As we all know, the oil price has crumbled in recent months, touching its minimum level in many years in February 2016. This was due to several factors: slowing growth in China and general sluggish growth in the rest of the world, which have depressed demand and caused an oversupply problem. But we may say that this fall in oil prices was caused also by the Shale oil production boom, that happened in the US since the late 00’s. Now, many Shale Oil producers, which are based in the US, have seen their financial situation deteriorate rapidly.

In fact, shale oil extraction has a higher breakeven point to be profitable, as the price of oil should be about 50$ for this to happen. Most shale oil producers have been hit hard by this situation of continuously depressed prices. In the last couple of years, they have seen their profitability fall sharply, being actually very negative for the vast majority of producers.

In addition to that, due to the capital intensiveness of the business, shale oil producers have increased their leverage exponentially, with an average Debt-to-Equity ratio of 2 for the major players. (This ratio is actually higher for smaller companies). Because of this situation, the rating agency Moody’s has downgraded most shale oil producers to “below investment grade” status. Moody’s enacted its downgrade for most companies in February 2016 well after the first sharp fall in oil, since rating agencies are not very fast in changing credit status after abrupt changes in the market.

After this downgrade, most Shale companies, which financed their capex by issuing bonds, have seen their bonds entering the high yield market. How is this transition impacting the high yield bond market? Too see the impact the downgrade had on the market, we analyzed the Merrill Lynch US High Yield index, which is composed for about 10% by bonds issued by shale oil producers. The first thing we noticed, is that the index and the WTI crude oil index have started moving in similar patterns since the beginning of 2015, one year before the general downgrade by Moody’s. This is likely due to the fact that investors anticipated the downgrade by the rating agencies, having noticed the dire situation US shale oil producers are in. From the plot we can see that HY bonds’ prices have dropped at the same time as the oil price and have recovered as oil price went up in recent weeks.

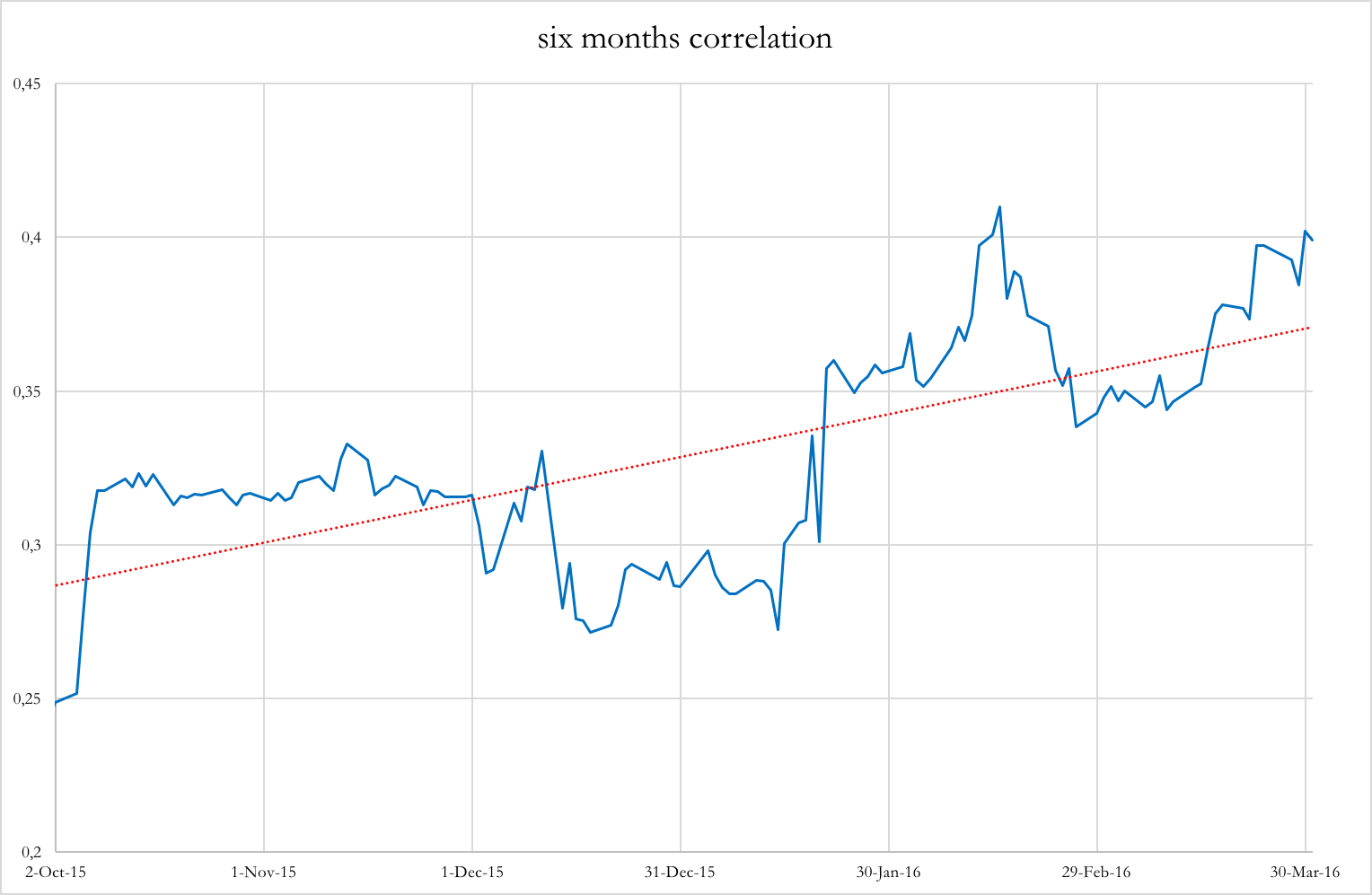

Then, we analyzed the 1, 3 and 6-month correlation between returns generated by both indexes. Although the former two correlations are quite volatile, there is a clear spike at the end of 2015, where the correlation between the indexes reached almost a value of 0.5.

This is quite interesting, as we can deduce that there exists a positive relation between the indexes, especially since shale oil companies represent not so big a portion of the Merrill Lynch index. A possible explanation is that many other companies whose business area is closely related to oil production, such as airlines, utilities and other commodity producers, are included in the index. Source: Bloomberg, BSIC

Source: Bloomberg, BSIC

In addition, the 6-month correlation showed a clear upward trend, probably due to the fact that even more shale oil producers in the US, those who still have a triple B rating, have a negative outlook by rating agencies and are probably going to be downgraded quite soon. Thus, even more shale oil companies (actually the largest among them) are probably going to enter the index, adding even more weight to the total. We estimated that, if this happens, the total weight of HY bonds issued by shale producers may become as high as 17%. Source: Bloomberg, BSIC

Source: Bloomberg, BSIC

At the moment, HY bonds from shale oil companies are trading quite below par, but have seen an increase in price after the recent rally of oil. Despite the recent failure to agree on a freeze of production by the largest oil producing countries at their recent meeting in Doha, oil seems to continue its rally. The big question is: will it reach the break-even point of 50$/b? If this happens, a good strategy would be to actually buy HY bonds, which are trading at a heavy discount and profit from the rise in prices subsequent to the improving situation for the issuers. Naturally, to diversify as much as possible, an investor should buy a portfolio as similar to the index as possible. In addition, the investor could hedge this position by selling futures on oil.

[edmc id= 3816]Download as PDF[/edmc]

0 Comments