Following the article from last week, we now investigate the Inflation Risk Premium. We start by introducing the role inflation plays in monetary policy decisions and what are the mechanics of the Inflation Risk Premium, which is one of the most important drivers of market-based inflation rate. Then we analyse how the changes in the general macroeconomic environment affected the Inflation Risk Premium.

Inflation Expectations and Monetary Policy

Much of central banks’ credibility derives from their ability to control price levels. To this purpose, major central banks around the world have the mandate to target a fixed level of inflation over a medium to long-term horizon. Under this constraint, central banks set nominal rates to meet their target inflation rate and to influence the economic activity.

According to the economic theory, it is generally assumed that agents and investors care about the real return they get from their investment decisions. Indeed, the real rate of returns, which is described by the Fisher equation, is:

![]()

Since it is impossible to observe realised inflation ex-ante, agents base their decisions on expected inflation. Therefore, central banks incorporate expected inflation within their monetary policy decision.

There are various measures of inflation expectations (market-based, surveys of professional forecasters, households’ expectations, etc.). As mentioned in the previous article, the breakeven rates for Inflation-Linked Bonds and Inflation Swaps may diverge from the true value of market-based expected inflation. Among other factors, a key driver of the difference is the Inflation Risk Premium (IRP), which plays a major role in the determination of market-based inflation rates.

Inflation Risk Premium

The Inflation Risk Premium (IRP) is usually defined as the compensation demanded by investors to hold financial assets which are subject to inflation risks. In other words, it is the extra return demanded by an investor who accepts to bear inflation risk.

Mathematically, Camba-Mendez and Werner (2017) define the inflation risk premium as:

![]()

where M is the stochastic discount factor (the rate at which the investor is willing to substitute consumption today for consumption tomorrow). Indeed, there is no mathematical constraint about the possible negative sign of the IRP, as it depends on the covariance term of the expression.

Empirically, the IRP can be expressed as the difference between the ILS rate and the expected inflation rate.

In an environment where there is the risk of higher than expected inflation, the risk bearer will demand extra compensation, thus driving up the ILS rate by more than the actual expected value of inflation. Conversely, if the market is concerned that deflationary pressures are mounting and that there is a significant probability of having lower than expected inflation, then investors are concerned that inflation will be below the expected level, thus compressing the IRP.

Different variables can affect the IRP (liquidity, inflation uncertainty, etc.). What in reality seems to be the main determinant of the IRP is the balance of inflation rather than inflation volatility. In other words, IRP tends to be driven by the level of inflation, instead of its volatility. As said before, if deflation fears increase, or the risk of inflation being higher than the target declines, the inflation risk premium declines.

One remark needs to be done. Declining inflation risk premium cannot be equated to declining inflation uncertainty and vice versa. Nor it can be seen as a purely positive thing, especially in the case of rising deflation fears, as markets anticipate disappointing inflation data caused by ineffective monetary policy. Indeed, inflation volatility seems to be a less important driver of IRP with respect to the balance of inflation risk. In other words, what is relevant is not the standard deviation of inflation but the shape of the inflation distribution. This implies that a low, or even negative, inflation risk premium is primarily associated with strong deflation risk rather than with low inflation uncertainty.

What changed

In the post-recessionary environment, major central banks around the world resorted to ultra-expansionary monetary policy, as well as non-conventional measures to contrast the economic crisis. Despite this massive injection of liquidity in the system, central banks have experienced difficulties in attaining their target inflation level for extended periods of time. Therefore, markets are now much more sceptical about central banks’ ability to achieve their inflation goals.

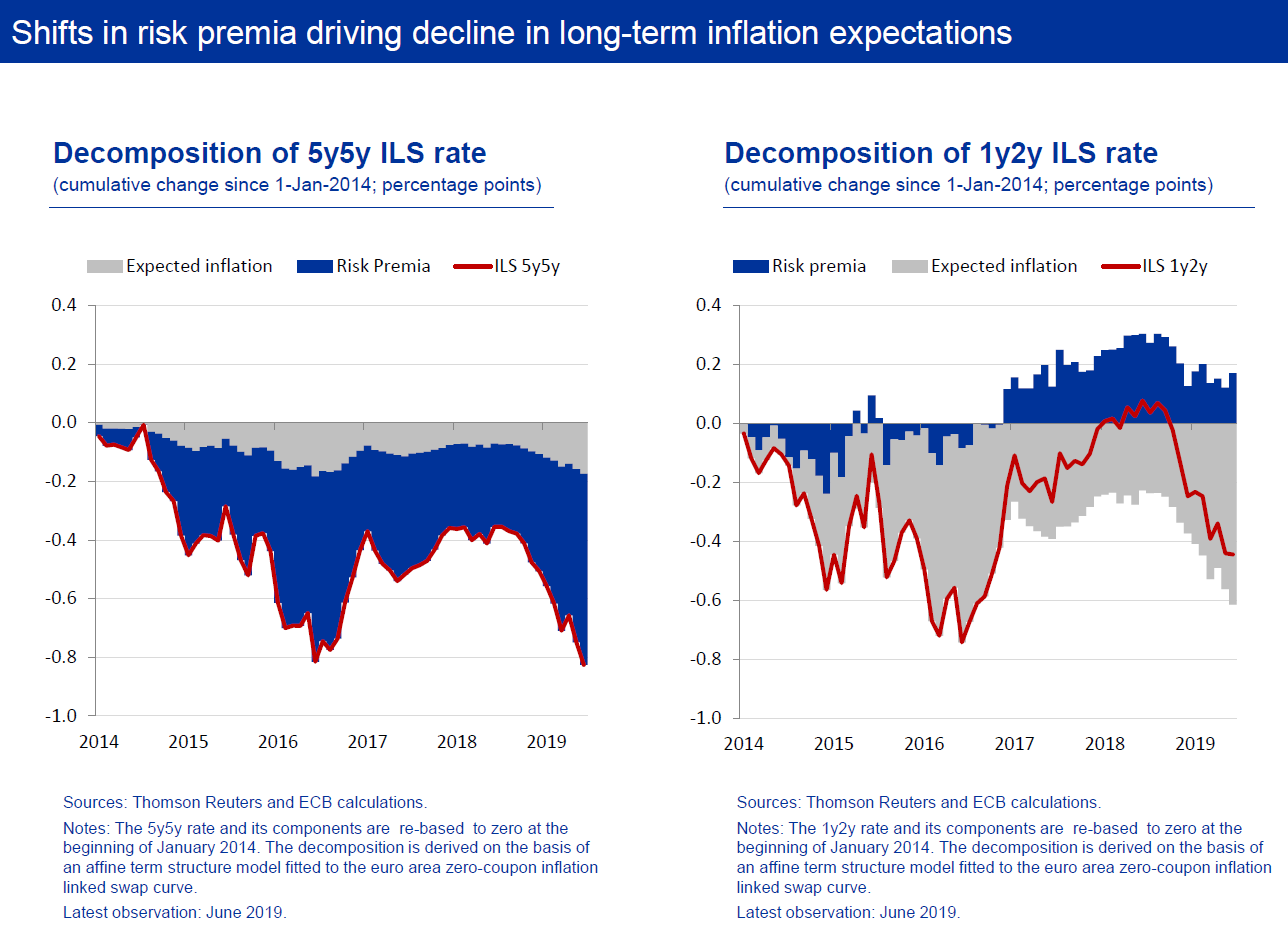

A clear example of that is the euro area. The sequence of below-target inflation data releases since the Great Recession may have ignited market participants with doubts about the central bank’s ability to meet its target, thus bringing down the IRP.

Source: “Inflation expectations and the conduct of monetary policy”, Benoît Cœuré, July 2019

Indeed, most of the drop in the ILS rate has been due to a drop in the IRP. One major reason can be that in the post-recessionary period there has been a radical change in the nature of the IRP. Particularly, the Inflation Risk Premium may have become a Deflation Risk Premium. Hence, markets have tilted towards weighting more deflation risk instead of higher than expected inflation risk or inflation volatility.

The reasons underlying this persistent inflation undershooting are diverse and not so clear. The severity of the Great Recession has played a role in the aftermath of the crisis. However, this may have not been the sole cause. Some economists are questioning the empirical evidence of the Phillips Curve, the inverse relationship between unemployment and prices which historically has been instrumental to take monetary policy decisions. To this purpose, the US did not experience out of target inflationary processes despite incredibly low unemployment rate.

Other causes may have played a role. The drop in global commodities prices roughly 5 years ago might have played a role, as these translated in lower inputs of productions.

On the other hand, the so-called “Amazon effect” has radically changed the competition in the retail sector. Similarly, the exponential growth in technological capabilities generated disinflationary pressure and influenced price indices.

Source: S&P World Commodity Index

Overall, the reasons behind these changes in inflation are diverse and go beyond the ones we listed here, but certainly, they will continue to be at the centre of the economic discussion.

Conclusion

As the ECB Executive Board member Benoît Cœuré pointed out, stable inflation expectations helped to curb harmful macroeconomic volatility. However, persistently low inflation led to questioning central banks’ ability to deliver on their mandate, which may have been constrained by the Zero Lower Bound.

Despite a consistent drop in market-based inflation expectations, other agents of the wider economy do not seem to have become so bearish on inflation expectations. To this purpose, it is interesting that market-based inflation expectations, once corrected for IRP, resemble the ones of professional forecasters and are more aligned with ECB targets. Nonetheless, low inflation rates may cast scepticism on the future of the euro area economic activity and influencing the transmission mechanism of monetary policy.

Something beyond the scope of this article but of tremendous interest is the point highlighted by some observers about a change in the nature of bonds, which as a consequence of the aforementioned changes in inflation may have switched from being “inflation bets” to “deflation hedges”.

The issue of inflation is not limited to IRP. Nonetheless, this risk measure can convey important information to central banks about market perceptions of deflation risk, thus helping them in contrasting this issue.

0 Comments