Introduction

The pharmaceuticals sector has been the center of attention lately for the successful vaccines trial that finally gave some hope of recovery, even though it wasn’t without controversies. However, a lot more has been going on in the industry that might change the reputation that the industry has in the eyes of the public. Here we list all the major trends currently affecting the industry.

1. Pharma is racing to find a vaccine

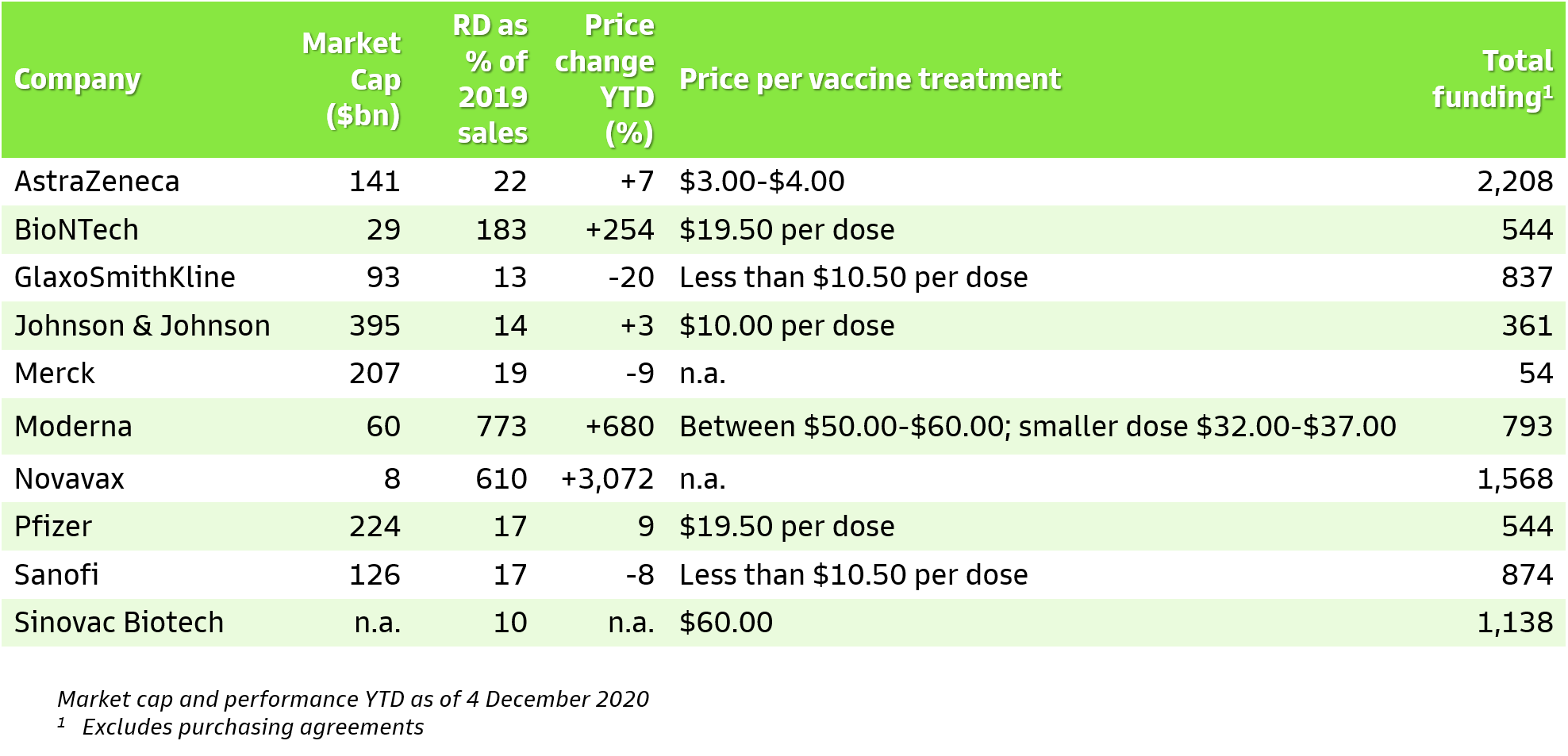

The most relevant pharmaceutical companies that have released results from their initial coronavirus vaccine trials are BioNtech/Pfizer, AstraZeneca/Oxford University and lastly, Moderna. Since the announcement of the vaccine on November 9th, BioNTech’s stock has increased 29% and Pfizer’s 16%. Moderna’s stock price since its vaccine announcement on November 16th increased a striking 61%. On the other hand, AstraZeneca saw a 1.5% dip in its share price since its announcement on November 23rd. Other relevant vaccines include the Russian Sputnik V vaccine, which operates in a similar way to the Oxford one, in addition to Janssem’s, which is currently recruiting thousands of individuals worldwide to test whether two shots are more effective than one. Given the current rates of production and purchase by various governments, it is likely that vaccines will be available to the entire public by the summer of 2021.

Regarding the vaccines’ price, most cost less than $20 per dose and the ease of the rollout will vary mostly depending on the vaccine’s storage requirements. For example, the AstraZeneca vaccine, scientifically labelled AZD1222, requires storage between 2-8C° whereas the Pfizer/BioNTech vaccine candidate requires a storage of -70C°, proving to be more complicated to transport. The very cold environment that the Pfizer/BioNTech vaccine requires has made it one of the most expensive jabs, as shown in the table below. To guarantee the transport of such products, DHL has implemented a “Medical Express” service specializing in the delivery of products with specific storage needs. The chief executive of DHL, John Pearson, stated that DHL is expecting a call in the “very near future,” asking them to act as the delivery partner of the Pfizer/BioNTech candidate. Although feasible, the rollout will prove to be challenging. Once approved by health authorities across the world, the vaccine will be prioritized for the elderly and frontline health and social care workers, just like it is being done in the UK.

The billion-dollar deals between governments and pharmaceutical companies are shrouded in secrecy, but they are substantial. For instance, the German government gave BioNTech $445m to develop its coronavirus vaccine and the US government committed $2bn to buying BioNTech’s first 100m doses. Several US agencies within the US Department of Health and Human Services committed a total of $2.5bn to develop Moderna’s vaccine. The US government provided $1.2bn and the UK government provided £88m in funding to AstraZeneca/Oxford University. In exchange, vaccine-makers have promised to make vaccines affordable. The first ones to roll out will cost around $40 for two doses, similarly to the annual flu vaccine. In fact, vaccine-makers AstraZeneca and Johnson & Johnson have pledged not to profit from the vaccine during the pandemic. Other vaccine-makers such as Pfizer and Moderna, however, indicated that they would. Critics say this socializes the risk and privatizes the profits. They call for more transparency about vaccine licensing agreements and clinical trial costs. They also denounce the “no-profit” pledges, which may not be as generous as they would initially seem. AstraZeneca for example, which made such a pledge, reserved the right to declare the end of the pandemic by July 2021 and raise prices thereafter.

Source: Financial Times, Bloomberg

2. Now is not the time for transformative M&A

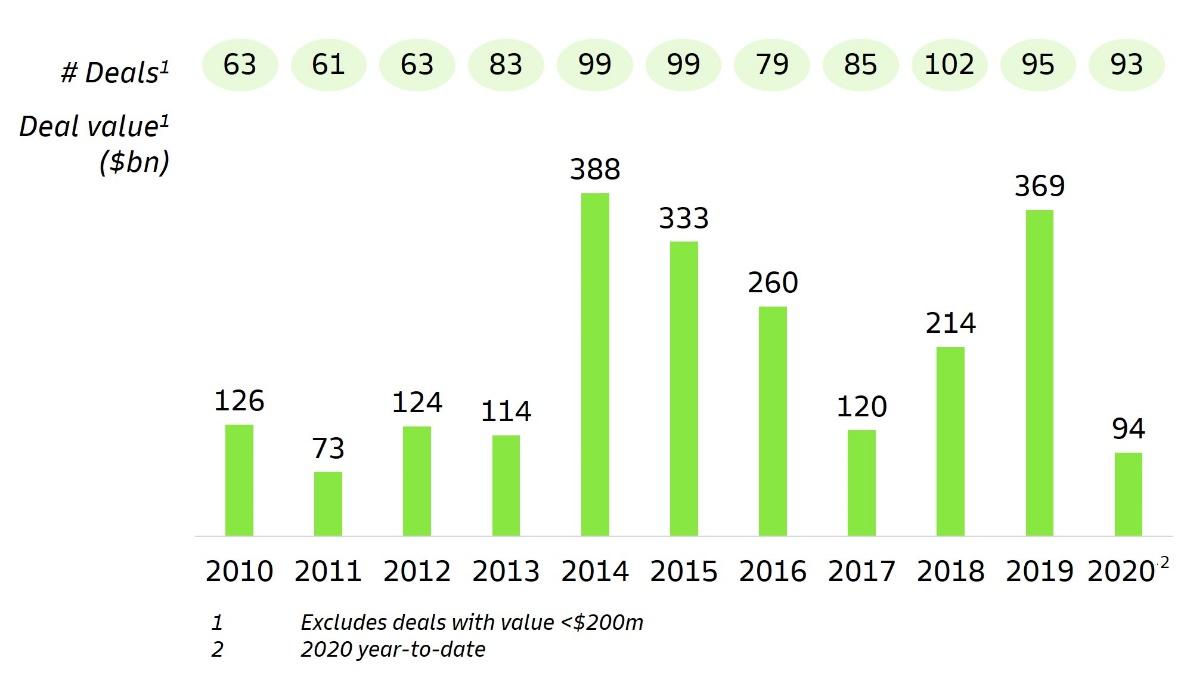

2020 has been a year for smaller M&A deals in pharmaceuticals. This year saw a marginal 1% YoY decline in the number of deals announced but a sharp 75% drop in total deal value, as shown in the chart below.

Source: MergerMarket

Indeed, pharmaceutical companies put transformative M&A on pause and forged ahead with bolt-on acquisitions instead. Antitrust concerns plagued some of last year’s transformative megadeals such as the $63bn Abbvie-Allergan deal and the $74bn Brystol-Myers Squibb/Celgene deal. To appease regulators, Abbvie had to sell two of its drugs while Celgene had to divest its Otezla business. Fears of such antitrust scrutiny, together with depressed stock prices in the first half of 2020, likely drove the bolt-on boom. As a result, big pharma snapped up smaller, specialty companies with promising novel treatments. In the US, Gilead acquired Forty Seven, which makes experimental blood cancer treatments for $4.9bn and Johnson and Johnson acquired Momenta, which makes experimental neuromuscular diseases treatments for $6.5bn. In Europe, Sanofi acquired Principia for $3.7bn and Bayer acquired biotech firm Asklepios for up to $4bn. 2020’s largest M&A deal was Gilead’s acquisition of oncology-focused Immunomedics for $21bn, which is a far cry from the $60bn+ acquisitions of 2019.

3. The outlook of the pharma industry under a Biden Administration

Under the Biden Administration, it is expected that prescription drug prices will decrease, in addition to the US government having more control over the pricing of medicines. This could, in turn, deeply hurt the pharmaceutical industry but not to a greater extent than President Trump’s policies. His policies revolved around the increase of imported drugs and the pinning of prices that Medicare pays for unspecified drugs to the rates that other countries have. However, if the Senate remains controlled by the GOP, or is split between the two main parties, the drug-pricing reform sought by the Democrats will be difficult to achieve. Nevertheless, President-elect Joe Biden plans to introduce a COVID-19 relief package and expand health-insurance coverage, implying an increase in government purchases of prescription drugs, as well as amendments to the Affordable Care Act. Another example of how the new US Healthcare Policy Reform will induce a turning point in “Big Pharma” is the set-up of an independent government board to determine prices paid by the government’s purchasing programs, and a direct flow of negotiation with drug makers for discounts, prohibited by the Medicare Modernization Act of 2003.

4. Pharma might repair its reputation

Big pharma is America’s #1 most hated sector, according to a Gallup poll. Scandals over product safety, sky-high drug pricing and political lobbying have eroded public trust and tarnished the sector’s ESG investability. Recent examples of scandals abound: in October for instance, Purdue Pharma agreed to a criminal and civil settlement of $8.3bn and to plead guilty for fueling the US opioid crisis. In July, Novartis reached a $642m settlement with US authorities for paying bribes to doctors and improperly funding drug purchases. The coronavirus pandemic, however, could help restore some positive investor sentiment. Many pharmaceutical companies have pledged to make COVID-19 therapies affordable, which will be of broad benefit to society. Public bodies have poured unprecedented amounts of money into big pharma, a testament to the industry’s ability to generate positive externalities. The US government alone has handed over $18bn to companies searching for a vaccine.

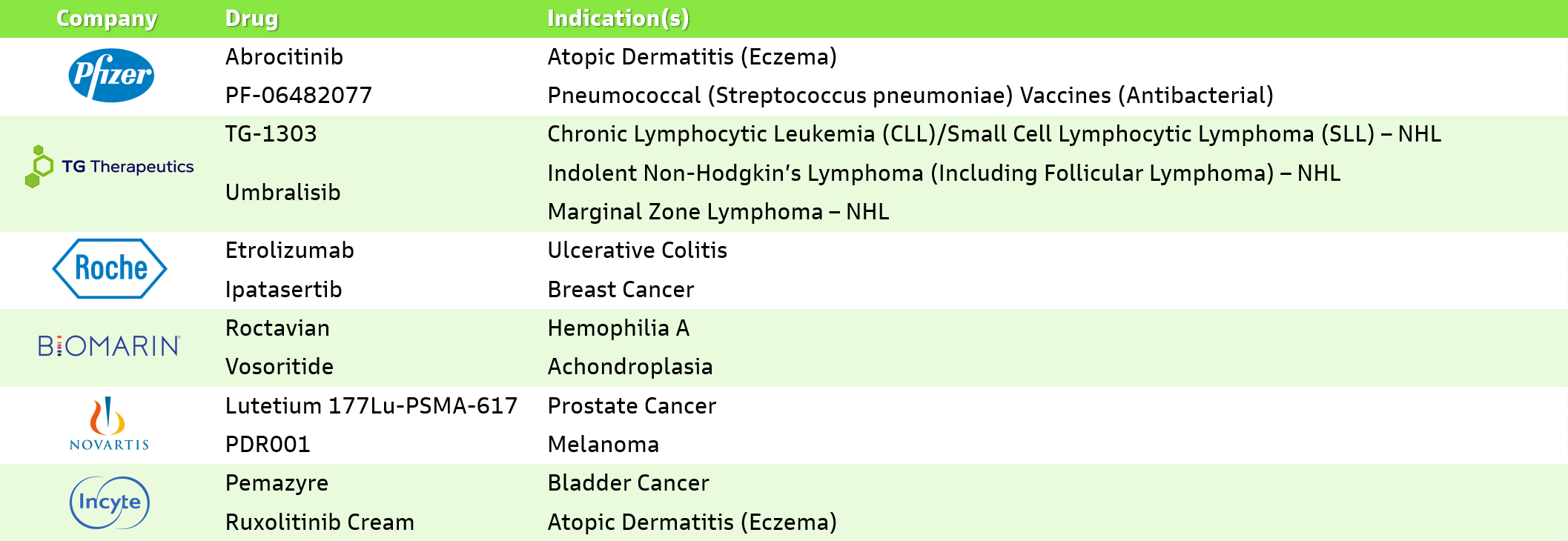

5. More innovation could happen in 2021

2020 enjoyed fewer R&D catalyst events than previous years, but innovation is expected to get back on track in 2021. According to research from Barclays, several R&D catalysts lie ahead in 2021: results from a head-to-head study of AstraZeneca’s leukemia treatment Calquence vs incumbent Imbruvica, study readouts regarding the effectiveness of Novartis’s Ilaris in treating lung cancer, as well as data releases about antibodies used in a variety of cancer treatments. Biomedtracker estimates 68 new drugs could potentially be launched in 2021; the table below lists some of the key ones.

Source: Biomedtracker

0 Comments