At the beginning of a new election term, Argentina finds itself in another economic crisis. After Alberto Fernández, a centre-left opposition leader, defeated president Mauricio Macri in election primary this August, the Argentine peso lost 33% of its value in three days, hitting a new record low. But this was only a catalyst exacerbating the country’s already uneasy economic situation – skyrocketing inflation, plunging stock market and interest rates as high as 60%. In 2015, when Mr Macri came to power, analysts were looking at Argentina with a lot of optimism. Let us have a closer look at what has gone so wrong.

In the article from November 2016, we examined the Argentinian fixed income market, considering the then economic outlook and political situation in the country. Today we will analyse how the situation evolved over the past four years, what are the roots of the current crisis, and how does Argentina’s current condition affect other countries in the Latin American region.

The cycle repeats

The presidential election in 2015 put an end to many years of a left-wing rule in Argentina. Newly elected Mr Macri was appraised for his market-friendly governing policies which included eliminating currency controls, cutting taxes and committing to reducing the fiscal deficit. In 2016, Argentina sold $16.5bn in high-yield government bonds with a 100-year maturity; the record emerging-market debt sale at that time. Moreover, it was the first time that an emerging-market country issued century bonds. This event marked the country’s successful return to the international fixed income market after the large government default in 2001. IMF projections from November 2016 predicted Argentina’s GDP to grow by 3% through 2019, and inflation rate to gradually decline, arriving at 9.4% in 2021. These positive signs suggested that Argentina was on the right path to recovering from the previous recession.

Figure 1 – Alberto Fernández with Cristina Fernández de Kirchner after winning the October 27th election (Source: FT)

However, in 2018 things started to take a turn. The climbing U.S. interest rates and an appreciating dollar had a twofold adverse impact on Argentina’s economy. First, a higher dollar return made risky emerging markets less attractive and induced some investors to relocate their money elsewhere. Second, the stronger U.S. currency coupled with rising rates raised concerns about Argentina’s ability to service its dollar-denominated debt, which amounted to as much as 70% of the country’s total debt. As a result of this weakened confidence, the peso started to soar. This prompted the Central Bank of Argentina (BCRA) to intervene by selling $2.1bn in reserves throughout April and May in order to support the local currency. However, this had little impact and by May 2018, the peso was down by almost 35% compared to its beginning-of-the-year value against the dollar. Furthermore, the interest rate surged to 40%, hurting local businesses, and GDP growth in April turned negative. As a consequence, Mr Macri turned to the International Monetary Fund (IMF) to stabilize the situation in the markets and secure the government’s ability to pay its debt. In June 2018, Argentina was granted a $56bn credit line; the largest one in the IMF’s history.

Yet, the peso continued to weaken further and in August the BCRA was forced to raise the interest rate to 60%. Despite the efforts, Argentina did not manage to restore its fiscal balance and regain investors’ confidence. The situation escalated in August 2019 when Alberto Fernández, the leader of a populist Peronist movement, outperformed the sitting president Mauricio Macri in the primary election. This spurred concerns that Argentina will again turn to the state-controlled economy since Mr Fernandéz’s party opposes the trade deal with the EU, as well as many of Mr Macri’s market-friendly reforms. Investors started to worry that this might increase the chances of Argentina defaulting on its debt. As a result, the country’s stocks saw a steep decline and the peso plummeted, losing more than 30% against the dollar. Since then, it has not yet recovered. The government has again imposed currency controls and with sky-high inflation, a further increase in poverty is likely to follow.

Mistakes that could have been avoided

So, what are the main reasons that have led Argentina to a crisis again? Firstly, during the past 4 years, the government delayed unpopular fiscal tightening measures that would have made Argentina less reliant on outside capital. By avoiding public spending cuts, Mr Macri pushed the economy of Argentina to even greater dependency on international debt. Unfortunately, Mr Macri failed to predict that steady growth and renewed access to foreign debt markets would not be enough to drive Argentina out of the economic hole that it was still facing at the time Mr Macri became the leader. Some experts point out that if he had used the money from the IMF from the outset, Argentina’s current position would be much better. It would have even been possible to avoid the economic meltdown. Unfortunately, the deal with the IMF was not struck until June 2018. Also, one of the controversies of the deal was to let the exchange rate float freely, which allowed for the sharp peso devaluation that undermined Argentina’s credibility.

Moreover, the level of exports has been insufficient to generate an inflow of dollars that would be enough to pay back the foreign debt. Currently, the external debt of Argentina approaches $300bn, while it was below $200bn 4 years ago. One of the other issues has become the sale of a 100-year government bond in 2017. The success of this unusual issuance was a result of investors’ hunger for higher-yielding debt and optimism towards Mr Macri’s pro-market reforms at that time. $2.75bn were raised at the interest rate of just 7.9%, thus keeping interest rates below the economic, financial and liquidity rationale. Such advantageous conditions incentivized the government to raise a substantial amount of money while underestimating the associated risks. This step has also become an incentive for more debt issuance by Argentinian entities.

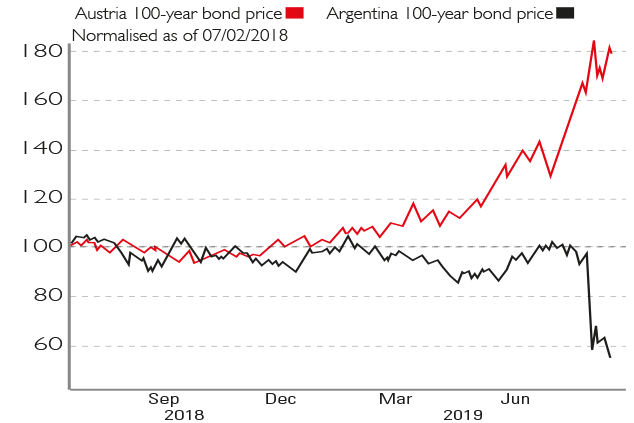

It is true that back in 2017 there was a lot of optimism associated with the said 100-year bond. However, let us look more closely into this and compare the price of Argentina’s century bond to the price of a 100-year bond issued by the Austrian government in the same year, only with a time lag of 6 months, making it a comparable asset. The prices of the two bonds diverged significantly this year with Austrian bond prices surging while the price of Argentinian bond slumped by 45% in the face of upcoming crisis, peso depreciation and rocketing inflation.

Figure 2 – Price evolvement of Austrian and Argentinian 100-year bond

Source: MoneyWeek

So, what comes next? Public debt is expected to decline in the following years, but this will hardly be enough to handle the upcoming crisis. The public debt-to-GDP is expected to decrease to 77% by the end of 2020 and to fall to 60% in the medium term, as a result of implementation programmed fiscal consolidation. This is another attempt of the government to balance its budget; however, this strategy remains exposed to downside risks related to exchange rates, interest rates, economic growth and contingent liabilities. The demand for pesos is still very low because of the lack of credibility to the currency. In the sequence of 8 defaults that Argentina faced during last 200 years, the upcoming breakdown could be not as dramatic as that of 2001 (which was a largest sovereign default in history), but may still have long-lasting consequences.

IMF’s reviews of Argentina still questionable

The interaction of Argentina with the IMF is quite ambiguous. The predictions provided by country reviews 1-4, published by the IMF, diverge greatly in numbers and seem to be too optimistic, leaving space for uncertainty. The 5th review is going to be published in December 2019 and the question is: how optimistic is it going to be this time?

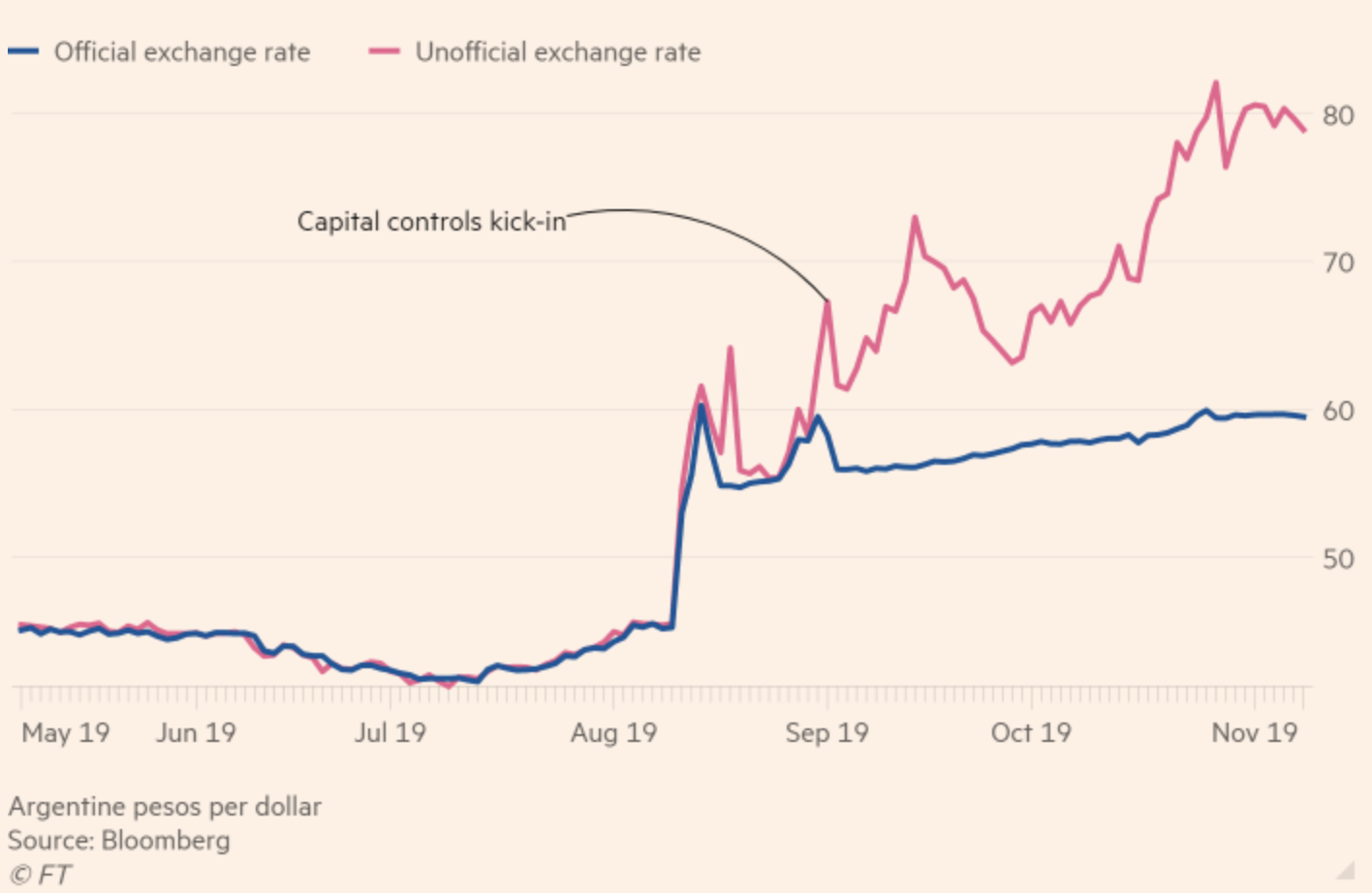

So far, despite moderate projections, Argentina continues moving towards greater economic turmoil. In the 4th review, the plan of the BCRA to intervene if the peso goes above some level was mentioned. When capital controls kicked-in in September 2019, the official exchange rate might have been perceived as stabilizing. What happened was the split between the official and unofficial exchange rate, with the peso continuing to devaluate at an extremely high speed according to the unofficial rate. The 4th review claims that “the program remains fully financed and Argentina’s capacity to repay remains adequate, albeit subject to heightened risks”. However, this statement does not seem very realistic anymore.

The latest IMF report on Argentina contains several requirements, including limitations on open market operations, on repos to domestic banks, and on sale of LEBAC (peso-denominated short-term debt). In addition to these requirements, the IMF also designed and implemented many plans regarding debt management and risk mitigation. Not all of these conditions have been met yet and the question is whether the required policies will be implemented in the future under the new government.

Now that the management of the IMF changed, it is very important for Mr Fernandéz to establish successful communication and find common ground with the fund since the relationship with the IMF will lay the foundation for Argentina’s chances to receive money from private investors. In any way, the IMF would probably support capital control and managed currency to some extent. Otherwise, Argentina is likely to reproduce its past path. However, it is not clear how these measures can be achieved, given the limited scope of fund-endorsed instruments. Moreover, we can see that the policy of capital controls and heavy market interventions, that was partly implemented by the BCRA, is not sustainable since the international reserves that the BCRA used for its intervention in foreign exchange have already declined sharply and no sufficient amount of reserves remain. This implies that a new approach most probably will be needed.

Figure 3 – Official and unofficial USD/ARS exchange rate

Source: Bloomberg, Financial Times

Worries of a domino effect abated

Contrary to expectations, the worries of a big spillover from Argentina to surrounding emerging markets are redundant, for now. A short analysis conducted on the FX and equities markets suggests that the aftermath of the primary election on the 12th of August was mostly constrained to the Argentinian market and did not live up to the contagion effect feared by many analysts who warned investors of cascading effects in the region.

In the analysis, we considered the following regional emerging market currencies vs the U.S. dollar: Brazilian Real (BRL), Mexican Peso (MXN), Colombian Peso (COP), Chilean Peso (CLP), and the controlling currencies: Euro (EUR) and Japanese Yen (JPY) [Data: Reuters Datastream]. As ARS sunk by 22% on the 12th of August, the comparable EM currencies reacted in line but only by a non-significant amount. The controlling currencies strengthened, as expected on a risk-off day, by less than 0.5%. The 1-month (1M) and 3-month (3M) average returns computed before and after the primary election do not reveal a significant change in average returns of the comparable currencies, except for Chile. There is a noticeable uptick compared in the 3M average return after the 12th of August, but when compared to the 1M return, which does not differ from the previous 1M return, we can explain the upswing by the turmoil that has hit Chile in October. The analysis of realised volatility reveals that ARS volatility has considerably increased when compared to levels before the primary election. That cannot be said for comparable EM currencies.

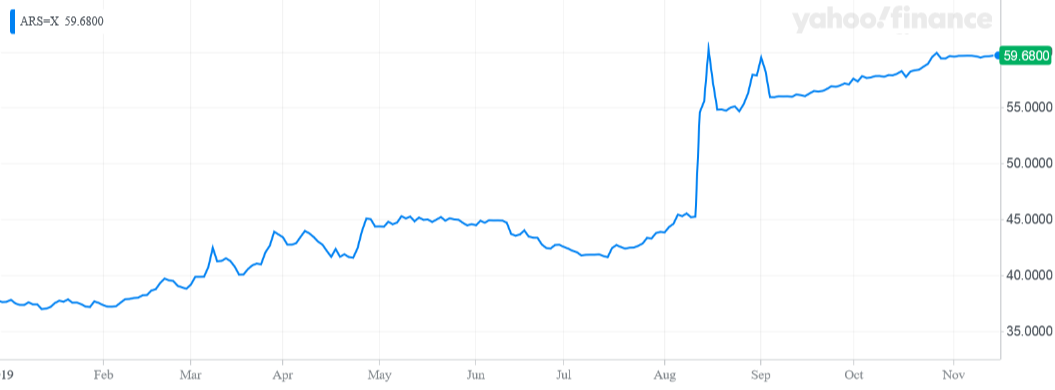

Figure 4 – Official USD ARS exchange rate in 2019

Source: Yahoo Finance

When analysing the equities’ market reaction, we compared the returns of equity indices in the EM region. While Argentina’s Merval Index lost 38% of its value on the 12th of August, the comparable main indices from the EM countries lost about 1%, which was in line with the losses recorded by the controlling indices (SP500, Stoxx600 and Nikkei225) on that day. When it comes to the comparison of realised volatilities, there is no indication of an increase in volatilities in comparable EM economies.

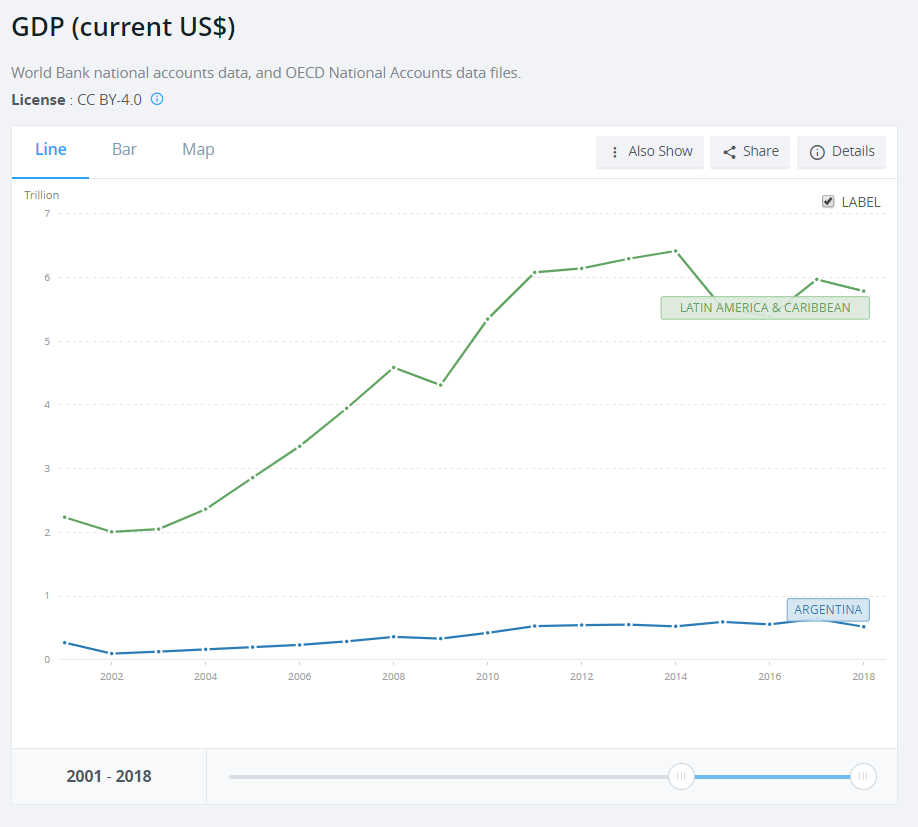

The absence of an immediate effect on the EM regional markets can be attributed to the combination of different factors. Firstly, it seems the EM investors have built resilience through a history of regular defaults. Moreover, the economic footprint of Argentina’s gross domestic product in current U.S. dollar terms has diminished, making up less than 9% of the Latin America and Caribbean region at the end of 2018 compared to 12% in 2001. Additionally, due to the limiting impact of Argentina’s recessionary episodes, the investors seem to treat the country as a fairly isolated market.

Figure 5 – GDP Argentina vs Region in USD

Source: World Bank

Indeed, as Argentina oscillates between crashes and too-good-to-be-true, make-belief recoveries, it is more and more out of touch with the rest of the emerging world. This observation, along with the performance of Argentina’s economy, makes the fact that the country was included in the MSCI EM Index in 2019 quite perplexing.

Lastly, the former powerhouse once made up a weight of almost 12% in the JPMorgan Emerging Markets Bond Index Global Diversified – the sector’s fixed income benchmark – and 1.1% of the equity MSCI Emerging Markets Index before the $93bn default in 2001. In 2019, the bond benchmark weighting has shrunk to 1.1%, while the MSCI EM index weight is a negligible 0.18%.

Figure 6 – Argentina delinked from EM

Source: Reuters

Since only 3 months have passed since the primary election date, there might be some future downward pressure on the other regional EM currencies as a direct consequence of a weaker trade balance. Brazil, Argentina’s biggest trade partner and the current leader of the region, is unlikely to be affected to a great extent since exports to Argentina account for only 8% of Brazil’s total exports.

Not negligible are the effects of a weakening Argentine peso on Mexico and Colombia. These are currently among the most vulnerable countries, thanks to a combination of wide balance of payments deficits, exposure to global economic factors and relatively weak domestic fundamentals. Analysts estimate that the Colombian peso is overvalued as much as 20% on a trade-weighted, real effective exchange rate basis, making it even more exposed to a weaker trade balance with Argentina, even if the two are not the most significant trade partners.

Conclusion

As Argentina turns back to the old political system, the question on everybody’s mind is whether we will see a repeat of 2001. The former president and soon to be Vice President, Cristina Fernandez de Kirchner, announced that the country will not default, but the measures taken cannot be at the expense of the people. This indicates, in our opinion, that the new government will probably not follow and implement all of the IMF program requirements, and such failure to act will aggravate the country’s above-mentioned issues. As the case of another Argentina’s default becomes increasingly likely, we, unfortunately, cannot completely discount its possible negative effects on the region, as this year’s events are not representative of such a serious economic shock.

0 Comments