The TMT market underwent profound changes during the last years, consolidating the best practice businesses and asking for a reshape of the others. That is the case of Nokia (NOK). In fact, it gave up to Microsoft the Devices & Services division in 2013 and, at the beginning of August 2015, revealed the sale of HERE, the map and geolocation business, to a pool led by BMW, Daimler and Audi. These operations are part of the strategic reorganization of the company, with the aim of focusing on the two core divisions remained: networks and technologies.

So far, the process has been successful from the financial standpoint. At the end of 2014, Nokia balance sheet was in a very healthy condition presenting low indebtness, even though rated below the investment grade threshold (which remains one of the long-term targets of the company). To throw in some numbers, both current and liquidity ratio improved roughly 25% from the previous year at, respectively, 1.88 and 1.71.

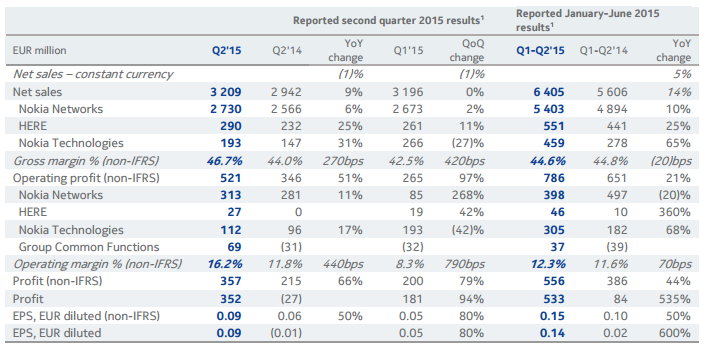

Furthermore, the financial data for the first half of 2015 support the management decision. As it is clear from a quick view of the earnings report, Nokia improved strongly since last year. In particular, one should notice the operating profit that increased 21% led by the technologies division.

In addition to that, attempting to create a competitive leader in the network technology and services, Nokia management announced the settlement of a tender offer for Alcatel-Lucent (ALU) last April. The company is expected to complete its all-stock acquisition of Alcatel-Lucent early next year, a merger that is going ahead of schedule, according to Nokia CEO Rajeev Suri.

Nokia focuses on this merger and it is still strongly convinced to go ahead with this acquisition, mainly because it presents great long-term investment value. In fact, the Finnish giant said it could achieve synergies and market opportunities with Alcatel-Lucent that it could not achieve alone. In essence, these are enormous companies with a wide range of growth and cost-cutting opportunities.

Nokia expects to achieve cost savings of nearly $1 billion annually by 2019, which means much higher margins for the combined company. The main drivers are the focus on the same business, which is telecom-equipment sale, and similar kind of clients. Nokia will be able to consolidate operations while streamlining its marketing approach and likely lowering its headcount as a combined entity.

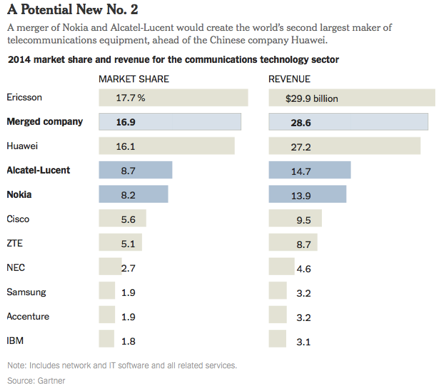

Alcatel-Lucent and Nokia both sell equipment to telecom companies, have a global reach and are enormous corporations with roughly $30 billion in combined revenue. On the other hand, we can also notice some differences and cross-selling opportunities that, combined with the margin improvement from cost-cutting, is why investors should own Nokia long-term.

Nokia is a builder of networks, like base stations and towers for the construction of 2G, 3G and 4G networks, as well as Wi-Fi solutions. Meanwhile, Alcatel-Lucent’s technology and products make networks better, like its IP routing, switching and optical equipment. Combined, this creates an all-around well-diversified business that can compete with juggernauts like Cisco (CSCO) and Ericsson (ERIC).

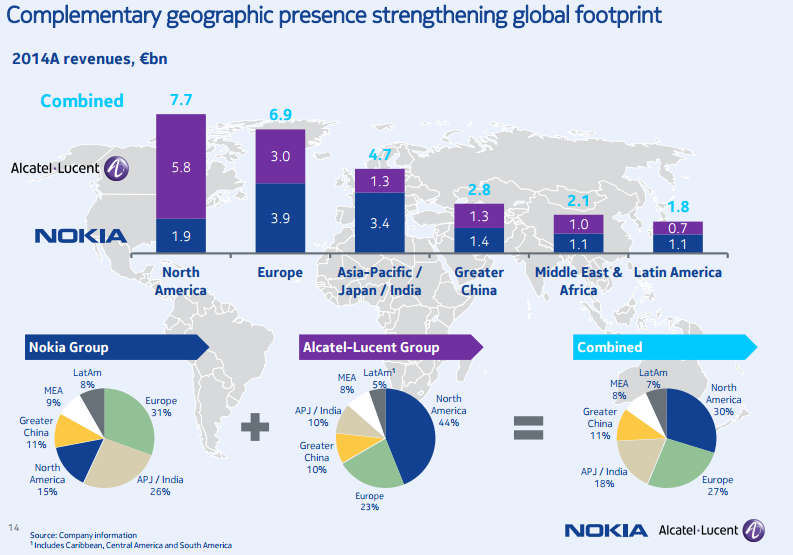

While both Alcatel-Lucent and Nokia are global companies, each thrives in different geographical areas (see the chart below). While Nokia is mainly exposed to European markets, Alcatel-Lucent generates almost half of its revenues in North America.

After that, Nokia is a dominant vendor in India, having 34 total contract wins in India last year. Alcatel-Lucent presence is not nearly as strong in India, but with IP traffic expected to grow at a compound annualized rate of 33% from 2014 to 2019, Alcatel-Lucent will have a great opportunity to capitalize with its IP-routing and IP-switching businesses.

Moreover, both companies have a great opportunity to set up and thrive their business in the Chinese market. Alcatel-Lucent joint venture with China Huaxin created $5 billion in revenue last year from China only, far better than the $1.5 billion that Nokia generated in the Asian country. In addition, they signed some contracts that allow them to use their routers in China Mobile, China Unicom and China Telecom’s 4G mobile networks. Ahead of the merger, Nokia has already solidified its partnership with China Huaxin to add network construction to the mix, thereby giving Nokia the opportunity to grow its core business larger in China.

On the other hand, the merger of these two super giants has not been happily accepted by the market. The main reasons of pessimism over the deal lay on big problems that derives from the long time needed for the merger and regulatory issues.

For example, Nokia and Alcatel will need to convince regulators in nine countries (including US and China) that their proposed tie-up will not impair competition in an already heavily consolidated telecoms equipment market. Gaining approval for the deal in the US will be a key hurdle to overcome. With Chinese rivals such as Huawei locked out of the market, the acquisition will in effect leave only one other major provider of telecoms equipment alongside Ericsson.

Winning over Chinese regulators could also hold up the deal, with Nokia likely to be mindful that authorities in the country were responsible for delaying the sale of its handset business to Microsoft.

Analysts believe that the European Commission may prove less of a problem, particularly as the deal is being presented as an attempt to create a European champion to challenge overseas rivals such as Huawei. Such an approach is likely to find favour among Brussels regulators seeking to strengthen the region technology groups.

Nokia is also facing several problems with the French Government over the issue of cutting jobs in Alcatel-Lucent due to the overlapping of some divisions, especially in the wireless business.

In a recent meeting with the French Minister of the Economy, Nokia reiterated its promises on keeping jobs and France key role on innovation. Nokia previously agreed to increase staff at Alcatel-Lucent French R&D sites from 2,000 to 2,500 over the next three years, in a move that will also see the hiring of at least 300 graduates. The company said it plans to keep the government informed of the integration process also after completion.

Once Nokia and Alcatel-Lucent will finally be merged, the combined company will have partnerships with all four U.S. nationwide wireless-service providers. They are going to offer about every wireless network construction product and service available today and will gain from the aforementioned new synergies and market opportunities. The new Nokia could likely threaten the current industry leader, Ericsson, in terms of revenues and trying to replace it at the top.

[edmc id= 2914]Download as PDF[/edmc]

0 Comments