Introduction

Telecom Italia (TIM) [BIT: TIT], known for its excellence in telecommunications, is currently facing a challenging financial situation. With a staggering €27.5bn in net debt and a net debt ratio of 4.4x, TIM’s financial difficulties are substantial. Starting from October 2022, S&P downgraded TIM’s debt rating, a decision driven by the company’s declining revenue and profits, further worsened by the company’s interest payments that have escalated to €1.3bn in the last nine months.

In this context, the proposed acquisition by KKR, a global PE firm, appears not just timely, but essential. The influx of cash from this deal is expected to play a pivotal role in repaying TIM’s debts and reducing its financial burden. However, there are many challenges along the way to the deal’s completion. Firstly, TIM’s top investor Vivendi [EPA: VIV] has expressed strong opposition to the deal because of TIM’s decision to bypass a shareholder vote, leading to a potential contest in court. Furthermore, another aspect to consider in this intricate scenario is the position of the Italian Government which has recognized the strategic interest of the fixed network business, leading to the decision to acquire a 20% stake in the new NetCo that will emerge post-acquisition.

TIM – Company Description

TIM Group, formally known as TIM S.p.A., is a leading telecommunications company based in Italy. Established on July 27 1994, following the merger of several state-owned telecom entities, TIM has grown into Italy’s largest telecommunications provider in terms of revenue and subscribers. The company’s broad range of services includes fixed and mobile telephony, broadband Internet, digital television, and IT services. Despite facing significant financial challenges as aforementioned, TIM has maintained a strong presence in the global telecom market, expanding its operations beyond Italy, notably in Brazil through its subsidiary TIM Brasil. The Company is committed to corporate social responsibility and actively participates in sustainability initiatives while being a member of several corporate social responsibility-focused indexes. As of 2022, TIM reported a revenue of €15.8bn, with total assets amounting to €62.0bn, and employed over 51,000 people.

TIM Group’s journey to accumulating €27.5bn in net debt is a complex narrative marked by strategic financial decisions and market dynamics. A significant portion of this debt, approximately $18.7bn, is attributed to bonds, with the majority issued between 2001 and 2005. This period was crucial for the telecom industry, characterized by rapid technological advancements and increased competition. The issuance of these bonds suggests a strategic move by TIM to secure capital for expansive projects, such as upgrading infrastructure, expanding into new markets, or investing in emerging technologies. This approach was not uncommon in the telecom sector during the early 2000s, as companies sought to capitalize on the growing demand for internet and mobile services. However, the market dynamics changed rapidly, and many telecom companies found themselves with high levels of debt as the market became saturated and growth slowed. This period was a defining one for the telecom industry, setting the stage for the challenges and strategies of companies like TIM Group in the subsequent years.

Notably, understanding TIM’s business model is crucial. TIM Group’s business model, divided into ServiceCo and NetworkCo, strategically segments its operations to enhance efficiency and focus. ServiceCo, the customer-centric division, handles the delivery of diverse telecommunications services including mobile and fixed telephony, broadband Internet, digital television, and IT services. This segment is dedicated to customer acquisition, retention, and satisfaction, adapting to market trends and technological advancements. On the other hand, NetworkCo manages the essential infrastructure that supports these services. It oversees network infrastructure, technological upgrades, compliance with standards, and investments in new technologies and expansions. This strategic separation facilitates not only a more efficient resource allocation but also provides clarity in corporate structuring and potential partnerships, particularly in infrastructure development and management.

Deal Rationale & Structure

The deal between KKR and TIM Group, first considered by TIM’s management in 2013, represents a strategic alignment of interests and objectives. The rationale behind this deal is rooted in the complementary strengths and opportunities that each party brings to the table. For TIM, partnering with a global investment firm like KKR could provide the necessary capital infusion and expertise to accelerate its growth strategies, particularly in areas like digital infrastructure and technology innovation. This partnership could also offer TIM the financial flexibility to manage its substantial debt, while potentially unlocking value in its assets and operations.

From KKR’s perspective, investing in TIM presents an opportunity to capitalize on the growing demand for telecommunications services, particularly in a key European market. TIM’s extensive infrastructure, customer base, and brand presence make it an attractive investment. Additionally, the telecom sector’s resilience and steady cash flows can be appealing for an investment firm looking for stable returns.

Notably, the Board of Directors of Telecom Italia has approved the binding offer submitted by KKR to acquire TIM’s fixed networks business NetCo, including its FiberCop last-mile operations. However, the board rejected KKR’s non-binding offer for TIM’s international wholesale business Sparkle, but stated that it would consider a potential binding offer for Sparkle “at a higher value once the due diligence is completed, the deadline for which has been extended to 5 December.” Furthermore, KKR’s acquisition of NetCo presents a multifaceted transaction encompassing various financial and structural components. The target is valued at an enterprise value of €18.8bn, and €2.9bn paid in earnout. This arrangement is strategically designed to facilitate TIM in diminishing its debt by approximately €14bn. Significantly, the transaction involves TIM contributing a business unit into FiberCop, which KKR’s Optics BidCo will then acquire. The price will be subject to adjustments at closing based on predefined parameters such as cash and debt transferred, working capital level, cost of transferred employees, and fulfillment of certain investment and fiber network deployment targets. The closing of the deal is contingent upon several conditions, including Antitrust authorization and authorization regarding distorting foreign subsidies.

Market Overview

The fixed network assets for telecommunications are a very competitive market in Italy. The main four operators are TIM, Vodafone, Wind Tre and Fast Web, which control over 85% of the market share in Italy. Even though TIM is the largest operator among all, it still is a very competitive market, in which companies consistently try to undercut one another through promotions and other commercial activities. Following the TIM transaction, it becomes the first telecom group in a major European country to carve out and sell its landline grid.

Most fixed network companies don’t own the towers they use, but instead contract from other companies. Prior to 2019, the tower market was more diversified and involved more actors. However, following the merger between Infrastrutture Wireless Italiane S.p.A (INWIT) [BIT: INW] and Vodafone Italy Towers, a large operator with over 24,000 sites was created. There are still some other competitors as Cellnex [BME: CLNX], WindTre or EI Towers, as well as some smaller ones, but no other group controls a grid of the size that INWIT has. Additionally, Vantage Towers, one of the leading European tower companies, possess a significant ownership in INWIT, further strengthening the brand name and providing expertise and clients. Hence, as a result of the market concentration, quality of service and strong brand name, most major operators in Italy are tenants of INWIT. This include TIM, which hasn’t owned towers before, and has been a long-time tenant of the company.

In February 2023, CK Hutchison Group Telecom signed a deal with EQT Infrastructure Partners to create a standalone business that will house Italian operator WindTre’s active network equipment and wholesale service units, with EQT taking a majority share (60%). As part of the deal, WindTre will commit to a long-term deal to use the assets being spun-off. Moreover, the deal came days after the 2022 financial year results were out, which showed the continued declined in revenues, as the company suffers from the intensive competitive nature of the Italian market.

KKR – Buying Up the Telecom Market

KKR is a leading global investment firm that offers alternative asset management, capital markets and insurance solutions. In 2008, KKR established its Global Infrastructure Business, which has grown to become one of the largest infrastructure investors globally. As of June 2022, the firm oversaw over $49bn in infrastructure assets across a broad range of geographies and subsectors. Nonetheless, across the different infrastructure asset types, KKR is particularly known for their significant investment in Telecom throughout the world. Aside from TIM, some of its most renowned investments in communication services include Vantage Towers, Telenor, FiberCop, Open Dutch Fiber, Hyperoptic, among others in the United States, Asia and Americas. Hence, it is safe to claim that KKR has a significant experience within telecom infrastructure investing.

In February 2023, KKR closed the transaction to acquire 30% of newly established Telenor Fiber AS, a Telenor subsidiary that owns passive fibre assets in Norway. This includes over 130,000 km of cables that connect upward to 560,000 homes in the country. Telenor Norge will be the subsidiary’s sole customer and all operational process will remain under Telenor control, guaranteeing the quality of service the company is known for. The sale price represents an Enterprise Value for the Norwegian company of NOK $36.1b, resulting in proceeds of approximately NOK $10.8bn ($1bn) to Telenor following the sale. Moreover, as of 2021 the businesses generated a proforma EBITDA of NOK $1.7bn.

The transaction results in an inflow capital of capital to support the continued high fibre expansion in Norway. Moreover, following this transaction Telenor plans to use up to 30% of the proceeds for a share buyback program. Furthermore, in the event of a potential future sale, the deal includes a right for Telenor, or the Norwegian government, to acquire the now KKR-owned minority because of national and societal interest.

In 2022, KKR, along Global Infrastructure Partners and Vodafone, formed a Joint Venture to acquire Vantage Towers AG, a German telecommunication tower infrastructure company. The strategic partnership aims at supporting the ongoing investment program to improve Vantage Towers’ current infrastructure, as well as expand its network. The acquired company has a large footprint of more than 84,600 towers in ten European countries, as well as long-term rental agreements with high-quality tenants. Moreover, the company has consistently benefited from organic growth, growing margins and strong cash generation. Furthermore, the deal allows the company to have the financial strength to pursue their ambitious program to build new sites for their current clients (Build-to-suit business model) that allows them to meet their coverage and densification requirements. The deal had a valuation of €32 per share, representing a 19% premium to Vantage Towers 3 month volume-weighted average share price and a multiple of 26x EBITDAaL (Earnings Before Interest Taxes Depreciation and Amortization After Leases).

Between 2020 and 2021, KKR acquired 37.5% of FiberCop from TIM for a consideration of €1.8bn, based in an Enterprise Value of about €7.7bn and an Equity Value of €4.7bn. The company was created in 2021 as a result of an initiative between TIM, KKR and FastWeb with the aim of accelerating the development of the fibre infrastructure in Italy, further contributing to the digitalization of the country. They offer services to the operators of the telecommunications sector with Fiber-To-The-Home (FTTH) and Fiber-To-The-Cabinet (FTTC) fibre optic access services through which they connect houses and businesses. Moreover, the transaction makes a massive contribution to the reduction of the digital gap in Italy, speeding the switch of customers from copper to fibre.

Also, in 2021, KKR, along with Deutsche Telecom Capital Partners, an investment manager backed by Deutsche Telecom, entered into an agreement with T-Mobile Netherlands to launch a Joint Venture known as Open Dutch Partners. The company will deploy FTTH broadband in the Netherlands across both urban and rural areas, delivering a high-quality service. It aims to achieve a 1 million home customer base by 2025, as well as upgrade T-Mobile’s current network in the Netherlands. The latter will be the anchor tenant for Open Dutch Fiber with a 20-year agreement, allowing the company to have certainty regarding their user base and demand. In 2019 KKR acquired a majority stake (75%) in Hyperoptic Ltd, the UK’s largest residential gigabit broadband provider. By year-end 2023, Hyperoptic set the target for its fiber network to pass 2 million homes. Their fiber network reaches 57 towns and cities in Greater London, and they are focused mostly on high-density urban areas. Even though no financials were disclosed, reports claim Hyperoptic was valued at the time at around £500m. Before the previous listed investments, KKR had already spent over $3.5bn acquiring European telecom asset, that have been already sold, which include Deutsche Glasfaser, 40% of Telefonica’s tower company Telxius, and 49% of Altice’s French tower company SFR TowerCo. Moreover, KKR has also acquired digital infrastructure assets in Chile, India, Philippines, the United States, among others.

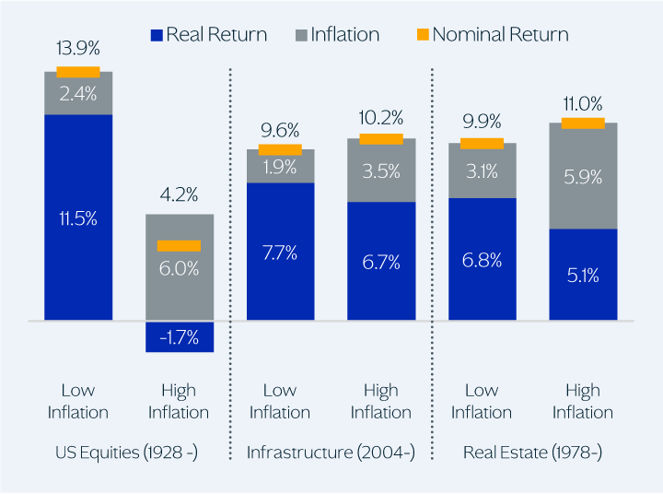

Overall, KKR has a broad experience in infrastructure, and more specifically in digital infrastructure. Real assets, as infrastructure, are an asset class that has received renewed focus because of its role as an inflation hedge, as rates have risen to the highest sustained level in over 30 years. Apart from the inflation protection that comes from investing in real assets, infrastructure has also performed very well in lower-inflation environments. Also, infrastructure investments often come along with contractual or regulatory protection on earnings, and long-term contracts, adding a significant degree of certainty to investors. Additionally, infrastructure is not only an inflation hedge, but can also serve as a macro hedge. For example, investment in infrastructure assets that retain value through economic cycles, including down markets, can be achieved by investing on assets with large market shares, industries with high barriers of entry, assets that are hard to replicate, and that provide stable or contracted cash flows. Moreover, infrastructure also acts as a hedge against market volatility. As contracts tend to be long term, even spanning for decades, with robust companies, as well as include contractual protection against inflation, they bring security to the investors. Furthermore, as infrastructure has a tangible underlying asset, it tends to retain value, or even appreciate during periods of high inflation. All of the above is particularly true for digital infrastructure as it is an asset type that has long-term contracts, has index-based adjustments, has extremely high barriers of entry, and is essential for any economy to operate.

Source: KKR

Moreover, another driver for KKR recent investments in towers is all the structural changes brought both by the COVID-19 crisis, as well as of the latest technological developments. On one hand, COVID-19 brought a greater demand for connectivity withing regions, as well as a demand for a better quality of service, as people began working from home, a tendency that has remained and is expected to grow. On the other hand the ongoing growth in demand in adjacent markets such as 5G networks, data centers, small cells, and the internet-of-things (IoT) contribute to the grow in demand for digital infrastructure, resulting in a good investment for KKR. Furthermore, it is possible for KKR to benefit from the synergies that may arise from all their different investments in Telecom in Europe. For example, Vantage Towers took significant shareholdings (33.2%) in INWIT in Italy. INWIT is Italy’s largest tower company with approximately 23,300 macro sites and presence in almost all the country. Also, as Italy is aiming on achieving national coverage by 2025, INWIT will continue expanding its network and strategic allies as Vantage Towers play a vital role in that. Moreover, its main customers are Gruppo TIM, Vodafone, WindTree and Iliad. Hence, now that KKR has acquired TIM’s network, they can possibly exercise some influence regarding price negotiations as KRR holds interest on different companies involved in the Telecom operations.

1 Comment

Beck · 31 March 2025 at 22:06

Honestly, not bad.