If you answered no to the question above, you have not probably read our article on the Italian energy market one year ago (you can find it here, it is not everything lost yet). As some of you might remember, we suggested to go long A2A, the multi-utility of Brescia and Milan. However, which factors have contributed to a 67% rise in the stock price? Surely, the QE implemented by the ECB has had a positive impact lowering the company financing costs, but to deeply understand the catalysts of such a huge climb, it is useful to look how the utility market has started changing silently even before the financial crisis exploded. In fact, the European utilities stocks index has behaved rather unexpectedly since the end of 2007. As a matter of fact, instead of performing like a refuge stock, due to the constancy and predictability of earnings, it underperformed the total European market. It can be interpreted as change in the perception of the sector risk by the market.

First of all, both the political and regulatory uncertainty and the impossibility of those companies operating in countries affected by the sovereign debt crisis to isolate from State creditworthiness deterioration hampered the industry. However, the major threat was to the business model these companies used.

The rise of some tendencies and trends imposed a profound review and modification to very well established models that no longer meet the current necessities.

Firstly, the energy demand is increasing, but if the emerging countries and North America is booming, the OECD nations are not even closer to the pre-crisis level. In addition to that, the governments of many countries implemented legislation with the aim of reducing the energy dependency. Take, for instance, the Obama’s administration policy, which has made the US energetically independent through the important subsidies to the renewable sources in the past years or the significant discoveries of oil and gas fields by the southern Europe countries in the Mediterranean Sea, one among all, the giant offshore gas field Zohr that Eni found this summer.

Furthermore, the continue development and upgrade of technologies implemented by green companies, which are reducing the cost of production and increasing the efficiency in terms of energy consumable over energy produced, contributes to surge in appeal compared to the traditional sources. For instance, natural gas is currently traded at the lowest price since three and a half year due to the shrink in demand and the expansion of supply.

Moreover, the appearance of the so-called prosumers is a clear evidence of what stated above. Prosumers are those people who produce autonomously, for example through solar panels, enough electricity to cover their needs and, in some cases, are also able to put it on the market.

Lastly, more and more attention is devoted to the improvement of storage capacity, which still remains one of the biggest challenge to overcome.

The dynamics expressed above have had a depressive impact on the net income of those companies operating in the industry, which leaded thousands of job cut, disinvestments, abandon of researches such as that of Shell in the Artic and investments reduces to the minimum.These modifications have driven to a reallocation of the geographic focus of deals in the energy and gas market. As the chart shows, now roughly half of the deals are in a global perspective. It means that, if European companies operating in the industry want to maintain their influence and share of the market have to expand beyond national and European borders to seek growth opportunities.

Moving from from the European level to the italian market, the situation is very peculiar. The electricity consumprion, after the small recover of the biannum 2010-2011, registered the record low in 2014, -9% compared to 2008, and it is expected to improve only 4% from now to 2020. The situation for the natural gas is even worse. The graph is selfexplainatory.

Moreover, the waste treatment, due to its very high correlation with the macroeconomical scenario, follows similar pattern to those previously cited, even if the negative impact is not so drastic as it is for the electricity.

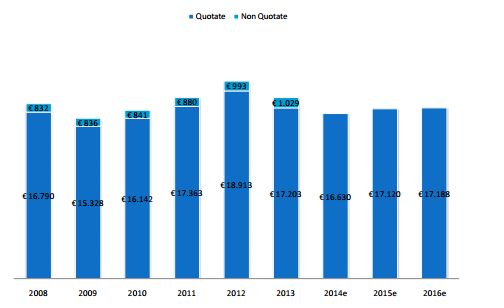

Analyzing the performance of a panel of utilities operating in Italy (A2A, Iren, Hera, Acea, LGH), the revenues grew constantly since 2010 to 2012, then thee trend stopped in 2013 registering -8.4% YoY, but now the situation is improving again as the half-year results confirmed. The expectations for the next three semesters define a stable growing pattern, even though the estimates of total revenue generated remain below the pre-crisis level.

Therefore, in order to be competitive and on the edge of the industry, three main strategic objective should be pursued:

- Optimization and efficiency maximization of existing activities;

- Adapt services to the modified needs of consumers;

- Development and innovation of old techniques.

These are the core points to strength to be competitive and appreciated by the market both in the short and long term. The following bubble chart summarize some of the projects the companies analyzed are going to implement, especially in the metropolitan area.

A2A is actually changing and developing innovative solutions, which are at the base of the huge rise in stock price. It is expanding in Montenegro where it has recently negotiated a further 5-year participation in the hydroelectricity producer company ECPG. In addition to that, in a project to increase the overall production from renewable sources, it acquired the full control of Edipower. It will generate operational synergies and implement portfolio performances. In line with that, next Monday the board of LGH decides on the merger offer presented by A2A. We are very confident of the good end of the operation, which will provide high synergies and cost reduction due to the operational area proximity. Nevertheless, A2A confirm its absolute predominance in the waste treatment and also energy innovation. Just look at these pictures and how the introduction of LED technologies changed drastically Milan.

A2A is currently traded at 1.247€, we expect a moderate growth in the medium term boosted by both the possible M&A operations in the market (very likely the wave has just begun) and the maintenance of the best practices pursuing optimization of resources and of cost efficiency.

Medium term target price: 1.40 €

[edmc id= 3100]Download as PDF[/edmc]

0 Comments