Introduction

This article will focus on the disruptive effects that e-commerce has on both the real estate and consumer retail sector. Subsequently, the paper will address Amazon and Walmart, as the former represents the incumbent driving this transition and the latter represents one of the main players being affected by the advent of online retailing.

Effects on the Consumer Retail Sector

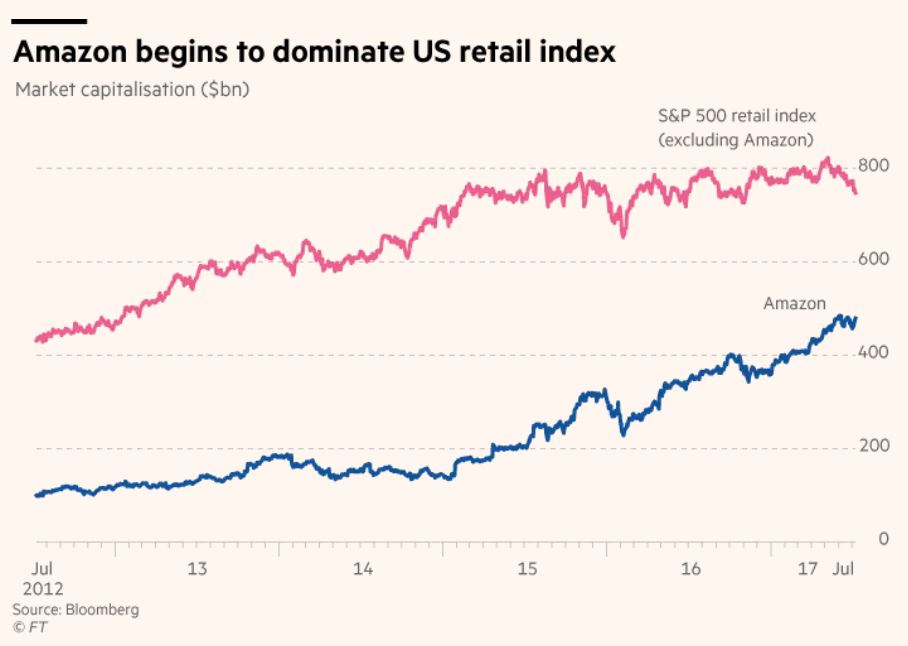

Source: Financial Times, Bloomberg

The so called “Amazon effect” is the spending shift from bricks-and-mortar shops to the online realm, a sub-sector dominated by the likes of Jeff Bezos’s internet retailing giant (Amazon). This trend has probably just started to shape the consumer retail industry, with some investors predicting that every corner of the traditional consumer retail will experience a painful burst of creative destruction as shoppers migrate online. As the graph shows, the US retail index (excluding Amazon) has remained flat since mid-2014, whereas, in the same time horizon, Amazon grew by more than 100% and now weights a third of the market capitalization of the entire index. Therefore, the growth in the US retail index in 2017 is a direct consequence of the increase in Amazon’s stock price and has not been provoked by the performance of the other incumbents.

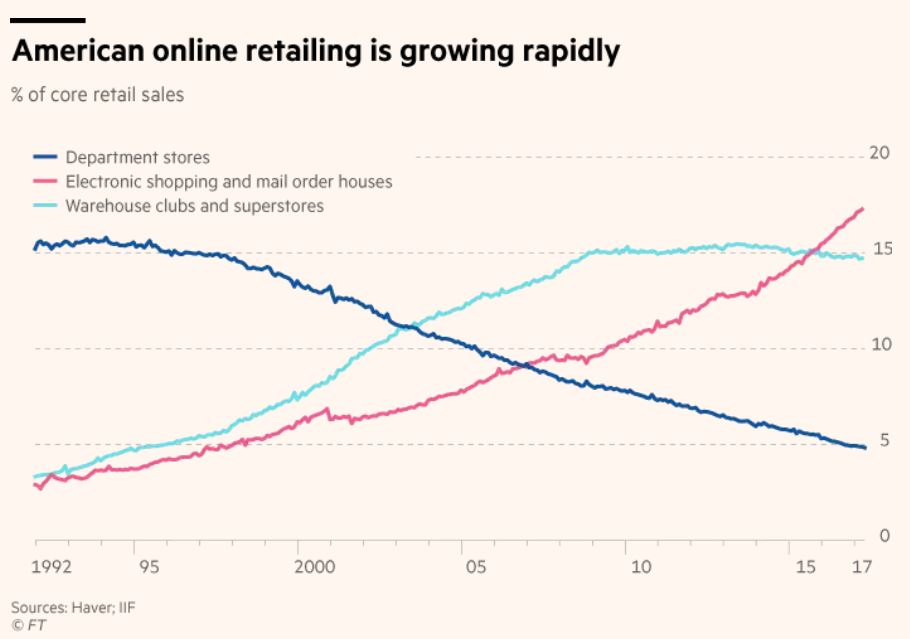

Source: Financial Times, Haver, IIF

The US retail industry is facing a growing headache with the cumulative number of bankruptcies in 2017 (data until July) already surpassing the total number of bankruptcies in 2016. On top of that, an additional problem is the dramatic overbuilding of stores, arising from the oversupply caused by the global financial crisis in 2008. Credit Suisse estimates that as many as 8,640 stores with 147m square feet of retailing space could close down just this year, surpassing the level of closures after the financial crisis and dotcom bust. The downturn is hitting the largely healthy US labour market: the retail industry has lost an average of 9,000 jobs a month this year, compared with average monthly job gains of 17,000 last year.

More than 10% of US retail sales are transacted online and this number is growing exponentially, forcing big chains to shutter thousands of stores in recent years.

Private equity firms and hedge funds that specialize in corporate upheaval, also called distressed debt investors, are largely shunning traditional retail, wary of the immense structural challenges that the industry is facing. This effect is conveyed by the accumulation of dry powder for most PE firms. In the unlikely event that the Federal Reserve embarks on aggressive rate rises, retailers would be hit by higher borrowing costs and lower sales (as the industry is cyclical). Moreover, retailers are characterized by high operating costs due to security, electricity and other utilities, and rent. The latter being the main expense especially for small-cap retailers. In addition, the closure of shops would have negative pressures on property prices, due to the oversupply following the GFC, reducing rents, and thereby affecting also the real estate sector (see next paragraph).

Effects on Shopping Malls and Real Estate Sector

Malls are given ratings by a small group of property consultants that generally range from A++ to C, based on factors that include their sales per square foot, geographical location, and maintenance. Investors tend to rely on these ratings to make decisions over how secure each mall is. “A” malls are (in theory) less risky than “C” malls (because e.g. landlords invest more resources to keep their property in good conditions or because they benefit from greater consumer exposure thanks to their central location).

Source: Financial Times, Thomson Reuters Datastream

As it can be inferred from the graph, betting big on Amazon, while short selling traditional retailers, has been a blockbuster trade for the recent years as investors believe that whatever Amazon does is “good”. It is important to assess the rationale of this investment decision.

An historical, albeit recently discussed, assumption regarding shopping malls is that “A” shopping malls’ business model should remain largely immune from the malaise affecting the retail sector. Their resilience to the adverse impact caused by e-commerce is due to the fact that investors are attracted by the large dividends paid by REITs and, therefore, are reluctant to switch. Furthermore, the high rating given by property consultants makes investors believe that “A” shopping malls are safe and insulated from exogenous industry shocks (similar to securitized products during the GFC but this assumption is being revisited). However, there has been growing evidence to suggest that the financial health of the large tenants of the bigger REITs, such as Simon Property and GGP, is also deteriorating. Tenants of these large mall operators are generally split between large “anchor” retailers, big name retailers such as Macy’s and Sears, and smaller so-called “in-line” tenants who tend to pay higher rents than the flagship stores. In-line tenants pay up to 30x more than anchor tenants, meaning that the fate of smaller retailers is crucial for the operating performance and profitability of mall operators. Therefore, the stock performance of mall operators is positively correlated to the performance of in-line tenants and small retailers, who are more sensitive to the disruption caused by e-commerce. Thus, also big mall operators are negatively affected by the advent of online retailing. The broadly held belief that “A” malls are different from other malls is a fallacy. Hedge funds have realized this and have started to short sell.

Furthermore, a secondary but still important issue for mall operators is related to contract clauses. When a shopping mall loses one of its major brands or stores, (known as anchor tenants) the other tenants can ask for a reduction in rent thanks to a specific type of contract clause. “Even though the loss of rent due to an anchor closing is minimal, the knock-on effect of reduced rents from the remaining tenants is a serious concern” (FT interview with Russell Clark of Horseman Capital).

Source: Financial Times, Green Street estimates

Therefore, when looking at the number of downgrades of US malls, two main questions may pop up to investors’ mind: “are analysts’ estimates wrong?” and “when should we expect a market correction?”.

Overview of Amazon

Amazon.com Inc. (NASDAQ: AMZN) – market cap as of 28/09/2017: $459.570bn

Amazon is an American e-commerce and cloud computing firm, headquartered in California. The company was founded by Jeff Bezos in 1994 and employs 341,400 individuals worldwide. Amazon is the largest online retailer by sales and by market capitalization. It started as an online bookstore and later diversified to sell a broad range of products such as electronics, furniture and food.

Amazon has historically been very active in terms of M&A activity. In 2008, the company purchased Audible for $300m, the world’s largest seller of downloadable audiobooks and other spoken content, and paid $970m in 2012 for the video streaming platform Twitch. More recently, Amazon started establishing its footprint in numerous emerging markets, by acquiring the Middle Eastern retail giant Souq.com. The $13.7bn Whole Foods transaction in 2017 (you can read about it here) further highlights the company’s desire to enter new high-growth sectors.

As the largest online retailer, Amazon is highly competitive against traditional “brick and mortar” players. Jeff Bezos utilizes an intensive growth strategy, especially outside the United States. The firm operates websites in more than 10 countries including Germany, Ireland, France and Canada. Cost leadership through advanced technologies, automation and maximum operational efficiency allows Amazon to undercut existing competitors and thus offer customers inexpensive and high-quality products. Permanent improvements in information technology also permit the firm to effectively target customers and maximize sales. Jeff Bezos emphasizes that each platform serves its own consumers in the best and fastest possible way.

The firm generated total revenues of $135.9bn in 2016. This value represents a 27% increase over the previous year. While high capital expenditures caused Amazon’s free cash flow levels to strongly fluctuate between 2010 and 2014 ($2.15bn and $395m), the company’s FCF was $9.71bn in 2016. Optimism among worldwide investors similarly caused Amazon’s stock to skyrocket in recent months. The stock is currently trading at a P/E ratio of 239.1x compared to a 43.1x industry average.

Overview of Walmart

Wal-Mart Stores, Inc. (NYSE: WMT) – market cap as of 28/09/2017: $235.018bn

The multinational retailing corporation was founded in 1962 by Sam Walton and employs 2.3m associates. Despite family-ownership, Walmart is the world’s largest company by revenue and one of the most valuable by market capitalization. According to the company’s website, 260m customers and members visit the 11,695 stores (in 28 countries) and e-commerce websites (in 11 countries) every week.

Cost-leadership and digitalization of operations allow Walmart to satisfy the fundamental needs of clients across the globe. The company aims to offer products at a 20% discount, by procuring products at the lowest possible prices from manufacturers, strictly controlling overhead costs and ensuring minimal rent. Walmart increasingly utilizes big-data to segment customers and to effectively address the unique demands of every buyer. Large retail spaces and densely populated metropolitan areas encourage Walmart to actively reorganize and to improve its inventory management. Cutting-edge technology’s such as Radio Frequency ID tags have been employed to minimalize storage and organisation costs. The corporation also currently performs experiments that seek to connect online and offline operations. For example, “Pickup Discount” offers a markdown on online-only items. Nevertheless, Walmart is only slowly entering the online shopping industry and with high acquisition costs that may not turn out to be cash positive.

Walmart reported moderate 2016 fiscal year results. Revenues decreased by 0.75% (from $482.23bn to $478.61bn) compared to the previous year. Additionally, in recent years the firm experienced strong fluctuations in free cash flow, as investments outside North America have seen mixed results, particularly in Germany and South Korea. Lastly, investors believe that the firm is partially unable to challenge Amazon’s e-commerce presence and that capital should be allocated differently.

TAGS: Consumer retail, real estate, Amazon, Walmart, shopping malls, Macy, e-commerce, online retail, brick and mortar, shops, hedge funds, private equity, US, ecommerce

The Effects of E-Commerce on Shopping Malls and on the Consumer Retail Sector – a US Case Study

1 Comment

How Are E-Commerce Solutions Shifting The Paradigm? | TheSquarePeg · 15 September 2020 at 13:55

[…] the contrary, large scale retailers have the technological capacity and financial power to reach new customers. An E-commerce act as a […]