Internet domains are an important alternative asset class in the web industry: lots of companies and investors use them for speculative reasons (a good domain name could be sold for million) or in order to avoid domain “hijacking” from competitors (although the trademark legislation covers also domain names). The valuation of domains requires some introductive concepts that are not interesting for what we are going to consider, but what it is relevant for us is that one of the main drivers of domain investing is the advertising revenue: beside the capital gain generated buying (or registering) and then selling a domain, particularly marketable keywords (i.e. sex.com) or wrong spelled names (mortage.com), and the subsequently huge daily amount of visits they collect, can generate relevant advertising revenue.

This is why the Internet Domain Index (IDNX), created by a MIT researcher, Thies Lindenthal, and featured on Bloomberg and Reuters Eikon, presents a great correlation with the internet advertising revenue, measured by the Internet Advertising Revenue Report (IAB) conducted by PricewaterhouseCoopers (PwC). In particular, Internet domains represent a sort of “manufacturing” indicator of the internet economy: prices rise as advertising revenue goes up, at least as long as domains (and websites) are the main source of advertising opportunities.

What happened after the birth of smartphones? Domains continued to catch only the “desktop sector” of internet advertising but started to trail the internet advertising economy as a whole; while tech companies, and in particular big companies (although they may be relatively new) benefited from the boom of applications and mobile advertising platforms.

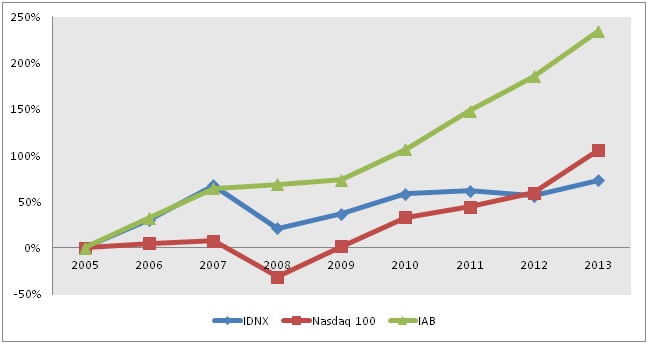

A single chart will explain this trend:

From 2005 to 2008 the IDNX was highly correlated with the IAB and outperformed the Nasdaq 100; after 2008 and in particular since 2010 the IAB has had a great boost (fueled by the three-digit growth of mobile advertising revenue), caught in part by the Nasdaq (that in particular had a great 2013), while IDNX suffered a steady growth and did not reached the 2007-highs.

As pointed out in the PwC report, mobile advertising is growing fast and will become more important than the “desktop advertising” in few years; Internet domains will not be able to follow this boost and maybe could switch from the speculative grade to a conservative investment in the internet economy, less correlated with the bubbling mobile market (and relative stocks). But it seems they won’t be able to outperform the Nasdaq anymore, as companies have soon realized that mobile is the place to be.

For now, domains can explain why Twitter in the IPO filings underlined its mobile nature and Mark Zuckerberg defined Facebook a “mobile company” a year before it was truly making most of its revenue on mobile: paraphrasing disrespectfully the title of a comedy written by Oscar Wilde, this could be defined “the importance of being mobile”.

[edmc id=1788]Download as pdf[/edmc]

0 Comments