What are the Basel Agreements?

Financial risks have long been observed and studied, but it was only in 1974, with the failure of West Germany’s Bankhaus Herstatt, that central bankers became aware of and decided to act on settlement risk. For these very purposes, the Bank of International Settlements (BIS), a branch of the Financial Stability Board (FSB), established the Basel Committee that very same year. The aim of the newly fledged committee would be that of setting internationally accepted regulatory and supervisory standards in financial markets. To this date, the Basel Committee has been active and has set forth three influential agreements. These accords have had a strong influence on financial institutions and financial markets because their approval has changed the overall method of operation of banks, their investment decisions, and the markets’ microstructure. In this article we analyze how microstructure, in terms of liquidity and market intermediation but also in investor confidence, information, mortgage rates and timing costs, might be affected by the implementation of the latest Basel accord.

Chronologic Framework

Basel’s history is crucial to understanding how financial market regulations evolved and how they might evolve in the coming years or longer-term future. The first Basel agreement, Basel I, was published in 1988 and implemented in 1993. It already significantly influenced financial intermediaries by introducing the concept of risk-weighted assets (RWA), which had not been theorized yet. It applied to both on and off-balance sheet assets, and initially regulated credit risk only, then extended regulations to market and operational risks too. Due to its limitations, Basel II was then implemented to make the banking system more reliable.

This second agreement introduced three main pillars. The first pillar was supposed to regulate minimal capital requirements with respect to credit, market, and operational risks, which could all be quantified through either standardized approaches (SA) or internal approaches. In the internal approach to credit risk capital requirements, named the Internal Ratings-Based approach (IRB), banks assign probabilities of default (PD) to every asset based on banks’ statistical models tracking payment histories by asset type. Every asset is assigned a risk weight, which then forms the banks’ RWA. A study conducted by Behn (2022) using loan-level data from German banks showed that capital requirements would have been 64% higher if the SA was used instead of the IRB approach, suggesting that banks using this approach rather than SA benefitted in the form of lower capital requirements.

While Basel III attempted to mitigate this effect but was not centered around the problem, Basel IV is committed to addressing the implications of this model choice-based effect, which disproportionately favors large banks that can sustain the high costs of an IRB compared to smaller banks. The second and third pillars introduced by Basel II are also significant: they control the risk assessment process and supervision of risk in financial institutions, and they enhance disclosure requirements and market transparency respectively. Increased levels of required market transparency and disclosure led to a more disciplined market and investors, as they theoretically only invested in structured and safer financial institutions.

The Revolution of Basel III – Friend or Foe?

Evidently, market discipline from Basel I and II was not enough to prevent a major global financial crisis: that of 2007 to 2008. After this crisis, Basel was further potentiated through Basel III, which showed particular attention towards macroprudential regulation, especially towards globally systemic banks to enforce resilience and prevent global financial crises as impactful as that of the 2000s. The strong capital and liquidity requirements dictated by Basel III resulted in a more resilient market, but also led to substantially increased costs for financial intermediaries.

Source: Bank for International Settlements

Source: Bank for International Settlements

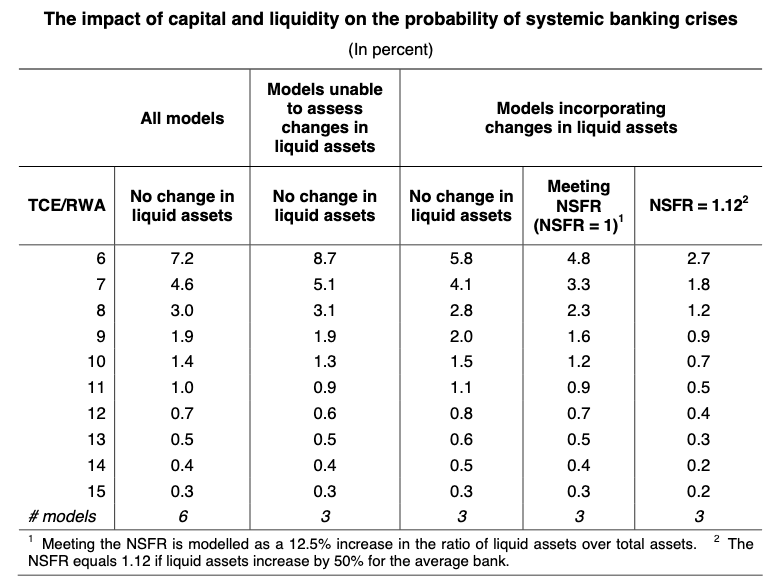

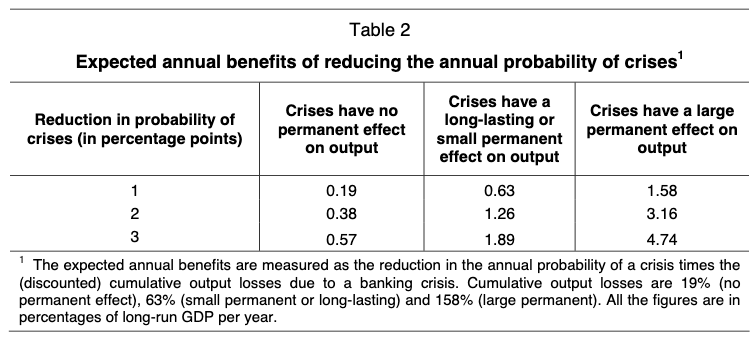

Basel III aided banks during the Covid-19 pandemic. The accord imposed higher minimum capital requirements compared to Basel I and II and regulated contagion risk through its macroprudential buffers including G-SIFI additional requirements. In this way, it might have prevented a strong global financial crisis after the Covid-19 pandemic. As a matter of fact, a study conducted by the Bank for International Settlements shows that higher CET1 Ratios are associated with greater market-based resistance of banks in financial crises. Also, BIS’ impact analysis of Basel II in the last 15 years shows that there are strong benefits to the real economy in reducing the probability of banking financial crises. For instance, the table above indicates that a drop of 1% in the probability of crises leads to a change of 0.63% on the output (long-run GDP per year) if crises are assumed to have a small permanent or long-lasting effect. Therefore, higher CET1 capital requirements and other standards aligned in Basel III might have somewhat mitigated the negative shocks on output driven by Covid-19.

However, these upsides of the third Basel agreement came to the detriment of financial markets, especially in terms of market microstructure. Firstly, the agreement decreased intermediation capacity. Over the years, financial dealers and market makers experienced extremely high costs of market-making due to leverage constraints imposed by Basel III. With the minimum leverage ratio of Tier I Capital to total, non-risk-weighted assets at 3% of the total, intermediation capacity of each dealer decreased, making it harder for them to make through repos. With this decrease in intermediation capacity by each dealer, banks and mutual funds were pushed to employ multiple dealers, instead of just one fiduciary dealer. Lower intermediation capacity of market makers led to lower market liquidity, especially for bonds.

Basel IV – will it solve Basel III’s limitations?

Basel III critiques have been directed towards four aspects. These are the complexity of the requirements and the reliance on the IRB approach, followed by its inability to capture off-balance sheet risk fully and to impose disclosure requirements that ascertain a transparent enough banking system. Some main innovations of this agreement compared to the previous accords will disadvantage banks and therefore market-making, exacerbating the effects of Basel III on the market. Other amendments instead tend to re-establish a more liquid market microstructure compared to after the implementation of Basel III. The main novelties of the recent agreement, which will be implemented from January 1st, 2023, include a 72.5% output floor on IRB capital requirements vis-à-vis requirements for the same bank under SA. Capital requirements will also be higher for high-risk assets and for income that arises from real estate. On the other hand, CVA and leverage ratio are revisited.

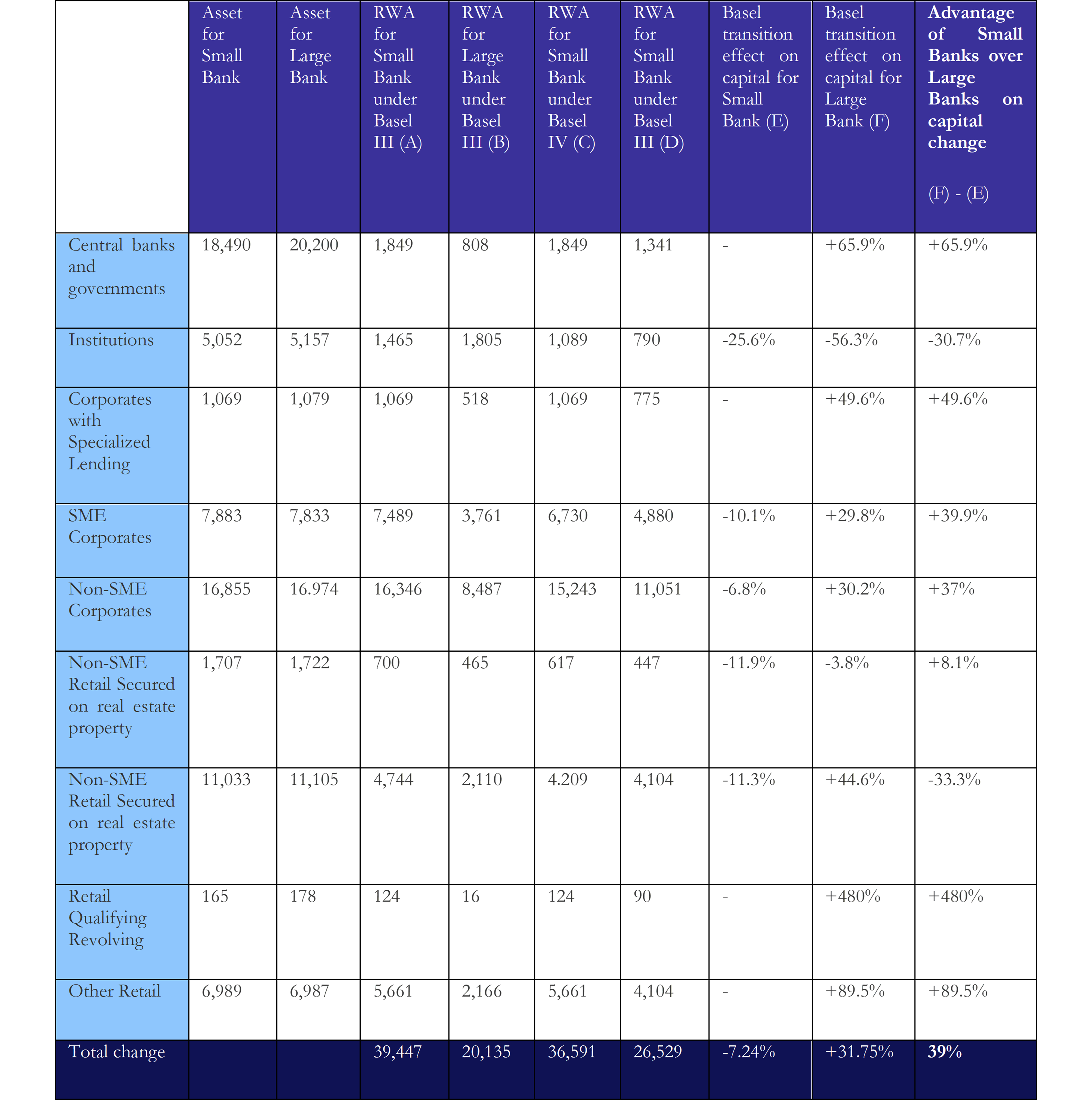

Basel IV introduces changes from Basel III mainly with respect to capital requirements due to credit risk. In terms of credit risk capital obligations, Basel IV grants an advantage to those banks with a SA, while it disadvantages those with IRB approach. As noted from the tables below, typically large institutions and corporations (those with asset turnover greater than $500m) in Italy are predicted to have an average increase in total capital required of +31.75%, compared to small Italian banks, which will face a reduction in total capital required of 7.24% in the move from Basel III to Basel IV. Summing up the benefit for small banks and the disadvantage for large banks, small banks will have a relative advantage of 39% lower cash required from the change to Basel IV from Basel III.

Also, large institutions will no longer be able to use Advanced IRB for assessing their credit risk under Basel IV, and other types of constraints will apply to the IRB approach. One of the greatest changes in Basel IV is the output floor, or a floor to the capital requirements under IRB up to a percentage of those calculated under the standardized approach. All these reforms will impose significant additional costs to large banks and intermediaries. For markets, this is especially significant in terms of banks’ balance sheets: if banks have a smaller balance sheet and can grant fewer loans, confidence in the businesses that are not granted enough loans will decrease.

As a matter of fact, a study conducted on excess returns by James (1987) proves that stock excess return increases when that corporation announces a loan, therefore bank loans are positive indicators and give assurance to investors. Confidence in the stock market will not deteriorate just because of the absence of bank loans: stocks might be reliable even without bank loans. However, banks’ specialness does provide the stock market and investors with confidence, especially in bear markets and for smaller firms with lower financing capacity. Also, higher costs for banks not only mean that they might decrease lending, but also that they might increase lending costs and therefore result in less profitable trades. Furthermore, lower availability of bank credit might result in more borrowing from shadow banks such as mutual funds, which are not regulated by Basel. In markets, this might lead in the very long run to mutual funds’ increasing availability of information, maybe competing with banks for the role of special solvers of asymmetric problems when lending.

Source: Bocconi Students Investment Club

Change in RWA from implementation of Basel IV on Small and Large Banks

Another Basel IV reform is that risk weights on residential mortgages will assume a more granular effect, with different weights for diverse Loan to Value (LTV) ratios. This applies to both residential and commercial mortgages. Specifically, the accord states that with LTV up to 80% banks will be able to maintain the risk weight of Basel III, namely 35% of the loan. However, when the 80% threshold is surpassed, risk weights will increase. LTV will have to be updated. This new rule on LTV will lead to three major changes in residential loans. Firstly, the assessment for residential properties backing up loans will take longer by banks, as they will invest in loans for properties that they firmly believe will increase in value. From a market point of view, customers might have delayed loan responses and more time for both residential and commercial parties to be granted a loan. In microstructure terms, this is called timing cost. In the long term, it might increase for residential-based asset borrowings. Also, fewer loans or loans that are smaller in size might become more predominant. Finally, we might experience what happened in Basel I, which is a risk shifting towards LTV that will take up the most risk with the lowest risk weight requirements, altering the trend of mortgages once again. This increased attention from banks materialized as a lower LTV ratio and increased quality of residential loans might put downward pressure on mortgage rates. This might happen because of lower LTV, therefore representing a disadvantage for borrowers.

Some might argue that since mortgages will be harder to find, more risky borrowers will be willing to accept an increased mortgage rate due to their low bargaining power and relatively lower price elasticity towards borrowers requesting non-residential loans. However, this would lead to adverse selection, theoretically leaving the mortgage market to more risky customers. Additionally, banks will not give out higher LTV (higher risk) mortgages, at inception or after inception, even though borrowers would pay a higher rate for them. This could be due to the revised weights on LTV ratios unless the higher mortgage rates were to more than offset the negative effect that higher LTVs and lower value residences have on capital.

Secondly, the accord modifies Credit Valuation Adjustment (CVA) rules. CVA is the process by which banks adjust their amount of capital based on risks, including counterparty risk, from derivatives and other hedges. Basel IV amends the models used to rate this risk, which are the Basic Approach (BA-CVA) and the Standard Approach (SA-CVA). These approaches might change the hedges that banks will use. The BA-CVA calculates risk on hedges of counterparty risk, while the SA-CVA includes all hedges. CVA requirements have always been strict, however, with the new Basel agreement, the committee has tried to address the liquidity and intermediation problems associated with Basel III by reducing the amount of securities financing transactions (SFTs) from the CVA risk framework. The SFTs that can be excluded from the risk evaluation process are those which don’t have a material risk or those arising from some eligible client-cleared derivatives. The latter are exposures that arise due to market-making services carried out by banks for their clients.

A study by Deloitte on market practices around counterparty risk has concluded that banks amend their derivative holdings to mitigate their sensitivity and CVA risk. BIS wants to incentivize market clearing through this CVA model revision. CVA is also considered a risk for the bank because a bank’s hedges such as futures are marked-to-market. Banks could reduce risk from changes in market value due to CVA risk by using dynamic hedging of market value jumps with a method named Merton jump-diffusion process, which uses cheap OTM options. This theory is based on a theoretical Monte-Carlo simulation. Instead, the BIS proposed a method for reducing CVA market risk. For a bank using SA-CVA, the bank can reduce CVA risk by decreasing its deltas for interest rate risk, foreign exchange risk and credit spread risk by 30%, 50%, and 2% respectively. This would change banks’ hedge composition, and therefore their long-term composition of derivatives and SFTs. As a result, these amendments to CVA total exposure calculation and increased attention towards CVA risk amendment should benefit market-making. Dealers and banks can intermediate credit in a less expensive way in terms of capital requirements and in terms of risk if they adapt their hedges by constructing portfolios of non-material exposures and hedging their CVA risks either through the Merton jump-diffusion process or through delta adjustments.

Similarly to CVA total exposure calculation, bank leverage ratios were recognized as problematic for credit availability under Basel III. Aware of this issue, the Euro Area negotiated leverage ratio requirements in 2018, during the drafting of Basel IV’s European implementation. With the goal of avoiding weakening clearing houses and therefore market liquidity and functioning, the leverage ratio is actually de facto lowered in Basel IV. Although Global Systemically Important Financial Institutions (G-SIFIs) are now required to hold a capital buffer of 50% of capital add-on they have, and some banks face a higher leverage ratio increased to offset the removal of CB reserves from total exposures, they and the other banks not classified as G-SIFIs face a lower minimum leverage ratio overall. Although the leverage ratio amendment does not change weights in the leverage ratio directly, it reduces total exposures, for instance by setting an upper bound to conversion factor of OBS activities, which now must be converted with only up to a 40% conversion factor. Also, other securitization ceases to be recognized as exposures for this ratio, leading to a further lower value in the ratio for given levels of Tier I capital and balance sheets. This amendment might solve Basel III’s negative impact on dealer exits and consequently on market liquidity in the long run.

Conclusion

To sum up, the Basel agreements are in continuous evolution, and Basel IV will be implemented starting from January 1st, 2023. Since these agreements impact the long-term market microstructure in various ways, not only banks but all market participants should understand the potential consequences of Basel IV. Marketwise, the most recent Basel agreement might enhance the microstructure problems of Basel III or mitigate them. Some Basel IV reforms like CVA and leverage are meant to improve market-making services availability and therefore the market shortfalls created by Basel III.

Basel IV reforms might additionally impact large banks especially when it comes to capital requirements on credit risk. CVA and leverage ratio amendments of Basel IV facilitate banks and market-making costs by reducing the components of total exposures in CVA Basic and Standard Models, and in the leverage ratio denominator. This might partially alleviate the illiquidity in markets that was caused by reduced intermediation capacity. However, banks, especially G-SIFIs, will face rising capital costs from output floors in the advanced IRB approach. Thus, Basel III credit intermediation shortages might instead be increased by the additional capital requirements imposed on banks, as for example shown by the study on Italian banks and dealers. Which of these effects on market-making will prevail will be understood after the implementation of Basel IV and based on how willing banks are to change their STFs portfolios.

Another effect of the agreement on the microstructure is the change in transaction patterns between corporations and banks: corporations might start borrowing even more in the market, or alternatively increase their borrowing from funds. This trading variation might have effects on information availability of funds, and therefore their increased role as lenders. Lastly, stricter regulation on loan to value at inception and loan to value monitoring can cause increased timing costs for market participants, because of a possible slowdown in residential loan granting. Furthermore, although residential loan mortgage yields might not increase due to this reform, fewer borrowers will be granted residential loans because of their higher costs to banks.

Sources

[1] Boyarchenko et al., 2022. “Bank-Intermediated Arbitrage”. FRB of New York Staff Report No. 858.

[2] Amorello, 2016. “Beyond the Horizon of Banking Regulation: What to Expect From Basel IV”. Harvard International Law Journal.

[3] Basel Committee on Banking Supervision, 2015. “Review of the Credit Valuation Adjustment Risk Framework”

[4] Basel Committee on Banking Supervision, 2029. “Credit Valuation Adjustment risk: targeted final revisions”.

[5] James, 1987. “Some evidence on the uniqueness of bank loans”. Journal of Financial Economics.

[6] Kurpad, 2020. “Basel IV: The Challenges”.

[7] Zwaard et al., 2020. “Computational Approach to Hedging Credit Valuation Adjustment in a Jump-Diffusion Setting”.

1 Comment

Christian Koch Færge · 15 March 2023 at 19:56

Very interesting paper. Can you share any insights on how you have calculated the RWAs for small and large banks under both Basel III and Basel IV?