GlobalLogic – privately owned

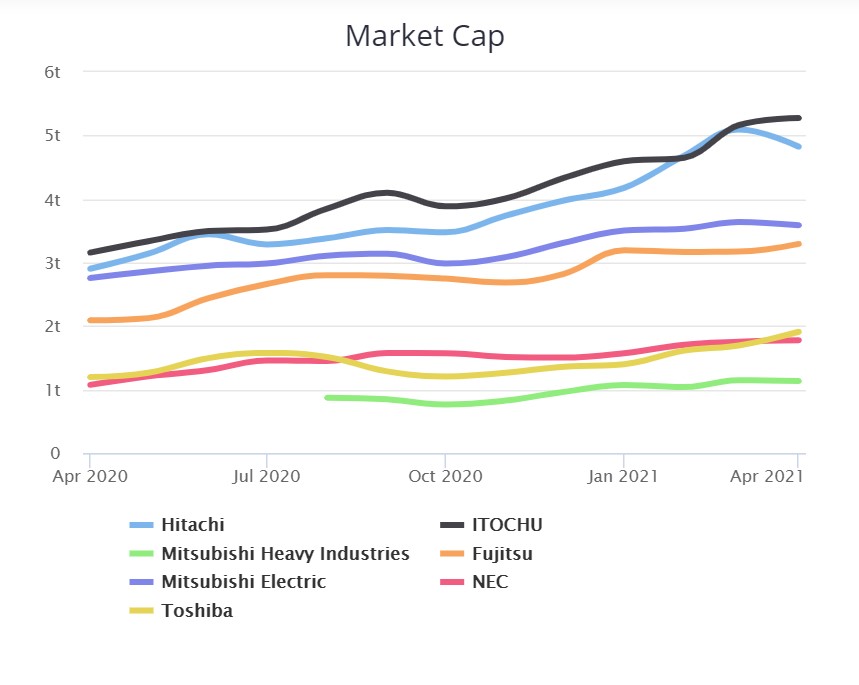

Hitachi – market cap as of 11th April: ¥4.97tn

Introduction

On March 31st 2021, Hitachi announced its agreement to acquire GlobalLogic, a Silicon Valley-based software services company, for $9.4bn. This transaction values GlobalLogic at 37x forecasted 2021 adjusted EBITDA, while giving it an equity value of $8.5bn.

This acquisition marks the latest attempt by Hitachi to boost its digital and software capabilities through strategic acquisitions. The company has also been divesting from a number of its listed subsidiaries in order to simplify its business and reduce its exposure to low-margin, slow growth businesses. This is also in-line with the overarching trend in Japan, with most industrial conglomerates attempting to simplify and re-focus their businesses through divestitures and carve-outs of non-core assets. While the logic behind this transaction is sound, it remains to be seen how the integration of this acquisition fares, especially considering the very high multiple paid.

About Hitachi

Hitachi, Ltd. is a multinational Japanese conglomerate based in Tokyo, Japan. Founded in 1910 by electrical engineer Namihei Odaira, Hitachi built its reputation on the robustness, reliability and innovation of its products, which enabled it to become one of the world’s largest diversified manufacturers of industrial machinery.

Market Capitalization of Hitachi and Competitors

Source: Craft.co

The Japanese industrial giant operates in six segments (IT, energy, industry, mobility, smart life, automotive systems business) across Asia, Europe and North America, offering a highly diversified product portfolio that spans from construction machinery to information and telecommunication systems.

The company has been undergoing years of reforms in order to push into fast-growing fields and transform the Japanese conglomerate into an IT and infrastructure specialist. Hitachi’s strategy has two main prongs: the acquisition of companies with software or digital capabilities, and the sales of listed subsidiaries in traditional low margin, capital intensive businesses. For example, in line with previous pioneering investments in futuristic industries, in July 2020 Hitachi completed a $6.8bn acquisition of Swiss ABB’s power grid division to tackle the rise of renewables and distributed energy. Furthermore, Hitachi has been significantly investing in services to help other companies modernize and digitalize manufacturing through its advanced IoT platform Lumada. On the divestment side, the Tokyo-based firm withdrew from a $26bn U.K. power project in September and disposed of some of its hardware and industrial businesses viewed as slow-growth, including Hitachi Chemicals. It is also currently in the process of weighing bids for its Metals unit, which manufactures industrial and automotive components, and is considering further divestitures of its construction business.

Annual revenues for the fiscal year ended March 31, 2020 amounted to $81.15bn (¥8,767.3bn), slightly down from the reported consolidated revenues of FY2018 which amounted to $87.75bn (¥9,480.6bn). Moreover, net income dropped from ¥222.5bn to ¥87.6bn causing a steep fall in the Japanese firm EPS from ¥230.47 to ¥90.71 over the same period.

About GlobalLogic

GlobalLogic is a leading digital engineering services company which offers digital transformation solutions and software engineering services. Headquartered in San Jose, California, and with over 20,000 professionals across 14 countries, GlobalLogic integrates “chip to cloud” software product engineering technology with vertical industry expertise. This allows it to help its clients design and build cutting-edge software, platforms and digital solutions, with the goal of maximizing their performance and efficiency along with developing new sources of revenue.

GlobalLogic’s origins can be traced back to Induslogic, which was founded in 2000 as a provider of outsourced software and product development services. In 2006 Induslogic merged with Bonus Technology, a New Jersey-based software engineering services company, creating the first truly global outsourced product developer at the time: GlobalLogic. Backed by a Series B funding round of $12.5m, the Silicon Valley-based company then acquired Lambent Technology, an offshore software development firm headquartered in Nagpur, India, and embarked on a series of growth-oriented acquisitions and ownership transitions involving several private equity firms and private investors. Key investors include Apax Partners, Canada Pension Plan Investment Board and Partners Group, the latter two owning 45% each of GlobalLogic. The company now serves over 400 firms across key industries including healthcare, communications, consumer and retail, financial services, manufacturing and automotive. Some of its high-profile clients include Volvo, McDonald’s, Samsung and HP.

In the fiscal year ended in March 2020, GlobalLogic reported over $771.1m of revenues, rising by 20% from FY2018, and $179.5m of adjusted EBITDA, representing an EBITDA growth of 23% from the previous year. The estimated annual revenues for the fiscal year ending in March 2021 are approximately $850m, as demand for digital transformation services significantly accelerated during Covid-19.

Industry Overview

Digital transformation has become increasingly a priority for organizations everywhere and the pandemic has catalyzed the demand’s expansion for new data-driven business models. Indeed, Digital transformation (DX) investment is growing at an accelerated pace globally. The International Data Corporation forecasts that, despite a global pandemic, direct digital transformation investment is still growing at a compound annual growth rate (CAGR) of 15.5% from 2020 to 2023 and is expected to approach $6.8trn as companies build on existing strategies and investments. Moreover, it is predicted 65% of global GDP will be digitalized by 2022 driven by products and services from digitally transformed enterprises. However, many organizations lack the knowledge and experience to develop new digital platforms and they are also short of talent able to design new interaction models and digital experiences, such as new digital ways of shopping or new models for delivering and receiving healthcare. Companies as GlobalLogic are growingly filling this void, making them extremely attractive to traditional engineering services companies.

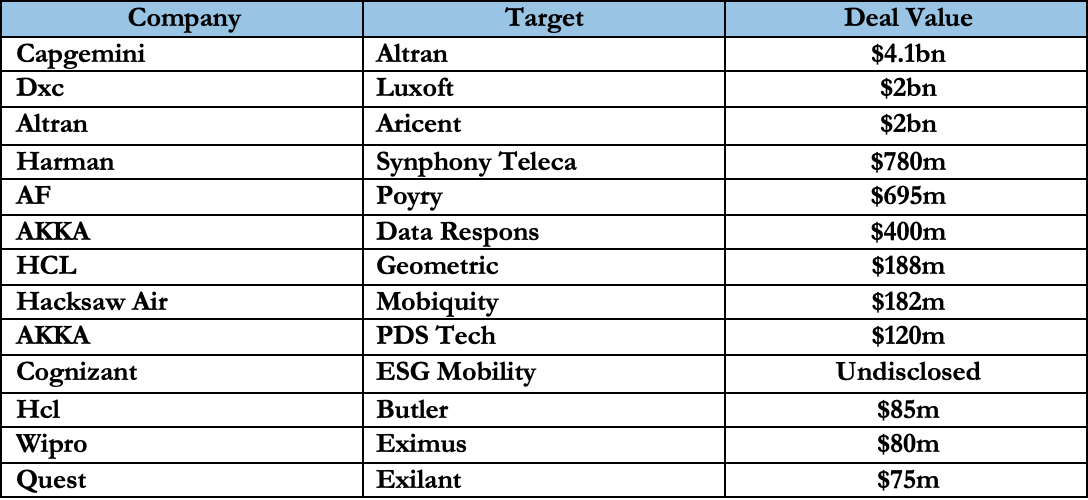

Hitachi’s acquisition of GlobalLogic is one of the biggest acquisitions in the product engineering services space. The engineering services space has been seeing significant M&A activity during the last few years. Looking at the table down below, the biggest deals in the sector have been Capgemini’s $4.1bn acquisition of Altran in 2019, and DXC’s $2bn acquisition of Luxoft in the same year.

The Hitachi-GlobalLogic deal is also a part of a wave of M&A and Restructuring operations to transition the enormously diversified Japanese conglomerates into their specialist core businesses.

Since the introduction of Japan’s corporate governance code in 2015, Hitachi has been one of the first Japanese traditional conglomerate giants to liquidate non-core businesses (especially to PE funds) and reduce its number of listed subsidiaries, in order to become an IT and infrastructure specialist.

Deal Structure

Hitachi and GlobalLogic have agreed on an equity value of $8.5bn and an enterprise value of $9.5bn, at 37 times this year’s forecasted adjusted EBITDA, with an EV/Revenue multiple of 7.9x. Hitachi is planning to fund the transaction through cash and bank loans.

Hitachi will acquire GlobalLogic through the “reverse triangular merger method”: in other words, SPC (a subsidiary established by Hitachi for the purpose of the acquisition) will be merged with and into GlobalLogic. Once the companies are merged, Hitachi or SPC will provide cash to the shareholders of GlobalLogic after which all the outstanding shares of GlobalLogic will be cancelled. All the shares of SPC held by Hitachi will be converted to common shares of GlobalLogic, the surviving company.

A reverse triangular merger is more easily accomplished than a direct merger because the subsidiary has only one shareholder—the acquiring company—and the acquiring company may obtain control of the target’s nontransferable assets and contracts. In this way, Hitachi will acquire 100% of the outstanding shares of GlobalLogic and the latter will become wholly owned subsidiary of Hitachi.

The deal is expected to close by the end of July 2021 and is subject to customary conditions and regulatory approvals.

Deal Rationale

Hitachi’s acquisition of GlobalLogic will help accelerate the 110-year-old Japanese industrial heavyweight’s mission to transform itself into a global leader in digital services. The acquisition of GlobalLogic is part of Hitachi’s 2021 mid-term plan, which involves a commitment to invest $9 billion to strengthen the digital capabilities of the company’s various businesses including IT, energy, industry and mobility.

This deal follows a recurring theme of hardware companies reforming themselves as enterprising software firms. For example, in 2018 chip maker BroadcomInc bought enterprise software company CA technologies for $18.9 billion. Hardware is characterised as a highly capital-intensive, low-margin business with low growth. In contrast, software development businesses are seen as a good entry point into a wide range of high growth sectors including autonomous vehicles and mobile devices. Demand for data-driven business models has risen even further as a result of the pandemic as companies with strong foundations in digital services and data analytics were able to leverage these competencies to gain a competitive advantage in a year where global supply chains were upended, and customer interaction went virtual. Hitachi identified that it did not possess the necessary capabilities to undergo a digital transformation on its own and like many other established companies looked elsewhere to find a partner to help propel its mission forward. Although Hitachi continues to be a primarily industrial products-focused company, this deal is just a part of their ongoing business overhaul as the company has also recently sold off other hardware and industrial businesses viewed as slow-growth, such as its power-tool and chemical businesses.

Hitachi hopes to take advantage of GlobalLogic’s strong digital engineering capabilities as well as their established design skills and vertical industry expertise in order to develop software for new products and digital experiences. CEO of Hitachi, Toshiaki Higashihara, said “the synergy of GlobalLogic’s leading experience design and innovation with Hitachi’s expertise in IT, operational technology, and products, will help us realise our goal to be the leading digital transformation innovator in social infrastructure worldwide.” Hitachi sees a potential to create synergies in the automotive systems business, in particular, as this is the industrial sector in which the two companies experience significant overlap; Hitachi automates plant machinery and GlobalLogic helps digitize cars.

Hitachi hopes the acquisition will strengthen the digital portfolio of Lumada and propel its global expansion plans forward. Lumada forms Hitachi’s advanced digital solutions and services business which focusses on creating value from customer data and accelerating digital solutions. Lumada derives about 70% of its revenue from Japan while over half of GlobalLogic’s clients are in the US and around one-third in Europe – this will contribute to an international push for the company. Hitachi’s head of services and platforms, Toshiaki Tokunaga, said at the deal announcement that GlobalLogic’s global reach with over 20000 employees in India, Europe and the US could result in the Lumada business getting more than half its revenue outside Japan.

Market Reaction

Nikkei leaked the acquisition on March 31st during market hours, leading to Hitachi trading down 7.3% that same day – the sharpest daily fall in more than a year. Hitachi then confirmed the acquisition after the market closed. There was a brief rally when trading resumed the following day with Hitachi up 2.5%, but this seems to have been just a temporary relief after the 7.3% decline the previous day. Investors were likely uncomfortable with the multiple being paid and the need to realise significant synergies.

Advisors

Credit Suisse advised Hitachi while Goldman Sachs and JP Morgan advised GlobalLogic.

0 Comments