Siemens AG (ETR: SIE) – market cap as of 06/04/2018: €88.8bn

Siemens Healthineers AG (ETR: SHL) – market cap as of 06/04/2018: €33.9bn

Introduction

On March 16, 2018, the German conglomerate Siemens performed an initial public offering of its principal and second most profitable division, Healthineers, on the Frankfurt Stock Exchange. The floatation was one of Germany’s largest in recent years and values the medical firm at approximately €32bn.

The listing will help Healthineers to develop cutting-edge medical products and to achieve structural cost savings. By retaining Siemens as an active and supportive shareholder, the company will also be able to enter neighboring growth markets, including precision medicine, technology-enabled services and artificial intelligence. An adequate capital structure of 1.5x Net Debt/EBITDA and a dividend payout ratio of 50-60% will ensure operational stability and an adequate shareholder return.

About Siemens AG

Siemens is headquartered in Berlin and Munich and employs roughly 372,000 staff across the entire globe. The corporation consists of eight major divisions (Building Technologies, Digital Factory, Energy Management, Financial Services, Mobility and Power and Gas), while Siemens Healthineers and Siemens Wind Power are managed as independent businesses. Moreover, senior management identified electrification, automation and digitalization as the long-term growth segments of the firm.

Various joint ventures have helped Siemens to create continuous innovation and development. In 2014, Siemens and Accenture founded an energy-focused, technology services company named OMNETRIC Group. On the other hand, the joint venture Siemens Traction Equipment specializes in the design, development and manufacturing of AC propulsion locomotives and propulsion systems. Siemens likewise possesses 53,300 patents and invested around €4.1bn in research and development.

Siemens has historically been very active in terms of M&A activity. In 2017, it announced the acquisition of Mentor Graphics Corporation, an electronic hardware and software design solutions provider. Additionally, the firm purchased the global engineering simulation company CD-adapco for roughly $970m (c. €790m) in 2016.

In FY2017, Siemens reported total revenues of €83.05bn, which denotes a 4.3% increase compared to €79.64bn in the previous year. The company reported a net income of €6.05bn in 2017, compared to €5.45bn in 2016. Diluted earnings per share also increased from €6.65 to €7.29, while free cash flow decreased from €5.48bn to €4.77bn in the same period.

About Siemens Healthineers AG

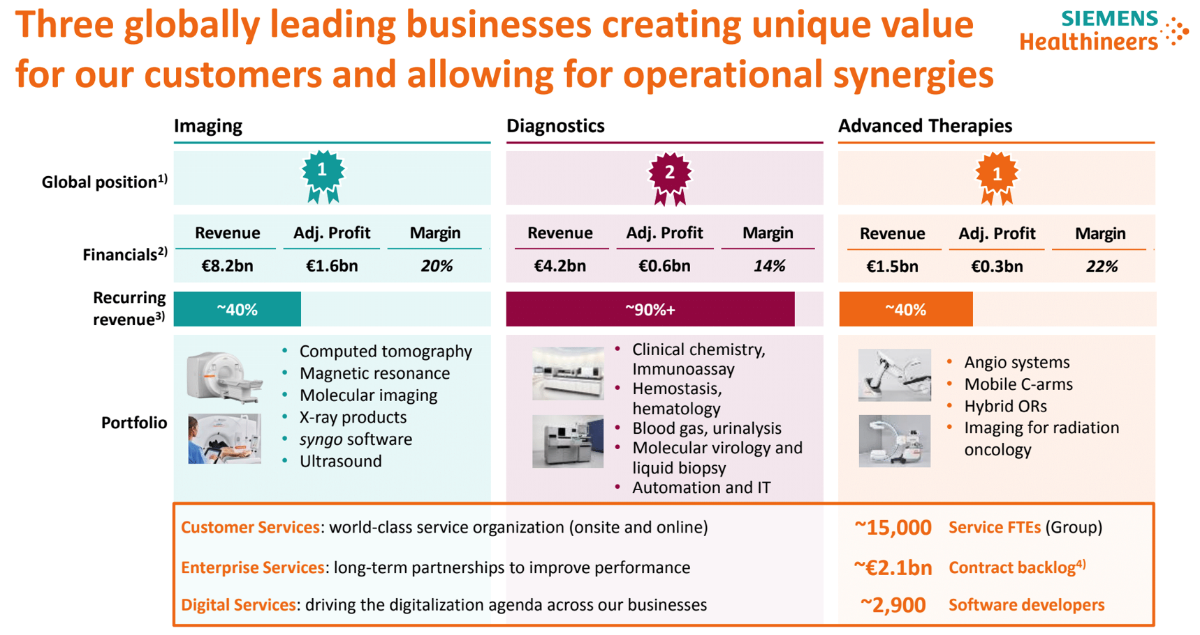

Siemens Healthineers AG is headquartered in Erlangen and employs roughly 47,000 people in 75 countries. The company primarily supplies hospitals with a broad spectrum of products, ranging from X-ray and MRI machines to lab diagnostics and robotic equipment. Siemens Healthineers has also been credited with countless transformational innovations, which led to continuous growth and value creation, as seen in the following graphic.

Source: Siemens

In recent years, Siemens significantly expanded the scope and strength of Healthineers’ operations through numerous mergers and acquisitions. In 2016, the firm purchased NEO New Oncology AG and in 2017 bought a Population Health Management business called Medicalis Corporation. According to Healthineers’ press release, it holds over 18,000 patents, provides access to care for 1.1bn people in emerging nations and 70% of acute clinical decisions are influenced by the firm’s products. In 2017, the organization spent €1.25bn on research and development.

In FY2017, Healthineers reported total revenues of €13.8bn (29% in emerging markets and 71% in advanced economies) and a free cash flow of €2.2bn, compared to €13.5bn and €2.3bn in the prior year. Net income and gross margin increased from €1.50bn and 40.4% in 2016 to €1.59bn and 41.8% in 2017 respectively. As a stand-alone company, Healthineers also expects approximately €240mil in cost savings and a revenue growth of 4-6% per annum.

Industry Overview

Globally, 2017 was the biggest year for IPOs since 2007, both in terms of size of proceeds raised (€153.88bn) and number of transactions (1,624). Out of this considerable number, 40 IPOs were performed by biotech companies which raised approximately €3.26bn compared to the €1.63bn raised in 2016. This has contributed to build up the momentum and optimism in the healthcare IPO market for 2018, where 30+ biotech IPOs are expected to take place during the year. In particular, the traditional hub of the Nasdaq, which currently includes 357 biotech companies, is expected to retain the leadership position in terms of new biotechnology listings.

As private market valuations continue to increase, the healthcare and more specifically the biotechnology industries remain very attractive investments. More confidence is also provided by the historical success of biotech IPOs both for small and large capital raises: indeed, over the past two years, the Nasdaq Biotechnology Index has been up 27.03% and, in 2018, 78% of these IPOs succeeded at being priced within or above the selected price range. One of the reasons beyond this trend could be identified in the nature of the healthcare industry itself. Indeed, as claimed by Healthineers chairman Michael Sen, over the last decades, the healthcare market has been characterized both by a “secular growth” pattern and by “tremendous changes and opportunities”. This has also been testified by a ripe environment for the 2018 1Q M&A activity in the sector, which is now being shaken even further by the public sale of Healthineers.

As opposed to most of the other industries, secular growth in the healthcare field is endless, as people’s tendency to get sick is uncorrelated with market cycles going up or down, thus ensuring a strong resilience to economic downturns. Additionally, this optimism is fueled by multiple trends such as the increasing ageing population (the generation 60+ is the fastest growing segment), the steady growing population, the increasing access to healthcare in emerging markets (such as Western China, Africa, India), as well as the surge in chronic diseases that are currently the cause of almost 75% of deaths worldwide, and the increasingly strict regulatory environment aimed at ensuring patient safety and effectiveness of devices (think about the US FDA Clearance or the EU CE Marking for which the minimum requirements needed to receive the approval for sale had been intensified).

Regarding instead the changes in the market, there are some challenges which, if not underestimated, could evolve into extremely profitable opportunities. The first among them is probably represented by a perpetual productivity challenge for the incumbents, due to the industrialization and consolidation of healthcare providers which are more and more engaging in vertical and horizontal integration, resulting in larger clinics and lab chains. This can be summarized in the so called “healthcare productivity paradox”, according to which the benefits of a decade of investments in IT systems and digitalization have not yet led to full productivity levels. Additional pressure in the global healthcare market is also due to the increasing demand for better outcomes at lower costs. Similarly, the accelerating use of data, digitalization, and AI are strongly contributing to render medicine more accessible and precise, shifting towards more medical consumerism (i.e. everybody becoming his/her own doctor), but at the same time they are increasing the risk of disappearance for traditional companies.

IPO Structure

The Initial Public Offering of Siemens Healthineers launched on March 16 on the Frankfurt Stock Exchange at €28/share (at the lower end of the €26-€31 target price range). This amounts to a total implied equity value of about €32bn.

The German conglomerate offered to the public a total of 150m shares of Healthineers, representing c. 13% of the company. Another 2% is affected by a greenshoe option, which enables the underwriters to sell further stock in case of a higher-than-expected demand or repurchase them in case of a price decline. The fully-subscribed stake totals to around €4.2bn.

Siemens decided on a somewhat long 180-day lock up period that prohibits business insiders from selling their shares for half a year from when the stock first started trading. Typically, these periods last between 90 and 180 days and are generally used to stabilize the stock price at initial launch.

IPO Rationale

The recent public sale belongs itself to the strategy of the Europe’s largest industrial conglomerate to allow Healthineers, as an independent business, to benefit from Siemens’s brand name, and to operate in a more cost-effective and efficient manner. Indeed, analysts consider this break from the parent company as an opportunity for Healthineers to cut overhead and other structural costs by more than €240m per year starting 2020, thus improving the room for incentives geared to creating shareholder value in the medium term.

The listing allowed investors seeking pure healthcare assets to invest directly in the core of the business, ranging from medical machinery sales to software and hardware solutions. Healthineers’ cornerstone business is represented by the medical technology (‘medtech’) unit, currently trying to strengthen its power in imaging equipment and to step in new development areas such as molecular diagnostics to ensure steady growth.

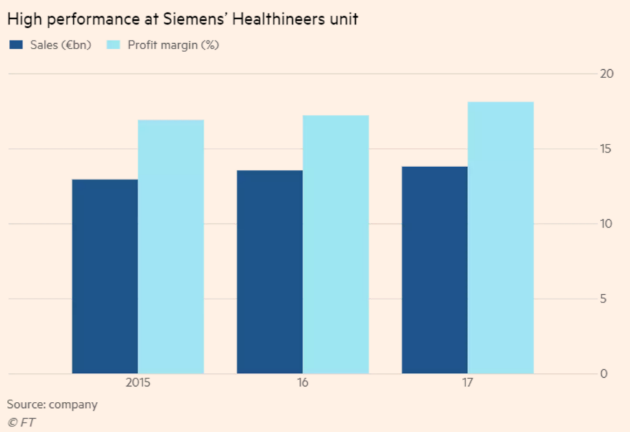

As shown in the graph below, Healthineers has always been among the strongest Siemens businesses in terms of revenues and profit margins. Its biggest markets by revenues are North America (40% of total revenues), EMEA (32%) and Asia (28%), where growth is increasingly being driven by emerging markets. By mean of the IPO, the company aims at creating a global platform for its business, in order to target new economies and enter new markets.

Source: Financial Times

As stated in its “Strategy 2025” presentation, the company is targeting a dividend payout ratio of 50% to 60% of net income. In a stable scenario, a 1.5x leverage (net debt including pensions over EBITDA) post-IPO will also provide financial flexibility to achieve the best results on the upcoming opportunities. Last but not least, the company will keep on being fully consolidated within Siemens’ financial accounts.

Siemens AG has stated that the IPO is the first step towards a new era of acquisitions, in US in particular, where more and more newborn companies and start-ups develop innovative health and diagnostic technologies and services. Analysts perceive this deal as an “ice-breaker”: several more will indeed follow, in the light of the market’s positive sentiment towards Healthineers’ listing.

A final consideration on the listing location decision must be made: Siemens decided to list Healthineers in Germany rather than in the US due to a perceived decrease in the valuation of US-listed companies in the healthcare sector throughout the last 10-15 years.

Market Reaction

The market reacted positively to the listing: with a launch price of €28/share, the stock started trading at €29.10 on March 16. By 12pm GMT, the share price was already up 7.1% with respect to its opening price at €29.98. It eventually closed up 7.9% at €30.2/share, signaling strong positive investors’ attitude towards the stock.

Financial Advisors

Goldman Sachs, Deutsche Bank and JP Morgan act as joint global coordinators and joint bookrunners together with BNP Paribas, Bank of America Merrill Lynch, Citigroup and UBS.

0 Comments