Investors are demanding an increasing amount of leveraged loans, with a lower capital cushions and little covenant protections. Furthermore, they are demanding a lower spread over the floating reference rate. In this article, we will give an overview of the situation, the fundamental reasons behind this trend and the potential risks.

Leveraged loans

Leveraged loans are senior loans provided to companies that are already holding a considerable amount of debt. These loans are characterized by a higher risk of default; therefore, borrowers will require a higher rate of return. They typically pay a floating rate based on LIBOR plus a stated interest margin, 125bp or higher.

Recent Huge Boom in Leveraged Loan Issuance

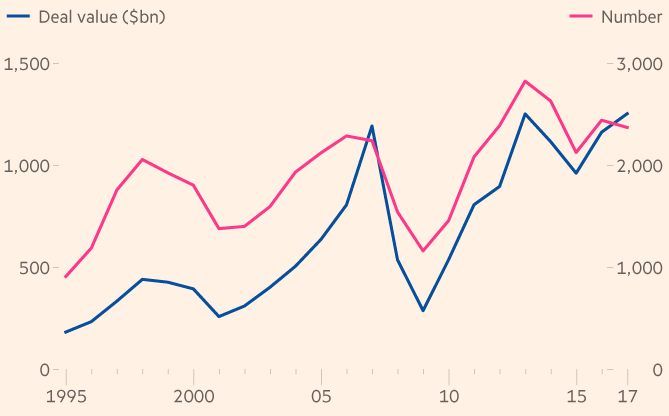

Recently, the volume of leveraged loans has hugely increased by surpassing the level registered in 2016. The underwritten volume reached $1.251tn, up 38 per cent from a year earlier and 60 per cent of the deals have been executed by refinancing existing loans. Companies with sub-investment grade ratings are able to renegotiate their debt at lower interest rates because there is a huge increasing demand for leveraged loans and a dearth of new loans. This happens because these loans have higher yields than investment grades, so yield starved investors have been buying them. Moreover, leveraged loans having higher seniority compared to high yield bonds appear to be safer for investors. In addition, since they are tied to an underlying floating rate benchmark, they are considered to have lower duration risk. Investors are even demanding a lower spread over the floating reference rate, anticipating a rise in the floating rate.

The largest source of this massive demand has been the surge in issuance of collateralized loan obligations (CLO), that are securities backed by a pool of different low rated loans. According to data from LCD, a unit of S&P Global, structured vehicles that issue CLO, by purchasing and packaging loans together in order to sell them to investors, have raised $100bn this year. On the other hand, high-yield bond funds have suffered outflows over the same period. However, these instruments are highly risky because the underlying companies have a high level of debt and there is the risk that they experience a downturn.

Chart 1: US leveraged loan volumes (Source: Financial Times)

Covenants have been getting progressively worse

The relative dearth of new loans has given borrowers more bargaining power. In this situation, as the side effect of demand-supply mismatch, covenants that are included in leveraged loans have touched lowest levels, according to the rating agency Moody’s, and the situation is getting worse. This has lead the share of covenants-lite loans in the leveraged loan market to reach its highs. In 2007, just under 30% of U.S. loans were covenant-lite, according to S&P Global Market Intelligence’s LCD research unit. In 2016, they accounted for almost 75% of U.S. deals.

Chart 2: Covenant-lite share of US Leveraged Loan Market (Source: LCD)

Covenants are protections for the lender that are included in loan documents, that can restrict further borrowing, open lines of communication with the company or maintain the lender’s position in the capital structure. Covenant-lite loans refer to debt where the issuer does not need to meet periodic performance goals and have lower restrictions, therefore this reduce the effectiveness of lenders to influence borrower’s actions.

Chart 3: The Loan Covenant Quality Indicator by Moody’s – Higher score means weaker covenants quality on a scale from 1 to 5 (Source: Bloomberg)

Leveraged Loans replace High Yields

As discussed earlier, leverages loans are considered more secure than high yield bonds, because they have higher seniority and high yield bonds investors would be subject to losses before senior loans in case a default of the issuer occurred. However, the leveraged loan market has been cannibalizing the high-yield market. Companies have been redeeming bonds and issuing leveraged loans because of the weaker covenants, lower spread and possibility to offer more flexibility to the issuer. Leveraged loan sales have beaten debt issuance this year. As consequence, that capital cushion that leverage loans had before beneath them is eroding. This creates a big risk for investors, because the benefit of seniority is vanishing. According to Gershon Distenfeld, director of credit at AllianceBenstein, roughly two of every three loans do not have debt beneath them.

Chart 4: US high-yield bonds and leveraged loans (Source: Financial Times)

Effect of US Tax Proposals on issuer

The new Republican proposal wants to cap the tax deductibility of interest payments exceeding 30 per cent of income. This would negatively affect highly leveraged companies which pay relatively little taxes. This concern was reflected by the market when the share prices of different PE firms tumbled after the announcement of the tax proposal, despite a cut of top corporate tax rate from 35 per cent to 20 per cent. The tax proposal is far from becoming a reality, but it’s something that could make a potentially have a negative impact for the holders of these leveraged loans.

US Junk Bonds have been selling off

During the credit boom of recent years, highly indebted companies have been able to raise money easily, but all of that may change as the credit cycle turns. Recently, a sell-off in the high-yield bond market interested mainly telecom, healthcare, cable, and satellite television industries because of lackluster earnings. This is not a particularly positive sign, when these bonds are considered as the buffer in the capital structure before losses start hitting senior leveraged loans. Furthermore, the high-yield market is generally considered a leading signal for distress in the overall credit markets.

0 Comments