BBVA (MCE: BBVA.MC) – market cap as of 27th November 2020: €26.34bn

PNC (NYSE: PNC) – market cap as of 27th November 2020: $53.23bn

Introduction

On November 16th BBVA, Spain’s second-largest bank, and PNC Financial Services Group announced that they have signed a definitive agreement for PNC to acquire BBVA USA Bancshares Inc. (excluding BBVA Securities) for a purchase price of $11.6bn to be funded with cash on hand in a fixed price structure.

The deal, which is expected to close in mid 2021, will be the second-biggest banking sector deal since the collapse of Lehman Brothers. PNC will become the fifth-largest US retail bank (behind JPMorgan Chase, Bank of America, Wells Fargo and Citigroup) with more than $550bn in assets and a coast-to-coast presence in 29 of the 30 largest markets in the US, accelerating PNC’s expansion plan. The deal comes six months after PNC sold its stake in Blackrock for $17 billion. The firm used the return of the sale to finance BBVA purchase.

Also, on Nov. 16th BBVA announced that it was in merger talks with Sabadell, another Spanish lender, but takeover talks were recently put to a halt due to a disagreement on the purchase price that BBVA would have paid for Sabadell.

About PNC Group

PNC Financial Services Group, Inc. is a US holding company that operates in Retail Banking, Corporate and Institutional Banking, and Asset Management. Based in Pittsburgh, PNC Bank has a strong presence in 21 US states with 2300 branches and almost 10 thousand ATMs. The firm is one of the largest banks in the US by assets, with $462bn in assets as of September 2020. It is the 5th largest bank by number of branches and 6th largest by deposits.

The name PNC comes from the initials of both two previous companies who merged in 1982. Pittsburgh National Corporation and Provident National Corporation became PNC Financial Corporation, a company with $10.3bn in assets. The deal was the largest bank merger in American history.

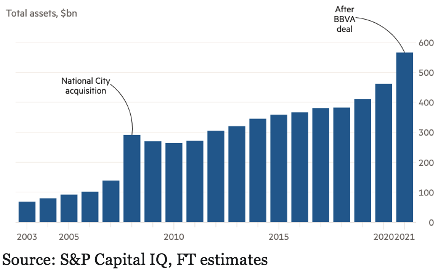

In the nineties PNC acquired more than ten smaller banks and financial institutions expanding its presence across the US. During the 2008 financial crisis, PNC purchased the National City for about $5.2bn in stock with funds from the US Treasury. At the time of the deal, National City was the 7th largest bank in the United States, two positions ahead of PNC. In 2012 PNC acquired RBC Bank, the US based retail banking division of the Royal Bank of Canada, for $3.5bn, therefore becoming the 6th largest bank by total assets.

We are now seeing another PNC’s attempt to boost its expansion, through the acquisition of BBVA’s US banking arm. The company is carrying on its assets’ collection adding others $104bn.

On September 30th, PNC reported solid Q3 results against the backdrop of the pandemic crisis. Net income from continuing operations was $1.5bn, an increase of $2.3 bn from Q2 and $350m from last year. This growth is driven by a lower provision for credit losses and higher noninterest income ($1.8 bn, up 16% LQ). The provision for credit losses decreased a lot, reflecting stable reserve levels.

On the asset side, average loans were $253bn, a decrease from $268 bn in Q2 2020 but even an increase from $237bn in Q3 2019. On the liability side, total deposits were $350bn, up $15 bn from last quarter and $70bn from Q3 2019. According to the last report, ROTE was 14.5%, showing that the company is continuing to execute on strategic priorities.

About BBVA Group

BBVA is a global financial services group founded in 1857. The firm has a leadership position in Spain, it is the largest financial institution in Mexico and it has key franchises in the Sunbelt Region of the US and in South America. BBVA adopts a responsible banking model which aspires to achieve a more inclusive and sustainable society.

In the US, BBVA operates with 641 branches in Texas, Alabama, Arizona, California, Florida, Colorado and New Mexico. BBVA USA Bancshares Inc., with $104bn in assets and headquartered in Houston, provides commercial and retail banking services through its banking subsidiary, BBVA USA.

BBVA USA was once Central Bank & Trust, founded in Birmingham in 1964. When it looked to expand in 1987 it went into Texas. The company eventually became Compass Bank, which was acquired for $9.6bn by Banco Bilbao Vizcaya Argentaria (BBVA) in 2007. In June 2019 BBVA Compass was rebranded as BBVA USA. The aim of the group was to become a truly global digital company where the unified brand is recognized in all the areas they operate.

In terms of performance, BBVA USA results for the third quarter of 2020 reported a net income of $166m which is lower than the $183m of Q3 2019. However, Q3 2020 still sees a jump in profits if compared to the net loss of $124m in Q2 2020, which reflected the impact of the pandemic crisis on macroeconomic forecasts, with a drop in interest rates and oil prices.

On the asset side, total loans at the end of Q3 2020 were $66.4bn, decreased from $68.5bn of the Q2 2020 and increased from $63.5bn of Q3 2019. On the liability side, deposits continue to grow with total deposits of Q3 2020 at $86.4bn, an increase of 4% (annualized) from Q2 2020 and 17% from Q3 2019. ROA and ROTE for the third quarter of 2020 were 0.63 % and 7.32%, respectively. Those numbers are definitely not satisfactory for a bank with over $100bn in assets. Despite the relatively bad performance, BBVA USA gives PNC a lot of strategic pieces like branches in many states where PNC has not a strong presence.

Industry Overview

The recent decade has not been the most stable in the history of European banks. Both the 2008 financial crisis, as well as the 2011 sovereign debt crisis, caused severe turbulence to banks’ business models. Big wigs such as Deutsche Bank, previously competing feverously in the US, were forced to retreat. Some, including BBVA, held on to their US assets for longer. Then came the coronavirus, which ripped through the whole banking industry again.

In the market of low, even negative interest rates, European banks found it especially hard to attain returns similar to their US and Chinese counterparts. With the coronavirus induced turbulence, the average return on equity fell to 1.3% at the end of Q1 2020 (versus still low 5.7% at the end of 2019). Once aiming to compete on a global scale, most of Europe’s main players shifted focus to making sure they remain in the black and continue making profits.

European banks face several problems, with lack of scale and fragmentation being the biggest ones. Although the European Union boasts around 450 million inhabitants, connected through a common market, no truly pan-European player exists. Domestic politics and strict regulation bear most of the guilt. Appetite for cross-border M&A deals is low. As a result, the most substantial European economies are home to several big, but not big enough banks. The 24 largest European banks yield a twice smaller return on assets (ROA), than 9 biggest US ones. Arguably, the coronavirus only exacerbated the structural issues holding the industry back.

Nowhere else has the virus put more stress on the banks as in Spain. With the economy heavily reliant on tourism, the projected fall in GDP of 11% is one of the highest in the EU. To hedge its far from stable economy, the government has actively encouraged its domestic banks to consolidate. Earlier in September, it gave a green light for the acquisition of state-owned Bankia by Caixa Bank, a Catalonian outfit. The approved deal, priced at $5.1bn, will create the biggest Spanish banks by assets (infographic below).

Possibly, with the sale of its US subsidiary, BBVA is following suit. Initial appraisals have already started, with the bank looking to acquire a smaller domestic rival, Banco Sabadell. Combined, the acquisition would yield the second largest Spanish bank measures by assets, resulting in strong economies of scale. Spain is the country with one of the highest number of branches per 100 thousand people – 50. Consolidation is the only route to greater stabilisation and chance for greater shareholder returns.

The trend is clear: the Spanish banking industry is set to become more concentrated. Following the Bankia deal, and BBVA’s move around the corner, both banks would exert control over 35-45% of Spanish loans, deposits, and market funds.

For PNC, BBVA’s US operations represent an opportunity to increase scale and hedge against the low interest rate market. Being a regional bank and relying more on retail banking than its Wall Street rivals, expanding the scale of operations is its only way to improve profits. The acquisition extends PNC’s reach to the southern US states, including Texas, creating the 5th biggest lender in the country. At around $0.5trn assets, it will surpass the recently merged US bank Truist. As seen, scale matters regardless which side of the Atlantic your banks’ offices are.

Deal Structure

Under the terms of the deal, BBVA has agreed to sell its US operations for $11.6bn. PNC, having recently sold its stake in BlackRock for $17bn, will cover the acquisition with 100% cash. The deal puts BBVA’s subsidiary at 20x its 2019 earnings and its provisions equal almost 50% of the Spanish banks’ market capitalisation.

The sale includes 637 branches and $102bn in assets, excluding the BBVA Securities and Propel Ventures worth $0.4bn.

Thanks to the sale, the Spanish bank will increase its tier one capital reserves by 300 basis points ($10.2bn), to 600 bps. Its shareholders should welcome the effect since the banks’ current reserves are one of the smallest in all Europe.

The transaction is set to be completed by mid 2021, subject to regulatory approval.

Deal Rationale

The acquisition of BBVA’s operations in the US will transform PNC into the 5th US largest coast-to-coast bank with more than $560bn in assets and 2,844 branches in 29 out of 30 US largest markets. Essentially, the purchase of c.$102bn in assets and 637 branches in seven US states will contribute to PNC’s commercial and retail banking services giving PNC presence in several important growth markets beyond its primarily mid-western and mid-Atlantic footprint and further accelerating PNC’s national expansion in a strain to build a nationwide franchise. PNC’s expansion through M&A does not come as a surprise taking into consideration its long history of buying struggling and underperforming banks (Riggs National (2005), Yardville National (2007), National City (2008), and RBC US operations (2012)).

Source: PNC

For PNC, the transaction is considered to be a strategic deployment of proceeds generated by the sale of the BlackRock investment in May 2020 and the sum paid for BBVA’s US operations almost exactly matches the after-tax proceeds of the sale. Originally divestiture of PNC’s $17bn passive stake in BlackRock in H1 2020 was prompted by the PNC’s pursuit to strengthen its capital position in order to offset negative effects caused by the COVID-19 pandemic with net income falling by 28% and loan-loss provisions increasing almost 5x to $914m in Q1 2020. However, it seems that now PNC is becoming more confident regarding the future of the US economy proving it with almost full utilization of the transaction proceeds.

PNC expects the transaction to be approximately 21% accretive to earnings in 2022 and to substantially replace the net income benefit from the passive equity investment in BlackRock. Despite the earnings accretion, it is expected that initially, the deal will be dilutive to PNC’s tangible book value falling from $96 per share to $88, however, it will still be above the pre-BlackRock-divestiture level. The acquisition will add c.$86bn of deposits and $66bn of loans to PNC, though, the estimated post-closing allowance for credit losses to total loans for the combined equity will be 2.85%, including reserves for the acquired loans from BBVA of 3.85%. Even though the initial integration and merger costs will be around $980m, the transaction is expected to generate about $900m in costs savings related to the overlap of global management and regulatory costs and the investment overall has an estimated internal rate of return above 19%.

For BBVA the transaction represents a unique exit opportunity with the price equivalent to c.50% of BBVA’s market capitalization for operations that account for less than 10% of total profit. The move follows a trend of banks such as HSBC and Deutsche Bank reducing their US presence after finding it difficult to compete with larger and better-capitalized rivals. Even though BBVA had sufficient capital in the US and invested heavily in technology, the attempt to bring operations to scale was ineffective and resulted in under-earnings

The transaction will generate €8.5bn in capital, financially reinforcing BBVA and granting ample strategic flexibility to invest in the present markets to further strengthen local positions and boost long-term growth. The additional capital will provide resilience during COVID-19 crisis and improve CET1 ratio by c.300 basis points (from 11.52% to 14.46%), adding confidence in BBVA operations and reassuring regulators that have been concerned by Spanish banks having one of the lowest CET1 capital in the Eurozone and Spanish economy being severely affected by the pandemic.

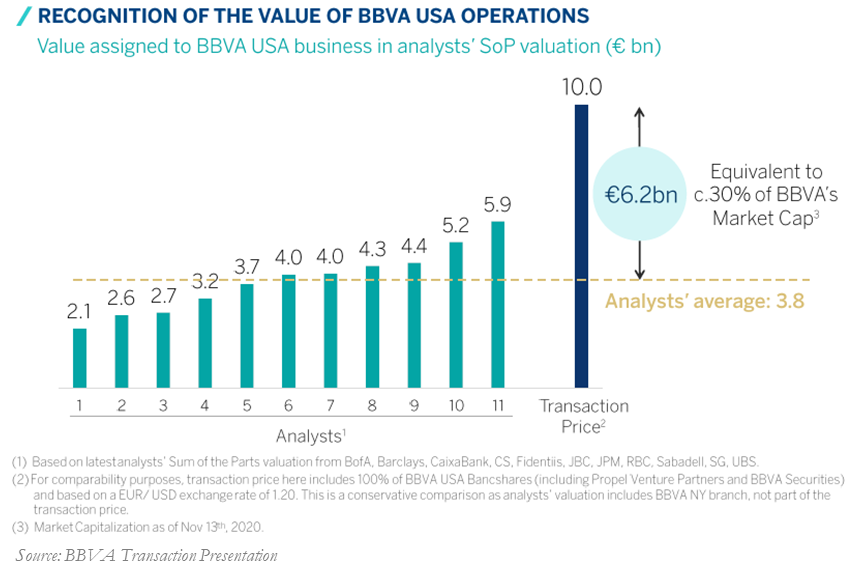

An additional aspect to mention is the attractive valuation offered by PNC (19.7x P/E and 1.34x P/TBV). The price paid for the BBVA’s US operations was 2.5x over the average value assigned by analysts in BBVA’s SOTP valuation, resulting in significant value creation for shareholders. Research analysts in SOTP valuation of the BBVA estimated value of the US operations in a €2.1- 5.9bn range with an average value of €3.8bn. Additional “premium” paid to the average valuation by analysts represents c.30% of BBVA’s market capitalization.

Source: BBVA Transactions Presentation

Finally, in the result of the transaction, apart from exploring potential investment opportunities in the present markets, BBVA is also planning to increase distribution to shareholders with buyback considered as a potential option of distribution (however, any potential repurchase would take place only after the expected close of the transaction in mid-2021).

Market Reaction

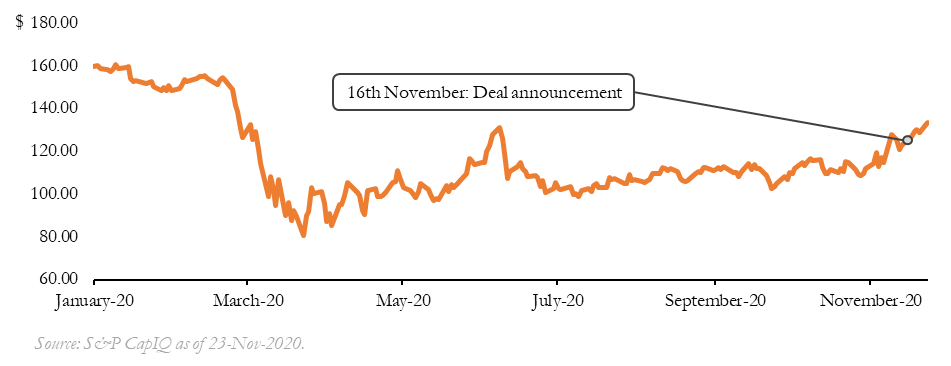

Source: S&P CapitalIQ

In the case of PNC, the transaction announcement was accepted by the market rather calmly compared to BBVA. On the day of the announcement PNC share price gained only 2.9%, however, the stock continued its growth after the deal announcement and one week later the total share price gain in relation to the pre-announcement level was 8.9%. In one week time, analysts’ mean consensus improved by 6.8% (from $121.51 to $129.73), with an unchanged recommendation “Hold”. Although, improvement in share price week after the announcement cannot be fully contributed to the deal, taking into consideration improvement of the US stock market based on the COVID-19 vaccine news.

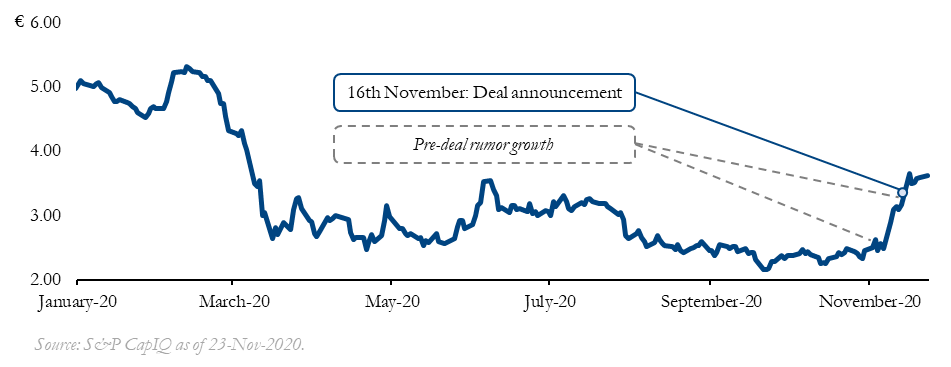

Source: S&P CapitalIQ

In the case of BBVA, the gain in share price was rather significant and on the day of the announcement share price added c.15% and continued its growth in the following days. Analysts’ mean consensus gained 15.8% in the week after the announcement resulting in a target price of €3.81 with an unchanged recommendation “Hold”.

Financial Advisors

J.P. Morgan served as an exclusive financial advisor to BBVA, while PNC was advised by Bank of America, Citi, Evercore and PNC Financial Institutions Advisory.

0 Comments