Introduction

The supranational, sub-sovereign and agency (SSA) market sits on a highly niche portion of the general bond market, having composed of sovereign government issuers and private credit borrowers.

The issuer landscape is made up of international institutions that have differing funding requirements, such as development banks, infrastructure developers, export creditors, shipping entities, etc. These institutions generally have in common of being mandated with social or economic public policy initiatives. The issuer structure could be divided into three different parts as the name suggests: supranational, sub-sovereign and agency.

Supranational Issuers

As a result of a perceived market failure, in which suitable funding sources were unavailable or simply unreliable, a need arose for an alternative source of secure funding, and thus supranational issuers were created. Being mandated across national borders as well as being governed by representatives or shareholders of multiple countries, supranational borrowers aim to assist governments or shareholders in developing better economic and social policies. These objectives are achieved by supplying loans to sovereigns and the private sector, or by taking equity investments. Considering the development and public policy initiatives of these institutions, dividends are mostly reinvested or retained to expand the capital base instead of being distributed.

In terms of size, geographical coverage and orientation there exists diversity amongst supranational issuers. The geographical reach can range from global to continental, or to regional in their focus.

Sub-sovereign Issuers

These type of issuers are situated one step below the sovereign issuer. They tend to be state-level borrowers rather than federal government issuers, such as Germany’s states (Länder) and Canada’s provinces. Particularly in Europe, the sub-sovereign market is very well developed, highly liquid, strongly supported, and regarded as safe-haven assets by investors. To take Germany as an example, investors perceive the Länder to be as secure as the German sovereign since it governs the financial support of the combined financial strength of all 16 states. However, not all of the Länder are rated AAA, like the sovereign, such as Berlin that is rated Aa1/AAA Moody’s/Fitch.

Agency Borrowers

This sector is very difficult to outline due to its highly diverse range of institutions by nature, shareholder ownership and guarantee structures. Some examples to the agency issuers include public banks, workout banks, infrastructure development bodies, export financiers and social security facilities. Therefore, the “agency” expression is fitting to include institutions of all kinds that are mandated on behalf of its governing sovereign or sovereign linked state for economic or public policy-related initiatives.

Guarantee Structures

The SSA universe is regarded as highly secure for its unique status granted by law, together with a broad range of explicit and implicit guarantees protecting it. This so-called “special status” relates to the association between a supranational issuer to its international shareholders or a group of sovereigns. The joint funding nature of supranational provides a higher degree of credit reliability and quality, leading to stronger credit ratings. Whereas, in the case of an agency or sub-sovereign issuer, the SSA issuer is backed up by its sovereign, providing further implications to the bonds’ security. The guarantee structures that are especially significant for SSA issuers can be classified into five principal groups.

1. Explicit issuance guarantee

It is the strongest possible guarantee type there is, allowing each bondholder to hold a direct claim on the guarantor in the case that the supra/sub-sovereign/agency defaults. Together with the explicit help of the respective sovereign, the issuer guarantee is perceived as legally binding, even though it might not be in a timely manner.

2. Explicit issuer or maintenance guarantee

This type of guarantee is slightly different from that of the “explicit issuance”, in which the guarantor certifies that the institution has adequate means of finances to perform its obligations in a timely manner, but the guarantor itself is not legally bound for credit claims in the event of distress or default. The institution could turn to the guarantor for financial support; however, the guarantor is not legally obliged to provide liquidity to third parties if the borrower were to be in default.

3. Implicit guarantee

The implied agreement confers the issuer with the full support of the sovereign should the issuer become distressed or experience default, despite not being set out by law. This trust is derived mostly from the relationship and integration that the sovereign holds with the issuer. The implicit guarantee may be confused for the maintenance guarantee, however, there exists neither formal nor explicit guarantee, as well as no legally binding clause to hold the sovereign liable. Although, the sovereign could still remain as a full or partial owner of the respective issuer.

4. Country-specific guarantees

The range of guarantees differs with respect to the jurisdiction and size of the market in the respective country. For instance, Germany has various different guarantee schemes as it is home to the biggest number and volume of issuance of European SSAs. German borrowers are entitled to benefit from direct guarantees by sub-sovereigns on municipalities and SoFFIN (Financial Market Stabilisation Fund). Additionally, there exists a backbone support system for states with lower tax generation capacity called the Financial Equalisation Scheme. This state-level guarantee system ensures sovereigns to proportionately spread financial capabilities over financial obligations. Many other guarantee types are in place to ensure that the credibility and liquidity of the SSA market in Germany is sustained, such as the maintenance obligation Anstaltslast and statutory guarantee Gewährträgerhaftung. Moreover, another particularly notable country that has peculiar guarantees is France. In France, SSA borrowers are supported by direct sovereign guarantees that are not explicit, as enjoyed by UNEDIC. The SSA issuers granted the status of Etablissements Publics (EPICs) or Etablissement Public national a character Administratif (EPAs) are fully owned and controlled by the French government. This close relationship is similar to that of “Explicit issuance” as in the issuer does not go bankrupt or lose assets if obligations to creditors are failed; however, the creditor must request a court judgement to collect what is due, thus interfering with the timeliness of the payments until the court reaches a decision.

5. Shareholder Guarantee

Shareholder’s support institutions buy bidding in with capital. A higher level of paid-in capital translates to a more reliable of an issuer, as the likeliness of one shareholder covering for another shareholder is far less. The shareholder’s capital is callable upon request to fulfil the debt. If there was a “call” on additional capital falling short on account of institutions not being able to pay their balance due, all shareholders chip in. Therefore, this guarantee structure emphasizes the creditworthiness of institutions by fostering a collaborative liability and responsibility structure. For instance, Multinational Development Banks (MDBs) are off-balance-sheet institutions that leverage off the combined credit worth of its shareholders, resulting in stronger credit ratings and higher acceptance for repo purposes at central banks.

Introduction to Credit Ratings

Ever since the financial crisis, the increase in SSA bonds has been on a sustainable long term growth path. Particularly in the US, this trend can be seen starting from 2008. With an increasing role came increasing regulation and oversight as well as interests for an impartial rating of SSA bonds. In December 2013 EU-registered rating agencies are required to publish an annual calendar outlining their ratings for the next 12 months, including for SSAs. Each issuer must be formally reviewed at least every six months. Within a published rating, the agencies have to specify:

- measures of six specific quantitative data points

- the relative weights of these data points in the rating decision

- an indicator of default probability and an indicator of economic development (of the sovereign)

- any other relevant qualitative factors (including their weights in the rating decision)

- a detailed evaluation of the changes to the qualitative assumptions justifying the reasons for the rating change and their relative weight

- a detailed description of the risks, limits and uncertainties related to the rating change

- a summary of the committee’s discussion

It is to note that not all SSA issues are reviewed by the 3 main rating agencies (Moodys, S&P, Fitch). Some issues are reviewed by just one of them while others are rated by all 3. Issuer size and liquidity are not of importance in this rating since the state of Hessen in Germany is rated only by S&P (2017) while Lower Austria is rated by Moodys and S&P (2017) and Umbira in Italy by all 3 despite their relative economic importance not being in that order.

Credit Ratings for Local and Regional Governments

For further analysis, we will look at the rating methodology of FitchRatings for International Local and Regional Governments (LRG). First is looking into the so-called “Key rating drivers” (KRD). These include “Key Risk Factors” (KRF). The risk profile of the LRG is determined by the interplay between risk sources and corresponding risk mitigants. For each KRF there is a rank given from stronger over midrange to weaker Here 3 main risk pillars are used: revenues, expenditures & debt, and liquidity. It is looked at how revenues can be developed, expenditures reduced and liquidity maintained. Furthermore, LRGs missions are examined with their relevant connection to their sovereign(s) with revenue drivers to fund the responsibility they are given by the sovereign. Other Key rating drivers include debt sustainability, the standalone credit profile (SCP) which is a combination of the debt sustainability and the previous risk profiles. Fitch continues with extraordinary support or asymmetric risk factors in respect to LRGs which draws back to certain implicit guarantees by the sovereign. In case of weaker performance, it may be that the LRG receives extraordinary support from an upper tier of government despite no explicit guarantee. Lastly, as a key rating driver is the influence of the sovereign rating. While this is not a problem for most EU countries in case a sovereign does not have a rating Fitch requires a rating to be made on the same scale (international or national) and in the same currency (foreign or local). The sovereign rating usually presents a “ceiling” to the rating of the LRG. This is due to the fact that apart from a very few exceptions, subnational governments are influenced by (and subject to) decision of the central/federal government to such an extent that not only is the LRG rating capped by this rating but the KRFs are influenced by it. It is very likely that LRGs in AAA or AA countries will receive a better mark on their KRFs. On the other hand, LRGs in lower-rated countries with BBB ratings will likely not achieve these high in their individual ranking.

The Standalone Credit Profile

While not officially named the standalone credit profile (SCP) is most likely the biggest factor affecting the final rating of the LRG. The risk profile together with the debt sustainability score assessments is combined in a table for the SCP. The table provides ranges that can be assigned to the LRG. The risk factors and their ranking (Strong, Midrange, Weaker) have already been touched upon above. In order to read a score, the debt sustainability Fitch looks at 2 metrics. Primary and secondary metrics split into two types depending on the issuer. Type A is for sovereign like LRGs that can incur structural deficits. They have some kind of sovereignty and are in charge of supporting policies. Type B are LRGs that need to cover their debt service from cash flow on an annual basis. While some flexibility might be observed these LRGs are subject to requirements imposed and enforced by upper-tier and national legislation.

The primary metrics for type A include the economic liability burden. which measures the size of the debt in proportion to GDP. The primary metric for Type B is the Payback ratio defined as the net adjusted debt divided by the operating balance. It measures the ability of an entity to pay down its debt from its own recurring resources. The secondary ratios considered are two coverage ratios forming a score as well as the fiscal burden ratio. With these ratios the following table gives a Debt sustainability score:

Using this score as well the risk profile from the key risk metrics discussed earlier fitch uses a table to determine the suggested analytical outcome of the rating.

It is to be noted that c rated LRGs have not been incorporated into the table. This is due to the fact that the nuances for the rating of these LRGs are slightly different than for a or b rated LRGs.

SSA market – a European perspective

Over the last two decades, European supranational have been at the forefront of issuance volume. Unlike some of their sovereign counterparts, main regional supras, such as the EU, the European Investment Bank, or the International Bank for Reconstruction and Development, all enjoy very high credit ratings due to the backing of multiple countries. This has allowed for the creation of a very peculiar channel through which European institutions jointly handle the economic crises. Previously, the stability of the union was addressed through ESM and EFSF, which were able to secure relatively lower rates inaccessible to some of the economies at risk. This time, however, the EU’s response is even stronger and may open a new chapter in its fiscal policy.

Next Generation EU and SURE packages

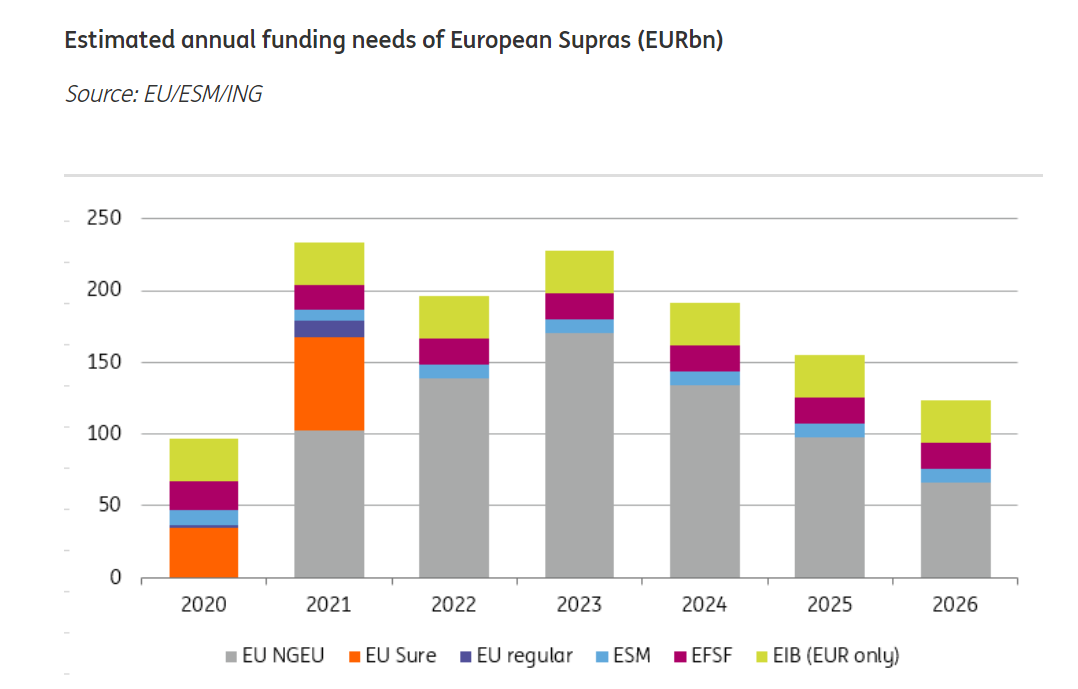

The EU seems to have learnt its lesson and to address the COVID-19 economic shock, it opted for a mutual and coordinated approach. As a response to the expected 7.9% contraction in 2020, it has recently adopted Next Generation EU (NGEU) and the Support to mitigate Unemployment Risks in an Emergency (SURE) economic packages, which may turn the EU into one of the largest borrowers in the region.

The EU currently has a modest amount of €50bn debt outstanding, but with future borrowing, the estimated amount can grow to as much as €900bn over the next six years. The Commission’s immediate focus is an issuance of €100bn worth of SURE social bonds to support a union-wide unemployment scheme. According to the commissioner Johannes Hahn, the EU plans to issue 5 billion worth of bonds every other week until the end of 2021, with maturities ranging from 3y to 30y. It is worth noting, that these will be issued as social bonds, for which the Commission has adopted an independently evaluated Social Bond Framework, making it a “clear demonstration of the EU’s long-term commitment to sustainable financing” according to the commissioner, looking to appeal to the ESG concerned investors.

The majority of the funding needs comes from the NGEU. The plan includes €360bn in loans and €312.5bn in non-repayable grants to the member states, channelled through the Recovery and Resilience Facility (RRF). This constitutes around 5% of the EU GDP. Another €77.5bn will be available via other programmes. The EU has stated that the maturities will range from 3 to 30 years and set a €29.25 limit on the annual repayment of the principal between 2028 and 2058.

The ESM has also announced a Pandemic Crisis Support, theoretically making an amount of €240bn available through its credit lines. So far none of the countries expressed an interest in accessing ESM’s support, but with the current second wave of COVID-19 cases across Europe it may become relevant to some of the smaller countries.

Auctions

Unlike most of the EU’s sovereigns, the supranational European debt is usually issued through a syndicated deal instead of a bid price auction. This is a specific agreement between a group of investment banks (dealers) and the issuer to buy securities for a previously agreed price, thus ensuring raising of the full amount. Banks receive an attractive fee for underwriting, but also bear a higher risk if the bonds were not to be fully sold. Such a procedure is usually used to launch longer end of the yield curve securities or when a market is not particularly deep. Interestingly, the commissioner Johannes Hahn said that with SURE bonds, aside from syndicates, the EU is looking into auctions as well. This hybrid model can result in some of the EU bonds trading with higher liquidity, making them more similar to the traditional government bonds.

Outlook for the Euro

With heightened levels of risk-aversion, it is expected that investors will warmly welcome the AAA-rated EU’s supranational debt. It seems that by having exposure to the southern and eastern member countries the EU debt will actually trade above the Bunds, even when accounted for the ESG aspect, which usually entails lower yields, as well as for the additional liquidity. This demand for the EU “coronabonds” can drive the demand for the Euro in the medium term, enhanced further by a lowered EMU-US interest rate differential. All of this, combined with a relatively appealing newly created fiscal union, can contribute to a more positive view of the Euro as a reserve currency.

The proponents of the fiscal union claim that its adoption is a necessary step in order to ensure the stability of the EMU, which would allow for a better solution to the macroeconomic imbalances within the EU. However, this potentially one-off response may set a precedent to the mutualization of the fiscal policy, thus taking away some of the independence of the democratically chosen local governments.

0 Comments