Industry Overview

Uranium is a heavy metal that has been used as a concentrated energy source for more than 60 years. It is extracted from uranium-rich minerals, such as uraninite. Uranium ore can be mined either open-pit or underground and is then crushed and treated in a mill to extract the valuable uranium from it. The mined uranium is then processed, stored, and sold as uranium oxide concentrate (U3O8). Its radioactive properties allow it to produce massive amounts of emissions-free energy with a greater reliability than wind or solar.

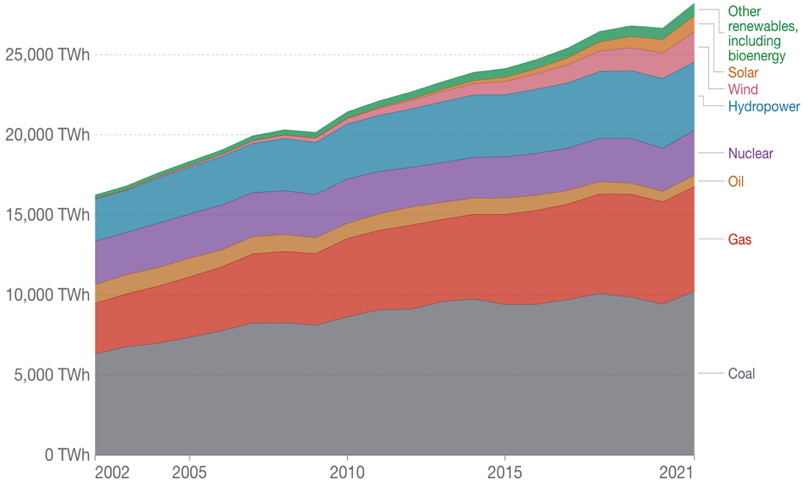

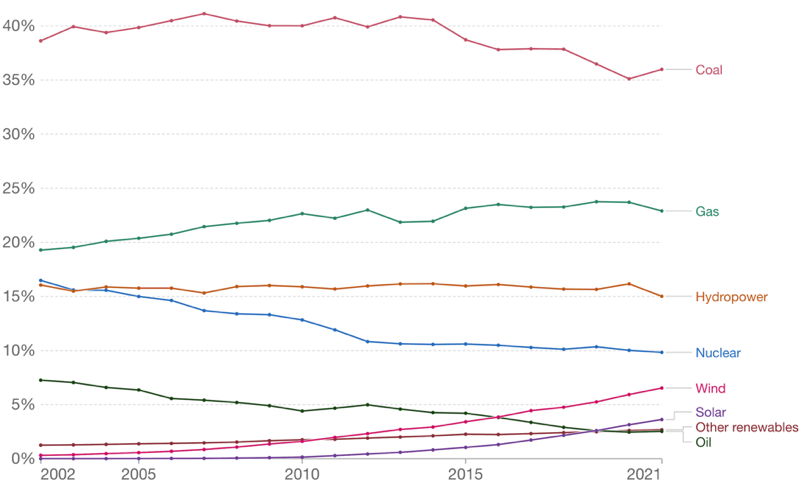

Australia has the world’s biggest uranium resources, accounting for 28% globally. Kazakhstan ranks second with 15% but the country is the world’s top uranium producer. Kazakhstan accounted for roughly 40% of global uranium output in 2020. In nuclear reactors, uranium is used to generate about 10% of the world’s electricity. There are 439 nuclear reactors globally, operating in 32 countries, with a total output capacity of 390,000 megawatts. Nuclear has played a key role in low-carbon electricity production for decades. In some countries, such as France, it is one of the largest sources of electricity. Globally we see that coal, followed by gas, is the largest source of electricity production. Of the low-carbon sources, hydropower and nuclear make the largest contribution while wind and solar are growing. Over the last decades, the share of nuclear energy declined while renewables grew as can be seen in the following charts. The progress made in renewables has been offset by a decline in nuclear energy.

Source: Our World in Data

Unlike other commodities such as gold, nickel or copper, there is no formal exchange to trade uranium. Instead, the trade is negotiated between buyers and sellers. The fuel can be sold using a spot market contract that typically consists of only one delivery or a long-term contract that ranges from two to ten years. About 85% of all uranium is sold under long-term agreements.

In May 2007, the uranium price hit an all-time high at 148 $/pound and began steadily declining. Prices continued to fall after a powerful earthquake in Japan in 2011 that caused a meltdown at the Fukushima plant. Uranium’s value started to rise in the last quarter of 2021, hitting a nine-year high of 48 $/pound in September. The price spiked after Toronto-based investment fund Sprott Asset Management LP began buying up millions of pounds of excess supply for a new trust. Political instability in the world’s biggest uranium producer, Kazakhstan, has also driven up uranium prices.

The uranium price eased to 45 $/pound in the last days of 2021 and in January 2022. It started to climb towards 50 $/pound in early March 2022, following the invasion of Ukraine and hit 60 $/pound on 11 March. This was the highest price since mid-2011.

Source: IAEA World Energy Outlook

Supply and Demand

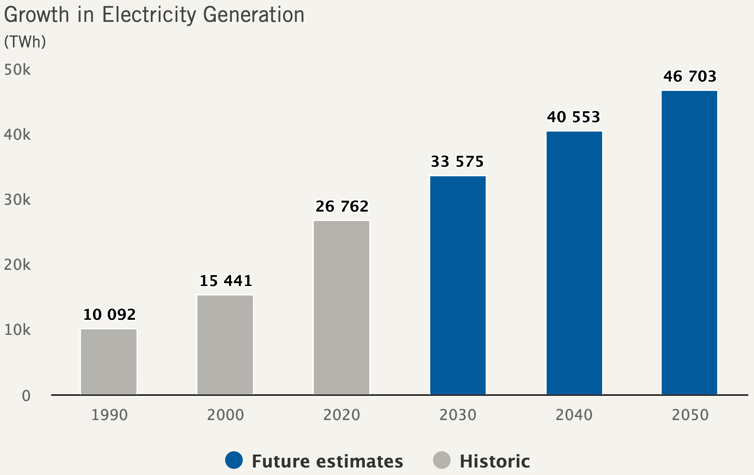

The IEA World Energy Outlook predicts a 52% increase in electricity demand from 2020 to 2040, with a 75% increase predicted from 2020 to 2050. The world is looking for safe, clean and reliable electricity. With a growing focus on electrification and decarbonization, the world has embarked on a clean-energy transition. The benefits of nuclear power have come clearly into focus due to its durability. Further, this development is driven by the accountability created by the net-zero carbon targets being set by countries and companies around the world. Although wind and solar energy are growing rapidly, the predicted increase in electricity demand cannot be satisfied by these two sources.

A stronger focus on nuclear power is merely limited by the public perception of the dangers surrounding it. Fukushima in 2011 and Chernobyl in 1986 were the only two major reactor accidents to occur in the cumulative 18,500 reactor years of nuclear power operations. We believe that six decades show nuclear power is a safe means of generating electricity with few and regressing accidents. In the drive for a clean energy profile, policymakers and business leaders must recognize that there is a need to balance affordability and security. Too much focus on intermittent, weather-dependent, renewable energy, has left some jurisdictions struggling with power shortages and spiking energy prices, or an increased dependence on Russian energy supplies. Nuclear provides safe, reliable, affordable, carbon-free baseload electricity while also offering energy security and independence.

The energy crisis experienced due to the Russia and Ukraine conflict has amplified concerns about energy security and led to a major global pivot in several countries all over the world to find alternative solutions and consider using nuclear power plants to reduce their reliance on fossil fuels such as oil, gas, and coal. Countries like Germany, Switzerland and California are suggesting bringing nuclear reactors back online.

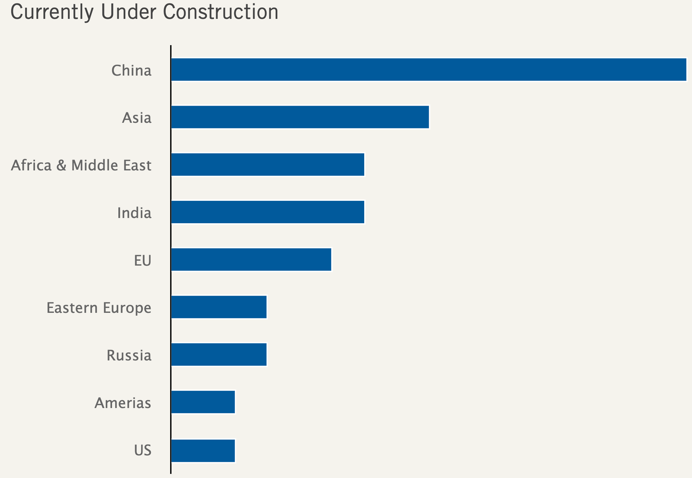

China’s focus on nuclear energy is well known. The current generating capacity is 50GWe and their goal is to hit 70GWe by 2025 and 100GWe target for 2030. China is planning to build 150 new reactors at a cost of about $440 billion, a 33% increase of the current global stock. Japan has currently nine reactors in operation, with another three to join them this year. The country plans to be carbon-neutral by 2050 and its strategy includes 20-22% from nuclear power. India has 23 reactors in operation, 6 under construction and 14 under approval. Moreover, in November last year, US President Joe Biden’s administration passed an Infrastructure Investment and Jobs Act that saw the country’s nuclear energy sector being allocated $25 billion, with $3.2 billion of that sum to be invested up to 2027 on an advanced reactor demonstration program. Additionally, the EU in January proposed plans to label nuclear energy projects as green investments if the projects have a plan, funds and a site to safely dispose of radioactive waste. According to the International Atomic Energy Agency, there are currently 439 reactors operating globally and 52 reactors under construction. All these developments can lead to a resurgence of uranium as a profitable commodity, as it was between 2006 and 2012. Although global reactor requirements are quite flat through 2024, forecasts show significant demand growth from 2025 to 2040 that will necessitate new production as resources are exhausted at several uranium projects.

Source: IAEA World Energy Outlook

According to the Financial Times, despite the steadily increasing demand for uranium, supply could fall by 15% in 2025, due to a lack of investment in new mines. This disequilibrium could lead to an inflated price. In 2021, globally mined output represented around 75% of all demand. The balance is made up of secondary sources including stockpiled uranium held by utility companies, and in the last few years of low prices, those civil stockpiles have been built up again following their depletion from 1990-2005. The gap between supply and demand is likely to continue growing as new nuclear reactors come online and secondary supply is drawn down.

Given past cuts to primary production and inventory optimization by utilities and producers, the uranium market is rapidly becoming production-driven, where spot and long-term prices more closely correlate to the marginal cost of uranium production. While there is plenty of uranium in the world, the market needs to see higher prices to substantially increase supply volumes. While new mines could take multiple decades to be built, new capacity could be brought on if existing mines are restarted. With spot prices now above the 50 $/pound, mine restarts are being planned. Accordingly, several producers have announced production restarts from idle mines in the last few months. Earlier this year, Cameco, a sector leader in production, announced it would restart its Key Lake project, a property that once accounted for 13% of globally mined supply and is considered the world’s largest high-grade uranium-producing mine. The project was initially discontinued in 2017 after years of low uranium prices made it economically unviable. Kazatomprom also recently decided to increase the 2024 Kazakhstani production to 90% of nominal capacity from the current 80% level.

As a result of heightened geopolitical risk, many utilities are shifting their focus to the term market to meet unfilled needs in the second half of this decade, while market participants with existing contracts on Russian-enriched uranium are actively seeking replacement supplies in the market.

To operate a reactor that could run for more than 60 years, natural uranium and the downstream services need to be purchased years in advance, allowing time for several processing steps before it arrives at the power plant as a finished fuel bundle. As the spot market continues to thin out, utilities are beginning to shift their attention to securing material for their uncovered requirements under long-term contracts. A renewed focus on the security of supply opens the early stages of a market transition. The current backlog of long-term contracting presents a substantial opportunity for suppliers like Cameco.

The Investment Thesis

Our thesis relies upon generating long exposure to the Uranium miners that are best positioned to exploit this trend, as the supply and demand relationship balances out. We identified the most interesting risk-reward profile in Cameco Corporation (NSYE: CCJ). Cameco, headquartered in Saskatoon, Canada, represents a pure-play investment in the fuel cycle for the generation of nuclear energy, and is the second largest uranium miner in the world. The main drivers behind our decision are:

Quality of the uranium reserves. Cameco’s main reserves are Cigar Lake, McArthur River, and Key Lake. In particular, the company has recently increased its stake in Cigar Lake, the largest mine in the world, to 55%. The current annual production of its main plants is lower than the annual licensed capacity by an average of 33%. Meaning that Cameco has significant room to ramp-up production in case of more favourable market conditions. Furthermore, Cameco sits on reserves of exceptional quality: the average grade in its Cigar Lake mine is 15.92%, compared to industry expectations that range between 0.05% to 0.2% concentration levels (McArthur Rivers is at 6.89%). Such higher quality will be reflected in the superior profitability of its mining activities.

Solid Financials. The latest earnings report from Cameco Corporation reflected a fundamental solidity of its financials. We believe financial stability to be a key factor, especially when investing in commodity producers, considering the volatile nature of commodity prices. In particular, Q2 showed a beat in expectations for both EPS ($0.18 vs $0.01), and Revenue ($558mn vs $383.11mn, +55.4% YoY). Management reaffirmed the guidance for yearly production of 11mn pounds. Thanks to the partial recovery in uranium prices the company has significantly improved its profitability from a $42mn loss in the first six months of 2021 to a $124mn profit in the same period of 2022. We believe there is still much room for larger profits. In addition, the company declared 464mn pounds in proven & probable reserves, which amount to $21.5bn (using constant dollar average uranium prices of $50 and $35 provided by Cameco’s report). This means that the company’s reserves are more than ten times higher than its long-term debt of $2bn, with cash & cash equivalents three times higher than current liabilities.

Vertical integration. The company is vertically integrated to perform the entire nuclear fuel cycle. In fact, despite Russia not being one of the main producers of uranium, they play a key role in the services part of the cycle, which consists of uranium’s conversion and enrichment. In 2020, Russia converted one-third of global uranium, and covered 43% of worldwide enrichment processes. Thus, it is key to invest in a company which is fully vertically integrated, eliminating the risk of disruptions due to geopolitical tensions.

Geopolitical Uncertainty. The US Congress is working on a bill to sanction Russian uranium imports, with Cameco set to be one of the biggest beneficiaries, as such decision would create even more imbalance in the supply-demand relationship. So far, Russian uranium was spared form sanctions, due to the control that Russia exercises on global uranium services, which the western countries could not yet seem to substitute. The Biden administration is pushing for a $4.3bn plan to eliminate the vulnerability of depending on Russia’s enrichment processes. However, the U.S. Nuclear Industry is lobbying the White House to avoid sanctions, as they could cripple the industry. For investors in stocks such as Cameco, such a ban would only mean lower supply, sending prices even higher. At the same time, Cameco is well positioned to benefit not only from a spike in uranium prices, but also rising demand for fuel services.

Technological innovation. In the longer term, Cameco is exploring new opportunities within the fuel cycle. Above all, the investments in Global Laser Enrichment LLC (NYSE: GLE) and the developments for commercialization of small modular reactors are extremely interesting. GLE is the exclusive licensee of the proprietary Separation of Isotopes by Laser Excitation (SILEX) technology, which has excellent potential to significantly improve the uranium enrichment cycle. Small modular reactors present the development of a scalable technology, that requires much less physical space and uranium than modern nuclear power plants, to produce the same amount of energy.

Risks

Investing in pure plays for commodities mining always presents some risks. In particular, we have identified three major risks that could impact Cameco’s long-term growth.

Nuclear plant major accident. One of the key obstacles to a broader adoption of nuclear energy has always been the public’s perception of a potential catastrophe. Despite the probability being extremely low, especially if we consider the technological advancements of the last decade, we must take this eventuality into account. After Fukushima’s 2011 disaster, the industry was almost entirely shut down, with prices reaching economically unsustainable levels.

Loss of momentum in uranium spot prices. As the spot price is starting to recover, it is of fundamental importance that we continue to see a sustained upward trend. Should uranium’s spot price lose the current momentum, planned investments for the industry would be at serious risk of being abandoned. Nonetheless, when uranium spot price rose in the last quarter of 2021, the appreciation was supported by institutional buying of the investment fund Sprott Asset Management LP that began storing millions in excess supply for a new trust. Right now, we believe that the appreciation of uranium prices will not only be supported by this kind of buying, but also by the risk premium of geopolitical uncertainties.

Risks related to the development of new technologies. The sustained long-term growth of Cameco, and of the nuclear energy industry in general, relies on certain technological advancements. Cameco’s current projects possibly represent significant improvements to the fuel cycle, but, as every technological innovation still in the process of being developed, imply the risk of not being technically and financially sustainable.

Alternative Options

To conclude, we also wanted to explore alternative investment ideas that present a different exposure to uranium mining. Keeping in mind the main drivers of Cameco’s projected long-term growth, we believe that Sprott Uranium Miners ETF (NYSE arca: URNM) represents a more diversified solution than selecting a single stock. The fund gives exposure to north shore companies devoting at least 50% of their assets to one of the processes of the uranium-mining industry. For true risk lovers, instead, Denison Mines Corporation (NYSE arca: DNN) is another Canadian company involved in uranium exploration and development. The company’s biggest project is Wheeler River, one of the largest undeveloped uranium sites in Canada. Such initiatives obviously carry an enormous amount of risk, but, at the same time, offer the highest potential reward.

0 Comments