Description of Belt and Road Initiative

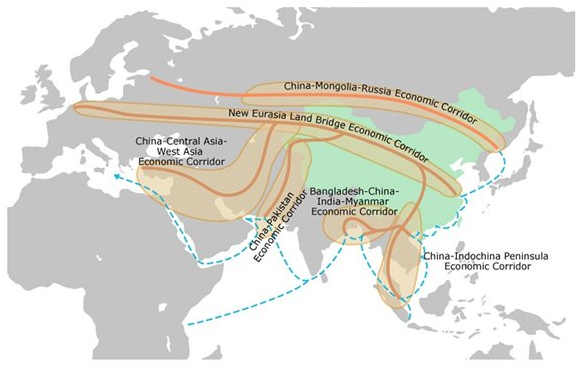

The Belt and Road Initiative (BRI), also known as the One Belt One Road (OBOR) or the Silk Road Economic Belt and the 21st-century Maritime Silk Road, is a development strategy adopted by the Chinese government involving infrastructure and investments in European, Asian and African countries. It was initially announced in 2013 with the purpose of restoring the ancient Silk route that connected Asia and Europe. The “Project of the Century”, as labelled by the Chinese authorities, is ambitiously focusing on improving connectivity and cooperation among the countries involved. The project covers two parts. First is called the “Silk Road Economic Belt” which is primarily land-based and is expected to connect China with south east Asia, south Asia, Central Asia, Russia and Europe. The second part is called the “21st Century Maritime Silk Road” which is sea-based and is expected to connect China’s southern coast to the Mediterranean, Africa, South-East Asia and Central Asia. The names may seem confusing as the “Belt” is actually a network of roads, and the “Road” is actually a sea route. The project has six corridors and five major priorities, which are: policy coordination, infrastructure connectivity, unimpeded trade, financial integration and connecting people. The BRI’s geographical scope is constantly expanding. So far it covers over 70 countries (71), accounting for about 65 per cent of the world’s population and around one-third of the world’s Gross Domestic Product (GDP).

Source: Kahraman, Ali Ihsan. (2018). Belt and Road Initiative: The Eurasian Cold War?

BRI is of high relevance to China for two reasons – it aims to boost the domestic growth and it is strategically important for economic diplomacy. The project is expected to open up and create new markets for Chinese goods and allow China to gain a tighter control of cost-effective routes to easily export materials. Therefore, China has announced over $1 trillion in investments, largely in infrastructure development for ports, roads, railways and airports, as well as power plants and telecommunications networks, and is funding them by offering low-cost loans to the participating countries. This is where the controversy arises.

Some nations see it as a strategic move towards the Chinese dominance in global affairs with a China-centric trading network.

The Asian Infrastructure Investment Bank (AIIB), Silk Road Fund and the New Development Bank have already committed approximately US$1.1 trillion in BRI infrastructure investment. The Asia Development Bank estimates, however, that projects in Asia alone will need US$1.7 trillion a year through 2030 compared to the US$881 billion currently being invested annually. This funding gap means that additional capital-raising and investment activity both inside China and out is needed.

Beijing has injected massive amounts of capital into Chinese public financial institutions, such as the Chinese Development Bank (CDB) and the Export-Import Bank of China (EXIM). Those banks enjoy very low borrowing costs since their bonds are treated like Chinese government debt with very low interest rates and they have access to lending from the People’s Bank of China’s (PBOC), allowing them to lend cheaply to Chinese companies working on BRI projects.

This easy financing enables China’s state-owned enterprises (SOEs) to be highly competitive against foreign companies that might be more financially constrained. For instance, in 2015 Japanese construction companies lost out to their Chinese counterparts in a bid to build a high-speed rail project in Indonesia. Discussing the reasons behind their choice, the Indonesian government cited Chinese financing from the CDB, which came with favourable conditions.

From BRI to financial distress

As already mentioned, expectations of a higher growth and economic development led a considerable number of countries to take part in China’s Belt and Road Initiative. However, after five years from its announcement, a major issue due to the BRI has been unveiled: debt sustainability. In order to better understand the issue, it is useful to have a closer look at a few specific examples: specifically, we are going to outline the cases of Pakistan, the Maldives, Montenegro and Mongolia.

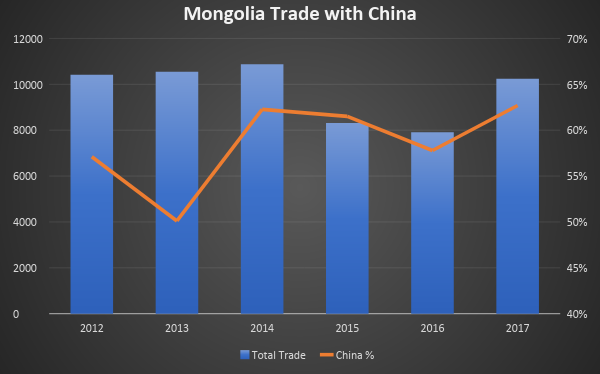

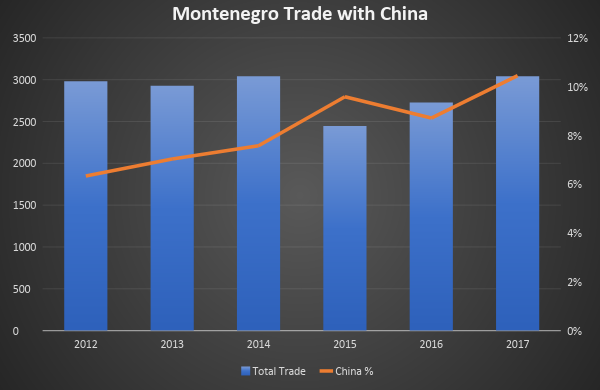

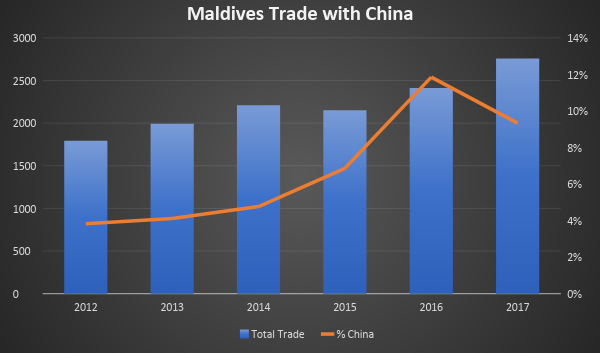

The charts below show the total trade of these four countries on the primary y-axis measured in USD million. Total trade is defined as the sum of exports and imports with the rest of the world. On the secondary y-axis the number shows the percentage of total trade made with China.

The graph shows some interesting implications. Generally, the BRI initiative has been agreed on in 2013 and came into effect in 2014. And in all these countries, we can see an increase of China’s share in total trade, which is represented by the orange line. In Montenegro, Pakistan and Maldives the number increased by around 5%-8% from 2013 to 2017 and China became one of the leading trade partners (apart from the case of Maldives, where the UAE and India are still predominant). Mongolia, however, presents a critical exception, where the Chinese share of total trade not only rose between 2013 and 2017, but rose by the whole 13% from 50% to 63%. It is also interesting to note that entering the BRI did not necessarily increase the total trade of these countries in absolute terms, probably due to the refocusing on the trade with the new strategic partner China.

(Source: Thomson Reuters)

We would like to analyze deeper each of the four countries and their relationship with China.

On April 20th 2015, China and Pakistan signed an agreement that established the so called “China-Pakistan Economic Corridor” (CPEC), a collection of infrastructure projects which has soon become BRI’s flagship investment. Originally valued at $46 billion and planned to run from northwest China’s Xinjiang province to Gwadar port in Pakistan’s Balochistan province, the CPEC is now worth more than $60 billion with 85 projects in either the planning stages, under construction or completed. In addition to the creation of roads, railways and other modern transportation networks the China-Pakistan Economic Corridor involves also the building of several energy plants and cooperation in the areas of agriculture and technology. Strictly after the announcement, the project was compared to the Marshall Plan in the United States since it was expected to boost Pakistan’s economic growth and to create a huge number of jobs between 2015 and 2030. Nevertheless, in October 2018 Pakistan was forced to ask the IMF for a $8 billion loan in order to bail itself out from a balance-of-payments crisis. While it could be argued that the country allows fiscal and balance of payments pressures to build up into a near-crisis situation every few years, for sure the One Belt One Road Initiative had a role in the most recent developments. As analysed by M. Ahmed[1], in Pakistan there are two principal causes of macroeconomic problems: the imbalance between public sector spending and income and an underdeveloped export base. Those factors were exacerbated by the BRI’s initiatives which led Pakistan to import lots of raw materials from abroad, mainly from China, and to borrow from Chinese bankers. The result of these actions was a worsening current account deficit which reached a monthly peak at $1.66 billion in December 2019 with a 37.3% increase compared to the previous month. Given the raising concerns about the potential drawbacks of the Belt and Road Initiative, the China-Pakistan partnership is coming under pressure and last year’s election of Imran Khan as Pakistan’s Prime Minister may be seen as another destabilizing element. Indeed, in January 2019 the new government decided to abandon plans for a $1.6bn Chinese-built power plant.

Because of its strategic location, the Maldives play a crucial role in the development of the “21st Century Maritime Silk Road”, the sea routes of the One Belt One Road Initiative. Starting from 2014, the country received massive investments from China aimed at building ports, bridges and other infrastructures that are crucial in the Maldivian core industries: tourism and shipping. At that time, those activities were welcomed by former president Abdulla Yameen who had plans for expanding the size and the capacity of the islands. In August 2018 the flagship project of Mr. Yameen’s policy was completed: the China-Maldives Friendship Bridge, a 2.1km bridge that connects the islands of Malé and Hulhulé with an estimated cost of $210 million, of which $126 million granted in aid by the Chinese government. On November 17th 2018, Ibrahim Mohamed Solih was appointed as President of the Maldives, bringing to an end Mr. Yameen’s five-years mandate. Soon after its election, the new government claimed that Chinese BRI led the Maldives to assume an unsustainable amount of debt, mainly owed to China; specifically, the Maldivian Finance Minister estimated a total of $935 million in guarantees of which $600 million directly owed to the Chinese government. Moreover, unofficial estimates maintain that, taking into account also the unreported guarantees, the total amount of debt may skyrocket to $3 billion, clearly a sum which is impossible to be repaid. While the Maldives were increasing their cooperation with China, India was alarmed by possibility that Beijing could build naval bases on the islands; nevertheless, thanks to President Solih, the country is now said to be in talk with the Maldives in order to offer a $1 billion low-interest loan over several instalments to help repay Chinese debt and strengthen its military presence in the area.

Thanks to the Belt and Road Initiative, China found an indirect way to enhance its presence in Europe via countries that one day may become members of the European Union; specifically, in the Balkan region, the deep need for investments in infrastructure led several states, such as Serbia and Montenegro, to undertake Chinese-built projects. The Belgrade-Bar motorway is an under-construction motorway that will link the Serbian capital of Belgrade to the Montenegrin seaport of Bar. With an overall length of 445km, the route implies the creation of deep-cut tunnels and bridges and it will be the largest infrastructure in Montenegro. While the Montenegrin government believes that the motorway will boost the connectivity with the EU thus leading to a faster economic growth, soon after the beginning of the first 41km construction, financing-related issues were raised. A China-backed loan granting the initial phase of the project made Montenegro’s debt expand and forced Moody’s to downgrade the country’s credit rating. Moreover, Montenegrin Debt to GDP ratio is expected to have peaked at around 80% in 2018 with the IMF predicting that no additional loans would be sustainable in order to complete the construction. As a consequence, Montenegro opted for a Public Private Partnership in which the state-owned China Road and Bridge Corporation (CRBC) was assigned the task to build, operate the motorway and collect tool fees for a period of 30 years after completion. Since various fiscal policy actions has already been implemented and the country’s fiscal space has shrunk, by offering revenue guarantees to finance its part of the Belgrade-Bar motorway Montenegro may have worsened its financial distress.

Mongolia is a strategic northern neighbour of China and the border between the two extends along 4677 km, and so the rationale for its inclusion in the BRI is clear. In fact, Mongolia had, as of October 2013, more than 12,000 foreign enterprises present, and 48.8% of those were Chinese origin. In addition, Chinese FDI in Mongolia equalled $ 3.8 bn which is 26.7% of total FDI.

The main channels of funding are the well-known Asian Infrastructure and Development Bank and Silk Road Fund. Additionally, in September 2017. Industrial Commercial Bank of China opened its branch in the capital Ulaanbaatar in order to facilitate investment in the region and to provide trade financing.

China’s Exim Bank provided a $1 bn loan at concessional rates in early 2017 for the construction of the highway between the capital and the airport and in addition for the development of the hydropower plant.

However, already in spring 2017 Mongolia found itself in difficulty due to the mounting debt repayments and had to ask the IMF for financial assistance amounting to $5.5 bn, which puts into question the institutional effectiveness in Mongolia and the sustainability of further investments under BRI.

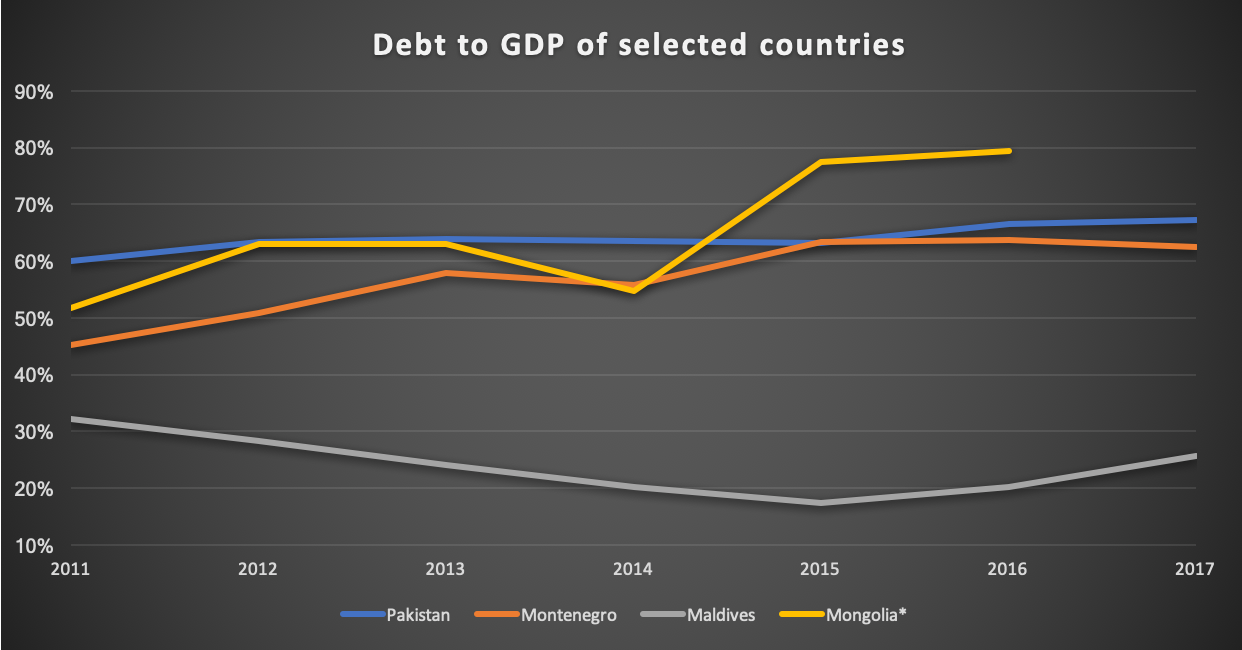

As a final note, we are providing the graph of the debt level (as percentage of GDP) of the four countries. Clearly, three of the countries have seen increasing levels of debt to GDP over time. Maldives is the only exception which probably carried out its cost benefit analysis and decided not to pursue further integration with China, as indicated by the recent cancellations of certain projects by the newly elected president.

(Source: Thomson Reuters)

Suggested Trading Strategies

Pakistan

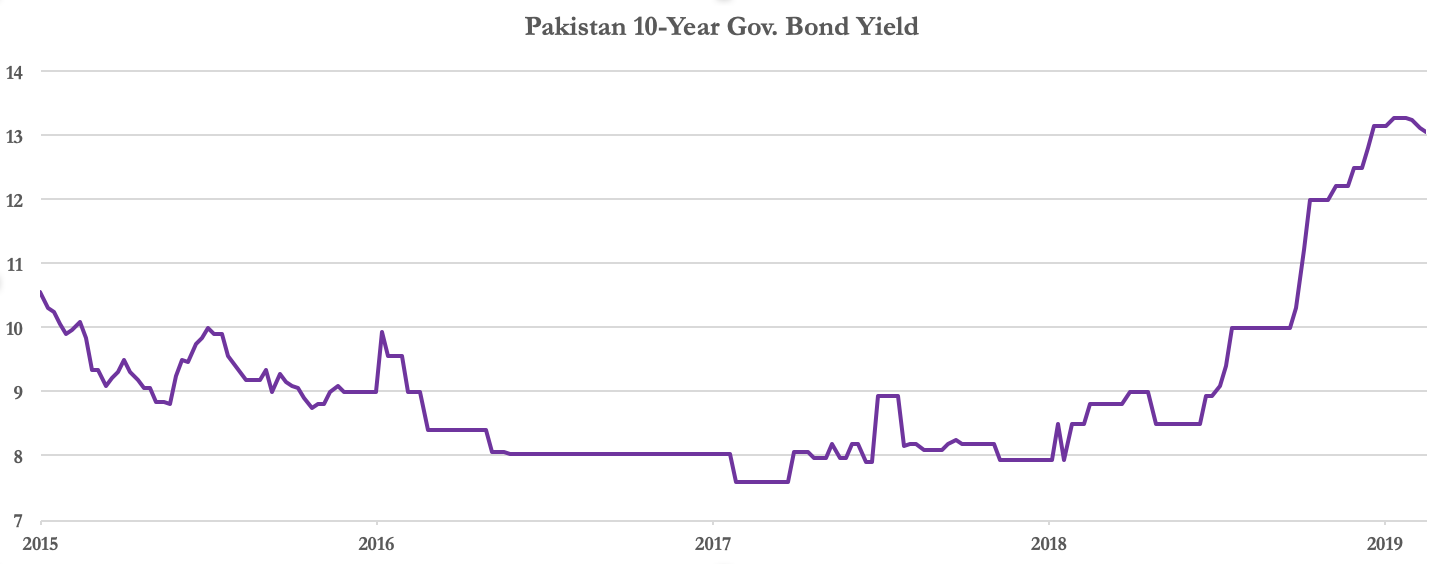

The analysis carried out above led us to conclude that Pakistan’s current financial distress is yet to be resolved and may potentially further deteriorate in a real debt crisis; even with the help of the IMF, the huge involvement in the Belt and Road Initiative raises several concerns about the country’s ability to get out from its balance-of-payments shortfall. The most straightforward way to profit from such a situation is to look at Pakistan’s fixed income market; specifically, over the last eight months, its Government Bond 10-Year Yield has gained approximately 450 basis points moving from 8.5% in June 2018 to around 13.1% in February 2019.

(Source: Thomson Reuters)

In our view, the trend will continue in the next few months and thus Pakistan’s Sovereign Bonds are going to depreciate even further. A simple and low-risk trading strategy could be buying a put option on the 10-Year Gov. Bond Future contract: in our predicted scenario, the exercise of the option will grant the right to sell the bond at a future date at a price which is higher than the actual price; conversely, in the worst-case scenario, at maturity the option is not exercised thus limiting potential risks. The time horizon of the trade should be around 2-3 months and the option would probably have to be negotiated OTC.

Mongolia

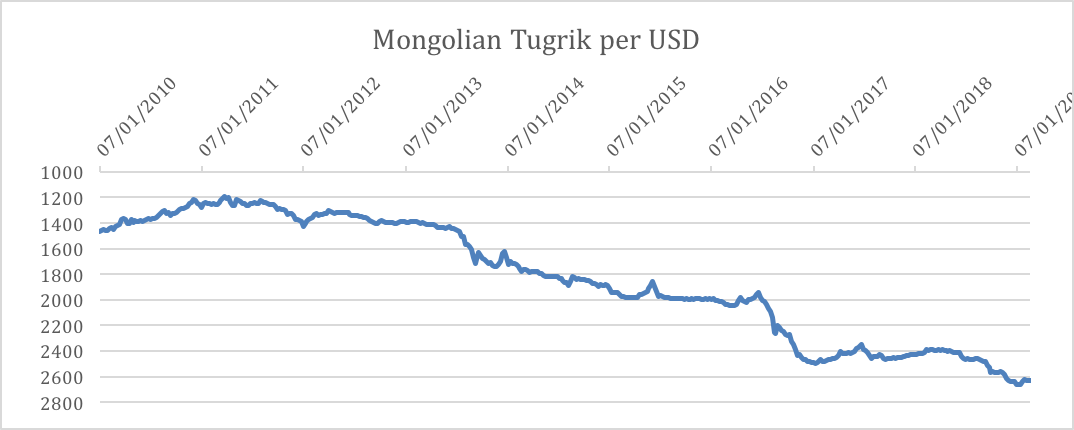

Another country which might suffer from the current environment is Mongolia, a country that just two years ago ran a deficit of a staggering 20.6% of GDP, the largest in the world. Average GDP growth during last years has picked up, from -1.7% in 2014 to 6.1% in 2018, but this has not managed to rein in a huge inflation and an abrupt fell in the value of the Mongol Turk against major currencies. The country is heavily dependent on China: it carries out as much as 62.7% of its total external trade with China, which also accounts for 84.8% of its export. It is therefore evident how a severe crisis in the Chinese market, as well as a slowdown in the Chinese manufacturing activity, could worsen the outlook for an economy still heavily dependent on its mineral resources. The country’s government has managed to bring the deficit figure down to 10.4% of GDP in 2017, but it still lacks credibility on its commitment to stick to austerity should the economy fall again. Such factors all caused the Mongolian Tugrik to a brutal devaluation against the USD of over 53% over the last 8 years.

(Source: Thomson Reuters)

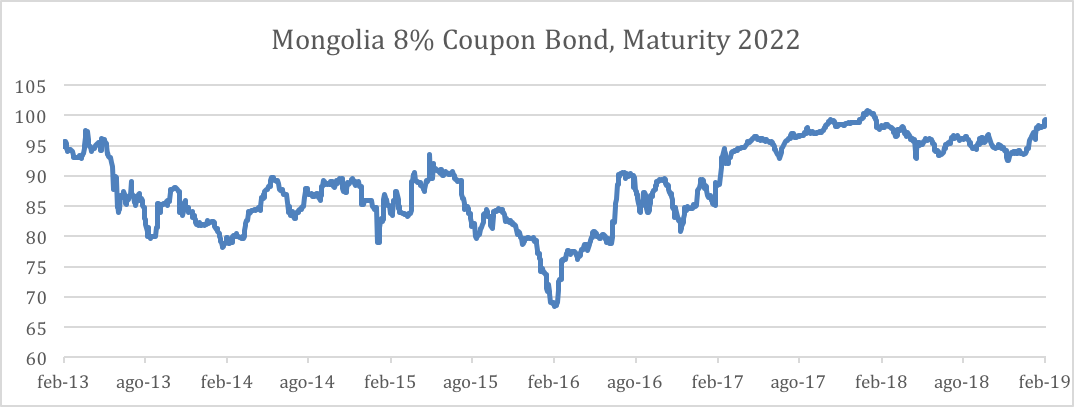

Over last years, Mongolia managed to tap international bond markets more than once to raise financing in hard currency, with USD-denominated government bonds listed in Singapore. The hunt for yield that markets witnessed until the beginning of 2018 made it possible for troubled issuers like Mongolia to attract foreign investors. A particular bond, a 10Y 8% coupon bond issued in 2012 captured our attention as we tried to evaluate its performance. It is interesting to notice that in the beginning of 2013, Moody’s and Fitch rated Mongolia as B+, while S&P with BB-, and the bond was priced slightly below par value. At that time, government deficit was lower than today’s figure (-8.9%, with the country running a surplus just three years before, in 2010) and a solid GDP growth of 11.3%. At that time US interest rates were set at 0.25-0.5% agains today’s 2.25-2.5%. Furthermore, today’s rating has worsened: S&P and Fitch attach a B to the country, while Moody’s has a B- outstanding. All in all, we do not think that the great recovery in value that the bond witnessed from February 2016 until today is fully justifies. The country still presents an elevated number of factors of risk that might heavily affect the bond price once risk-mode of investors turns off. Finally, the fact that the risk premium attached to Mongolia today is lower than in 2013 does not point in the right direction in our opinion. In conclusion, we think that such bond is overvalued and might lose value as China’s GPD growth slows down and the Belt and Road Initiative critique points arise in the future. Furthermore, the steep devaluation of the Tugrik has made all repayments 53% more expensive as compared to 2012.

(Source: Thomson Reuters)

- M. Ahmed, Why Does Pakistan Have Repeated Macroeconomic Crises?, July 2018. ↑

0 Comments