Introduction

On October 27th, Elon Musk – the richest person in the world with a net wort of almost $200bn – finalized the acquisition of the social media company Twitter, Inc, for a total enterprise value of approximately $44bn. Musk is the co-founder and CEO of Tesla [TSLA : NASDAQ], an American multinational automotive and clean energy firm and SpaceX, an American spacecraft manufacturer, launcher, and a satellite communications corporation.

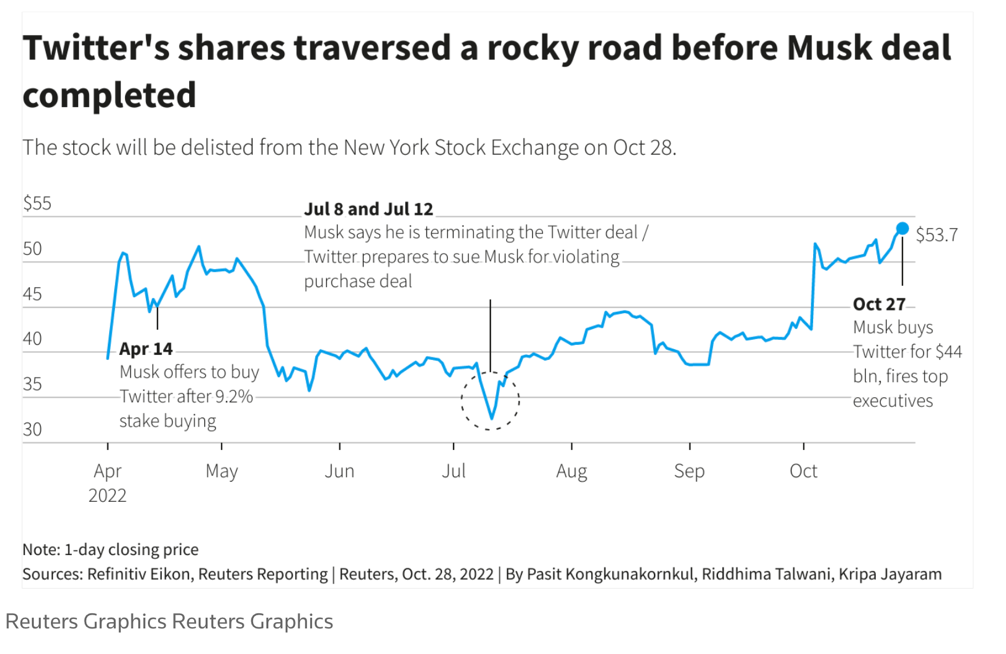

He started investing in Twitter in January, becoming the largest shareholders with a 9.2% ownership stake in April. From the initial offering on April 14th amounting to $54.2 per share in cash, the transaction later turned very chaotic due to a continuous back-and-forth of allegations, withdrawn offers, and lawsuits. When Musk eventually assumed the position as CEO on October 27th (even though this is supposed to be only on an interim basis), he laid off half of the company’s 7,500 employees and fired former CEO Parag Agrawal, among other top executives including CFO Ned Segal, CLO Vijaya Gadde, and general counsel Sean Edgett.

The decisions Musk made following the takeover generated considerable controversy and many individuals and corporations have decided to temporarily leave the platform or pause advertising. And the turmoil continues as just this weekend Twitter closed its offices after Musk’s ultimatum, sent on November 16th, to either commit to an “extremely hardcore culture” or leave the company is sparking a wave of resignations.

Musk’s Rationale Behind his Bid

Since he joined Twitter in June 2010, Musk has always been very active on this social media: as of now, with 115m followers, he is the second most-followed person in the world. The appreciation he has always shown towards Twitter, which he firmly believes holds an extraordinary potential, constitutes the first and foremost reason underlying his intention to turn this platform into the most respected one globally.

After submitting his initial bid, Musk affirmed “Free speech is the bedrock of a functioning democracy, and Twitter is the digital town square where matters vital to the future of humanity are debated”. He considers himself a “free-speech absolutist”, yet this does not mean that Twitter will turn into a “free-for-all escape, where anything can be said with no consequences”. Over all these months of drama and legal challenges, the explanation that Musk has always given to the media to justify this takeover is indeed his intention to “help humanity”. For instance, he has repeatedly asserted that he wanted to remove permanent bans such as the one imposed on Donald Trump, since, according to external sources, he is firmly against lifelong prohibitions. The former US president had, in fact, been banned after the Capitol Hill attack to prevent the risk of further incitement of violence. Moreover, at a TED conference held last April, Musk declared his plans to make Twitter’s algorithm and code open source and eliminate fake accounts.

An alternative explanation of the true reason why Musk bought Twitter is related to payments. First of all, Musk is a great admirer of Chinese WeChat – an instant messaging, social media, and mobile payment app – which allows the Chinese population to carry out a significant number of daily activities such as ordering in restaurants and paying bills directly through this all-in-one platform. He has often mentioned the fact that buying Twitter will accelerate his idea of creating a comprehensive app, the everything app called “X”. Outside China there is nothing similar yet: filling this void is exactly what Musk is going after. Furthermore, Musk is part of the so-called PayPal Mafia, a group of founders and former employees of PayPal which then created other technology companies. Looking at the people who advised Musk in the deal would add on evidence to this theory: Binance founder Changpeng Zhao who contributed $500m in the buyout; David Sacks, another PayPal Mafia member who is deeply interested in next-wave technologies; and Sriram Krishnan, the general partner of Venture Capital a16z Crypto.

In addition, Musk himself openly discussed about the transformative opportunity he sees in payments. Indeed, he believes that there is an evident analogy between sending a direct message and sending a payment from an information point of view. The underlying rationale is that an individual could use a direct messaging stack for payments. “And so that’s definitely a direction we’re going to go in, enabling people on Twitter to be able to send money anywhere in the world instantly and in real time”, said in one of the first meetings with Twitter employees. He also predicted that Twitter would bring in $1.2bn in payment revenue by 2028, which would achieve his stated objective of diversifying revenues streams for the social media, by making it less dependent on advertisers.

Overall, it is clear that Musk did not complete this transaction because of its financially attractive perspective, given that in its most recent earnings results Twitter generated negative free cashflow of approximately $124m. On top of that, Musk took on $13.5bn debt to finance the deal for which Twitter will have to pay nearly $1.2 bn in the next 12 months. On the contrary, he really seems to care about building a Twitter 2.0, be it for either promoting free speech or making it the next WeChat.

Initial Phase of Bid

On January 31st, Musk started buying Twitter shares in near-daily installments, reaching a 5% stake by mid-March. A first hint about a potential acquisition can be traced back to when he tweeted, towards the end of March, that he was having “serious thoughts” about building a new social media platform allowing free speech.

On April 4th, Musk announced he had amassed a 9.2% stake in Twitter, which corresponded to 73.5m stocks worth approximately $2.89bn. This made him Twitter’s most important individual shareholder. Even though he was still a passive investor, other investors started pushing the share price higher as they believed this could lead to something more. This resulted in the stock rising by more than 27%, which represented the best day for the company since its IPO in 2013. Nonetheless, on April 8th, the Vanguard Group, the world’s second-largest asset manager, increased its ownership stake in Twitter to over 10%, making it the top shareholder.

Musk’s interest became even more serious when he disclosed his intention to join Twitter’s Board of Directors. As part of the agreement, Musk agreed not to buy more than 14.9% of the company’s shares whilst on the Board. However, just a few days later, Musk stated that he would have not gone through with the arrangement. This plot twist represented just one episode of a long series of unexpected events which occurred one after the other. Indeed, 3 days later, on April 14th, Musk proposed buying the remaining shares of Twitter he did not already own at $54.20 per share, in an all-cash transaction valued at $44bn. This represented a 54% premium over the day before he started investing in Twitter and a 38% premium over the last trading day before his 9.2% stake was publicly announced on April 1st. Musk also declared: “My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder.”

In response, Twitter’s Board unanimously adopted a “poison pill” defense the following day to prevent a hostile takeover. This financial device wields against unsolicited investors since it enables shareholders to acquire more shares at a discounted price. Consequently, the market is flooded with so much newly created stock that a takeover becomes prohibitively expensive. In this situation, the poison pill had an exercise price of $210, thus authorizing each shareholder to pay $210 to purchase stock having a then-current market value of twice the exercise price, that is $420.

On April 25th, Twitter ultimately officially accepted the offer Musk put forward on April 14th, entering into a definitive agreement with him.

Source: Reuters Graphics

Scandals Emerge and Arriving to the Final Acquisition

Following Twitter’s U-turn and the acceptance of the acquisition, Elon Musk announced he was going to improve Twitter for the best, by releasing new features, making the algorithm open-source, and defeating bots, making it the “town square for free speech” that he advocated so much for. The acquisition was even promoted by Jack Dorsey, Twitter Co-Founder, that remarked how taking the company private was the only right choice to make, and would have freed the company from investors’ pressures. In the following days, Musk started the due diligence process, requesting more thorough internal metrics regarding user activity; he was particularly skeptical about the Daily Active Users reported by the management, which indicated that more than 90% of users engaged daily on Twitter. When the CEO, Parag Agrawal, refused to hand the proof, Musk gave an ultimatum, saying that the transaction would not go forward until he received the information that he requested: as the CEO didn’t change his position on the matter, Musk eventually announced on July 8th that the deal would not go through, because of the breach of Twitter’s obligations of the merger agreement.

As a response, Twitter sued Musk: the company was granted an expedited trial, that was set to start on October 17, 2022; however, just before the start of the trial, Tesla’s CEO agreed to buy Twitter for the initial $44bn, sealing the deal on October 28. The contract indicated a $1bn breakup payment, but it was hardly the main reason that pushed Elon to change his mind: historically, Delaware courts have almost never let a buyer walk away at this stage of a transaction, and Musk probably realized that the chances of successfully walking out of the deal were slim. Anyway, his strategy was never to seek a discount: Musk already made arrangements with banks to fund the $13bn loan that he needed; the negotiations were held in April when the interest rates were still far lower than the levels we’re seeing now. If he were to re-negotiate financing, it would have been much more expensive: that was probably enough to make up for the valuation gap that originated from the fall in technology stocks.

Deal Structure

Musk provided $46.5 billion in equity and debt financing for the buyout, which comprises both the $44bn price tag as well as the closing costs. Musk’s $33.5bn equity commitment included his 9.2% Twitter stake worth $2.9bn and the $20bn in cash derived from selling part of his stake in Tesla through multiple transactions in November and December last year and then April and August. He also received $7.1bn from equity investors including Oracle co-founder Larry Ellison, Saudi Prince Alwaleed bin Talal, the crypto exchange Binance, and the asset managers Fidelity, Brookfield, and Sequoia Capital. In addition, Bank of America, Barclays, BNP Paribas, Mizuho, Morgan Stanley, MUFG, and Société Générale contributed with $13bn in loans (with Morgan Stanley alone committing nearly $3.5bn), for which the company will have to pay nearly $1.2 bn in the next 12 months.

Twitter under Musk so far

Layoffs and U-Turn in work culture

As soon as the deal was completed, Musk started putting into practice his strategy for the company, firing the company’s CEO, along with the top executives: the CFO, Head of Legal Policy, Trust and Safety, and the General Counsel. Furthermore, he announced the layoff of some 3,700 employees (almost half of the total workforce of 7500 people), in response to which the employees filed a class action, sustaining that Musk violated federal and California law by not giving enough notice. Furthermore, Elon Musk changed the work policy, canceling the loose work-from-home and requesting all employees to work at least 40 hours in the office per week. Musk recently sent an ultimatum to employees, telling them that they will have to work long hours and “be extremely hardcore” to build the new Twitter, and asked all employees through a survey whether they wanted to be part of this. This could lead to even more people fleeing Twitter since it’s a complete turnaround from the traditional work culture at the company, much more relaxed and keener to remote working.

Hate Speech

Shortly after the acquisition, there has been a spike in hate speech on Twitter, with more than 398 tweets per hour containing a slug word (prior to the acquisition, the figure was 84 tweets/hour, a 4.7-fold increase); the tweets were estimated to have reached more than 3 million users. In fact, Elon Musk announced that he would loosen content moderation controls, allowing “all but illegal” content and potentially lifting all the permanent bans (first of which, Donald Trump); however, he announced that every change to content moderation will have to be approved by a council “with widely diverse viewpoints”, that has yet to be appointed, and remarked that there have been no changes to content moderation policies yet.

The new Twitter Blue

Twitter Blue is one of the cornerstones of Elon Musk’s strategy: the subscription plan already existed before the acquisition and allowed users to edit their tweets and get to test new features at $4.99/month, but had nothing to do with verification. Musk announced that Twitter Blue, now costing $8/month (initially announced to be $20/month, but later restated), will allow all users to get access to the “verified” badge, previously only given to public figures: in addition to that, subscribers will get priority in replies, mentions, and search, the ability to post long video and audio, and will receive half as many ads. He also announced that he would be willing to partner with publishers to potentially lift the paywall for Twitter Blue users. But how many people would pay $8/month for Twitter Blue, anyway? According to a Twitter poll run by Jason Calacanis, Musk’s adviser, where more than 2m people expressed their willingness to pay for the service, 81.5% said “they would not pay” to be verified and get the blue badge; 10.5% would pay up to $5/month, 2.5% would pay up to $10/month, and 5.5% would pay up to $15/month.

The release of Twitter Blue was essential and urgent, so much so that Musk put pressure on the employees to develop the features by November 7, if they wanted to still have a place at the company. The new Twitter Blue eventually got released, but it caused many, many problems, first of all for advertisers. Several users exploited the verification method for Twitter Blue, creating impersonating accounts for popular brands and known figures, with catastrophic consequences. One user impersonated Lockheed Martin (NYSE:LMT), saying that they would stop selling weapons to the United States, Saudi Arabia, and Israel, while another created a fake account for Eli Lilly (NYSE:LLY), an American pharmaceutical company, announcing that insulin would be free from now on: the company’s stock shed $15.6bn in market cap (-4.37%) after the incident. All this forced the management to suspend new signups for Twitter Blue until the impersonation issues are addressed.

Advertisers pause spending on the platform

The wave of impersonators, along with the spike in hate speech, were the main factors that fueled the concerns that Twitter was not a safe place to advertise on. In addition to that, more and more activists are putting pressure on advertisers to stop spending money on the platform, and sent a letter to the CEOs of the top 20 companies that market on Twitter, pushing them to address the issue. To make things even worse, Yoel Roth, the Head of Trust and Safety, who had played an essential role in reassuring the advertisers that the platform was safe, and was one of the most trusted executives by Musk, resigned; the Chief Privacy Officer, Chief Information Security Officer, and Chief Compliance Officer all left the company as well.

As a consequence, major advertisers – such as Volkswagen AG, Pfizer Inc., General Mills Inc., GM, Carlsberg, Mondelez (Oreo), Allianz, Audi, United Airlines, and Pfizer – are pausing their spending on the platform, which has suffered a massive drop in revenue, as stated by Elon Musk.

Twitter going forward

Even if, in an early presentation to investors, Musk promised to quintuple revenues by 2028 and reach 932m users, on November 10, he admitted that the economic outlook is “dire” and will probably suffer from net negative cashflow of several billion dollars, stating that bankruptcy was not out of the question. There are several factors that will affect Twitter’s future performance, and none of them is in favor of the company right now.

Overdependence on Advertisers and “Heavy Tweeters”

Twitter relies on ads for 90% of its revenues, and now is risking up to $4.5bn of the annual advertising spending from the brands cited above, because of all the recent controversies. The fact that Twitter heavily depends on advertisers gives them significant power when it comes to making demands and pushing Musk to safeguard the platform from the type of controversies we’ve seen (hate speech and impersonation). Major advertising firms, among which Omnicom and GroupM, are now advising clients to take distance from Twitter, defining it as a “high risk” platform; GroupM, for instance, which works with brands like Google, Ford, and Coca-Cola, and represents 1/3 of all ads globally, stated in an internal document that several things had to change for Twitter to be deemed “safe” again. Elon Musk is very well aware of this problem: indeed, he wants to shift away from relying so heavily on advertising in the future; if everything goes according to his plans, the revenue from advertisements will be 45% of total turnover in 2028, down from the current 90% (2021).

It has to be noted as well that Twitter has never been the first choice for advertisers, more a “nice to have” rather than a “must”, and isn’t like Facebook or Google, which are key in the marketing mix of most modern companies. In fact, only 68.3% of marketers used Twitter in 2021, compared to 88.2% and 80.8% for Facebook and Instagram, respectively. Finally, everyone that currently has the verified badge will have to subscribe to Twitter Blue, if they want to keep it: this could further alienate famous figures, that are essential for bringing traffic and engagement to the platform. Elon Musk is very well aware of this: he wants to shift away

Finally, Twitter has recently seen a decline in its “heavy tweeters”: defined as users that log in 6/7 times a week and post 3-4 tweets a week, they’re less than 10% of overall users; yet, they generate 90% of the total tweets and 50% of global revenue. At the same time, Cryptocurrency and NSFW content, which advertisers avoid as much as they can, are the most trending topics on Twitter, while news, sports, and entertainment, the topics most desirable for marketers, have seen a decline in popularity.

The FTC and EU Regulators

While Elon Musk hurries to roll out new features, he is currently ignoring the FTC, with which Twitter has a rather troubled history. In 2011, after a pair of data breaches, the company signed a consent decree, pledging to better protect user data, and agreeing to submit regular reports to the FTC about its privacy practices. The FTC reported that it’s closely following the developments at Twitter with great concern, and is ready to enforce its rights; if Twitter doesn’t comply, the FTC could fine it for billions of dollars, in one of the worst moments for the company so far. Also, a day before the deadline to submit the report to the FTC, Twitter’s chief information security officer, chief privacy officer, and chief compliance officer quit, after clashing with Musk about the importance of being compliant with the obligations with the FTC.

In Europe, the situation is not much different: Twitter is under close monitoring from regulators, who are ready to enforce the Digital Services Act, valid from November 16. The DSA will require all Big Tech companies to have massive technical and legal compliance when it comes to user data and to adhere to even stricter rules if they exceed 45m users; Twitter will most likely fall into this category and could even represent an opportunity for Brussels to test these new regulations. As part of the new rules, if Musk doesn’t solve the fake profiles problem, regulators have the power to ask a judge to block Twitter entirely and to impose periodic fines of up to 6% of revenues.

New Features and X

Rollout of new features, such as Twitter Blue, and the more long-term vision to make Twitter a payment system, will play a key role in the company’s success. After the recent controversies, the release of Twitter Blue has been pushed to November 29, Musk said in a tweet. Musk also announced his plans for bringing payments to Twitter, including debit cards, P2P transactions, and money market accounts; the company even filed paperwork to become a financial services industry and registered as a payments processor with the US Treasury. Musk’s long term vision is to create an “everything” app, which he referred to as X, that will integrate messaging, payments, ecommerce and other capabilities, along the lines of what WeChat did in China.

Conclusion

The future of Twitter is uncertain, to say the least: in Q2 2022, the company reported an operating loss of $344m, and Musk reported on November 5 that Twitter is still losing $4m a day; given that more and more companies are pausing their spending on the platform, these losses will most likely increase exponentially in the short term. Musk will have to restructure the business completely, by significantly cutting costs and convincing millions of users to subscribe to Twitter Blue; the CEO said in an email to employees that roughly half of the revenue would have to come from subscriptions, in order to survive the upcoming economic downturn. In the short term, and until he diversifies more the revenue mix, it is crucial he convinces advertisers that the platform is safe and attractive for marketing investments.

0 Comments