There’s a Yiddish proverb fittingly saying: “interest on debts can grow without rain”. How can this be? In an ultra-low-rate environment, debt has become ubiquitous to sail through the COVID-19 pandemic and so has the fear related to its sustainability. Countries have taken the center stage in the debt management market, thus increasing the overall notional value of derivatives used as a hedge.

The aim of this article is to give an overview on how a country can manage its debt, and most specifically its foreign exposure. A certain number of OTC transactions become very useful at hand in this scenario, namely with cross-currency swaps derivatives. While we are not willing to dive deeper on the basics of these instruments, which have been explained at length here and there at BSIC, it is useful to give a government’s perspective and how these derivatives were creatively used in Italy and Greece before some accounting practices were rectified.

Public Debt Hedging 101

Let us briefly remember that a cross-currency swap has some core characteristics: transforming a funding position in one currency in one currency position in another currency. It is usually stipulated with an investment bank, and the notional is exchanged unlike many swaps. Since this effectively locks exchange rates for a period, not only it can be used to hedge FX risks but also to benefit from a favorable FX rate. Even though the two legs of the swap may vary considerably according to the contract, a government debt manager is reasonably expected to walk out of an investment bank building with a swap that:

- Is negotiated at current market exchange rates;

- Will let the country receive the fixed rate, while conversely giving a floating payment of LIBOR plus a spread;

- As they are transacted at spot exchange rates, cross-currency swaps of this type have zero present value at inception, although the net value – and credit exposure of either counterparty – may subsequently fluctuate.

While the world of finance is all about future expectation, it is all but a physical law. Arguably, these axioms were swiftly breached during the creation of the Euro, at the eve of this century.

Balance sheet cosmetics: a window-dressing guide

It would be difficult to dispute that the introduction of OTC contracts has brought on a great deal of innovation in the financial world. Before the 1980s, when swaps were not yet invented or used to a full scale, debt managers faced an enduring issue: most sovereign borrowers, to attract investors, issue a certain number of long-term bonds. On one side, in the primary auctions these bonds need to be offered in large amounts to ensure their liquidity in the secondary market, while on the other the debt managers are extending the duration of the overall debt in doing so. Cross-currency swaps, amazingly, solve both problems: with their effective use, a country can separate the funding decision from the portfolio decision. While we can’t avoid mentioning that we have introduced the swap counterparty risk in the meantime, it didn’t look like a headache for the governments which initiated an arm’s race just before the beginning of the euro.

As of 2001, the road ahead for the Eurozone countries and their debt could not be lusher. Spreads around the regions were converging swiftly around the German Bunds, thus lowering borrowing costs for the peripheral countries. Once a derivative to gain foreign currency debt exposure and further international investors, now cross-currency swaps were facing a turnaround and the liquidity of the European market was rapidly growing.

Beforehand, it is paramount to note that such a big player as the Finance Minister, making hedging trades in their local currency OTC market, could have caused large swings and, hence, be often perceived by other participants with a view which they didn’t have. The political support, meanwhile, was unanimous: long forgotten the Bank of England’s close collapse in 1992, Italy’s finance minister Carlo Azeglio Ciampi decided to get the country back to the currency fluctuation levels of the European Monetary System (EMS) in September 1996, sending a strong signal towards the monetary union.

So where does the gist lie? Intended to rein in fiscal profligacy among aspiring eurozone entrants, the Stability and Growth Pact (SGP) – established in 1996 – sets two important targets for member states: a debt/GDP ratio of less than 60% and a deficit/GDP ratio of less than 3%. Countries that showed persistent breaches of the 3% target were liable to pay fines to Brussels of up to 0.5% of GDP under the so-called Excessive Deficit Program (EDP). Performing the key regulatory role of determining whether the targets have been met is the European Statistical Office (Eurostat). Now comes the banal, yet fundamental issue at the time: how should derivatives transactions be accounted nationally to compute these figures? Interestingly, while in October 1997 the Inter-Secretariat Working Group on National Accounts (ISWGNA) – which comprises Eurostat, the IMF and the OECD – approved changes to the System of National Accounts that recorded income from swap arrangements as property income (SNA 1993), the Eurostat took an unprecedented twist with the subsequent regulation (ESA 1995). It was stated that upfront swap payments – which Eurostat classifies as interest – can reduce debt, without the corresponding negative market value of the swap increasing it. In the ESA95, there is a page-long clarification which only covers “currency swaps based on existing liabilities”: such OTC transactions could be omitted in the computation of a country’s deficit and debt before the swap came to maturity.

This rule was eventually rectified by the Eurostat agency in March 2008, with a 20-page note on financial derivatives that denied the previous window-dressing game. Indeed, between the hiatus of 2000-2008 some countries decided to enter into cross-currency swap agreements which did not fix the currency at current market rates: the LIBOR rate and the terms of deal took the shape of a “lump sum loan” which was to be repaid in the following years. It is no coincidence, in fact, that the Eurostat notice came out just after that the “Greek scandal” was made somewhat public. In the words of Gustavo Piga (2001):

“A more common type of off-market rate derivative transaction occurs when a debt office enters into a domestic IRS by receiving-fixed and paying-floating rates but asks that the fixed payment be lower than the swap market rate. This implies that the swap is not valued at zero, having instead a negative value for the sovereign borrower. To complete the deal, the debt office will either need a lower (in algebraic value) spread on its LIBOR-linked payments, or will ask to be compensated immediately with an up-front payment.

The two alternatives are very different. In the first case, the remaining value of the swap is amortized over the life of the swap as a greater gain for the treasury, which compensates more or less equally over the life of the transaction for the lower fixed rate received with respect to the market rate. In the second case, up-front payments, if not amortized, might constitute operations meant to avoid the accrual principle for the purpose of window-dressing.”

A new Trojan horse? The case of Greece

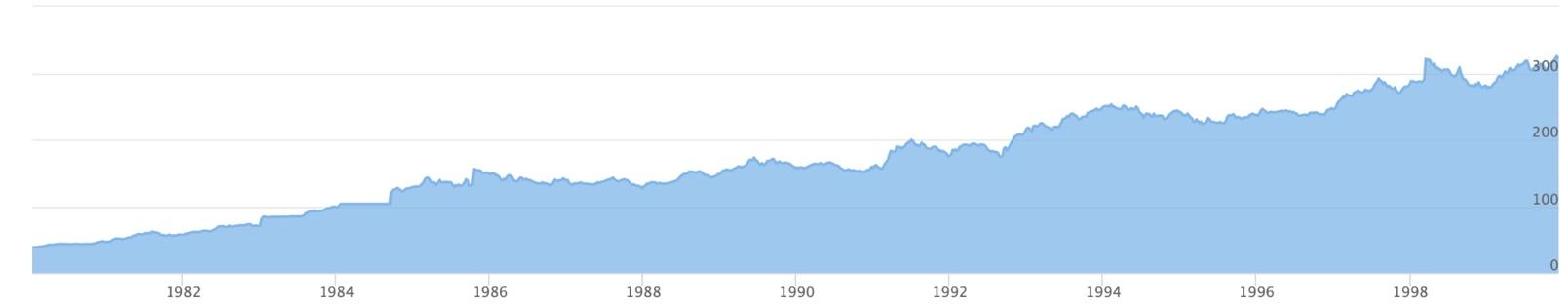

Greece has had a past of “debt addiction”, long before it joined the Eurozone. Since the 1980s and onwards, while still in the Drachma, Greece borrowed billions in foreign currencies, particularly in yen and dollars, effectively raising the Debt to GDP ratio from 23% to a staggering 103%, by 2001. The unsustainability of the country’s rising debt levels was being amplified by the fact that the exchange rate compared to most major currencies was consistently dropping throughout that time period. In effect, the debt kept rising in value pushing Greece further underwater on these foreign currency bonds.

Source: Eurostat

Source: Eurostat

Figures: Graphs of Greece debt to GDP ratio and divergence with Greece drachma exchange rate.

At the time, the country was about to enter the Eurozone and so they needed to comply with the terms of the Maastricht Treaty. Given that Greece was already well in excess of these limits, it was looking for a creative way to “window dress” its deficit on the balance sheet.

Their idea was to do a cross currency swap where these foreign currency bonds would switch denomination to euros. As mentioned earlier, this is a practice widely used by governments to hedge against currency risk. What made this particular swap unconventional was that the exchange rate employed for these swaps was different than the actual one at the time: even though the exact terms of the deal still remain unknown, the exchange rate offered and locked by the investment bank was one with a significantly weaker euro versus dollar and yen. The result of this questionable accounting game was that the country’s balance sheet is estimated to have shrunk by 2.8 billion euros, on paper, due to the notional mismatching.

Exhibit: Hypothesis of the Greece-Goldman Sachs cross-currency swap. More than one contract has reportedly taken place.

Greece wanted to remove some debt pressure off its balance sheet and show it was less leveraged than it was in order to make the transition into the Eurozone smoother. The OTC nature of the deal allowed the use of the derivative to effectively function as an illiquid loan to Greece by Goldman Sachs. This is so, since Greece was obliged to pay the amount erased from its balance sheet at a later date, with interest. It is significant to mention at this point that what made this financial accounting “window dressing” possible was the fact that Greece was not obliged to report the credit to Goldman Sachs, at all. It is estimated that the deal was structured in a way in which, even if Greece wanted to get out of the deal one day after it was signed, it would have to pay 600 million euros to the investment bank.

These transactions are regarded as questionable by many due to the fact that they significantly obscure economic reality. It should be highlighted, however, that this use of cross currency swaps by sovereign entities was legal until 2008, when it was outright outlawed. After the scandal broke out, in late 2009 and early 2010 did it become apparent that Greece’s true budget deficit was about 12% of its GDP.

Trimming the deficit? The case of Italy

Turning back the time for a few years and a few kilometers away from Greece, we found another similar agreement between Italy and Morgan Stanley in 1996. Some of these derivatives were subject to public scrutiny when the Italian appeals court (Corte di Cassazione) examined a series of OTC transactions between 1995 and 2005. More specifically, in 1995 Italy issued on the primary market a quantity of 3 year and 3 months yen-denominated bonds maturing in 1998 with a face value of ¥200 billion and a yearly coupon of 2.3%. These bonds were sold at par. It is very noteworthy to mention that the exchange rate, that day, was ITL 193.44 for ¥1. Subsequently, a few years later the exchange rate changed to 134.1 ITL/¥, therefore setting up a possible cross-currency swap to profit from the favorable situation and receive fixed. Pictured below is a possible solution given that the one-year yen swap market rate was trading at around 0.75% in 1996.

Somewhat surprisingly, Italy decided against this transaction and Morgan Stanley tailored a more structured product. The swap was entered in 1996 maturing in 1998 – precisely when the bonds had to be repaid – featuring the same notional and fixed leg aforementioned. On the other leg, however, the exchange rate was fixed at 193.44 ITL/¥ and, please note, the floating rate set to LIBOR -16.77%! Effectively, Italy was going to receive income on both legs of the swap until maturity, but at that date in the future it had to pay the bank a much bigger overall amount given the set exchange rate. The situation is pictured below.

Based on this kind of agreement, it is reasonable to assume – but not certain – that Italy had been able to trim 0.3% from the deficit of 1997. At the time, this was just enough to post an under-3% figure on national accounts and signal a directional move to enter the single European currency. It is unlikely, however, that this single move was detrimental for the long-term sustainability of the overall debt.

Conclusion: the case for redemption

These transactions are regarded as questionable by many due to the fact that they significantly obscure economic reality. It is clear that this kind of window dressing techniques are a manifestation of the larger issue of problematic debt management, on the sovereign entity scale. This issue is also more contemporary and significant than ever, given the current macroeconomic environment shaped by the COVID-19 pandemic. An environment which has loudened the need for even more excessive borrowing and has raised the question of debt sustainability throughout the economic cycle. Now is the time to be creative, while not compromising economic reality. That is why there is a growing number of economists arguing that a possible solution to sovereign debt borrowing could be the use of GDP linked government bonds. In a few words, this type of bond provides the following widely needed flexibility: when the economy is doing growing interest rate linked to these bonds increases, and when the economy is entering a recessive state, the interest decreases. Yet, what are the implications of these bonds? Could they actually prove to be a case of redemption? This is what we will examine in the second part of the article, coming next week.

0 Comments