Introduction

Industrial metals were in the news in the past few weeks because of the remarkable surge in prices. Copper has received most of the attention, with its spot price topping 10,000$/metric ton on April 29, close to the all-time high of 10,190$/metric ton reached in February 2011. Aluminum also climbed, reaching 2445$/metric ton, but remaining far from its historical high of 3065$/metric ton in June 2008, alongside Nickel, which jumped to 17653$/metric ton. Iron ore fell drastically on April 30, losing 4.87% of its value in just one day on worries that Chinese authorities might implement price control policies, after the China Iron and Steel Association stated the price of the metal was unreasonably high.

Source: Bloomberg

The climb in prices was driven to a large extent by bullish market sentiment. Industrial commodities are economic bellwethers and rebounding global growth has pushed investors to seek returns in the metals space. Oil was up as well, with Brent futures touching 69$/barrel after OPEC announced they have revised upwards their demand forecast for the year. Brent futures retreated on April 29 on fears that Indian demand comeback might be slowed by the worsening of the pandemic situation, with daily infections marking a global record at 400,000. But the signal is clear: there is enthusiasm in the air for the go-to cyclical gauges of economic recovery.

The optimism and the growth scenario undergirding it led global investment bank Goldman Sachs to raise its forecast for the price of copper to $11,000 over the next 12 months and $15,000 by 2025. For the metal, that would represent a new record. For investors, it would grant remarkable returns. All this hype begs the question: are you worried about missing out on the recovery-driven bull market in commodities? We at BSIC have got you covered. In this article we provide a guide on investing in industrial metals, often referred to as base metals, alongside our outlook and a trade idea involving copper and cobalt.

An introduction to industrial metals

Metals are generally grouped into four major categories: base (or industrial) metals, which include aluminum, copper, iron, lead, nickel, and zinc; precious metals, primarily gold, silver, and platinum; nuclear energy metals, namely uranium, thorium, and plutonium; and the rest, which are referred to as specialty metals.

Another important classification is by level of scarcity. Rare metals are found in smaller quantities in the earth’s crust. More precisely, their concentration is between 1 and 1000 ppm. lead, copper, zinc, nickel, and cobalt are examples of rare metals. Gold, silver, and platinum are considered extremely rare (concentration<1 ppm). Abundant metals, on the other hand, include silicon, iron, and aluminum.

The strongest-performing metal in April 2021 was copper. As the old saying goes, “Dr Copper has a PhD in Economics”, namely, copper is a good gauge of the macroeconomy, because of its large use in industrial activity. Another factor turning the attention to copper is its potential scarcity. Most research previously indicated lithium ores to be closest to full depletion, but recent studies have shifted the focus onto copper, suggesting that 90% of the currently known mines might be depleted by 2050. Copper is primarily produced in Chile (25% of global production) and Peru (12%). While production is a not highly concentrated, copper consumption is, with China representing 51% of global copper demand. China is also a big player in the copper refining segment of the market, accounting for about 39% of refined copper production globally in 2018.

Cobalt is used in the construction of aircraft engines and batteries and to impart blue and green color to ceramics. Its production is extremely concentrated in the Democratic Republic of Congo, which accounted for around 70% of global output in 2019. The political instability of the country explains why the metal is considered to have a high level of geological criticality.

Lithium is employed primarily in rechargeable batteries for any mobile device and in alloys with magnesium and aluminum used in aircrafts and high-speed trains. Lithium’s geological criticality is low, and almost three quarters of known resources are expected to still be available in 2050.

Nickel, like most of the other metals previously mentioned, is valued for its resistance to corrosion and is thus used to plate other metals to protect them. Moreover, it is used in batteries, coins and as a catalyst for hydrogenating oils. It is regarded as moderately critical in terms of geological availability.

Outlook on industrial metals

1.Global growth

Starting from April 2020, the prices of base metals spiked, primarily driven by the rebound of industrial production in China, the world’s largest consumer of base metals. Reports indicate that Chinese production is very strong, in fact, the strongest since 2011. China’s GDP is forecast to grow by about 8% in 2021. We expect this to exert a significant upward pressure to industrial metal prices, supported by the economic recovery worldwide and the vaccine rollout, which is finally accelerating in the EU as well.

2.EV penetration

Industrial metals have a notable application is in electric vehicles (EV) and their components. Lithium, nickel, and cobalt to a lesser extent, are paramount for battery technologies. In particular, the component in the battery where the energy is stored is fabricated with nickel, making the metal crucial for battery production. The more nickel is used, the higher the energy density and the longer distances the vehicle can travel. Copper is obviously crucial for the wiring. A common misconception is that low-carbon technologies for transportation, electricity production, storage, and connectivity consume fewer amounts of the metals we described above. In fact, the opposite is true.

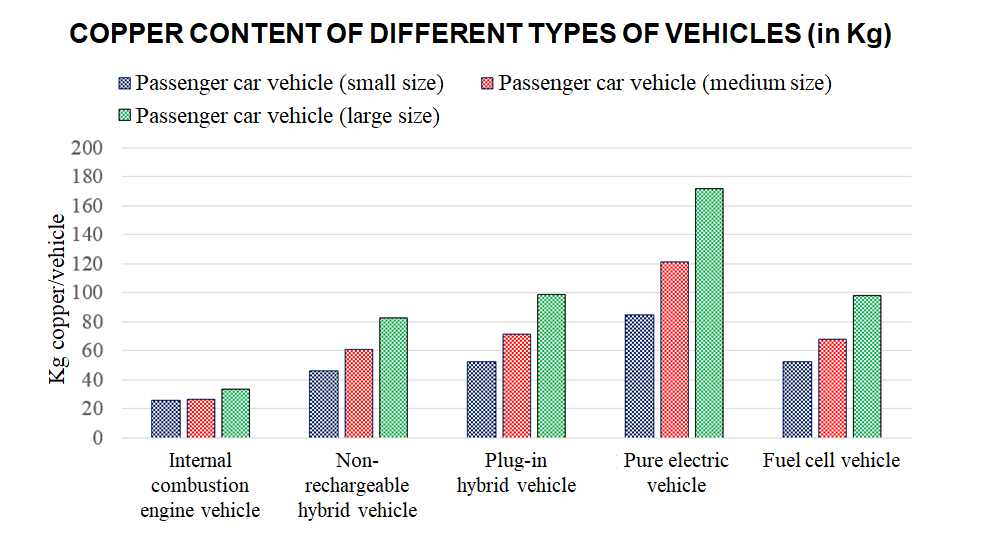

Source: French Institute of Petroleum

The data speaks clearly. 20 kg of copper are needed to manufacture medium-sized internal combustion cars, 60 kg to 70 kg for a hybrid vehicle of the same size and 120 kg for a purely electric vehicle. In other words, EVs take around 6 times the amount of copper that internal combustion vehicles take to be produced. Not to mention, copper will also be needed to build charging ports. These elements point to a significant increase in demand as EV penetration increases, leading to higher copper prices. But copper is not the only player in town. Bloomberg estimates that by 2030 demand for nickel and aluminum will increase 14x, for iron 13x and for lithium 9x.

Source: Bloomberg

3.Infrastructure plan and massive fiscal stimulus

In March, US President Joe Biden announced that his administration would be pursuing a $2 trillion infrastructure plan aimed at rebuilding America’s roads and bridges, making progress towards the energy transition, and modernizing the country’s industrial sector. The plan will take eight years to complete, and $200 billion will be put in road and rail projects, causing demand for steel products to soar. The American Iron & Steel Institute estimates that for every $1 billion of infrastructure spending, 50,000 tons of steel demand are created.

Biden’s plan, alongside similar ones in the EU under the Recovery Plan, is extremely bullish for commodities and industrial metals specifically. Governments are devoting an unprecedented amount of public funds to projects whose realization depends directly on the use of base metals, thus we expect demand to skyrocket in the upcoming months. A strong correlation is registered between the Capex share of GDP and the prices of base metals, and the policies we mentioned are about to drive a Capex boom.

4. Weak dollar and low interest rates

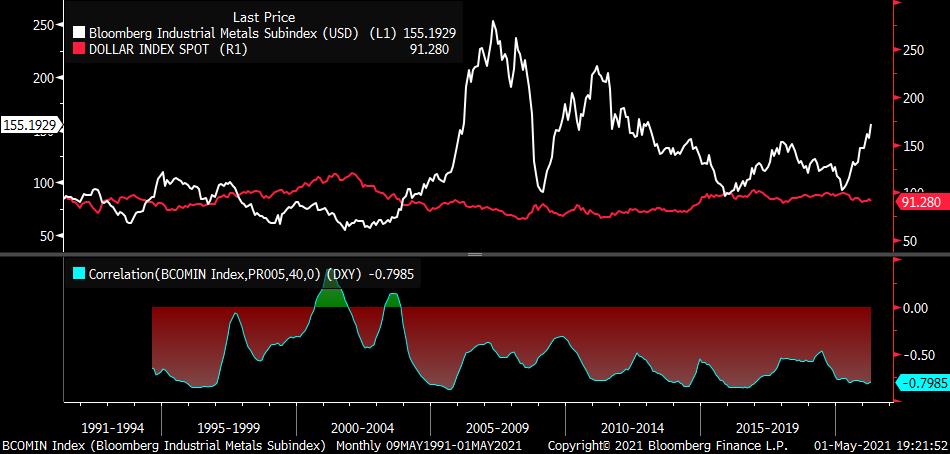

The dollar has been relatively weak especially compared to the euro and, more importantly, the yuan. A weak dollar is a strong incentive to buy commodities denominated in USD (i.e., almost all of them) as they become cheaper. That relation is so strong that it translates into a negative correlation of -80% between the Bloomberg Industrial Metal Index and the Dollar Index (see chart below). Now, the dollar is expected to remain structurally weak until rates start significantly increasing in the US. That is not a scenario we expect to materialize before the second half of 2022, giving ample room for commodity buyers to benefit from the currency depreciation, thus driving prices up.

Source: Bloomberg

5. Supply issues

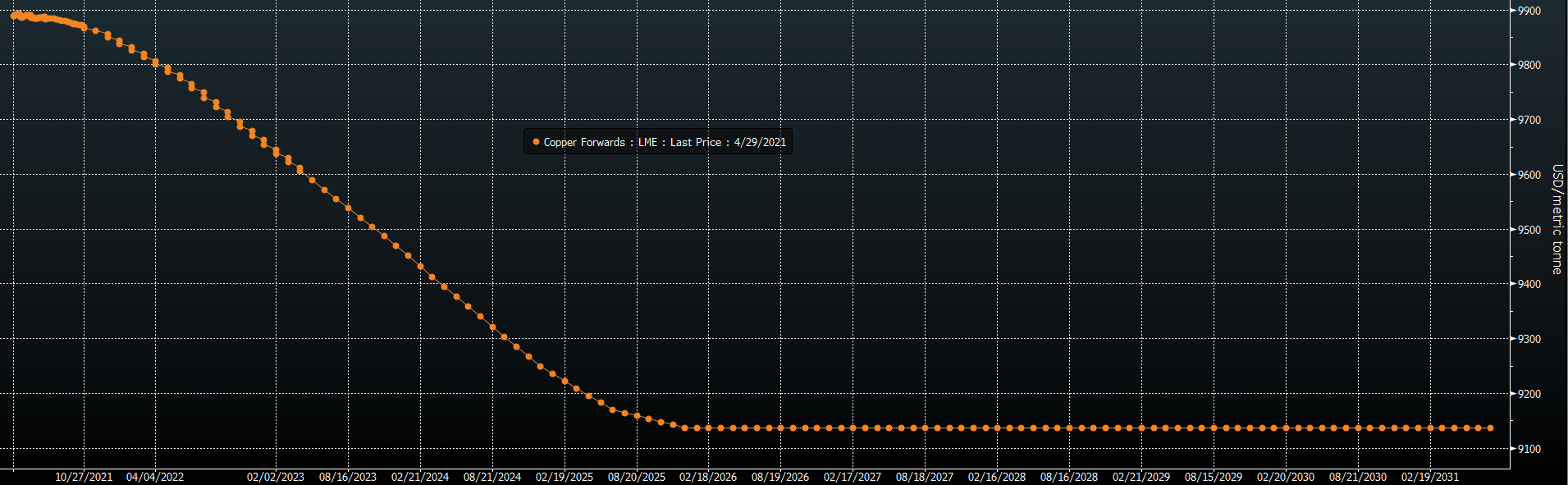

Across the industrial metals space, even for resources that are not geologically critical, supply issues have been registered. Firstly, the Covid pandemic caused a disruption in global production. As the chart below shows, the copper market is currently in severe backwardation, with a negative 5 year spread of almost 800$/metric ton. Backwardation is a signal that current demand is outstripping supply, driving the spot price above futures quotes.

Source: Bloomberg

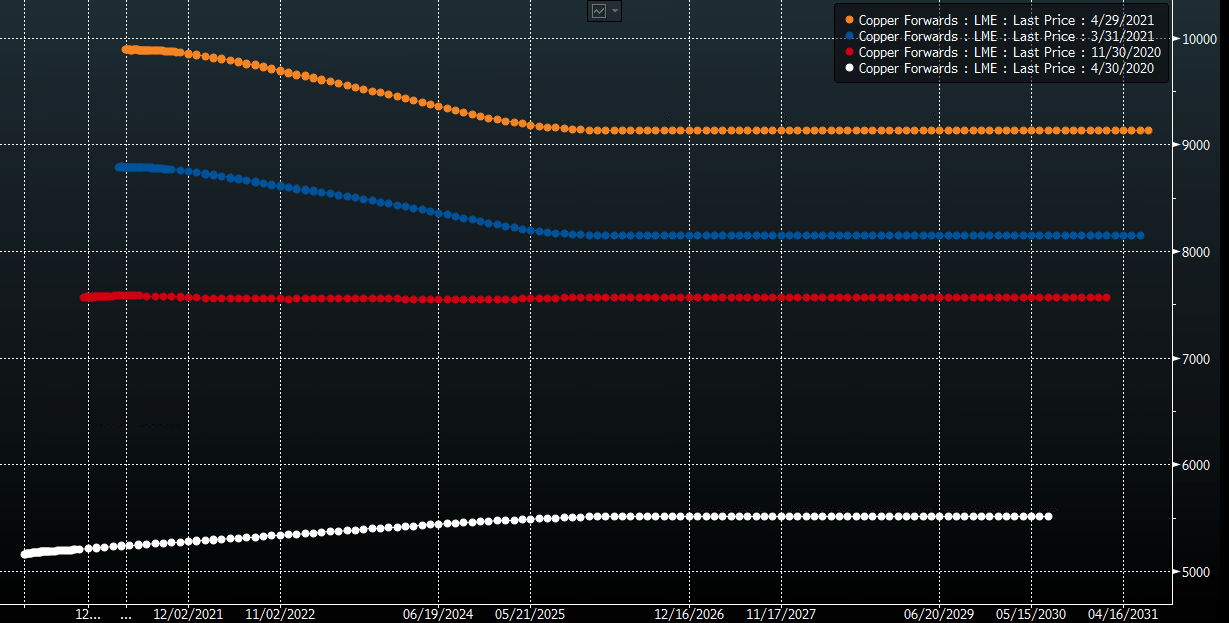

Moreover, we can see from the next chart that the copper forward curve has been rather quickly moving from contango to backwardation in the year since the outbreak of the pandemic, signaling a rapid reprise in demand for the commodity, as emerging market industrial production reaches pre-pandemic levels, and a less rapid comeback of supply.

Source: Bloomberg

A longer-term outlook yields similar considerations. While copper is still relatively abundant in the earth’s crust, there is scarcity in high-grade mining projects. On the one hand, many of the discoveries are located in areas lacking infrastructure, for instance Russia’s Far East. On the other hand, new mines take almost 10 years to develop. As a result, copper inventories have plunged by around 30% this year, exerting an upward pressure on prices coming from the supply side as well as the demand side.

A very different story is at play for nickel, which is forecast to be oversupplied for the upcoming years until 2024 at least, due to new projects being carried out in Africa, Canada, and Indonesia. That leads us to think that the recent jump in nickel prices was caused more by macro fundamentals than supply and demand fundamentals. A similar conclusion applies to lithium as well, since the ease with which lithium mines are brought online is expected to absorb the strong rise in demand forecast for the upcoming decade.

In conclusion, copper emerges from supply-demand analysis as a safe bet, given the current policy environment, while other metals like nickel and lithium will see supply go up alongside demand, thus eliminating most price pressures deriving from shortages.

6. Energy transition: the race to net zero

A possibly surprising finding is that fighting climate change is metal-intensive. EVs aren’t the only important destination use of industrial metals. Another notable product is fuel cells, which work like batteries but instead of needing recharging, they rely on fuel to produce electricity. Fuel can be hydrogen, which is currently the center of focus for many public and private investments and for the EU’s Green Deal, for its potential to contribute to the energy transition. Fuel cells need platinum, palladium, and rhodium to be built. Wind and solar power technologies also employ copper and silicon, among the many metals.

The next chart clearly shows that traditional sources of energy require much smaller quantities of copper compared to clean & renewable energy sources.

A drastic surge in production of solar panels, wind turbines and fuel cells is expected to take place in the decade. Moreover, the USA and EU are channeling very large sums towards energy transition projects in their stimulus plans. Overall, we see the green shift trend as one of the strongest drivers of industrial metal prices, with copper once again deserving most of the attention.

Trade Idea

Source: Bloomberg

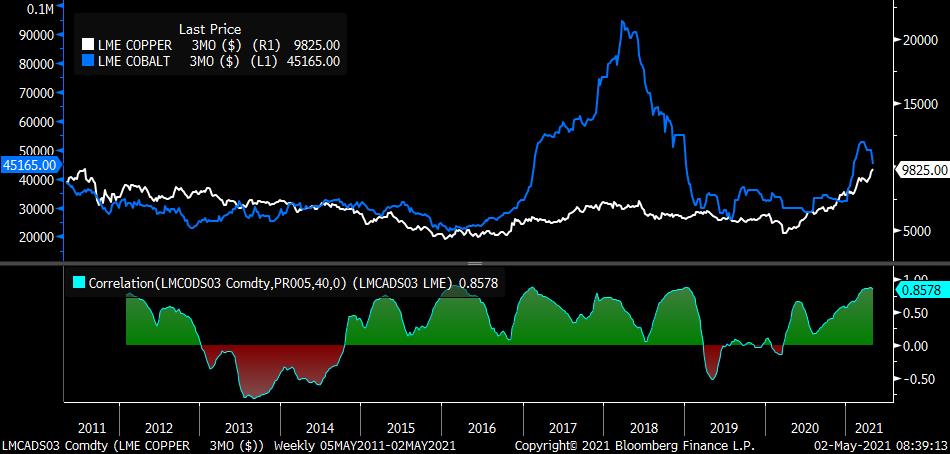

After having established that copper’s rally has legs, we now propose a trade idea undergirded by our bullish outlook on industrial metals. This is a pairs trade on copper (long) and cobalt (short).

Pairs trades are a major type of correlation trades based on the price trends between two assets being strongly tied. That is the case with copper and cobalt, as the chart above shows, since their current correlation is at a staggering 85.78%. The most relevant step in structuring a pairs trade is choosing the long leg and the short leg. The trade is meant to be market neutral, namely it should do well in any market scenario, but the long leg is in general expected to perform better than the short one, leading to a net profit form the pairs. While we have already made our case as to why we see copper prices sustainably higher going forward, a case needs to be made as to why investors should short cobalt.

Cobalt is an important metal in the production of lithium-ion batteries that are at the core of EVs and many mobile devices, but two major issues are undermining cobalt’s outlook. Firstly, the Republic Democratic of Congo has been under scrutiny after it was reported that children work in cobalt mines, causing a strong global backlash. Electric carmakers Tesla and Volkswagen have already announced that they would drastically reduce their reliance on cobalt, while BMW has stated that it will only buy the metal from Australia and Morocco.

Secondly, cobalt is not strictly necessary to make batteries or for EVs to work. Newer battery technologies don’t employ the metal. For instance, GM unveiled last year a model that reduces the use of cobalt by 70%. In China, a significant amount of the EVs in circulation already rely on batteries built with alternative metals. In conclusion, we are bearish on cobalt in the medium-to-long run for human rights and technological reasons.

Our target price for copper for Q1 of 2022 is 11,000$/metric tons, up by 1000$/mt from current levels, while we expect cobalt to start its plunge, with a target of 35,000$/mt, but with more uncertainty as to when such price will be reached, given the dependence on technology adoption. A relatively safe bet would be to buy copper futures and short cobalt futures with 1y maturity.

Clearly this trade comes with some risks. In our view, the major source of uncertainty for the bullish leg comes from the resurgence of the pandemic in India. Just a month ago, the situation seemed under control, but cases have now reached dramatic records. Industrial production is unlikely to get back to pre-Covid levels soon, but that might only cause our bullish outlook to shift a few months ahead.

0 Comments