Introduction

Grindr [GRND:NYSE], an online dating app targeted towards the LGBTQ+ community, went public on November 18, 2022 after completing a merger with Tiga Acquisition Corp., a Special Purpose Acquisition Company (SPAC), at an initial post-transaction enterprise value of $2.1bn. The leading social network for the LGBTQ+ community announced its aim to go public back in March. On its first day of trading Grindr’s stock jumped from an opening price of $16.90 to a high of $71.51, closing at $36.50. The stock price surge can be attributed to an interest in the company, but mainly to the low float of the stock of 500,000 shares. A redemption rate of 98%, saw only 2% of investors staying onboard, severely reducing the stock float and making trading more volatile and producing explosive prices on the opening day. The stock price has since fallen to its current price of $6.40 (as of November 29, 2022), a 91% drop from the post-IPO rally’s high. Despite public competitors Match Group [MTCH:NASDAQ], owners of Tinder, and Bumble [BMBL:NASDAQ] having fallen 64% and 31% respectively this year, the dating app has claimed to see the long-term benefits for business growth of being a public company. With only 83 SPAC IPOs so far in 2022, compared to 542 in the same period last year and 178 the year before, SPACs have been on a downward trend over the last year.

Company Overview

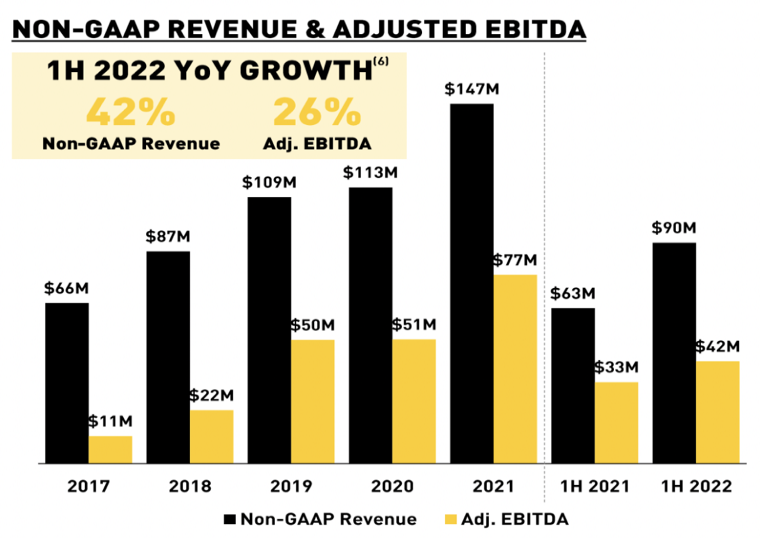

Founded in 2009, Grindr is the leading global LGBTQ+ social networking and dating platform, with around 11 million monthly active users. The app was launched on the Appstore in March of 2009 by tech entrepreneur Joel Simkhai out of California. It quickly spread amongst the queer community globally, reaching 500,000 users by March 2010. In early 2016, Grindr announced a $93mn sale of a 60% stake in the company to Chinese video game development firm, Kunlun Tech Co Ltd, which proceeded to buy the remainder of the shares for $152mn two years later. The company was then sold to a US-based investors group, San Vicente Acquisition LLC, in March 2020 after US national security concerns were raised by the Committee on Foreign Investment in the United States (CFIUS). The government agency claimed that having the app owned by a Chinese company with access to data of millions of Americans posed a national security risk. Grindr is censored in many countries across the world such as China, Indonesia and the UAE, and is completely unavailable due to government restrictions in others such as Iran, Syria, and Pakistan. Furthermore, Grindr has been the subject of much criticism over time, including being a risk to minors, user data privacy issues, and monitoring hate speech. Often compared to Tinder, but for gay dating, the app has both free and paid membership options similarly to many of its competitors. Grindr monetizes its application through premium membership options including a $19.99 per month subscription plan named “XTRA”, and an “Unlimited” version for $39.99 per month. Both allow users to avoid advertisements and provides them with more connections and functionalities. With around 6% of users being classified as paying users, and an average direct revenue per paying user of around 16$, Grindr has steady revenues, and potential for growth by converting free users to one of the paid tiers. Furthermore, paid users are monetized through advertising, also presenting a steady income stream. Grindr saw record revenues of $147mn in 2021, and a steady 4-year annual growth rate of 22%. Revenues from the first half of this year grew 42% year over year, reaching $90mn, with $42mn in EBITDA.

Source: Grindr

Source: Grindr

The dating app industry overview

Online dating apps are now mainstream in the U.S, Europe and many other places in the world, and have become a common and socially-accepted way for new couples to meet. Today, the online dating industry is made up of hundreds of smartphone apps where people can meet and chat online. Tinder, released in 2012, is perhaps the most well-known app, and the leader in the surge of mobile dating applications. Tinder was founded under the Match Group which owns and operates a global portfolio of 45 dating companies and some of the leading online dating apps including Tinder, Match.com, OkCupid, Hinge, and PlentyOfFish. Tinder founded the simple system of swiping right if interested, left if not, which has now become widely used across dating platforms such as Bumble. In 2020, Tinder had 6.2mn paying users or “subscribers” and 75mn active users, and as of 2021 has recorded 65bn matches worldwide. Outside of the US, however, Badoo, a UK-based and Russian founded platform which is now under the Bumble brand, is the market leader with over 318mn users. Grindr, is by far the most popular dating app amongst the LGBTQ+ community, and competes amongst the other top dating apps.

The online dating application market was valued at $7.55bn in 2021 and is expected to grow at a compound annual growth rate of 12.65% according to a market research report published by Polaris. Dating applications are expecting growth driven by increased adoption in Asia-Pacific and Africa, following a growing use of smartphones in the developing world. Furthermore, dating apps saw large increases in users and usage time during the COVID-19 pandemic, positively impacting the global online dating application market. Lockdowns and strict social distancing rules accelerated the use of online platforms to socialize and meet new people. Grindr hopes to expand its revenues as it sees its core market, the self-identified LGBTQ+ population, to grow up to 660mn by 2026. Looking specifically at the LGBTQ+ dating app industry, Grindr claims that “Gen Z adults (18-24) are 4x more likely to identify LGBTQ+ than boomers (65+)”. Furthermore, in company investor presentations, Grindr claims that according to private market research the US LGBTQ+ population spends 30% more per capita on recreational activities than the general population, something they believe will give them a significant competitive advantage.

Dating app stocks, however, have crashed this year with Match Group, and Bumble having fallen 64% and 31% respectively. This can mainly be attributed to the weakening economy suppressing subscription revenues, and the strength of the US dollar hurting international sales. Moreover, the younger user base’s disposable income has been hit harder by rising prices, further hurting the industry.

Deal Structure

Despite the slowdown faced by public offerings in 2022, in May LGBTQ+ dating app Grindr announced its plans to merge with the special purpose acquisition company Tiga Acquisitions. Tiga was set up by Ashish Gupta in 2020. After the approval of Tiga’s shareholders, the transaction was completed on November 18th, valuing Grindr at $2.1bn, including debt. The combined company was renamed Grindr Inc [NYSE : GRND] and is publicly listed on the New York Stock Exchange.

The estimated valuation of $2.1bn is 14x Grindr’s 2021 revenues and more than triple what San Vincente Acquisition paid when acquiring the company in 2020 when US regulators forced Grindr’s Chinese owner to divest the company over national security concerns. Through the merger, Grindr will raise $384m, including $284m that Tiga Acquisitions has held in a trust since going public in 2020, and an additional $100m will come from a forward purchase agreement. The deal has a minimum cash closing condition of $100m and at deal closing, Grindr’s existing equity shareholders owned about 78% of the company. Interestingly, none of the funding was raised through a PIPE deal, transaction that played a crucial role in SPACs’ boom in 2020. Another unique aspect of this transaction is that around 98% of Tiga Acquisitions’ investors chose to redeem their shares instead of taking part in the merger. As a result, only 500,000 shares were left for trading, which also explains the large fluctuations in Grindr Inc’s stock price after the completion of the acquisition.

In September, in preparation for the public listing, Grindr announced a new management team. George Arison, founder of the online car sales company Shift, was appointed as the new chief executive and started his role in August. The new CFO is Vanna Krantz, who previously covered the same position at fintech company Passport and at Disney Streaming Services. Grindr’s previous CEO and CFO, Jeff. Bonforte and Gary Hsueh, transitioned to advisory roles within the company.

Deal Rationale

Grindr’s management decided to list the company through a SPAC for specific reasons. Firstly, out of the $384m Grindr will receive as part of the merger, roughly $138m will be used to pay down the company’s debt. As the company stated, the main goal of the transaction is to bolster its balance sheet and raise new funds. These new funds will be used for “supporting growth areas and launching new endeavours”. The company, which currently counts fewer users compared to its competitors in the dating app industry, has developed a new “strategy for growth and value creation” that would allow Grindr to expand and reach new clients.

Another key objective that drove Grindr’s management to list publicly despite the current challenges of the macroeconomic environment is to improve the brand’s reputation. According to Arison, Grindr has long been misunderstood and going public would give the company a formal chance to describe its business with each quarterly earnings report. He said that listing on the NYSE would be not only good from a market perspective but also from a reception perspective. People would start looking at Grindr as a respectful company and not only as a “casual dating app”. If this were the case, the new brand reputation would attract new users and eventually expand Grindr’s customer base and market share. The company is committed to serving the LGBTQ+ community and, as the management states, listing on the NYSE, which was the site of protests against the high price of AIDS drugs, would symbolize “how far the world has come over the past few decades”.

As mentioned above, Grindr’s management perceived going public on the stock exchange as the best strategy for the company and, therefore, they had two options: an IPO or a SPAC. They chose a SPAC because, although it was hard to predict the redemption rate, an initial public offering would have been even riskier and the market for IPO is more or less shut down. The company was confident in the transaction as “unlike many companies in more speculative industries that have tapped the SPAC market”, Grindr is a firmly established business that witnessed exponential growth over the past years. Because the company needed the funds and strongly believed in going public to improve its reputation, doing it through a SPAC was the best option as it promised a less volatile outcome than an IPO.

Grindr: Valuation & Stock Price

Grindr saw extremely high and volatile prices on its first day trading on the NYSE. This rally can mainly be attributed to the small float of the stock, with less than 500,000 remaining outstanding shares. This followed the roughly 98% of investors who chose to redeem their stake when voting to approve the deal. The smaller number of shares available to trade on the exchange drove extreme volatility in the stock, a phenomenon which has been more and more common for SPAC IPOs.

This low float following high SPAC investor redemptions sent the share price well beyond its intrinsic value. At its closing price of $36.50, Grindr traded at a 38x price-to-sales multiple, calculated by dividing its market cap at the time by its $200mn in revenue for its current fiscal year. This is compared to Bumble’s 3.42x multiple and Match Group’s 4.41x. At its current price of $6.40, Grindr’s price-to-sales multiple stands at 6.15x, much more in line with its competitors. Grindr is yet another SPAC IPO which has seen its stock price tumble since its opening day.

Advisors

The Raine Group LLC served as financial advisor to Grindr, while its legal advisor was Cooley LLP. Raine Securities LLC’s legal advisor was Freshfields Bruckhaus Deringer LLP, and TAC’s legal advisor was Milbank LLP.

SPACs market

Tiga’s shareholders had plenty of reasons to redeem their shares as the majority of SPAC mergers reaching completion this year have plunged. According to SPAC Research, these deals reported an average loss of 49% during the first nine months of 2022 compared to the S&P 500 which lost 25% over the same period. Overall, the first half of 2022 witnessed a slowdown in SPAC activity as only 77 SPAC M&A deals were announced compared to the 167 transactions of the same period in 2021. Furthermore, only 69 SPAC IPOs were listed compared to the 362 that were priced the year before. 2022 also had the highest number of withdrawn SPAC mergers on record. According to EY, in the first half of 2022, SPAC IPOs have attracted about $11.8bn in gross proceeds, down 88% year-on-year.

SPACs that announced transactions in 2022 also faced significantly rising redemption rates. Between January and July 2021, the monthly redemption rate ranged between 7% and 43%. In contrast, average redemption rates this year were above 81%. The higher redemption rate environment poses considerable challenges to SPACs aiming to complete acquisitions, as less cash remains in the SPAC’s trust to satisfy the minimum cash condition required to complete the transaction. Moreover, high redemption rates result in lower cash proceeds that the combined company would use for its post-transaction operations. SPACs’ cash positions are deteriorating also because of a newly established 1% excise tax on stock repurchases by US public corporations passed by the US government as part of the Inflation Reduction Act.

Private investments in public equity, also referred to as PIPE deals, heavily contributed to the success of SPACs over the past years. However, potential PIPE investors are starting to scrutinize SPAC transactions more closely because of the low performance these companies have been delivering. While there has been a lack of interested third-party financial PIPE investors, two types of PIPE investors have risen: “insider-only” and “strategic” investors. Insider-only PIPEs refer to investors consisting only of SPAC sponsors, target insiders and their “friends and family”. In contrast, in “strategic” PIPEs, the investors have a commercial or business relationship with the target.

The overall slowdown faced by SPACs over the past months is related to the current macroeconomic environment the world is facing. Rising inflation and interest rates are unquestionably negatively affecting SPACs’ performance. High inflation is causing bond yields to rise, and high interest rates are leading investors’ appetites to transition from growth to value stocks. This market’s hunger for speculative assets is what drove the boom in SPACs in the first place. The rise in interest rates is affecting the values of SPACs and young growth start-ups more than mature and established companies. This is because a company’s enterprise value is the value of its expected future cash flows and terminal value discounted to their net present values. Growth stocks have more value coming from the future and, therefore, a higher discount rate would lead to lower valuations.

SPACs that went public during the 2020 SPAC boom are approaching their deadlines to complete initial business combinations and must decide whether to seek an extension or to dissolve. According to SPAC Research, almost $75bn worth of SPACs is due to reach their expiration date between now and February, with a further $36bn to come in March. Due to the market’s uncertainty and unfavorable conditions, we will witness several SPACs repaying their shareholders and dissolving. In the following months, the SPACs market will also see an increase in regulations as the SEC is raising concerns regarding the high-profile SPACs that fell short of expectations in the last period. These new regulations include limitations on the ability of sponsors to sell shares of their companies as well as measures preventing fraud. In the short term, the SEC regulations will result in more uncertainty in an already challenging environment resulting in lower deals’ profitability. However, in the long run, these new limitations might improve transparency and deal integrity and, as a result, reduce investors’ uncertainty in the SPACs market.

As already mentioned, the most crucial factor contributing to the slowdown in SPACs is the current macroeconomic climate featuring high inflation and interest rates. Analysts predict that the SPACs market will not recover as long as high inflation persists. Once the market returns to normal and inflation lowers, SPACs will come back but not at the levels witnessed in 2020. Despite these challenges, SPACs will still be a good investment option as they offer an important alternative to the traditional IPO and provide an opportunity for investors to diversify their portfolios. Through SPACs, investors can gain exposure to companies within a specific industry or niche with minimal risk compared to investing directly in start-up stocks. When the macroeconomic challenges will mitigate, several companies will come out of the challenging period with significant debt and a SPAC could provide an attractive alternative to recover a solid financial profile.

0 Comments