In this article we are going to analyse Brazil’s next General elections, scheduled to be held on October 7 (i.e. today). The first section will present some basic information about Brazil and a brief background on the current political situation. The second part will present key factors on the Brazilian economy and about the functioning of the electoral system. The third part will present the main candidates for the presidency and their respective platforms. The fourth part will look at the most debated and controversial electoral topics. Finally, the fifth part will look at two possible trade strategies, one concerning Brazil’s currency, the Real, and the other on the largest Brazilian bank, Banco do Brasil.

Basic Information

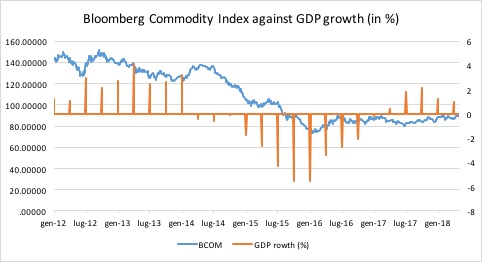

The Federative Republic of Brazil is the largest and most populous country in South America. The federation is composed of 26 states and a federal district, Portuguese is the official language. Brazil’s economy is the ninth largest in the world in nominal terms and eight by PPP. Its economy is relatively unfree and ranks #153 out of 180 countries, as per the 2018 Index of Economic Freedom by the Heritage Foundation. Natural resources play a significant role in the economy and indeed Brazil is the world’s leading producer of tin, iron ore and phosphate. Agriculture and manufacturing also play an important role: Brazil is the largest producer of coffee, with about a third of all coffee worldwide, and has the third biggest manufacturing sector in the Americas. The Bovespa Index is the benchmark index of stocks traded on B3, the main stock exchange in the country. The index reached its record-high at about 87,700 on 26 February 2018 and is currently hovering around 80,000. From 2000 to 2012 the country grew at sustained high rates, averaging at about 5% per year. The economy decelerated in 2013 and entered a recession in 2014 amidst political scandals and protests. The falling prices of commodities played a major role in this, as the Lula governments used large portion of the money coming from booming commodity prices in expensive social security plans that became unsustainable when commodity prices started falling from 2012 onwards. The recession officially ended in 2016 but growth is still sluggish, hovering around 1.6% for 2018 and a forecasted 2.5% in 2019.

The incumbent president is Michel Temer succeeded to Dilma Rousseff after she was impeached on charges of criminal administrative misconduct and disregard for the federal budget. Ms. Rousseff, together with former president Luiz Inacio Lula Da Silva, is also implicated in the “Lava Jato” scandal, a money-laundering investigation involving the oil-giant Petrobras, where executives allegedly accepted bribes in exchange for awarding inflated construction contracts. Since April 2018, Lula is serving a 12-year sentence and is the fifth president of Brazil who has ever gone to jail. This caused public outcry and today 55% of Brazilians see corruption as one of the biggest problems currently affecting their country. It is interesting how, in spite of that, 90% of the politicians currently under investigation for corruption will run for re-election. This is also a major reason why the young electorate is increasingly rejecting the old way of doing politics, and why many people stopped seeing privatization under a bad light, as it is widely seen as a source of corruption among public officers. Petrobras’ privatization would have been completely off the table in 2006, when Lula famously stated that “God is Brazilian”, thanks to its abundant natural resources. Such privatization is no longer a taboo.

Sources: Thomson Reuters and Federal Reserve Bank of St. Louis (FRED)

The Economy and the Electoral System

Brazil has a presidential system in a democratic federative republic. The president is elected for a four-year term with possibility of a second term and is both the head of State and the head of government, hence holding substantial powers. The president is also commander-in-chief of the Brazilian army and appoints all the Ministers of State. The National Congress is composed of a lower house, the Chamber of Deputies, and an upper one, the Federal Senate. The Chamber of deputies has 513 members and is renewed every four years while the Federal Senate has 81 members and is alternatively renewed for one third or two thirds every four years. The President is elected with a majoritarian two round system, the first round will be held on October 7 and in the likely case that no single candidate gets the absolute majority a second round between the top two candidates will be held on October 28. The whole 513 deputies will be elected using an open-list proportional system while two thirds (54) of the senators will be elected using a first-past-the-post (winner takes all) system.

Since the 1988 Constitution introduced the current electoral system a plethora of new parties arose and the political landscape in now very fragmented as even the largest parties usually control less than 15-20% of the seats. Indeed, the specific implementation of Brazil’s electoral system induced a highly fragmented party politics and incentives the formation of coalitions. The current pro-government coalition, With the Strength of the People, holds around 56% of the seats in the Chamber of Deputies and is made up of nine different parties. The first party, the Workers’ Party of Lula and Rousseff, holding just below 14% of seats. Notably, parties receive public funding and airtime allotments for political ads in proportion to their presence in congress. Therefore, this system tends to favour the establishment while penalizing young parties without a coalition and might become particularly relevant in this election.

The overall dependence of the economy on commodity exports implies that the country is highly dependent on commodity prices. This was a key factor contributing to Brazil’s impressing growth over the past years but also one of the reasons why much needed structural reforms were delayed. Amidst falling commodity prices and corruption scandals, the country experienced a severe recession from 2014 to 2016. After the impeachment of Dilma Rousseff, Michel Temer set out to implement market-friendly policies. He managed to introduce more flexibility in the labour market and a constitutional amendment to cap public spending for up to 20 years. Although the reforms contributed to decrease the budget deficit, many other reforms, such as a complete overhaul of the pension system, are still needed to bring about fiscal stability. Furthermore, the structural reforms which were implemented were met with protests and strikes from the general population and it has inflamed even more the current political debate. It is worth noting how Brazil has huge imbalances in their budget: ever since the fall of commodities prices’ it has had issues in funding its expensive social security program, which accounts for roughly 2/3 of the government expenses. Moreover, the pension system shows huge imbalances between the public and the private sector, with the former receiving overly generous pensions which do not have enough inflows to be sustained. The healthcare system is very inefficient, and people consider its improvement a top priority. Projections state that within 2021 the whole budget would be consumed by social security programs, if they are not reformed. President Temer tried to push a reform in Congress, but it did not pass. Meanwhile, between the end of 2015 and the beginning of 2016 the three major rating agencies all cut Brazil’s debt to junk, which is currently standing at Baa2/BB.

Source: Bloomberg

The Candidates

1. Jair Bolsonaro

Ex-army captain and deputy Jair Bolsonaro has been named the “Trump of Brazil” or “Trumpinho”. He’s running with the Social Liberal Party (PSL) and is currently leading in the polls. He’s running on a right-wing nationalist platform. From a social standpoint he has a conservative approach: he opposes abortion, same sex marriage and drug liberalization. This might be one of the reasons why he has little support among female voters. On economic matters he is advised by UChicago alumnus Paulo Guedes, who favours privatizations and a general overhaul of social security as well as the need of an independent central bank. Bolsonaro was attacked during a campaign rally, where a protester stabbed him and caused him to stay in hospital for some time.

2. Fernando Haddad

The candidate of Workers’ Party (PT) and heir to former president Lula, Fernando Haddad is currently polling second after Bolsonaro. He served as Minister of Education under Lula and Rousseff as well as Mayor of Brazil’s most populous city, São Paulo. Haddad was initially the running mate of Lula but was named his replacement after Lula was declared ineligible to run by the Brazilian Supreme Court due to his corruption conviction. The platform of Haddad is heavily influenced by Lula’s heritage: he plans to increase public spending and enhancing social programs such as subsidies for low-income families. He supports a decriminalization of drugs in order to solve the overpopulation of the prison system and to expand civil rights to LGBT minorities. Given the popularity that Lula still holds, it is possible that a significant portion of the electorate will see him as a rightful successor and thus support him as the next president. However, his party and government are partly to blame for the current economic downturn as well as for the widespread corruption.

3. Ciro Gomes

Long-time politician Ciro Gomes is running with the Democratic Labor Party (PDT) and is polling third. He is a center-left politician and shares part of his electorate with Haddad’s Workers’ Party. He’s seen as anti-establishment even though he held several political positions and was Lula’s heir apparent before he decided to support Haddad. On a left-wing platform, Gomes plans to raise taxes on high-income households, expropriate oil fields and undo Temer’s spending caps. He was outspoken in his criticism of Brazil’s high inequality and capital concentration and proposed cuts to civil servant’s benefits in order to address the pension deficit.

4. Geraldo Alckmin

Pro-business and former governor of São Paulo, Gerald Alckmin is the market favourite. He’s polling fourth and has close ties to the financial and political establishments. He showed support for the labor reforms of Temer and received his endorsement. He’s running on a centrist market-friendly platform. He is backed by a centrist coalition, Centrão , which secured him the longest slot for political ads on television channels. He advocates smaller government and tax cuts as a way to rekindle growth in Brazil. As governor of São Paulo he oversaw investments in education and health funded by privatization programs and reduction in payrolls. Furthermore, during his term, the state’s homicide rate declined by an astounding 80%, which can be of particular relevance in this election, since Brazil’s homicide rate skyrocketed in the past years. On social issues Alckmin holds a sort of third way between other candidates, supporting LGBT rights but opposing the decriminalization of abortion.

5. Other candidates

Marina Silva was the former Minister of Environment of Lula but switched from the Workers’ Party to the Green Party in a protest against the government policies on environmental issues. She is supported by a green coalition made of the Sustainability Party and the Green Party. She was polling high in the first part of the year but has since been overtaken by Haddad, Alckmin and Gomes.

João Amoêdo is the founder of NOVO, a party ideologically aligned with classical liberalism. He called for the privatization of public enterprises and public health and education. He supports Bolsa Familia, one of the main social welfare programs in Brazil and has spoken in favour of giving vouchers to poor families who can’t afford health or education.

Remarks

If the polls are correct we should expect Bolsonaro and Haddad to win the first round with around 35% and 25% of votes respectively. In the second round the electorate of the excluded candidates will have to decide to whom cast their vote and this is where things can get interesting. According to Datafolha, Bolsonaro and Haddad are quite controversial in that 45% and 40% of the respondents stated that they would never vote for the candidate, respectively. In a possible runoff election, the electorate of Gomes would probably converge to Haddad, but it is unclear the direction of Ms. Silva and Mr. Alckmin voters. The former, as champion of environment and a representative of poorer classes, but also a moderate supporter of liberalization, might yield more votes to Mr. Haddad than to Bolsonaro. The latter is the most moderate candidate, backed by Centrão, an advocate of free-trade and has always tried to look at responsible voters, business and international communities. He is the first preference of investors. From an economic point of view, his voters should throw their support behind Bolsonaro, to avoid the nationalist policies of the PT. However, moderate centrist voters are usually reluctant to vote for a divisive candidate, such as Bolsonaro. This is why polls have been constantly changing the potential winner of the run-off while having a clear front runner in the first round. The first round will therefore be important to understand which parties will overperform the polls.

While overall turnout will not be indicative of the final result, the regional figures might return an important indicator. The poorer Northern regions are traditionally attached to the leftist governments, as they see Lula as the president who elevated their living standards and will yield great turnouts in favour of Haddad and Gomes. Bolsonaro’s natural vote basins are the Southern and Central regions, where the bad economic policies that Lula and Rousseff pursued after the commodities’ price fell caused the greatest pains and where high taxation further increased dissatisfaction.

Haddad could win if the electorate decides to converge to a less controversial candidate, somewhat similar to what happened in the last French elections, but he carries the heavy weight of his party’s past malfeasances and the Petrobras scandal. Bolsonaro holds little political experience but has the outsider appeal and holds a strong lead in the polls.

Major betting exchanges are somewhat in line with polls, expecting Bolsonaro winning the presidency and giving him odds of around 1.40:1 while Haddad is seen as less likely to win, with odds of around 3:1. Gomes and Alckmin are much less expected to win, with odds around 40:1 and 70:1 respectively.

One key consideration is that whoever the winner is, he will not have the majority in the Parliament. 2/3 of the Senate is up for renewal in 2018 and the current composition, mixed with polls, suggests that either front-runner candidates will have difficulties in forming coalitions, with resulting problems with the implementation of their programmes. Bolsonaro’s party (PSL), in particular, is expected to account for less than 10% of total seats. It would be therefore crucial for candidates to create a coalition which includes the traditional big-tent parties of Centrão, thus making it more difficult to overturn the system that the Centrão itself represents.

Finally, over the past years, examples such as Brexit referendum and Trump’s election have made us a bit wary of trusting too much polls, which can easily miss deep-rooted social dynamics and consequential rare events. In this highly debated election, one of the most critical for Brazil, anything could happen. Just as an example, Alckmin might be able to repeat his 2006 feat where, contrary to all major polls, he placed second in the general elections, albeit losing to Lula in the runoff.

Source: BNP Paribas

Source: Datafolha

Sources: Datafolha, IBOPE and XP

Main Electoral Topics

- Privatizations

One of the most polarising themes is the that of privatization. The leading candidate Bolsonaro is the most in favour of privatization. His leading advisor, Paulo Guedes, has openly praised more pro-market policies. In an interview in May, he commented the status of public companies saying that the government should “sell them all” as soon as possible, as “privatising cautiously, bashfully, just won’t do”. In his view, such an abrupt move would make Brazil earn around BRL 800 billion, which should contribute to buy back public debt and reduce the debt/GDP by roughly 20%, thus liberating money for social reforms. Nevertheless, many commentators are doubtful about the renewed commitment to liberal policies by Bolsonaro. Since his appearance in the Brazil Parliament, he has often been in-line with the nationalist state-driven economic agenda put in place by several past governments.

On the opposite side we find Fernando Haddad, who is in line with the traditional left-wing approach. The PT’s chief advisor supports a wider use of concessions as a tool to increase government inflows but is against opening the private sector to public investments.

Ciro Gomes, on the contrary, takes a more decisive position. He is not against privatisation in principle but opposes absolutely the sale of companies in key sectors like energy, therefore keeping Petrobras and Electrobras public. It is worth noting that, for the latter, the privatisation process is already under way, as former president Temer successfully initiated the sale of Centrais Eletricas Brasileiras SA (Latin America’s biggest utility company). More importantly, Ciro Gomes warned investors to avoid buying state assets in the energy sector because he would expropriate them, with a particular focus on oil fields.

Geraldo Alckmin takes a moderate stance towards privatization which is in line also with the Temer’s administration. He is in favour of a gradual privatization of most of the state-owned companies but stepped back from the initial claim about the sale of a controlling stake of Petrobras, as it is the most sensitive case. Similarly, he dislikes the idea of selling controlling stakes in financial institutions like Banco do Brasil and Caixa Economica Federal.

Marina Silva has not expressed a particular view on privatizations so far. While she stated that she is not against privatizations in principle, she assured that she would not proceed with the sales of Petrobras and financial institutions. Interestingly, her staff would not use the proceeds to sustain short-term fiscal deficit but to implement structural reforms and reduce the overall debt load.

- Pension Reforms

Bolsonaro was one of the politicians who voted for blowing the pension reform proposed by the Temer’s government. In any case, he acknowledges that at the current state the pension system would inevitably blow up in a matter of years and has proposed some corrections. He plans to create a system for the capitalization of social security, while providing indigent citizens a minimum pension.

Leftist candidate Ciro Gomes also draws attention on the poorest portion of the population, in particular in the rural areas, to which he believes the state should guarantee a minimum pension. On the contrary, in his proposed mixed system, the richest part of Brazilians should pay for their pensions in a self-sustaining way.

Ms. Silva is on the same line of Bolsonaro, on the idea that pensions should be capitalized, paying the cost of the transition with the proceeds of the privatization of public companies. As the system is currently unsustainable, this should be one of the most urgent matters of the next government.

Mr. Alckmin opposes the view that pensions should be capitalized at the current stage and instead is in favour of finding a way to reform pensions without worsening the budget deficit. He is, in fact, a supporter of Temer’s: he strongly supports a minimum retirement age and he pledged to diminish the difference between public and private pensions.

Finally, Mr. Haddad has denied that the pension reform is urgent, even if he pledged to fix the current imbalances. Nevertheless, he never really explained how we would deal with the current cost of today’s pension system.

- Fiscal Reforms

PT’s vision of fiscal and budget reforms is unique among the candidates. Indeed, the party is the only one which does not see the necessity to contain the budget deficit. Guilherme Mello, a chief economist of the party, stated that the PT plans to reinitiate plans of infrastructure expenditures and low-cost loans provision. He said that this plan would also entail trying to scrap the spending cap from the constitution. Mello’s point of view is that Brazil cannot afford a fiscal reform with GDP growth as low as 1%. Furthermore, in order to boost social spending, the party is considering imposing additional taxes on large financial flows, inheritance, profits and dividends.

Bolsonaro is in favour of a far more liberal fiscal reform. He intends to decentralize resources from the government to states and cities, and to adopt a more progressive tax system. Furthermore, his plan to use privatization inflows to buy back debt would help decreasing the tax level. He is generally against new taxes to improve the budget deficit and would rather cut social expenditures, pensions, health care and public sector payrolls, which account for about two thirds of total expenditures.

Mr. Gomes backs a fiscal reform with a clear left-wing footage. He supports the idea of shifting the tax burden from basic goods to other areas that include inheritance and wealth, in order to try to diminish inequalities. He believes that it is urgent to fix the deficit issue as the Real is currently facing too much volatility for Brazil’s economy to restart growing. He also supports cuts to corporate income taxes consequent to public expenditure cuts.

Mr. Alckmin has widely criticized the management of public companies by the government, pointing out overstaffing and corruption as two major issues. He is a supporter of the creation of a value-added tax and favours the elimination of some sector-specific tax exemptions, while he would ease intermediation taxes. Furthermore, he would try to cut the cost of doing business in Brazil by implementing measures that boost competitiveness and increase confidence to attract foreign direct investments that would help easing the budget deficit.

Ms. Silva plans to cut social security benefits without increasing the effective tax rate. Nevertheless, she is in favour of cutting indirect taxation affecting the low-income portion of the population, and increase the tax burden on the higher class. She backs a simpler and more transparent tax system with more autonomy for states. She believes that privatizations should not compromise the ability of the state to provide basic services.

Trade Strategies

- Brazilian Real and US dollar

The elections will play a large role in the decisions of foreign investors. The unpredictability of Bolsonaro is somewhat neutralized by the influence that Guedes might exert on economics matters. If Guedes gets his way on the much needed privatizations and pension reforms, capital will likely flow back to the country with a consequent decrease in the risk premium. On the other hand, the populist approach of Bolsonaro might clash with the economic reformism of Guedes, which could harm particularly the Armed Forces, and ex-comrades of Bolsonaro, who benefit from generous pension benefits. If such a clash were to happen, it’s not too unlikely that Guedes might quit, thus leaving Bolsonaro’s economic populism unchecked, with possible dire consequences for the country’s finances.

On the other hand, a win for Haddad will probably cause a sell-off of Brazilian securities and consequent depreciation of the Real. Many investors blame the PT policies for the recession and Haddad’s declarations on public spending are likely to push investors even further away. Indeed, the iBovespa rallied in the past weeks as Bolsonaro rose in the polls: should he lose to Haddad these gains would probably be wiped out by expectations of future deficits and increase in government debt. For the reasons expressed above we do not feel comfortable proposing a directional strategy on the Real. Instead, we believe that going long on volatility BRLUSD would be a better strategy. Indeed, in case of a Bolsonaro-Haddad runoff, a too-close-to-call second round and inflamed declarations during the period leading to the final election will likely put stress on the markets. As stated above, in case of a win for Haddad, investors will probably sell off Brazilian securities and continue the depreciation of the Real which has been going on in the past years. In the other scenario, Bolsonaro seizing the presidency, the Real will likely experience a short-term rally which however could be put at risk in the medium term, depending on Bolsonaro’s approach and whether he can actually manage to secure enough support in the parliament to get through the reforms – and whether he actually intends to implement them at all. Therefore, a simple strategy would be to build a straddle on BRLUSD to profit from the increased volatility in near future. This would entail buying a put and a call with the same strike (ATM) on BRLUSD. The time horizon should be around 2-3 months. Indeed, by then, the government should have already drafted a plan with a coalition and will likely have given a direction on how they will set the economic agenda. CME does list BRLUSD options with maturity up to Jan 2019 but volumes are quite low so one would probably have to negotiate them OTC.

Source: Thomson Reuters

- Banco do Brasil

A second trade idea, which might suit best contrarian investors, concerns Banco do Brasil (BB) in case of Bolsonaro presidency. The stock has shown to move in line with polls, as the privatization plan proposed by Bolsonaro would boost the profitability of the bank and efficiency, moving away from the low-interest rates policies that the leftist governments have used in the last years to boost growth, which led to a NPL rate of 27.2% in 2016, with a partial recovery to 23.4% in 2017, and very low profitability. There is no wonder, therefore, that a privatization could boost the largest Latin American bank. The market seems to be starting to price in the possibility of a Bolsonaro president, with a BB rally of 26.7% over the past week thanks to the boost that Bolsonaro had in latest polls. Hence, it is likely for the stock to get a further boost in case that Bolsonaro actually becomes president. We expect BB’s stock to get a boost of over 10-15% based on last week’s performance and depending on the BRL’s appreciation. This would be due to the fact that, at the moment, the market should be pricing Bolsonaro’s victory in the run-off at around 50%. Nevertheless, in our opinion such rally would be short-lived. While BB would benefit from the stabilization of the BRL and the debt repurchases promised by Bolsonaro’s economic advisor, the likelihood of its privatization, even in case of Bolsonaro’s victory, is extremely low. It is essential to point out that the privatization would have to pass through the Congress, in which Bolsonaro’s coalition will play a minor role in any scenario. When he will need to form a coalition with other parties, he will have to make concessions and to scrap parts of his economic reforms. When it comes to privatization, all parties but PT are favorable to partial privatization of public companies to fund budget deficit. However, no candidate but Bolsonaro is in favor of BB’s privatization. In our view, it is likely that he will scrap BB’s privatization in exchange for other privatization decrees to pass the Congress vote. This should have clear negative implications for BB’s stock price. Moreover, if a Congress majority struggles to form, as it would be in the case of Bolsonaro’s victory, the political uncertainty might impact negatively BB’s stock price, as the market realizes that economic growth and privatizations might be difficult to attain even under a Bolsonaro presidency. This is the rationale behind initiating a bear spread strategy in case of victory of Bolsonaro at the run-off, with BB’s stock price appreciating, in our view, by more than 15% and overstating the probability of privatization. Such a strategy would involve being long a put with a strike price K0 = price of stock after Bolsonaro’s victory (around +15% over current price of BRL 35.74) and shorting a put option with a strike price K1 = 0.9*(K0) betting on a decrease in stock price of around 10% with a time horizon of 3-4 months, i.e. the time for the market to price the uncertain majority in Congress and the low likelihood of BB’s privatization.

Source: Thomson Reuters

0 Comments