As of the end of March, financial news worldwide began covering extensively the unraveling of Archegos Capital Management – a family office whose way of conducting business de facto resembled a hedge fund. The speed which characterized this process of wealth destruction and the spillover effects that it brought about in the financial system were the focal points that were put under the spotlight by the major news outlets. Given the significance of this event, references were made to the historical collapse of Long Term Capital Management back in 1998, so as to warn against future potential systemic liquidity issues.

The Architect

The man behind this investment vehicle is Mr. Bill Hwang, a Korean-born but US-based investor who is an alumnus of the hedge fund Tiger Management for which he had already been convicted to pay a $44 million settlement to the SEC for related insider trading charges. The Korean investor created the family office back in 2013 with an initial investment of $200 million, which grew over time to reach roughly $20 billion in March 2021, before imploding at the end of the last month and resetting at zero.

Mr. Hwang managed to use an insane amount of leverage, placing bets on a concentrated portfolio of tech and media stocks which allowed him, as long as the wind was in his favor, to increase his net worth, amassing sizable funds that turned him into a billionaire in a matter of a few years. He was exploiting the full power of margin lending, combined with the loose disclosure requirements set forth by the competent authorities when dealing with family offices, and this allowed him to buy an incredible number of stocks without having to invest a lot in equity upfront and without raising any concerns with the regulators or banks.

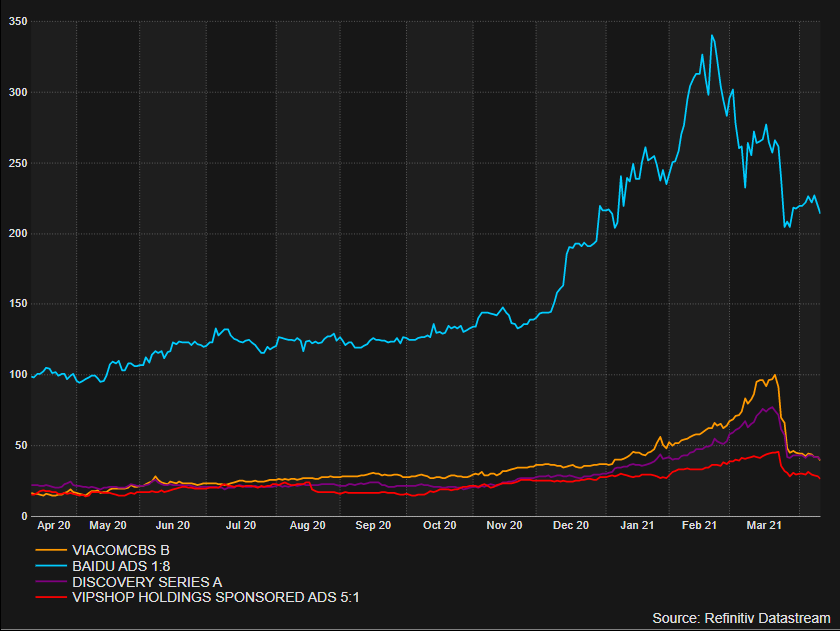

Mr. Hwang held big positions in companies like Baidu Inc., a Chinese multinational specializing in artificial intelligence and internet-related products which rose from $97.20 a year ago to $339.91 this February, and ViacomCBS Inc., an American mass media conglomerate, whose share price increased roughly by 700% in one year. By using lots of leverage, Mr. Hwang vastly amplified these returns which allowed him to accumulate riches in a very short period of time.

The Power of Total Return Swaps

The instrument that allowed Archegos to take large, concentrated, and leveraged positions in selected stocks is called total return swap. Let’s now examine how this contract works and how it is structured as we also did in our short-selling article.

A total return swap (TRS) is an OTC agreement between two parties to exchange the total return on a single asset or a basket of assets for a stream of periodic cash flows, typically based on a floating rate such as LIBOR. The total return is composed of both the capital appreciation, when the asset increases in value, and any income that the asset generates (such as coupon payments or dividends).

There are two parties to the contract: the total return payer and the total return receiver. The total return payer is typically a bank, an insurance company, or a fixed income portfolio manager. Typical total return receivers are hedge funds, private equity funds, pension funds, or other investors who want to make leveraged investments. The underlying asset can be a stock, an equity index, a bond, or a basket of bonds.

The main purpose of the TRS is to allow the receiver to gain exposure to the underlying asset, without having to own it. Thus, the payer (asset owner, the equity financing desk of a Markets division in an IB) agrees to pay the receiver the total return on the reference asset in exchange for the periodic interest payments; usually LIBOR plus a spread. If the asset increases in value, the total return is positive, and the receiver obtains a positive payoff. However, if the asset declines in value, the receiver must pay the asset owner a sum equal to this capital depreciation. This is because the receiver assumes any risk associated with the reference asset. This arrangement is effectively a way to lend securities because it allows the receiving party to get full exposure to the security without a transfer of actual ownership. A great advantage for the receiver is that he is only required to pay a fraction of the asset value up-front to enter into the contract. This is what makes TRS a leveraged transaction. While the interest payments always occur at specified periodic intervals, for payments related to the change in value of the asset, alternative structures are possible. Typically, the TRS foresees a payment of capital appreciation/depreciation at maturity of the contract. However, it is possible for parties to agree that the total return (including any capital gain or loss) is paid at the end of each interest period.

While the investment risk is borne by the total return receiver, the total return payer still faces counterparty risk. This is particularly relevant if the receiver, i.e. the investor, enters into multiple TRS contracts on similar reference assets. Any decline in the price of those assets will result in capital losses for the investor, while he still continues to make regular interest payments. If the value of the portfolio drops, the payer (prime brokerage desk of a Markets division in an IB), will make a margin call requiring the investor to post more collateral. If the investor is not sufficiently capitalized and fails to comply, the bank may sell the underlying assets. However, this obviously creates even more downward pressure on their price given the size of the notional such that this transaction meets the requirements of a block trade which needs to be handled in tranches and at specific market conditions such that the sale itself does not cause an excessive price move.

The Meltdown

This is what eventually happened to Archegos in March when the wind started blowing in the wrong direction, and many of its investments turned into serious perils for the financial sustainability of the family office. In particular, the downward movements of the share prices of many of the companies included in its portfolio started exposing more and more its levered positions and its major lenders, namely Morgan Stanley, Credit Suisse, Nomura and Goldman Sachs began exercising margin calls.

Given that Mr. Hwang could not fulfill the requests of the investment banks, the latter started unburdening the positions they held on behalf of Archegos. Whereas some banks like Morgan Stanley and Goldman Sachs managed to unload their exposures to Archegos without incurring major losses, others such as Credit Suisse and Nomura experienced estimated losses of $4.7 billion and $2 billion, respectively. Several executives at the Swiss-based bank were laid off following this business disaster that came right after the damages previously incurred due to the failure of Greensill Capital.

There are a couple of interesting points in this story. First is the strategy that Mr. Hwang used to maximize the leverage of his trades and thereby the gross volume of his positions. He did not only manage to hold quite a concentrated portfolio by using total return swaps, but also amplified his footprint by using the swaps on the same stocks with multiple different prime brokers. After the collapse, banks said that they were unaware of the extent of positions Archegos was holding with other banks. Indeed, clients do not necessarily need to disclose details about their trades with other lenders. If banks had complete information, they might have been prompted to be more cautious and tighten their lending conditions to Archegos. But since this was not the case, Archegos managed to increase its leverage on some positions to as much as 8:1 and allegedly hold nearly 25% in some of the companies it was invested in. Generally, investors who hold more than 10% of a company’s stock are subject to enhanced disclosure requirements. But Archegos technically only owned a fraction of its gross holdings, the major part was still owned by banks brokering the total return swaps. Hence, the family office successfully stayed off the radar, despite amassing sizable positions in several companies.

Second, Archegos’s investment strategy was apparently even more aggressive that one would assume at first glance. It seems that Mr. Hwang was not only making highly leveraged bets, but also to have reinvested his gains back to the stocks he targeted, further amplifying these levered trades. And for one or two years his bets were highly successful, making his gains substantial. Let us make a simple illustrative example. Suppose that a leverage ratio is 5:1, or 80%. This means that to buy $100 worth of stock, an investor needs to post $20 as a margin and effectively owes the remaining $80 to the broker. If the stock goes up to $160, the leverage automatically decreases to 2:1, or 50%. The investor still owes $80 to the broker, but his position is now worth $160. Suppose that the position is left as it is, and the stock price drops to $120. That is still higher than the initial $100, so the investment is still profitable, and the bank is satisfied with the original margin. On the other hand, if the investor decides to plough the $60 back into the trade to borrow even more, his leverage ratio obviously doesn’t remain at 2:1 but goes up anew. Now if the stock price decreases, leverage automatically rises even further, because the position will be worth less. In this case, the bank will call the investor to post an additional margin. However, if the investor is highly leveraged and doesn’t have enough own capital to comply with the margin call, the whole trade collapses and banks are forced to liquidate their positions. In Archegos’s case, this dynamic triggered a devastating avalanche.

Lastly, let us have a closer look at the rally that the stocks which were at the core of Mr. Hwang’s portfolio experienced over the past year, before they eventually crumpled. Ironically, it seems that one of the reasons why the price of stocks he targeted went up was the very fact that he invested so much in them. Since Archeogos’s portfolio was highly concentrated, its trades and particularly the growing levered positions were substantial enough to push the stock prices up. Without this momentum, the prices were bound to tumble at some point, as it happened to ViacomCBS at the end of March, after its new share offering fell significantly short of its original target. In short, Archeogos created a powerful but very fragile scheme and when it was disrupted, the consequences were fatal.

Source: Refinitiv Datastream

The Fragilities in the Banking System Exposed

In spite of the fact that some banks managed to stay unscathed by the abrupt collapse in prices of the stocks held by Archegos, some awkward questions started coming to surface. Why did the banks keep on lending substantial amounts of money to Mr. Hwang even though he was holding very little cash and his collateral mainly consisted of a very concentrated portfolio of stocks? Was it out of greed and because they were confident that they would be able to exit their positions in time and thus avoid losses? Were the banks deceived by the current regulatory regime that does not require family offices to disclose their pre-existing outstanding loans and financial positions with other banks? How come that banks like Morgan Stanley acted both as bookrunners of the secondary offering of ViacomCBS, and at the same time were prime brokers to Archegos, eventually offloading a large amount of ViacomCBS stock only days after they led the stock sale? Many of these questions still remain unanswered, but two things are certain: prime brokerage business now appears way riskier than just a couple of weeks ago and, as it is often the case, the market rewards those players who act the fastest and the most ruthlessly.

Last but not least, it is interesting to observe that after the fire sale triggered by the Archegos’s debacle, many hedge funds and alike are starting to ponder over their existing prime brokerage relationships with banks, concerned by the possibility that financial institutions could be exposed to hidden risks, thus threatening funds’ own reputation in the industry. As Cutler Cook, a managing partner at Clay Point Investors, put it: “Anyone who lived through 2008 is going to be checking their prime brokerage exposure”. It is therefore clear to the attentive reader that it would not be odd if some investment firms and hedge funds were to switch lenders in the aftermath of these events.

Conclusion

It remains to be seen what implications this story will have on the long-established order of global banking. Some call for an increased regulatory scrutiny for financial institutions, as well as for hedge funds, family offices and their investment activities. For banks, questions arise about the degree of leverage they can extend to individual clients and how to properly measure and monitor the associated risks. Vast majority of banks are already scrutinizing their risk limits and outstanding credit lines and we might potentially see an implementation of stricter and more prudent rules. For example, Credit Suisse is already exploring a shift from static to dynamic margining, whereby the latter allows the prime broker to require more collateral if the risk of the position rises because of increased volatility or concentration. Further, regulators both in the US and in Europe signal that they are reviewing risks associated with banks’ leveraged exposures. In any case, the crucial question remains: will the Archeogos debacle remain a one-time event, or will it have systemic consequences for the financial landscape?

0 Comments