Inflation is down – again – to 0.3%, far away from the target of the ECB.

Source: TradingEconomics, Eurostat

Inflation Expectations are also down. The expected inflation in 5 years dipped last months below the threshold of 2%. This is a major issue for ECB: given its mandate to maintain price stability with inflation below but close to 2%, if market participants believe inflation in 5 years is going to be below 2% it simply means that ECB is losing its credibility.

As China steps in with more expansionary policy (Interest rate cut -40 Bp to 5.6%), the ECB remains the only major central bank that has not undertaken serious action.

Additionally, the most recent fall in Oil prices also is driving inflation expectation down, adding more and more pressure to the ECB to act.

In this chart the red, the white and the blue line represent respectively BOJ, FED and ECB balance sheet. As we can see their strategies have diverged enormously and the interesting fact is that the first vertical line indicates the day when Draghi announced that he will do “whatever it takes” to preserve the Euro. He basically said he would do whatever, but he actually did the opposite, by shrinking ECB balance Sheet.

Today, once again, very little has been done, and a lot has been anticipated.

Draghi announced last Friday that ECB is unanimous in taking action and that it is essential to target inflation “without delay”. Therefore if an action is round the corner…

How will ECB carry out QE?

Markets for ABS and covered bonds are too small, ECB cannot target only such securities without causing major price distortions in those markets. Therefore speculation arises about what other securities the ECB will buy. Most likely they will be Government or Corporate Bonds.

There are two major hypothesis about how the ECB is going to implement this unconventional monetary policy: by Capital Subscription or by National GDP.

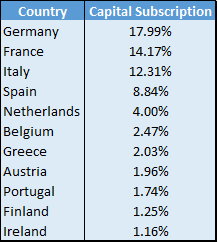

Capital subscription

Capital subscription is the amount of paid-up Capital made by National Central Banks to the ECB.

In order to make the QE more ”democratic” and likely accepted by European Nations, the ECB might buy bonds from each country in proportion to their contribution.

National GDP

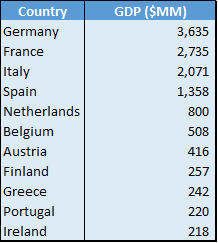

Another option is the one of buying bonds in proportion to the national GDP.

What we would highlight here is that in both cases bonds issued by Italy (or by Italian corporate) will benefit more that those issued by Spain (or by Spanish companies).

Therefore we suggest buy Italy 10yr BTP and sell Spain 10yr Bonos; the gap today stands at 14 Basis point, already down from ~ 30 Bp one month ago, and we expect it to narrow further.

Even though economic fundamentals are worse for Italy compared to Spain (Debt/GDP, GDP Growth) and also the trend of unemployment is reversed (Italian Unemployment still rising), in a QE scenario the market will no longer price in those yields country risk premium and therefore our trade would be profitable.

[edmc id=2260]Download as PDF[/edmc]

0 Comments