OVO Energy Limited – privately held

SSE PLC (LON: SSE) – market cap as of 20/09/2019: £12.62bn

Introduction

On September 13th, the energy suppliers SSE Energy Services and OVO Energy Limited reached an agreement whereby SSE agreed to sell its British retail business to OVO at an enterprise value of £500, consisting of £400m in cash and £100m in loan notes.

Despite its relatively small size, this deal marks an important moment for the UK energy industry and the energy industry at large. In a market shaken up by advances in technology, the vital need to decarbonise, the falling costs of sustainable energy and battery storage, and the revolution of data, the big six UK energy companies have been struggling and their dominance is on the wane. Instead, smaller energy companies have been consistently undercutting the biggest energy providers thanks to lower-cost bases and have managed to eat up a significant share of the market. During the past three years, OVO has been taking advantage of new opportunities in this changing market and the deal with SSE is yet another step in its long path of heavily investing in scalable operating platforms, smart data capabilities and home services.

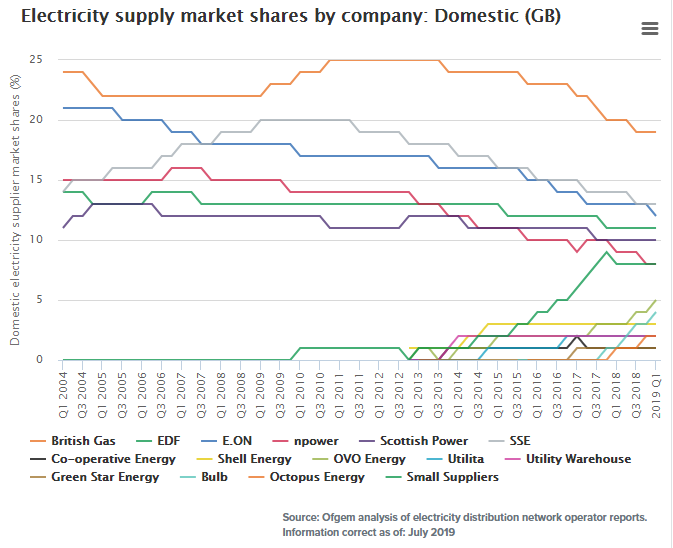

OVO is currently the seventh-largest supplier, with 4% of the market share. After the completion of the deal, OVO will be propelled into the top echelon with a 15% market share, only second to British Gas with 23%. The eventual completion of the deal is expected to be achieved by early 2020 or earlier and is subject to regulatory approvals.

About OVO Energy Limited

OVO Energy Limited is a GB-based independent energy supplier founded by Stephen Fitzpatrick in 2009. Through a special focus on customer service and the development of renewable energy technologies, the company has grown to become the UK’s largest independent energy supplier, now serving 1.5m household customers. OVO currently employs around 2,000 employees and achieved a revenue of £1bn in 2018. In 2019, it was ranked 1st in six categories including Best Customer Satisfaction by uSwtich.

In November 2018, as one of its largest competitors, Spark Energy, announced it was ceasing to be a supplier, OVO acquired Spark’s operating company and maintained the brand. A couple of months later, in February 2019, Mitsubishi Corporation acquired a 20% stake in OVO, valuing the company at £1bn. This significant strategic investment has allowed OVO to invest even further in the technology required to achieve its ultimate goal of transitioning to a zero-carbon future as well as to provide sufficient equity to continue its acquisition-based growth.

During last year, OVO continued its steady growth, increasing its UK customer base by 50% and opening operations in continental Europe, namely in France and Spain. Additionally, OVO has revealed its plans to open in Australia, Germany and Italy next year.

About SSE Energy Services

SSE Energy Services is the third-largest supplier in the GB energy market and supplies energy and related services to around 5.7m household customers across Great Britain. SSE is regarded as one of the “Big Six” companies which dominate the UK’s energy market. Headquartered in Perth, Scotland, SSE provides a large variety of services ranging from electricity and gas to telephone and including broadband, metering, boiler installation and maintenance services. SSE Energy Services’ bulk of operating profit comes mainly from regulated electricity networks and renewable sources of energy, and it is these businesses that are at the core of the Group’s low-carbon strategy.

SSE Energy Services achieved a far higher revenue than its acquirer with £6.3bn in 2018, and during the last 12 months, SSE Energy Services made an adjusted operating profit of £89.6m, with reported pre-tax profit at £35.3m. It employs around 8,000 people across several locations in GB with a net asset value of £764m.

The deal comes as a relief for SSE, which had been desperately trying to spin-off its retail business after the failure of a previous agreement to merge it with the German-owned Npower to then spin-off the combined company.

Industry Overview

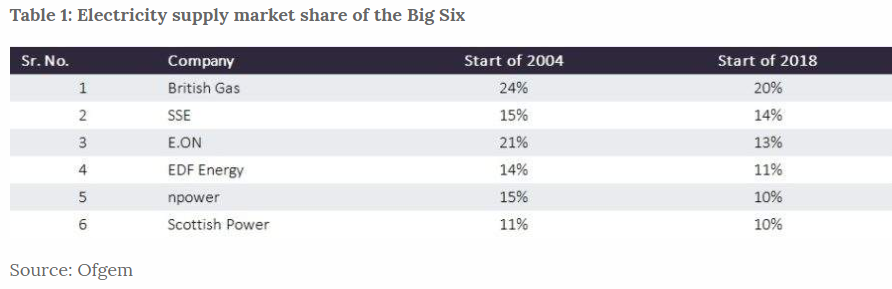

The UK electricity market is now witnessing fundamental changes, slowly shifting from a traditional model to an almost-perfect competition market. Six energy suppliers have monopolised the UK energy market since the gas and electricity networks were privatised in the 1990s, but over 60 smaller rivals have recently emerged as effective competition. In fact, between Q2 2011 and Q1 2019 the combined electricity market share of the six largest suppliers dropped from nearly 100% to 73%. This was the goal of an “action plan” launched by the Office of Gas and Electricity Markets (Ofgem). The regulator was trying to reduce barriers to growth for so-called challenger companies to tackle the dominance of the Big Six and offer consumers a broader spectrum of choices. According to Ofgem, in 2017 5.1m electricity consumers switched suppliers, the highest number in almost a decade, and more than a third of the customers switched from the Big Six to a challenger firm. Such a shift has been quick, and it started from residential consumers, followed by commercial consumers, seeking fairer tariffs.

Fierce competition will surely dent the big utilities but could also lead to the disappearance of small players, who need structural and reliable supply prices hedging. Otherwise, by directly accessing energy supplies on the spot market, they would meet lower flexibility to pass on marginal costs to customers. This explains recent player failures, namely Iresa and Future Energy in 2018, and GB Energy in 2016. At the same time, questions arise regarding the sustainability of some of the minnows owning market shares of less than 1%.

Small players have also leveraged a lack of satisfaction and poor customer care provided by Big Six to their households. Besides that, they have created unique selling points by providing prepaid energy or 100% renewable energy services. Adding a further point, they rely more and more on distribution networks as smaller-scale power plants become more common, bypassing the transmission network. E.g. OVO has pledged to achieve net-zero carbon emissions in its operations and eliminate all its customers’ household emissions by 2030.

Government has intervened through mandated price-caps, mainly targeted to challenge the Big Six’s tariff policy. Energy suppliers will not be able to charge higher than £1,136 per year for a typical dual fuel customer paying by direct debit. The move will allow 11m households to save on average £75, also eroding energy suppliers’ operating margins. Many energy companies admit they can no longer rely solely on electricity and gas supply, hence they have been providing new services, for example helping electric vehicle owners easy-charge when there is a surplus of renewable electricity.

Deal Structure

On the 13th of September OVO bought the household business of SSE at an enterprise value of £500m. £400m will be paid in cash, although £59m will be deducted to cover future payments associated with a UK back-up power scheme. While the rest of price, £100m, will be covered through the issuance of a loan note to SSE that will be due for repayment in 2029 and that will carry an annual interest rate of 13.29%.

It is worth mentioning that on the 14th of February OVO sold a 20% stake to Mitsubishi Corporation at a valuation of about £1bn thus raising £216m in cash.

Deal Rationale

After the collapse of a previous deal to merge its retailing business with the German-owned Npower, SSE found a second potential counterparty in OVO.

According to Alistair Phillips-Davies, CEO of SSE, the acquisition allows for further improvement in customers, employees and other stakeholders focus and an overall better competitive position in the industry in terms of technological investments that OVO plans to carry out.

The last years saw SSE’s growth in its renewable energy pipeline and electricity networks designed to deliver energy services with the minimum emission of carbon. The deal creates a good environment for SSE to further develop its low-carbon infrastructure and create value from a more and more electrified economy with low emissions.

OVO, on the other hand, has continuously invested in technology, getting ready for a shakeup in the industry as renewable energy costs are decreasing, pressure for lower carbon emissions are rising, battery storage capacities are increasing and the industry is shifting towards a heavy reliance on data and data analysis to ultimately improve customer service.

Considering the negative last few years characterized by lower profits for the biggest British energy suppliers, due to lower prices, an explosion of smaller competitors ready to steal market share and a government price cap for 11m households, Mr Fitzpatrick, CEO of OVO believes in the possibility of a better opportunity to navigate this changing industry after the official closure of the deal.

Market Reaction

SSE’s share price was up by 1.7% on Friday, the 13th of September, reflecting the premium paid on the acquisition price. Its share price has continued going up during the following week, which shows the confidence that the market has on the resulting competitive position of the firm after the acquisition.

No information on share prices is available for OVO, as the company is privately held.

Financial Advisors

Barclays and Greentech Capital Advisors acted as Financial Advisors to OVO. On the other part of the deal, Credit Suisse and Morgan Stanley acted as joint Financial Advisors and Corporate Brokers to SSE. Legal advisors for both parties were not disclosed.

0 Comments