Introduction

In view of the coming season of earnings releases we analyze the famed British carmaker Aston Martin, and we propose: 1) a long investment on its equity based on a successful execution of its multi-year turnaround plan, and 2) a trade idea on the implied vol of the stock in relation to its earnings which will be announced on the 4th of May.

Aston Martin Lagonda (AML) is a well-known company with more than 100 years of history producing cars at the crossroads of the high-performance and ultra-luxury worlds. AML went public in October 2018 led by CEO Andy Palmer who managed to sell to potential investors his so-called Second Century Plan which consisted in reaching wholesale deliveries of 14’000 units per year for a company used to sell approximately 4’000/5’000 cars per year. This plan required large investments, the company was already highly levered, and the IPO was focused on allowing existing shareholders to sell out rather than raise cash. Moreover, the management team was volume-driven and pushed for higher wholesale than retail sales, as a result, Aston’s dealership accumulated excessive inventory. Over time, this led to large price markdowns on its vehicles, thus Aston suffered large losses which forced it to raise equity in 2020, with its share price having fallen by 90% since the IPO.

On this occasion, Lawrence Stroll lead a syndicate that invested £ 250ml in the company, becoming its largest shareholder and Chairman. Stroll is a perfect match with Aston: he is a famed investor who managed to successfully turnaround several luxury brands including Tommy Hilfiger and Michael Kors. With a combination of equity increases and debt refinancing to push maturities in 2025, he raised sufficient cash to execute a turnaround plan free from short-term balance sheet pressures. He appointed as CEO Tobias Moers who led the profitable Mercedes AMG division for close to 10 years and struck a deal with Mercedes to use their EV platform and Infotainment technology in exchange for an equity stake in Aston, to reduce the company’s investment needs.

The first step of Stroll’s strategy consisted in restoring the ultra-luxury image of the historic British brand. To do so, he brought the company back to a demand-driven production model, typical of luxury brands, aggressively de-stocking dealers’ inventory in 2020.

Now, Aston is executing a new plan, the so-called Project Horizon, which consists in achieving by 2025:

- Wholesale deliveries of 10’000 units

- Revenues for £ 2bn

- EBITDA of £ 500ml

We believe that management forecasts are very conservative and that this plan can be easily reached, without any further equity increase, as we will now show in detail.

At the moment, Aston’s product lineup is composed of two main categories:

- Front Engine Sports Cars: DB 11, DBS, Vantage

- SUVs: DBX

The wholesale deliveries per category in the past years are the following:

Aston has historically produced Front Engine Cars, whose demand has been close to 4’000 vehicles per year. In 2021 it launched its first SUV, the DBX, which was an instant success capturing approximately 20% of market share for ultra-luxury SUVs and selling 3’000 units in 2021.

The management target of 10’000 units in 2025 is split as follows:

- Front Engine Sports Car: 4’000 units

- SUVs: 4’500 units

- Mid-Engine Sports Car: 1’500 units

We believe that Project Horizon is reasonable considering that:

- Historically demand for Front Engine vehicles has averaged 4’000 units per year, in addition to this, wholesale deliveries in 2021 stood at 3’000 units, and this was achieved with 3 years old cars which will be replaced in 2023. Moreover, the company may have a lot of room to expand in the APAC region, as shown by this year 200% growth rate in China.

- The DBX sold approximately 3’000 units in 2021, considering the launch of two new variants in the current year and additional variants in the coming years, we believe that the target should be within reach.

- Mid-Engine sports cars will be introduced by Aston in 2024, it is difficult to precisely estimate demand for them, nevertheless, the management’s target of 1’500 units seems conservative.

The target revenues of £ 2bn imply an Average Selling Price (ASP) per vehicle of £ 200k. We show in the following table the overall ASP for the past years, and that for core vehicles (excluding specials):

In our opinion, the target is very conservative considering that in 2021 management achieved an ASP on core vehicles of £ 150k with front engine models that accounted for 50% of wholesale deliveries that are 3 years old (they were launched in 2018/2019) and that have technology approximately 6 years old (the old management team signed a deal with Mercedes which allowed the use of Mercedes’ technology on Aston Martins if it was at least 3 years old). Considering that all front engine models will be refreshed in 2023 with brand new technology, and that Mid-Engine models will be launched in 2024, we expect that target ASP should be easily reached in the coming years. In this respect, the management shift to a demand-driven production model has already led to a strong increase in ASP during 2021 (ASP on core vehicles increased from £ 132k in 2019 to £ 150k in 2021) thanks to a larger share of cars being individually personalized by costumers.

A key point is whether the company will be able to reach an EBITDA margin of 25%, and thus switch to free cash flow generation, which is essential for long-term sustainability. In the following graph we display the evolution of the EBITDA margin in the past years:

So far, the management team has focused on cutting down costs and reducing inefficiencies, this has already resulted in a 20% reduction of manufacturing costs which lead to an EBITDA margin in Q4 2021 of 18.3%. From 2023 onwards, the launch of new models with a contribution margin of at least 40% will lead to the target EBITDA.

Finally, a key factor is whether current cash, standing at £ 400m, will be enough to launch the new line-up of models and reach cash flow sustainability. We believe cash is more than enough: considering that old models are already sold out until they will be replaced, we expect in 2022 an overall cash outflow for approximately £ 120m. Then, starting from 2023 Aston should be cash flow positive. Moreover, a big drag on cash flows is the company’s £ 1bn debt carrying interest rates higher than 10% (because it was raised amid the Covid pandemic), thus leading to an interest expense per year higher than £ 100m. The refinancing of this debt in 2023 at far lower interest rates will contribute to higher cash flows.

In the following table we show the evolution of FCF and Net Cash Interest over time, we can notice that the management team has already done much progress: Aston Martin was almost FCF breakeven in 2021, which was not the case since 2017.

Overall, we believe Project Horizon is feasible, we thus use the conservative targets of the management team to value the company. We consider a set of European Luxury companies, shown in the table below, and apply their average EV/EBITDA multiple to Aston’s target EBITDA, obtaining an EV of £ 7.4bn, which would imply an Equity Value of £ 6.4bn.

Once we factor in the dilution coming from the future issuance of shares, as shown in the following table, we obtain a Price per Share in 2025 of £ 48.13, which leads to a return over the holding period slightly higher than 450%.

Trading the earnings

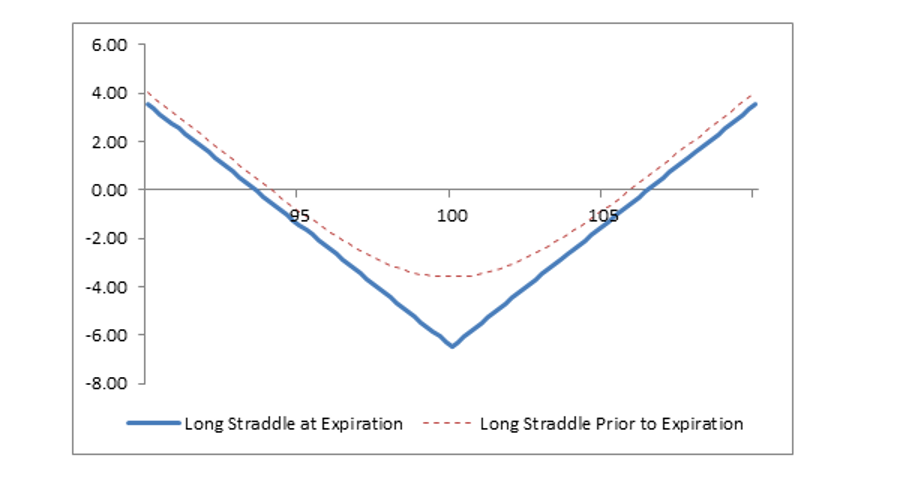

Based on what the market is discounting, uncertain expectations, and low volumes of the stock, we propose to enter a long straddle on the earnings of Aston Martin Lagonda that will be released on the 4th of May. A straddle is an option strategy which involves buying simultaneously a call option and a put option of the underlying security with the same expiration date and strike price. Combining the payoffs of both options the strategy will look as follows:

Source: Fidelity Investments

As we can see from the diagram of a hypothetical long straddle with strike price 100, the more volatility the underlying stock experiences the more you profit. The maximum loss of the trade will be in the scenario that the stock ends up at expiration exactly at the strike price you chose, this way you will not exercise any option and lose both premiums. Furthermore, you have a symmetric payoff, this means that you have no view about the direction that the stock will take in the future, you are only betting that the underlying security will undergo a surge in volatility. So, you are long vol on the security.

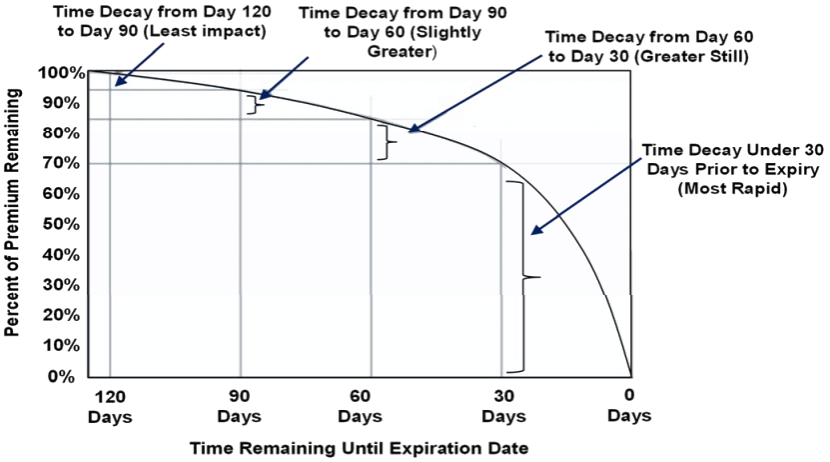

It is important to understand that if you decide to hold the straddle until expiration then the blue line represents your total payoff, while the more we move far away from maturity date the more the payoff V-shape will shift up (dotted line) since there are also other factors influencing options prices such as theta, which is the time decay that lowers options premium the more we approach expiration.

Source: Rosen Capital

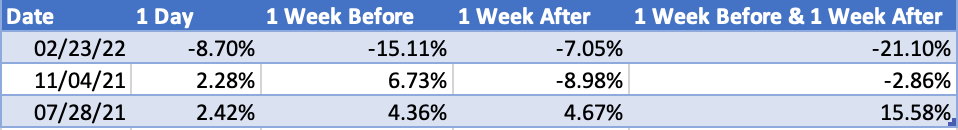

We propose to enter a long delta neutral straddle on Aston Martin Lagonda stock. The trade will be set up following the standard straddle described in “Anticipating Uncertainty: Straddles Around Earnings Announcements” by Chao Gao, Yuhang Xing and Xiaoyan Zhang which we have already discussed more in depth in this article (link). The straddle used in the academic paper is standardized for all stocks: enter a long ATM straddle, with maturity >30 days, one week before the earnings announcement and sell the day or one day after earnings are released. We do take this strategy as a model but then we arbitrarily customized the trade based on our analysis. Looking at the stock price response to earnings announcements in the last year the ideal period that we have considered for the trade is to enter a week before and close one week after the 4th of May (earnings released).

Source: BSIC

This way options are less expensive since the amount of time premium built into the price of the options for a stock with an impending earnings announcement will rise just prior to the announcement, as the market anticipates the potential for increased volatility once earnings are announced. In terms of strike price, we buy an at-the-money straddle betting that the price will deviate from that in the upcoming weeks. Finally, we need to choose the expiration month to trade. May 2022 options do obviously cost less but experience high time decay diminishing rapidly our position each day. To lower the impact of theta on our trade we selected June 2022 expiration.

The stock has closed on Friday 29th April at GBX 851.46. We therefore enter the trade with a strike price of GBX 850.

These are the quotes for the call option and the put option with strike price of GBX 850 as we enter the trade on April 29th and the position will be consequently closed on May 11th. As we can see from the greeks, delta is not the same therefore to be delta neutral we need to weight our positions this way: , where stands for the weight of the call. Solving this equation, it gives us that and thus .

Despite being delta neutral there are several risks associated with the trade: first we need to consider the volatility crush which is the result of implied volatility exploding after earnings are released which lowers options premium. Using the Black-Scholes model we derive an implied volatility of 43% which we think the market is currently underestimating since earnings release is imminent and annualized volatility of the stock is 50.06%. Lastly, even if we chose a >30 days expiration date from the day we plan to close the trade, time decay still plays a role and puts downward pressure on option prices.

0 Comments