Introduction

Covid-19 and the policy measures put in place to contain its spread have not only resulted in significant operational disruption for companies, e.g. reductions in demand from customers and failing supply chain with reduced inventories available for sale, but have also created serious issues for companies across a wide range of sectors, especially in terms of available liquidity. That results in a reduced ability to meet financial commitments, such as payments to employees and suppliers, and the situation is further worsened by reduced access to debt financing. The goal of this article is to give an overview of the most common transaction types – IPO, SPAC, strategic and financial M&A, restructuring – and to look at how the Covid-19 pandemic affected each of them.

IPO

An Initial Public Offering is the process with which a company issues stocks for the public, for the first time. The process can also be accompanied by investors selling already existing shares, a secondary offering, although that does not directly contribute to the financials of the company. As a significant step on the path towards long-term growth, IPOs have been and largely remain the go-to tool for businesses desiring to raise capital and enhance their reputation. However, it also involves challenges such as the loss of management flexibility, risks of loss in value, length of the process, numerous legal undertakings, and huge direct costs; not to mention the indirect costs incurred by the effort and attention invested into the process rather than the daily running of the company.

Historically speaking, the IPO market has been relatively unstable due to the countless factors involved. The dot-com boom of the late 1990s drove record-breaking years, hitting a peak in 1999. The financial crisis of 2008 produced the opposite effect, as the future of financial institutions looked nothing short of miserable. Through the boosts and the downturns, the tool of IPO itself was rarely challenged, as it remained the main way growing companies offered shares to the public. In recent years, however, SPACs made quite a disruption and thus will be considered in more detail later in the article.

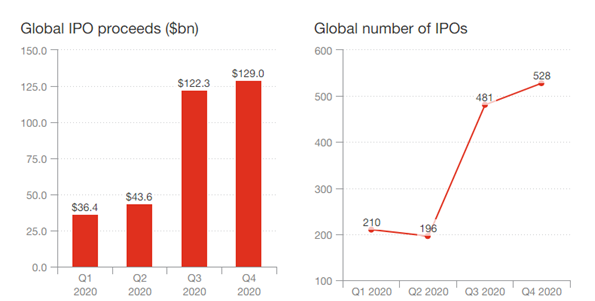

Overall, 2020 has been a very active year for IPOs. The year started optimistically with the normalizing trade ties between the US and China but quickly turned gloomy as the severity of Covid-19 was realized. In the US, in January and February, a total of 32 companies went public, an increase of 5 from 2019. March, April, and May saw record lows, with 5, 9, and 18 IPOs respectively, half of the same period in 2019. In June, optimism picked up as governments and central banks raced to the rescue. As the first news of record speed in vaccine development spread in late summer, confidence increased and the last quarter saw a booming market with 97 IPOs in October. Globally, in 2020, 1,415 IPOs raised a total of $331.3bn, up 36% and 66% respectively from 2019. Adding to that, 2021 also saw the highest global IPO activity in the first quarter since 2000, with 430 IPOs that produced total proceeds of $105.6bn.

Source: PwC

SPAC

Special Purpose Acquisition Companies, also known as blank check companies, have been around for decades but have attracted particular attention since 2019. A SPAC is formed usually by hedge funds or private equity firms and is immediately taken public through an IPO. Existing completely on paper, the firm does not have any commercial activities. The only goal is to acquire or merge with a private company and take that company public through some financial engineering. This process, known as SPAC listing or reverse takeover, offers some advantages. One is the significant reduction in the duration of going public, stemming from the fact that striking out a deal directly with another company is much faster than endeavoring to comply with all regulations and waiting for approval from a government agency. For a look at all the alternatives to the traditional IPO, our article from October 2020 is worth the read.

In 2009-2017, in the United States, the average number of SPAC listings per year was 13.4. 2018 marked the start of a rapid increase with 46 SPACs registered for gross proceeds of $10.7bn, while 2019 broke the record yet again as 59 SPACs grossed $13.6bn. Most notable among these listings were Virgin Galactic (NYSE: SPCE) and Repay Holdings (NASDAQ: RPAY) which got high-caliber underwriters such as Goldman Sachs, JP Morgan, and Credit Suisse involved. In comparison to the previous years though, 2020 was off the charts. 248 companies went public through a SPAC for gross proceeds of $83.3bn, more than the previous 10 years combined. Not only more companies were getting in on the action, but the newcomers were bigger companies too. While the average size of the SPACs was hovering around $250m in the previous years, 2020 saw an average size of $336.1m. In the first 3 months of 2021 alone, both the number of SPAC listings and gross proceeds from them surpassed that of the whole of 2020.

Covid-19 has shaken every sector to its core, and capital markets were no exception. Through very tumultuous times, the market of public listings emerged stronger than it has been since the dot-com boom as high optimism accompanied the skyrocketing popularity of SPACs. A post-pandemic recovery is almost guaranteed but whether the confidence in the IPO market is sustainable or just euphoria remains to be seen.

Strategic M&A

Unsurprisingly, the outbreak of the coronavirus pandemic has induced chaos not only on the medical side but also on the financial markets. Measures to curb the spread of the disease – most notably lockdowns – depressed economies around the world. Outstandingly, the value of M&A deals in the 1H2020 was almost 50% lower year-to-year. Arguably, CEOs focused on adapting to the realms induced by the pandemic and in some cases also saving companies from bankruptcies.

Nevertheless, the economic crisis brought about by the pandemic did not have an effect similar to the one brought by the 2008-2009 financial crisis. Between 2008 and 2009 the value of deals plummeted by an astonishing figure of 29.1%. This time, the financial sectors’ sentiment was more optimistic due to, among others, stronger balance sheets of banks, the flurry of economic stimulus packages issued by national governments, and low interest rates across the Western economies. Thanks to these factors, M&A activity rebounded in a bullish manner in the 2H2020, with $2.2tn spent, according to MergerMarket. As a result, the total value of deals was only 6.6% lower compared to 2019.

The run has well continued into 2021, with a record-breaking Q1 when deals totalled $1.3tn. According to Simona Malleare, global co-head of financial sponsors at UBS, “firms need to make up for a lost time during 1H2020” and “are in a rush to make deals”.

One of the most hard-hit sectors was the energy industry. With nearly totally depressed human activity at the beginning of the year, Brent crude oil price plunged to lows of $9.12, straining any kind of profitability at the oil giants. Many players faced the need to consolidate or divest assets to survive the low-price environment. Chevron bought Noble Energy for $5bn, BP sold its petrochemical business for the same price, and Dominion Energy divested its gas transmission assets to Berkshire Hathaway for nearly $10bn. Overall, year-to-year, the sector recorded a 3.8% growth in deal value, hitting a $477.7bn mark in 2020. Arguably, more deals are likely to come in the sector facing calls to become climate-friendly.

On the other side of the wall was the technology sector which enjoyed the most M&A activity last year. Riding high on the proliferation of digital services during the pandemic, $851.8bn worth of deals were completed. 2020 saw Analog Devices, a chipmaker, acquiring Maxim Integrated Products for $22bn, and Nvidia scooping up Arm, a producer of chips used in smartphones, for $40bn. Although, the latter still has not been approved by regulators. Further, T-Mobile purchased Sprint for $26.5bn, hoping to further boost its 5G presence. Overall, these moves follow underlying trends of digitalization of everyday life which cannot be supplemented without technological development.

Financial M&A

On the side of private equity deals (PE), to some extent surprisingly, the pandemic has not induced such havoc as in the field of strategic M&As. Thanks to a strong 2H2020, PE firms were able to turn their fortunes around from a poor 1H2020, during which the value of transactions fell by 20%.

Further, although the number of completed deals worldwide declined by 280, their total value increased marginally, by 3.3%, to $608.7bn. In 2020, the industry spent the most capital since the financial crisis of 2008-2009. For the last 4 years, the value of buyouts remained relatively stable, with no significant divergence from the average sum of $581.35bn.

The underlying trend driving the industry is the focus on technology-savvy companies, as well as medical ones. In a $9.5bn deal, Thoma Bravo acquired RealPage, an American producer of property management software. On a similar note, Vista Equity Partners bought Pluralsight, an online education provider, for $3.5bn. More recently, CVC Capital Partners announced its intention to acquire the distressed Japanese tech giant, Toshiba, for a huge price of $20bn. If the deal were to be completed it would overtake 2020’s record-breaking acquisition of Thyssen-Krupp Elevator by Advent International and Cinvent, for $18.8bn.

Overall, it can be argued that the outlook for the private equity industry is favourable. Shares in Blackstone and KKR, respectively the first and the third biggest PE funds worldwide, trade at all-time highs. Whether they will use their gunpowder and prolong the industry’s good times is for us to observe.

Restructuring

Many companies struggled a lot because of the Covid-19 pandemic and were forced to opt for restructuring. Restructuring is the act of changing the business model of an organization to improve it. The reasons for such a shift in the company can be either internal or external. The Covid-19 pandemic caused a change in the business environment and was an external event. Among other possible situations when restructuring might be necessary are the introduction of new methods of operation, e.g. improvements in technology and advancements in working systems, buyouts such as. when a buyer wants to change the organizational structure of the company acquired or when after an acquisition the acquired company adapts to the system and the culture of the acquirer, and bad performance yielding low profitability in general. The restructuring driven from inside can be related to changes in operational processes, legal and ownership structure.

Restructuring is usually about minimizing losses rather than maximizing value. In restructuring M&A, the bankers advise the creditors during a transaction to modify their capital structures to survive. Restructuring M&A usually happens during the acquisitions of challenged businesses to develop effective strategies to manage risks on the acquisition and to preserve value on a business sale, relieving financial pressure and creating liquidity.

30 years ago, restructuring was mostly done when companies were running out of cash. However, for the years before Covid-19 restructuring has already had many developments and was mostly done by companies that were underperforming without clear signs of insolvency problems. An example of a business undergoing a major business restructuring was 3M, the manufacturing conglomerate and producer of Scotch Tape and Post-it Notes. The company saw a drop in sales in 2019, partly due to the ongoing US-China trade war hitting demand from its Chinese customers. 3M decided to go for restructuring to drive productivity, reduce costs, and increase cash flow, cutting 2,000 jobs worldwide.

Source: Raconteur

More in general, as shown by the table above, even before the pandemic companies were becoming more aware of the operational changes they needed to implement to avoid an eventual crisis. In particular, this involved dealing with headcount optimization, improving working capital, and reducing capital expenditures to preserve liquidity in the balance sheet.

The Covid-19 pandemic did not have an impact similar to the one produced by the 2007-2009 crisis. Most governments granted subsidies and had support programs including support for employees and payroll, as well as creditor forbearance schemes. The generosity of governments allowed many companies to weather the storm through 2020, leading also to a lower-than-expected number of distressed M&A opportunities.

Despite the coronavirus pandemic, thanks to the developments of the previous years, when companies became more sophisticated, agile, and responsive to market needs, business restructurings nowadays aim beyond headcount and capacity reduction. Unless it is a desperate bid for short-term survival, the main goal should be to improve long-term health and capacity to prepare businesses to bounce back for the possible economic recovery. The broader goals for future growth include developments in technology, improvements in products and customer service, and working capital efficiency.

However, for the industries hit most severely by the pandemic, such as tourism and hospitality, where a severe drop in demand with great uncertainty towards recovery could cause solvency problems, restructuring might become the only option to avoid bankruptcy. A good example could be the restructuring of Virgin Atlantic that has announced the completion of the £1.2bn private-only solvent recapitalization of the airline and holiday businesses. The restructuring plan envisages a refinancing package worth £1.2bn over the next 18 months in addition to the self-help measures already taken: £280m in cost savings per year, £880m reduction in fleet CAPEX in the next five years. Virgin Atlantic’s shareholders Virgin Group and Delta Airlines are providing £600m in support over the life of the plan, including a £200m investment from Virgin Group and the deferral of £400m of shareholder payments such as brand fees and joint venture related costs from Delta Airlines. The airline continues to have the support of merchant services providers Lloyd’s Cardnet, First Data, and American Express. Davidson Kempner Capital Management, a global institutional investment management firm, is providing £170m of secured financing, and the airline’s largest creditors and suppliers are contributing an additional £450m by way of deferrals.

Conclusion

The coronavirus outbreak had a profound effect on businesses around the world, and the crisis caused by the pandemic is irrefutable. However, the financial markets, initially strongly hit by the pandemic and related measures, saw a quick recovery in the second half of 2020, and the first quarter of 2021 only continued this trend. Government support schemes, low interest rates, and overall optimism present in the market became the main reasons for such a behavior of capital markets. Nevertheless, with the pandemic still being underway, it might be too early to draw definitive conclusions.

0 Comments