relation between the President and the Federal Reserve is worthy of a look. While Biden has publicly stated full support for the independence of the fed, President Trump has always been vocal on his criticism of Jerome Powell, whose term as Chairman will end in 2022. Who will be next? As the political scientist M. Saeki points out, the serving president, historically, shows a significant indirect impact on the appointment of the following Fed Chair, thus begging the question if a more dovish successor could come next. It is needed to say, however, that the Federal Reserve Board is widely considered to be one of the most independent governmental agencies worldwide and, furthermore, this political influence has not been recorded for the Board of Governors, where Powell will sit until 2028.

Currencies

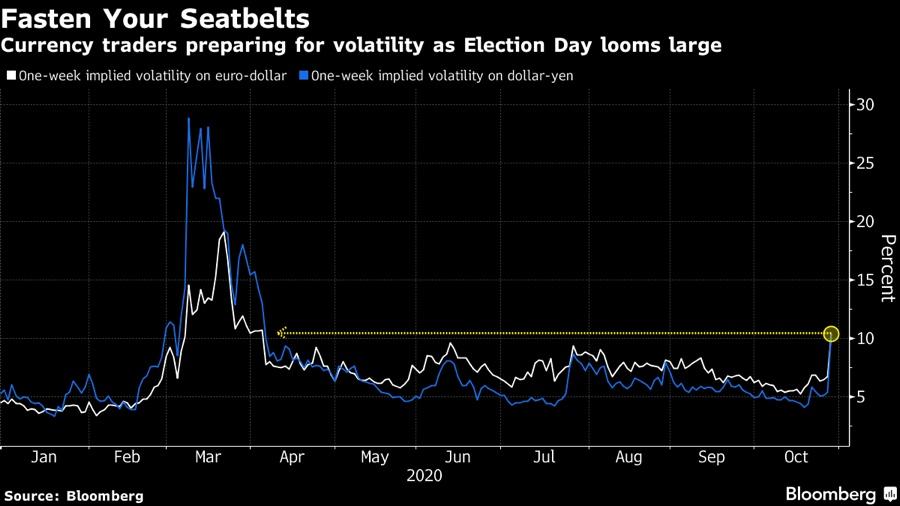

Many investors, while trading on the equity and fixed income markets, may have been more focused on the long-lasting effects of the coronavirus pandemic and the financial health of the companies instead of an anticipated presidential election. Conversely, the FX market has seen more closely the battleground between the two candidates, with currencies now singing to the same Biden tune. Although the US dollar has been considered a safe-haven currency in March, investors have not been afraid to buy riskier assets, despite the severe economic conditions caused by COVID-19.

Source: Bloomberg

This has been reflected in the recent rally of several currencies, namely the Mexican Peso, the South Korean Wan and the Taiwanese and Singapore Dollar, but a tougher ride for the Turkish lira and the Russian ruble. Biden is seen as a rules-based conventional president and thus may retract the flamboyant threats of the previous presidency be it the fear of ending the North American Free Trade Agreement (NAFTA) with Mexico or menacing South Korea, Japan and Taiwan to pay more for US’s military support in Asia. It would work in the other way, too, with loosening ties with president Erdogan and a dire inflationary spiral sending the lira tumbling, and relations with Putin expected to worsen.

Does that mean that all bets have been put, implying increased volatility if Trump wins? It is not so granted, according to a Deutsche Bank report. In their view, “real money” investors tend to refrain from making big portfolio changes before a historic event unfolds, and it can take many weeks to price it. This was the case in July, for instance, when the European Union had struck a deal to borrow billions for their first time in history, but the euro only rallied against the dollar after final confirmation. Under a Red Redux or Republican Sweep, we may still see an appreciation of the DXY.

Either way the election can go, it looks like the Chinese yuan has already been crowned as a winner. Foreign investors have snapped up Chinese debt this year, attracted by relatively high yields and the country’s economic recovery after the coronavirus pandemic. Most importantly, the People’s Bank of China has not sought to weaken the currency with mini-devaluations after large rallies for both the onshore and internationally traded versions.

Flows into China’s bond markets in the year to August topped Rmb615bn ($90bn), bringing foreign holdings to Rmb2.8tn. Net equity market inflows were Rmb93bn for the same period, taking foreign holdings to more than Rmb1tn. Even if a Trump win can enforce stronger, self-damaging trade wars, the Sleeping Giant’s entrance into the FTSE Russell World Government Bond index could lure a further $140bn into the country’s government debt.

Emerging countries

Neither of candidates took a strong stance on this topic, as most countries in the world have seen a political inward move to wage the social measures linked to the coronavirus. Notwithstanding the exceptional current situation, the US economy remains firmly at the helm of the world trade volume of financial and real assets, the dollar itself accounting for 80% of daily transactions. This is particularly important from a public sector viewpoint, as emerging countries around the world happen to take part of their debt in dollars and find themselves on the hook in times of crisis. Not surprisingly, the Federal Reserve acted swiftly in March by announcing the U.S. dollar liquidity swap lines and the temporary repurchase agreement facility for foreign and international monetary authorities (FIMA repo facility) to other nine central banks in the world.

Be it, Trump or Biden, unfortunately, this measure is not enough to make them better off, as the various balance of payments have cracked in the recent months, such as Lebanon’s or Argentina’s. For what concerns other countries, it is notable to see how the dollar dominance in the world underlines different outcomes of the same fiscal policy around the world. While Biden’s proposal encompasses $2tn and a great increase of the government deficit without foreign investors budging, many emerging countries are meeting financing problems: Indonesia’s central bank has bought $27bn worth of bonds directly from the government, and the similar picture is holding true for Philippines, Poland, Croatia, Thailand, South Africa, Romania, Hungary, Chile, Costa Rica, Colombia and Argentina.

Despite the grim picture, a Democratic sweep may also benefit emerging market equities, given its association with expectations for more infrastructure spending and rising long-end yields. One notable exception is Russia, which could face sanction risks. Presumably, as said, during the second half of Biden’s term a large fiscal stimulus could pull forward Fed rate hikes, resulting in some headaches for EM fixed income returns.

On the other side, a Trump presidential win will still see strong support for the “America First” trade agenda, and we would therefore expect EM assets to underperform. At the same, by following the same reasoning, a longer period of lower rates will benefit investment-grade EM Credit and low-yielder rates.

0 Comments