Introduction

Formally, a Commodity Trading Advisor (CTA) is defined as an individual or firm registered with the Commodity Futures Trading Commission (CFTC) which gives “advice” on futures, options, and the actual trading of managed futures. CTAs are responsible for advising managed accounts and pooled investment vehicles, such as commodity pools. Commodity pools enable investors to diversify beyond traditional investments and gain exposure to managed futures that are historically non-correlated to the broader stock market. One of the primary distinguishing factors of CTAs is the products in which they trade. They trade almost exclusively in highly liquid, regulated, exchange-traded instruments found on options and futures exchanges or in deep over-the-counter currency markets. This means that CTAs primarily operate in a regulated domain, allowing higher security for investors. CTAs trade a variety of different products, ranging from commodities, interest rates, currencies, equity index futures, and other products such as housing prices and weather. The main diversifier of managed futures is the expanse of markets across which they trade, with many participants trading in more than 100 markets. Furthermore, because future prices are settled daily and the CTAs’ holdings are market-to-market, it allows CTAs to report their fund’s value to investors daily. Many CTAs offer immediate, or nearly immediate, redemption features to clients because their futures positions allow them to quickly reverse positions.

History and evolution of CTAs

The rapid expansion of the industry over the past two decades has likely been caused by the explosion in the number of exchanges and contracts where the CTA funds can participate. It took nearly 20 years from the inception of tracking managed futures industry assets in 1980 for AUM to surpass the $40bn mark, but in the last two decades, the growth has accelerated dramatically. According to FIA, from a notional $2.2tn at the end of 1998, the global turnover of futures and options had increased by 2010 to more than $22tn. This has provided CTA managers a clear road for growing their portfolios. According to BarclayHedge, AUM in the liquid CTA industry reached highs of $317.7bn by the end of 2011, now in Q4 of 2022, AUM are $404.9 billion.

Another factor driving the positive trend of AUM has been the growing interest of institutional investors, who suffered heavy losses in the global financial crisis of 2008. There are mainly three reasons why the global financial crisis made institutional investors more aware of CTAs. Firstly, it was their ability to show the low correlation in regards to the broader market; MSCI Global Equity Index was down 40.3% in 2008, the S&P 500 was down 37% and by contrast the HFRI Systematic Diversified Index (tracking many of the systematic CTA traders) was up 17.2% and the BarclayHedge Discretionary traders index was up 12.2%. For many institutional investors, having exposure to liquid CTA strategies was viewed as a necessary diversification option for their portfolios. Furthermore, beyond offering greater returns in the financial crisis, liquid CTA managers provided liquidity; in periods where investors were desperate to generate cash, CTAs were seen as an important source of capital especially for investors directly having exposure to hedge funds and funds of funds (which even imposed restrictions that prevented investors to withdraw assets). Lastly, CTAs in contrast to hedge funds provided transparency in their portfolio holdings.

For much of its early history, the CTA space was evenly divided between discretionary and systematic trading approaches. This balance however has shifted dramatically in favor of systematic trading strategies due to advances in technology which made it possible to develop complex models that can screen markets dynamically and identify opportunities across a whole array of markets and time horizons. Discretionary traders use their understanding of demand and supply, events, and news to develop their trading approach while systematic traders measure certain mathematical relationships within a market and build systems with rules for establishing, adding to, reducing, or exiting positions. According to BarclayHedge, in 1999 discretionary traders held 45% of AUM while systematic trading accounted for 55% of AUM. Now out of the total $404.9 billion of AUM of managed futures (Q42022), systematic trading holds 362.4 billion USD while discretionary systems account for about $29.8 billion USD.

Trend following

In this article, we are mostly going to focus on trend-following strategies, the most widespread strategy used by CTAs. The time-series momentum refers to the trading strategy that results from the aggregation of various univariate momentum strategies on a volatility-adjusted basis. Trend-following investments involve going long markets that have been rising and going short markets that have been falling, betting that the trend continues. Two potential trading signals are the return sign and time-trend t-statistic.

Return Sign (SIGN): The standard measure of past performance in the momentum is the sign of the past 12-month return. A positive (negative) past return dictates a long (short) position:

Time-trend t-statistic (TREND): Another way to capture the trend of a price series is by fitting a linear trend on the past 12-month daily futures price series using least-squares. The momentum signal can then be determined based on the significance of the slope coefficient of the fit. Assume the linear regression model:

The significance of the time-trend is determined by the t-statistic of β, t (β), and the cutoff points for the long/short position of the trading signal are chosen to be +2/-2 respectively:

Trend following strategies perform well only if prices trend more often than not. A large body of research suggests that trends exist mostly because of long-standing behavioral biases exhibited by investors such as herding and anchoring. Another essential factor in trend formations is the participation of nonprofit-seeking participants such as the central bank and hedging programs. Taking a closer look over trend-following strategies in CTAs, the performance has been surprisingly consistent over an extensive time period. The strategy has proved resilient even during multiple recessions, the Great Depression, the global financial crisis, and periods of rising and falling interest rates. Figure 1 shows the average CTA Equal Weighted Index returns on an annual basis compared to those of the US equity market. As one can see, the correlation to the US market is relatively low, proving solutions for investors who seek diversification. The consistency of trend following strategies can also be seen by the risk-adjusted returns (as measured by the Sharpe ratio). We see that the strategy has delivered positive average returns in each decade, with an average Sharpe ratio of approximately 0.76, higher than the historical average S&P500 Sharpe ratio of 0.40.

Source: Institutional Investors Journals

This strategy has shown a low correlation to US stocks, giving investors a way to diversify their portfolios. Furthermore, this strategy has performed exceptionally well on the extreme parts of the spectrum. As seen in the figure below, CTAs have done particularly well in extreme down- and up- years for the stock market, the second-order polynomial shows exactly this.

Source: Institutional Investors Journals

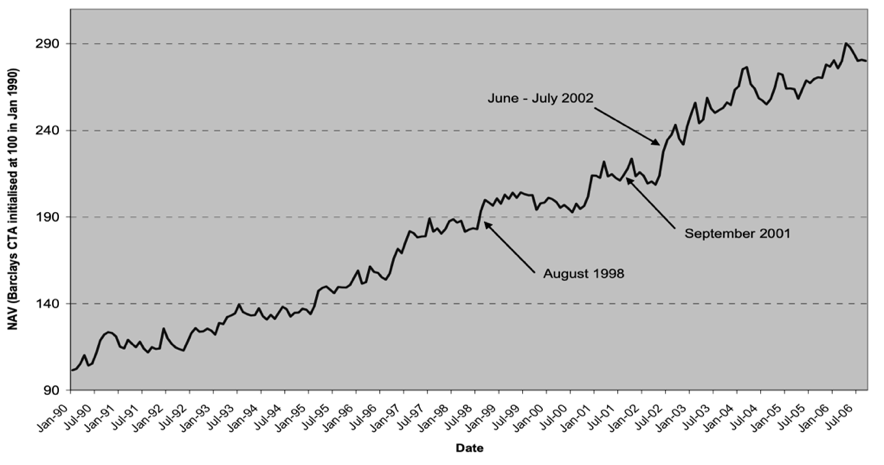

However, trend following strategies have performed better during bear markets because typically bear markets occur gradually, during a couple of months, giving trend followers an opportunity to position themselves short after the initial decline. In fact, the average peak-to-trough drawdown of a typical 60-40 portfolio between 1880 and 2016 was approximately 15 months. The figure below shows the evolution of the Barclays CTA index from January 1990 to September 2006. The index returned 5.92%, 1.79% and 9.56% respectively in August 1998 (the Russian default crisis and LTCM), September 2001 (9/11) and June–July 2002 (the collapse of Enron and others).

Source: Conquest Capital Group LLC

However, during the Covid crash, which occurred very rapidly and didn’t give CTAs time to adjust their portfolio; the BTOP50 index posted a loss of 1.32% in February and 1.07% in March. It outperformed the broader market, but it was not giving the returns one would expect during a bear market.

Next, it is very interesting to examine the difference in performance during the ten largest drawdowns of a typical 60/40 portfolio. As the chart below indicates, a trend-following strategy experienced significant positive returns, and only in two out of ten drawdowns did the trend-following strategy experience negative returns. This demonstrates how trend-following strategies, especially during crises, tend to offer diversification solutions for institutional investors. In the paper “A Century of Evidence on Trend-Following Investing” by Hurst et al., a simulation was conducted, allocating 20% of the capital from a 60/40 portfolio to a trend-following strategy. They noticed how the allocation reduced the maximum portfolio drawdown (from 62.3% to 50.2%), lowered portfolio volatility (from 10.7% to 8.7% annualized volatility), and increased both portfolio returns (from 4.1% to 4.8%) and the reward-to-volatility (from 0.39 to 0.55 Sharpe ratio).

Source: Institutional Investor Journal

Trend Following and Volatility

In the figure below, it can be seen that the average SPX returns tend to decline as the VIX moves up. Here, the average SPX return for all changes in the VIX are shown when they are larger than a given percentile.

Source: Conquest Capital Group LLC

Looking at Fung and Hsieh’s paper (2001), the idea is that a perfectly timing investor who can go long or short and trade dynamically has a return profile resembling a lookback straddle. A lookback straddle is a type of exotic option. It gives the holder the right to receive a payoff equal to the difference between the highest and lowest levels an underlying achieved during the life of the option. While trend followers are not perfect market timers, they estimate the returns generated by a rolling lookback straddle position in five broad categories (short rates, bonds, commodities, equity indexes, and currencies), then perform a multifactor regression against an equally weighted index of more than 400 funds. As it turns out, their regression gives significant results, with an R-squared close to 50% over a 10-year horizon.

It is tempting to conclude from Fung and Hsieh that trend followers are very likely to profit from rising volatility. A dynamically traded position in each market is qualitatively and to some degree statistically like a long straddle in the market, and the buyer of a straddle is long volatility. However, an interesting study from Dobrovolsky and Malek (2006) provides an argument against this widely held idea. They made the following intuitive points.

• Managers tend to increase long or short exposure as a trend builds, which corresponds to a long gamma position but does not have a direct connection to vega.

• As market returns become increasingly choppy, realized volatility can go up without the formation of a trend; this can be the worst scenario for a trend follower as many false signals are generated.

• Movements in the VIX are not necessarily connected with implied volatility changes in other markets, such as commodities.

Their empirical results were based on returns for the Conquest Managed Futures Select (MFS) fund, a fund designed to replicate the returns of most trend-following indices with complete transparency and minimal back fitting. Positions were initiated based on a simple n-day breakout system, according to specific trading rules. MFS applied these trading rules to roughly 50 markets over 20-time frequencies ranging from five to 200 days. The sector allocations to stock indexes, bonds, currencies, and commodities were then chosen to match roughly some of the larger managed futures funds in the industry. The returns of MFS have a high correlation to the major managed futures indices (>80% using simulated returns from 1990 to 2004 and realized returns till their publication). Thus, MFS appeared to be a statistically robust and intuitive proxy for trend followers. The advantage of using MFS over a peer group index was that breakout systems could be tested over different horizons against changes in volatility.

To summarize their conclusions, Dobrovolsky and Malek chose five representative markets and calculated the correlation between realized volatility and the performance of different breakout systems in each market. The correlation between the performance of different breakout systems and changes in realized volatility for a given market turns out to be fairly small. More generally, they find that the correlation between changes in the VIX and composite MFS returns is also quite low (roughly 25% from 1990 to 2006, using a daily time step). However, the correlation between VIX changes and MFS returns is highly dependent on move size. If either VIX changes or MFS returns are more than two standard deviations away from average, the correlation increases from under 10% to over 40% (based on several hundred daily realizations above two standard deviations). This suggests that the VIX–MFS correlation conditioned on large moves of the VIX may also be quite large. The analysis suggests that sharp moves in the VIX usually coincide with global market trends, while smaller changes may simply imply that equity markets have become choppier.

The figure below shows the performance over a 22-day trading horizon. While the top line gives the average 22-day MFS return of each breakout system, the bottom line shows the correlation of each system to large VIX changes. The average return rises rapidly, then is reasonably stable for all systems larger than 10 days. However, there is a mild decay as the breakout horizon goes beyond 85 days. This means that an investor’s conditional expected return given large changes in the VIX is not very sensitive to the breakout horizon, though short- to medium-term systems tend to give the best results. The correlation line shows much more sensitivity to the horizon. For breakout horizons beyond 50 days, there is a sustained decline in correlation, from 60% to 20%.

Source: Conquest Capital LLC

Trend Following and Recent Performance

Next, it is very interesting to examine how trend following has performed recently and whether we believe the trend is likely to continue. Trend-following indices, such as the SG Trend and Barclay BTOP50 have posted their best year-to-date results since 2000, caused by a very poor performance from traditional asset classes such as bonds and equities. This year’s market drop is characterized by the underperformance of a lot of of asset classes, causing decorrelation products to have higher demand as investors seek diversification.

In the below figure, it is possible to observe that the annualized real return during inflationary regimes is positive for each of the five trend strategies, covering the four asset classes plus the all-asset version. The last column also summarizes the hit rate, the proportion of inflationary periods with positive returns, and the t-statistic on inflationary periods having higher returns. For bonds and commodities, the real returns are positive during each of the individual inflationary regimes. This seems intuitive, as bonds and commodities have a very clear exposure to inflation (suffering and benefitting from rising inflation, respectively). Also, for the bonds-and-commodities trend, the performance in rising inflationary periods is much higher than during other periods. The all-asset class trend also performs relatively well during rising inflation periods.

Source: Man Group Database

In 2022, the BTOP50 index is posting exceptionally good returns compared to the major market indexes, there is some empirical evidence that especially in 2022, simple is best: pure trend strategies trading the largest futures markets have been the star performers. This year macro-events are driving the market, with the central’s bank activity, the Russian-Ukraine war, supply chain disruptions, inflation, and post-pandemic recovery. Therefore, all these macro trends are well captured in macro-sensitive instruments such as futures on global markets, government bonds, or commodities. In fact, there is the traditional fayre of CTA trend followers which has largely outperformed non-traditional trend-following strategies. The BTOP50 index is up 16.88% YTD, while a typical 60/40 portfolio is down 14.18%, outperforming the US market by 2%. This shows the strengths of trend-following strategies and how they can serve as portfolio diversification, providing better reward-to-volatility and overall returns.

Sources

[1] Hurst, Brian, Yao Hua Ooi, and Lasse Heje Pedersen. “A century of evidence on trend-following investing.” The Journal of Portfolio Management 44.1 (2017): 15-29.

[2] Fung, William, and David A. Hsieh. “The risk in hedge fund strategies: Theory and evidence from trend followers.” The review of financial studies 14.2 (2001): 313-341.

[3] Malek, Marc H., and Sergei Dobrovolsky. “Volatility Exposure of CTA Programs and Other Hedge Fund Strategies.” The Journal of Alternative Investments 11.4 (2009): 68-89.

0 Comments