IPOs volatility

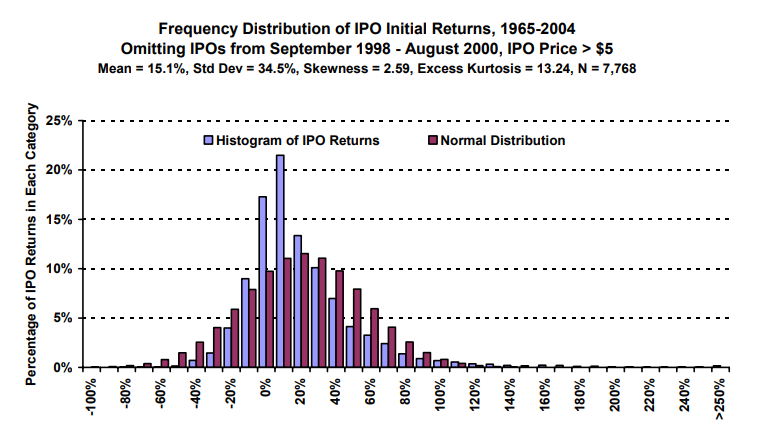

Initial returns of initial public offerings are usually large, averaging 15.1% over the 1965–2004 period (excluding the dot.com bubble interval that would further boost IPOs returns). For investors that can buy IPOs at the offer price, IPOs are a good short-run investment. However, we should care about risk in addition to expected return. IPOs are typically highly volatile in the first months of their existence and to company management, employees, and investors, the aftermarket performance of the stock is vital. Moreover, investors should keep in mind that an IPO may only represent a small percentage of total shares outstanding, with the rest retained by the original investors and insiders.

Source: “The Variability of IPO Initial Returns” (Michelle Lowry; Micah S. Officer; G. William Schwert; 2006)

The pricing of an IPO is a complex process, and it is critical to obtain investor support for an IPO. Besides, an adverse difference between the market price and the offer price is bad for the issuer and the underwriter/lead manager, since there will be a perception that the offer was over-priced, which may have reputational issues. Although the issuer and its investment bank know considerably more about the firm’s prospects than any single market participant does, aggregate demand uncertainty is one of the principal problems facing issuers and their investment banks when attempting to price an IPO, and uncertainty about aggregate demand for IPO stocks varies in both the time series and the cross-section. Only the initiation of trading fully resolves this information asymmetry between the issuing firm and the market.

Beatty and Ritter (1986) predict that the difference between the market price and the offer price, i.e., the initial return, will be systematically related to this information asymmetry between firms and the market. Specifically, companies for which information asymmetry is greater will tend to be more underpriced on average. Moreover, aggregate demand for the firm’s stock is difficult to estimate precisely for high information-asymmetry companies, implying that initial returns for these firms will be dispersed. The process of marketing an issue to institutional investors, for example during the roadshow, appears able to resolve only a relatively small portion of this uncertainty. Issues for which the most learning occurs during the registration period, are characterized by the highest average and the highest volatility of initial returns, suggesting particularly high information asymmetry.

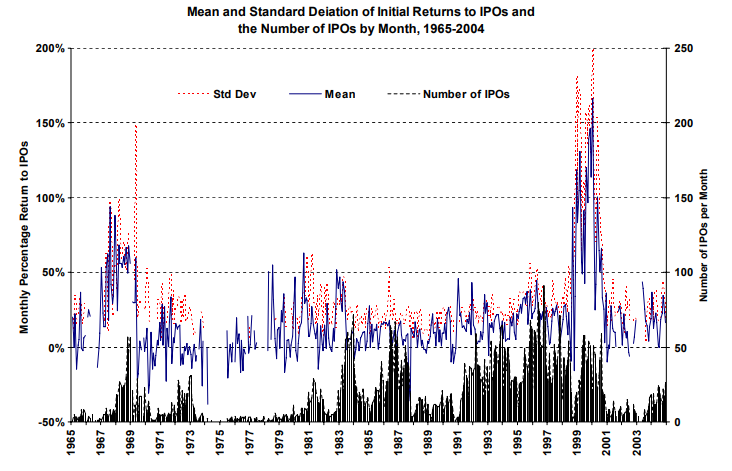

M. Lowry, M. Officer, and G. Schwert (2006) examined the dispersion of IPO initial returns, measured as the volatility of initial returns across all firms going public and proved that initial returns of IPOs are highly dispersed within each month. They compared this IPO initial return volatility to the time-varying volatility of secondary market returns (assuming that market risk affects both market-wide returns and IPO initial returns, one might expect the two series to behave similarly). In contrast to the negative relation between market returns and market volatility, they found that average IPO initial returns and the dispersion of initial returns are highly and significantly positively correlated. This fundamental distributional difference between IPO initial returns and aggregate market returns is potentially related to the fact that IPO initial returns are economically different from the returns of stocks that are already publicly traded. IPO initial returns represent the difference between market-clearing prices at the end of the measurement interval and prices formed in a non-market setting by the issuer and its investment bank. This study shows that IPOs are risky even in the first few weeks of trading and not only in the long term. Moreover, it proves that, while average initial returns are high, investors are not guaranteed to receive this return and the dispersion in realized initial returns can be considerable, also because the risk is highest in periods when average returns are highest (during hot IPO markets).

Source: “The Variability of IPO Initial Returns” (Michelle Lowry; Micah S. Officer; G. William Schwert; 2006)

The greenshoe or over-allotment option

To mitigate the risk of the price of newly listed securities falling below the offer price in the period immediately following the listing, and to help provide confidence to potential investors about the sustainability of the offer price, the underwriter (or lead manager) may seek to undertake post-offer market stabilization. The over-allotment option or greenshoe can reduce underpricing by decreasing price risk since the option gives the underwriter a tool to execute aftermarket price stabilization. Also, the greenshoe enables the underwriter to bring extra liquidity into the market.

The traditional transaction structure of a stabilization arrangement follows. Firstly, the stabilization manager allocates to institutional investors several securities (the “over-allotment securities”) greater than the amount of the issue (up to +15% in most countries). Then the stabilization manager borrows the over-allotment securities from one or more existing security holders. The stabilization manager must repay the stock loan by re-delivering an equivalent number of securities to that security holder at the end of the “stabilization period” (usually up to 30 days after trading of the securities begins). Sequent, the stabilization manager takes a greenshoe option over the same number of securities. The “greenshoe” option is traditionally granted to the stabilization manager by either a vendor security holder or by the issuer which gives the stabilization manager the right to buy (from the vendor) or to subscribe for (from the issuer) additional securities at the offer price. The benefit of the greenshoe for the stabilization manager is that it prevents it from being “squeezed” (he had a short position in the first place).

After the IPO settles, the proceeds of the offer are provided to the issuer (if a primary offer) or the vending security holders (if a secondary offer) except for the proceeds of the sale of the over-allotment securities, which are retained by the stabilization manager. If during the stabilization period, the market price of the securities falls below the offer price, the stabilization manager may acquire securities on market at the prevailing price up to the number of over-allotment securities. Subsequently, the stabilization manager may either use the securities in repayment of the Stock Loan or sell those securities again (but only if the market price exceeds the offer price). If by the end of the stabilization period the stabilization manager holds fewer securities than required to repay the Stock Loan, he will exercise the greenshoe option, and the securities acquired by the stabilization manager upon exercise of the greenshoe will be used to repay the Stock Loan.

Of course, the optimal outcome from an issuer’s and a lead manager’s point of view is where the greenshoe option is exercised in full, meaning that there have not been any stabilization bids made by the stabilization manager (the market price of the securities has not fallen below the offer price) and the size of the offer has been maximized. Furthermore, if the price falls below the offer and the stabilization manager starts buying the issuer’s stocks a profit has been made and it is equal to the difference between the offer price and the market one. This profit could be of the stabilization manager or of the issuer, depending on contractual form, but usually the former. The greenshoe could be defined as a kind of market manipulation, but it is a legal kind, and one that people think is valuable (the theory is that investors will be more willing to buy stock in IPOs if the underwriters are planning to stabilize the stock after it prices).

In theory, the greenshoe is a risk-free product. Strong initial demand for its stock allows a company to raise extra capital via the greenshoe, generating bigger commissions to the underwriters that got the pricing wrong. And if the price flops the stabilization manager can cover its loan with market purchases on which it extracts a trading profit (which, again, it may or may not pass to the company). Greenshoes have been part of the scenery for so long that investors rarely question their inclusion.

K. Mazouz, S. Agyei-Ampomah, B. Saadouni, and S. Yinin in their paper “Stabilization and the aftermarket prices of initial public offerings” (2012) examine the determinants of stabilization and its impact on the aftermarket prices, coming up with interesting results. They use a dataset based on the Hong Kong IPOs. The authors chose this market as it allows to overcome empirical difficulties mainly related to disclosure issues. Previous studies focused mainly on stabilization activities in the US IPO market, but as underwriters in the US are not required to disclose their price support activities, researchers find it difficult to precisely identify stabilized IPOs in that market. The paper highlights that underwriters support IPO prices shortly after listing, particularly in cold markets and when demand is weak. They also show that stabilized IPOs are more common amongst reputable underwriters. This finding suggests that stabilization may be used as a mechanism to protect the underwriter’s reputation. It also implies that reputable underwriters may possess private information and price IPOs closer to their true values (i.e., higher than those indicated by the weak premarket demand). Consistent with the latter view, they show that stabilized IPOs are offered at higher prices. The post-IPO performance results indicate that stabilized IPOs are unlikely to be mispriced as their prices do not exhibit any significant reversal after the initial stabilization period. The authors conclude that stabilization may be superior as it protects investors from purchasing overpriced IPOs, benefits issuers by reducing the total money ‘‘left on the table’’ and enhances the overall profitability of underwriters.

The Deliveroo case

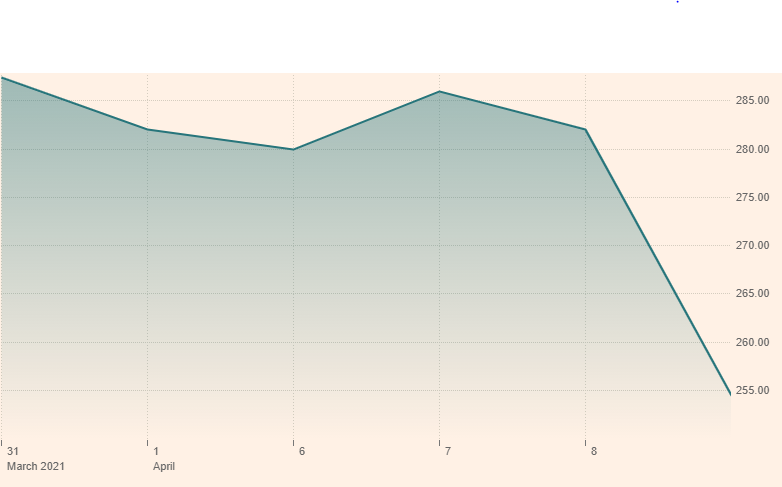

Deliveroo started trading in London on March 31st and is the biggest UK debut by market capitalization (GBP 7.6bn at the opening valuation) in a decade. The company raised GBP 1.5bn with the share sale, including gross proceeds of GBP 1bn for investment and expansion. The offer was at the bottom of its target range at GBP 3.9, while the company initially targeted a valuation of GBP 4.60 per share, implying a market cap of GBP 8.9bn. The stock opened on its first day at GBP 3.31, tumbling 17%, and closing its first day with a 27% loss. The company closed at GBP 2.55 on Friday 9th April, bringing the overall loss to 35%.

Deliveroo stock price (in pennies)

Source: Financial Times

Deliveroo was founded in 2013 and last year, despite improving its net income by around GBP 90m, lost GBP 224m, notwithstanding a 54% jump in revenues. Even though the growth, there are important headwinds to this company. Deliveroo’s business is a low-margin one and is highly competitive (there are countless peers, and the firm market share is not that big). The moment was not the best, probably it would have been better to do an IPO faster (maybe through a SPAC) to exploit the 2020 Q4 excitement as done by DoorDash. It was also too early to capitalize on planned changes to UK listing rules that would allow companies with dual-class share structures — which give chief executive Will Shu control of the board — to secure a premium listing in London and inclusion in the FTSE 100. The company is still posting huge losses despite the strong COVID-19 tailwind that pushed customers to use food delivery apps, this implies that growth prospects are not that good. The Business model, and its (low) margin, is based on the assumption of low-cost labor, this employees’ practice could rapidly change due to government regulations. Moreover, ESG investors dislike these types of businesses with low attention to employees. A final headwind could have been that the company decided to go public in London and not in New York, maybe going public on the NASDAQ would have implied a better valuation. Despite this is a frequent media critique, we believe that is marginal and that the drop is due to the former explanations.

It became increasingly clear that Deliveroo would have faced difficulties in the run-up to the final pricing decision, but the company was constrained by early investors wanting to sell. Pricing also lacked flexibility: fundraising agreed in January had put the headline value on the company at just over $7bn, which was widely seen as the reserve value. In the end, support was blown away also because underwriters had tapped all available demand.

Advisors working on the deal received roughly GBP 49m (around 3.5%) in fees, and while Goldman Sachs is the sole stabilization agent on the deal, it oversaw the listing process alongside JPM. As a result of the terrible stock performance, the FT reported on April 6th that Goldman bought about GBP 75m in Deliveroo shares to prop up trading, ending up absorbing nearly a quarter of the value of shares traded during the first two days of trading. GS was given an option to draw down an extra 38.5m of new shares at any point within 30 days from when trading started last week. These greenshoe shares would enlarge Deliveroo’s share issue by 10% and raise an extra GBP 150m for the company. Goldman also agreed on a separate option with Accel Partners, a long-term Deliveroo investor, to borrow up to the same number of shares.

The difference between the GBP 3.90 issue price and whatever Goldman Sachs paid in the market equates to the profit booked on the trade. But these profits will be surrendered to Deliveroo, as part of an agreement between the two companies which was not disclosed in the company’s IPO prospectus. A few days ago, the FT reported that Goldman has used roughly half of the overallotment designated to stabilize the price of Deliveroo’s shares.

Other stabilization methods

First of all, it is also important to notice that during the book-building process Investment Banks try to avoid “stock flippers”. Stock flippers pose a problem for underwriters of initial public offerings as they subscribe to the issue, but immediately re-sell their shares, so they create an artificial demand that overstates the true demand in the market. Usual stock flippers include Hedge Funds. In this environment a weak IPO is over-subscribed, but flippers cause the after-market price to decrease. To overcome this situation Investment Banks try to reserve to stock flippers only a small part of the offer during the book-building process. For this reason, it is considered healthy for Banks to choose a price in which the number of requests is sensibly higher than the offer.

Lock-up agreements are also used to reduce IPOs volatility. An initial public offering lock-up period is a contract preventing insiders who already have shares from selling them for a certain amount of time after the IPO, typically ranges from 90 to 180 days. The lock-up period is usually longer for SPAC IPOs (typically 180 days – one year). Lock-up periods generally apply to insiders, such as a company’s founders, owners, managers, and employees. However, it may also apply to venture capitalists and other early private investors. The purpose of an IPO lock-up period is to stop large investors from flooding the market with shares, which would initially depress the stock’s price. Lock-up periods can also eliminate the appearance that those closest to the company lack faith in its prospects. Lock-up periods are not mandated by the Securities and Exchange Commission (SEC) or any other regulatory body but are self-imposed by the company going public or required by the investment bank underwriting.

Some recommend that private investors should wait for the lock-up period to expire before investing in IPOs. This is because stocks could fall in price when insiders unload their shares at the end of the lock-up period. A high-profile example is Facebook. After its 2012 IPO, the lock-up prevented the sale of 268m shares during the company’s first three months of public ownership. On August 16th, 2012 Facebook’s stock price plummeted to an all-time low of $19.69 (losing 6.3% daily) the day its first lock-up period ended.

Another discussed method to overcome the IPOs volatility is the Auction method. Despite discussions, the evidence is not favorable. A Dutch auction is a market structure in which the price of something offered is determined after taking in all bids to arrive at the highest price at which the total offering can be sold. The U.S. Treasury uses a Dutch auction to sell its securities as well as most governments. If a company is using a Dutch auction IPO, potential investors enter their bids for the number of shares they want to purchase as well as the price they are willing to pay. Once all the bids are submitted, the allotted placement is assigned to the bidders from the highest bids down, until all the allotted shares are assigned. As an example, suppose that 100 shares are issued and the bids are the sequent: 80 at $92, 60 at $93, 55 at $95, 30 at $100, 20 at $105. The auction price will be $95 (20+30+55=105 which is higher than the offer 100). Differently, for a normal IPO with the same offers, a Bookrunner would likely decide to allocate at $93 because of the presence of stock flippers. It has to be taken into consideration that agents are perfectly aware of the functioning of the book-building process so usually they increase their bids because they assume that they will get only a percentage of them.

Such auctions are meant to democratize public offerings and allow small investors to take part in the offering. Moreover, theoretically, they are also supposed to minimize the difference between offering and actual listing prices, being a more transparent method in which an array of bids from multiple types of customers are sent. But there is a strong drawback because the auction is open to all investors, there is a danger that they may perform less rigorous analysis as compared to investment bankers and come with a price estimate that may not accurately reflect the company’s prospects. This may arise from informational asymmetries between small investors and sophisticated ones, as well as reduced scrutiny.

There is little, if any, support for the popular view that auctions lead to highly accurate pricing and hence to a very low mean and variance of initial returns. In the paper by R. Jagannathan and A. Sherman “Why do IPO Auctions fail?” (2006) is established that IPO auctions have been tried in more than 20 countries, and have been rejected in favor of other methods for bringing new equity issues to the market. When issuers have been given a choice, they have generally chosen not to use auctions once they became familiar with the method. The authors found evidence suggesting the presence of free riders who placed unrealistically high bids, apparently relying on other bidders to perform due diligence and engage in price discovery. Eventually, investors began to lose money on IPO auctions, leading to lower participation levels and undersubscribed offerings. The authors show that auctions have led to under-subscription and to extreme mispricing, but it must be noted that other IPO methods have also led to withdrawn offerings and mispricing. Thus, the evidence of problems with standard auctions may, on its own, be insufficient to establish which IPO method is superior. Moreover, the very non-existence of large, stable samples of IPO auctions, is consistent with models that predict that IPO auctions may be problematic. With book-building, the underwriter can act as a gatekeeper, coordinating the number and type of entrants. With an auction, on the other hand, someone who invests time and money evaluating an offering can easily be squeezed out by a thousand free riders. Without some way to screen out free riders and ensure the participation of serious investors, IPO auctions are highly risky for both issuers and investors and the author’s findings are consistent with the fact that book-building should replace auctions in more developed markets.

Lastly, similarly to auctions, someone suggests that going public via SPACs (black check companies) could imply lower volatility of IPOs. Despite SPACs can be useful on some occasions, mainly thanks to their lower timeline (3/4 months, about half of a normal IPO), there is not enough evidence that these vehicles imply lower volatility of initial returns.

Bibliography

Beatty, Ritter, 1986, “Investment banking, reputation, and the underpricing of initial public offerings”, Journal of Financial Economics.

Mazouz, Agyei-Ampomah, Saadouni, Yinin, 2006, “Stabilization and the aftermarket prices of initial public offerings”, Review of Quantitative Finance and Accounting.

Lowry, Officer, Schwert, 2006, “The Variability of IPO Initial Returns”, NBER working paper.

Jagannathan, Sherman, 2006, “Why do IPO Auctions fail?”, NBER working paper.

0 Comments