Introduction

The Issa Borthers, along with their private equity partner TDR, made the headlines in early 2021 when, out of relative obscurity, they acquired the UK supermarket chain ASDA from the US giant Walmart [NYSE: WMT] for an enterprise value of £6.8bn. Despite having acquired susbtancial wealth through their ownership of the EG Group, many observers wondered how the brothers managed to come up for the equity required to finance the acquisition, as the EG group was heavily indebted due to a rapid expansion. Soon, however, it became clear that they, together with TDR, had only contributed £200m pounds in equity, with the rest being financed with debt and the help of substancial financial engineering. In this article, we will try to shed some light on how this transaction was structured.

The Deal History

In 1999, Walmart, the American grocery giant, outbid its rival Kingfisher [LON: KGF] to acquire ASDA, valuing the supermarket chain at £6.7bn. This marked the world’s biggest retailer’s first steps in its ambition to conquer the European grocery market as it planned to use ASDA’s foot in Germany as a “springboard” for a pan-European expansion. This new presence in the UK market was set to threaten local players and shake up market shares through the same cut-price efficiency strategy that had proven successful in the United States. At the time, former UK prime minister, Tony Blair was pleased with the acquisition as he saw a potential to contribute to his mission of reducing prices in the country. Yet, one can wonder, why did Walmart target ASDA specifically? Three key characteristics promised ASDA to be a good fit: the group was similar to its US counterpart, catered to low-middle income households, had a sizeable non-food business, and ran significantly larger stores than its UK rivals.

Twenty years later, disappointing very large expectations, ASDA only evolved into a small contributor to the Walmart group with $29bn in revenues compared to the group’s $520bn total in 2019. Locally, with a 14.5% market share, ASDA has been competing for second place against Sainsbury and never threatened Tesco for the leading position. Walmart has been able to apply its model of price differentials and large out of town stores to “blow its competition out of the water” in all the markets it entered such as China or India, which further highlights the group’s unexpected failure to realize its early ambitions in the UK. A predominant factor was the misjudgment of how hard it would be to copy the American model and opening big out of town shops in the UK. ASDA’s rejected acquisition of Sparks by regulators was also a large obstacle in its quest to gain market share as it would have provided more scale and exposure to the group, especially in the south of England. Over the past two decades, ASDA was loyal to its claim of offering the lowest prices; however, with the rise of discounters, it lost its special proposition to customers. Lastly, management committed strategic errors such as failing to produce a rival to Tesco Express or Sainsbury’s Local which prevented ASDA from capitalizing on local, convenience-type markets. This succession of setbacks taught Walmart precious lessons and, in 2020, it decided to sell ASDA.

Initially, Sainsbury had agreed to take over its main rival, ASDA, for £7bn. However, regulators blocked the transaction despite both companies claiming that the merger’s main mission was to “lower prices for customers”. Therefore, after this failed sale, Walmart was seeking other potential buyers and multiple bidders arose. Among them were many private equity funds including the likes of Apollo Global Management [NYSE: APO], TDR Capital with the Issa brothers, and a consortium of Advent International, Cinven, and Lone Star Funds. Ultimately, TDR Capital and the Issa brothers emerged as the successful bidders and acquired the supermarket chain at a £6.8bn enterprise value. At the time of the acquisition, ASDA’s yearly EBITDA was in the region of £1.1bn, implying a 6.18x EV/EBITDA multiple. According to S&P Global Market Intelligence, the median EV/EBITDA multiple in the retail (food and groceries) industry in 2020 was 7.8x, revealing a sharp discount in the sale of ASDA mostly due to the highly competitive nature of the UK retail market which puts pressure on ASDA’s sales growth, and regulatory concerns around the acquisition added uncertainty, which could have contributed to the lower valuation.

On the Issa brothers

Mohsin and Zuber Issa are two brothers who were raised in Blackburn, UK into a family of Indian immigrants. From a young age, they were involved in the family’s petrol station, which helped them grasp the ropes of the industry very early. Almost naturally, in the early 2000s, the brothers started their own petrol station business with a single location in Bury, Lancashire, under the name of European Garages (EG). In the early stages of the business, the group adopted a strategy of organic growth combined with an aggressive expansion by acquiring underperforming local petrol stations and implementing operational improvements and extracting cost efficiencies. By 2012, the group had scaled exponentially and reached 100 locations, becoming one largest independent petrol stations operators in the UK. It now had the power and means to take over larger groups in its pursuit of gaining market share. Notably, in 2015 Euro Garage acquired 195 Esso petrol stations from ExxonMobil for £250m. This transaction was a turning point for EG Group as it enabled an accelerated growth and eventually led to a global presence. In 2016, it opened its first site in the United States and, by 2018, the group was present in more than 20 countries with a total of 5000 locations. More recently, consistent with their strategy, the Issa brothers took over petrol station and convenience store chain, MRH, for an estimated £1.2 billion in 2018, US convenience store chain, Cumberland Farms, for an estimated $4.4 billion in 2019, and of course, ASDA in 2020. Aside from M&A operations, the group also partnered with strong brands by the likes of KFC or Starbucks to solidify its brand reputation, attract additional customers, and further unlock growth potentials.

Across the past two decades, to fund these numerous transactions, the EG Group amassed large amounts of debt. Indeed, in all its acquisitions it combined small portions of equity and substantial leverage with high debt to equity ratios, enabling the brothers to target larger groups and sustain their expansion ambitions. For example, in the £1.2bn takeover of MRH and the $4.4bn takeover of Cumberland, the group only took £400m and £1.5bn of cash respectively out of its pockets. More extremely, in the £6.8bn acquisition of ASDA, the Issa brothers and TDR Capital only injected £200m of equity. As a result, EG Group’s debt pile quadrupled since 2017 and reached up to £8bn, awarding it fourth place in the biggest borrowers in Europe’s €100bn market of collateralized loan obligations. As it was pushing the limits of capacity in the loan market, EG Group entered the junk bond market for the first time in February 2021, offering bonds at yields around 3.5% and raising a total of £2.75. There is thus a growing concern around EG Group and its ability to further sustain its debts. However, the Issa brothers’ prowess in financial engineering might yet again bail them out. A practice repeatedly adopted by the brothers to obtain large amounts of cash is the sale and leaseback of their properties, notably in the acquisition of Cumberland Farms and ASDA. In the latter, Blackstone acquired a portfolio of warehouses at a valuation of £1.5bn. This practice can provide the company with a large amount of cash up front, which can be used to finance growth or pay down debt. Last year, to fund the brother’s latest acquisitions, the EG Group began raising additional money using preference shares, which offer high returns to investors in exchange for lower priority in the case of bankruptcy. Such techniques and high levels of debt can be effective in generating value, but they can also be risky and therefore require careful management. Yet, the Issa brothers have been at the center of controversies such as borrowing tens of millions of pounds through interest free loans from their heavily indebted EG group to buy two private jets, underlining their overlapping personal and professional interests in managing EG Group.

The Deal Structure

The Issa brothers and TDR entered at an 11x EV/EBITDA, a number considered high given the headwinds facing UK retail. TDR Capital and the Issa brothers used a significant amount of debt to finance the acquisition, with reports suggesting that the consortium loaded ASDA with £3.5bn of debt initially, but in end effect was assumed to be as much as £4.5bn. The interest payments have been putting significant pressure on ASDA’s cash flows, as the costs to service their debt continues to step up. The high interest expense has been limiting the company’s ability to invest in growth initiatives, fund capital expenditures, or pay dividends to shareholders.

Despite the aforementioned, all parties involved have been able to record eye-watering profits, with TDR valuing their stake in 2022 as 20x their entry, far surpassing the average 1.8x return achieved by financial sponsors on supermarkets and more broadly consumer businesses from 2009-2021. This was largely achieved through the general business model of TDR, involving financial engineering through under-equitizing firms and then pulling their initial investment out through dividend recaps, allowing for large upsides with little risk to their equity.

Source: Financial Times

In 2020, the average European leveraged buyout saw its equity component at above 50%. That’s a stark contrast to the equity equivalent of just about 12% achieved by the Issa brothers, TDR and the EG Group through a convoluted series of asset disposals and debt deals. This, however, is not foreign to the Issa brothers and their financial sponsor partners. Their first venture together, EG Group, was only able to achieve its current scale (allowing its involvement in this transaction) via a long series of heavily debt-funded add-on acquisitions.

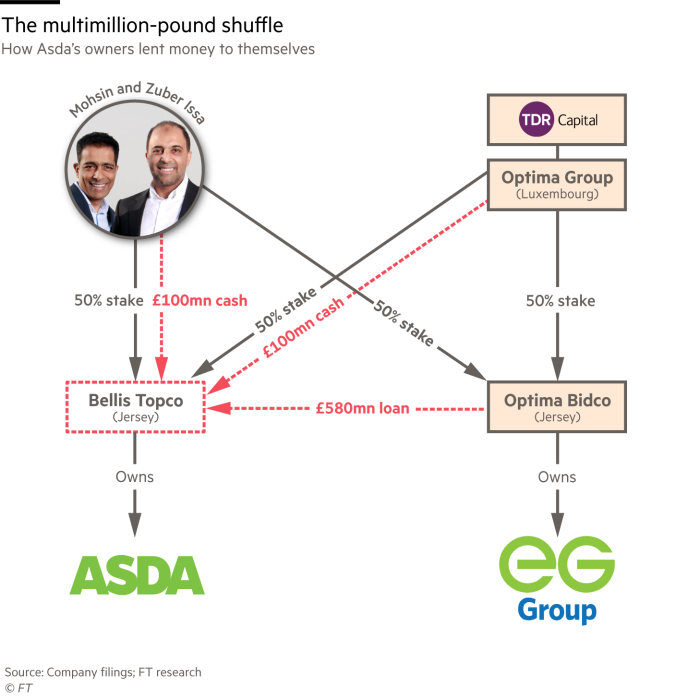

In the case of ASDA, the Issa brothers and TDR were able to pay only a small fraction of the purchase price because EG’s parent company, Optima Bidco Jersey, loaned more than half a billion pounds to ASDA’s parent company, Bellis Topco. To raise the money for the loan, Optima Bidco sold two batches of preferred stock in 2020 worth €405m and $316m, and then lent £580m of the proceeds to Bellis Topco, leaving the Issa brothers and TDR with a measly £100m equity contribution each. This has landed EG, which already had €8bn of debt, with renewed financial burdens. However, TDR has managed to generate a c. 5x return on the 234m that was put into EG Group in 2014, and expects this number to balloon to 11x by exit, so in a way it is a use of profits.

Source: Financial Times

Although there is no fixed date for repayment, the loan has a 12% interest rate and servicing Optima’s more than £1.7bn in total outstanding preferred shares has been becoming more costly by the day, with articles published in January indicating that EG Group’s interest payments will step up to an aggregate £202m per annum by the end of 2023. Shortly after the acquisition, ASDA sold 27 warehouse properties to Blackstone for £1.5bn, a major windfall at around 3.5x the book value of the assets, and about £750m more than the Issa brothers and TDR budgeted for sales and leasebacks to contribute to the purchase.

While this is obviously viable going forward, and especially now as the broader industrials commercial real estate sector has finally trended back into positive growth as of March, analysts still question as to whether this will be enough considering the nearly £6.7bn in debt coming due for refinancing in 2025, thus starting talk regarding the de-levering of EG Group while levering ASDA. To do this, it has been rumored the Issa brothers and TDR are considering selling EG’s entire UK operations to ASDA, creating one of the largest privately-owned UK businesses with over £29bn in yearly revenues. Selling even a part of EG to ASDA would mean levering up ASDA, even to potentially unsafe levels with regards to interest rates, which some bondholders believe could be a less-than-ideal situation for ASDA as an entity. Despite this, ASDA has been seeing its core earnings rise, first primarily due to a reduction of COVID-era operating costs, and now due to increased operational efficiency and a general rebound in UK retail. It remains to be seen if the debt burden will be sustainable going forward and if the initiatives planned by the Issa brothers and TDR will serve enough to realize the high returns thus far reported.

Conclusion

Over the last decade, historically low interest rates always rewarded those who borrowed money and invested in risky projects, as low interest rates continuously pushed up asset values. The Issa brothers are definitely amongst those who played this game the most aggressively and became very wealthy in the process. With this era of interest rates coming to an end, it will remain to be seen whether the brothers will be able to salvage their heavily indebted business holdings, with some debts, as mentioned above, requiring refinancing in the not-so-distant future. In any case, the example of ASDA shows just how much was possible during the time of low interest rates and speculative sentiment, and the extent to which some market participants took advantage of these possibilities.

2 Comments

Anointing · 10 June 2023 at 20:43

I just want to appreciate your research and writeup, this was detailed. Thanks

As speculated ASDA acquired EG group with a term B loan from Apollo management.

Ian · 19 September 2023 at 10:09

Thankyou, very interesting. Would be nice to read a follow up article