Introduction

The purpose of this article is to investigate whether gold, and in particular its spot returns against other currencies, display some correlation with other macroeconomic drivers, particularly with monetary policy decisions by Central banks.

Gold: Anti-Cyclical Asset or simple Commodity?

In the realm of financial markets and investment, there persists a widely held belief that gold and other precious metals serve as attractive asset options for investors seeking to deploy their capital during times of economic uncertainty, particularly in the midst of bearish market conditions. This belief stems from the intrinsic value associated with gold, rooted in its natural scarcity, which sets it apart from widely circulated fiat currencies. If we were to accept this assertion as valid, it would be reasonable to anticipate the existence of a discernible negative correlation between the value of gold and the strength of other major currencies like the US Dollar or the Euro. To assess the veracity of this hypothesis, we undertake an empirical examination, scrutinizing both simple and logarithmic returns of currency pairs involving gold and select G10 currencies. This examination takes place both prior to and following events that traditionally exert significant influence on the respective currency values, most notably announcements regarding changes in the target policy rates by central banks.

Should this hypothesized relationship indeed hold true, we would anticipate observing a pattern where the XAUCCY currency cross exhibits positive returns whenever central banks announce reductions in their target interest rates, and conversely, negative returns when they implement interest rate hikes. In practical terms, this would signify that investors aiming to articulate directional views regarding the monetary policies of central banks could effectively translate these perspectives into actionable investment strategies by trading gold against the currency of their choosing, in alignment with the central banks’ rate adjustment decisions. This not only underscores the role of gold as a financial safe haven but also highlights its potential utility as a tool for expressing speculative positions on central bank monetary policies.

Analysis

We put our hypothesis to the test across a spectrum of six distinct gold currency pairs, spanning six different countries and their respective central banks: the ECB representing the European Union, the FED for the United States, the RBA covering Australia, the BOC in Canada, the PBC for China, and the BOE overseeing the United Kingdom.

Our sample period, dictated by data availability constraints, spans a range from the 1980s and 1990s through to the present day, concluding on September 12th, 2023.

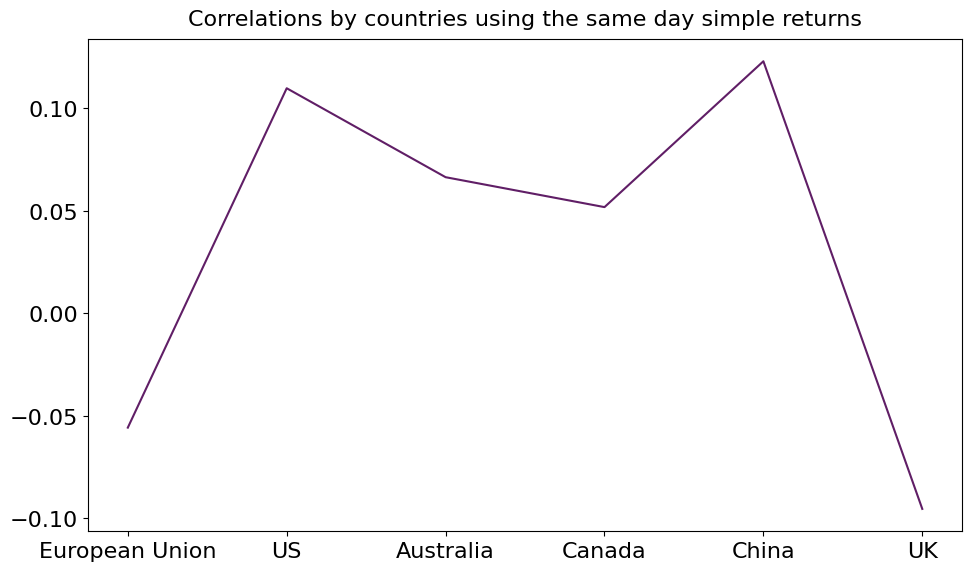

Upon conducting an exhaustive and meticulous analysis, we arrive at the conclusion that there is no statistically significant correlation observed between these two pivotal factors. Indeed, throughout our rigorous examinations, the average correlation coefficient consistently hovers at a mere 0.044. It’s noteworthy that the United States stands out with the highest correlation coefficients across the board, particularly evident in the average logarithmic returns on the day of a policy rate alteration and the day following it, registering at 0.1301. China and Australia also exhibit notably feeble correlations, with respective gold returns of 0.125 and 0.115. Conversely, for the remaining countries, we can confidently assert that these factors can be considered entirely uncorrelated.

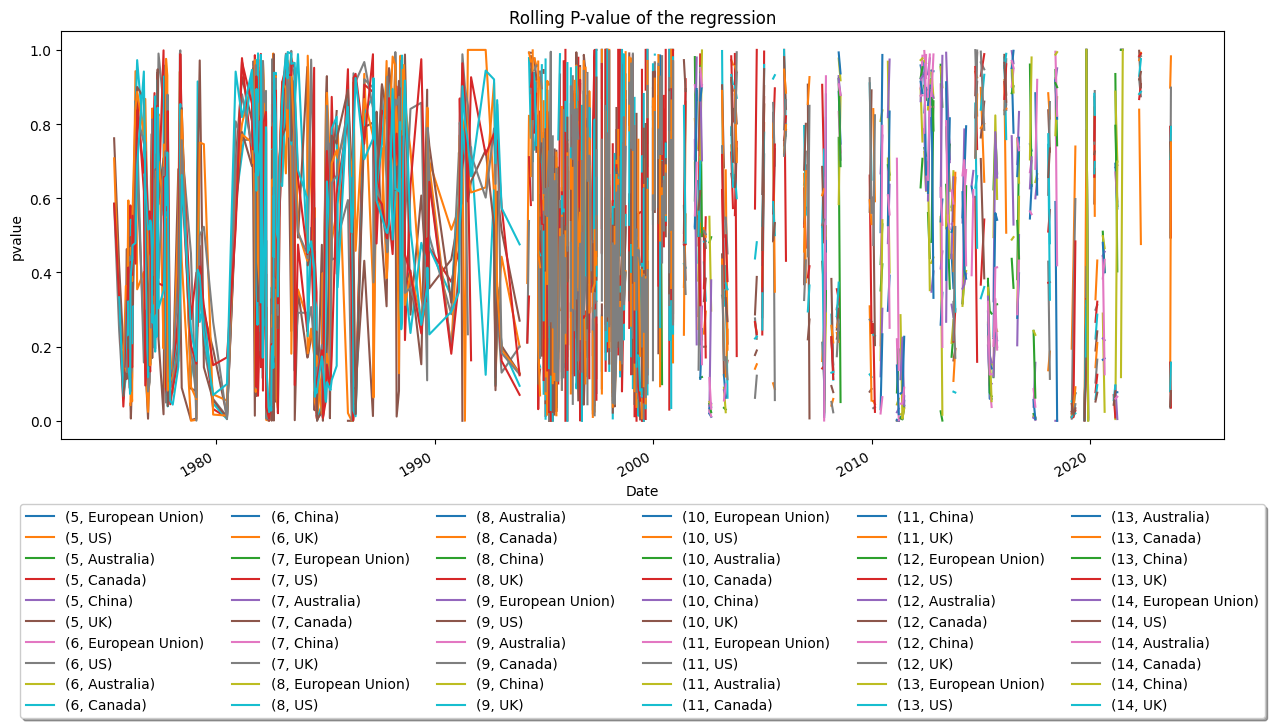

We can arrive at a comparable conclusion when we employ a rolling regression model, pitting simple returns against fluctuations in central bank interest rates. An insightful examination of the rolling p-value associated with this regression analysis reveals a highly erratic statistical measure. This volatility in the p-value underscores the inherent unpredictability of the regression model and, consequently, the tenuous nature of the correlation between the variables in question:

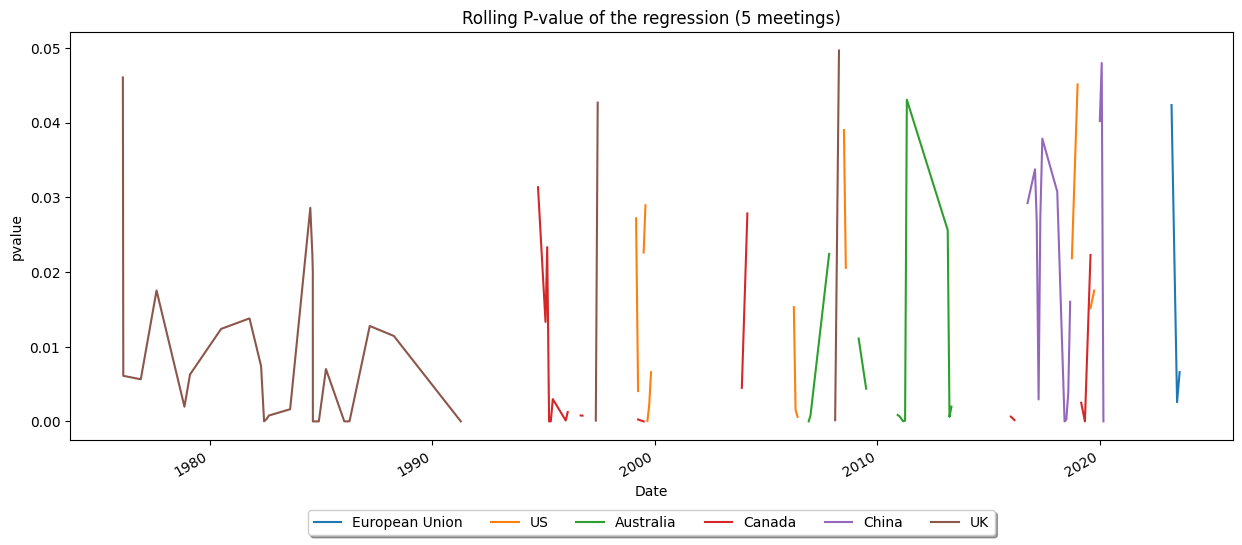

If, for instance, we opt to filter our data to include only instances where significance exceeds the 95% threshold, we substantially diminish the total number of dates under consideration:

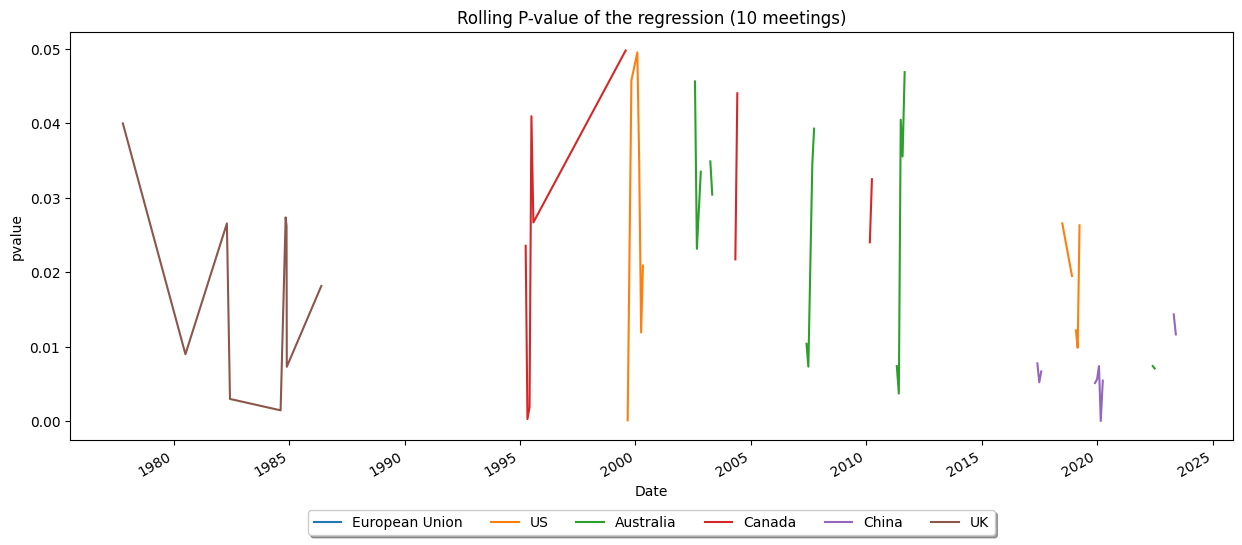

Furthermore, it’s worth noting that these findings appear to exhibit a strong reliance on the specific rolling window size chosen for analysis. Notably, a significant proportion of the “meaningful” observations tend to cluster within narrower rolling windows, while the count dwindles considerably as we extend the window size:

This outcome, especially when considering the relatively brief window we initially select (equivalent to roughly 1 to 2 years’ worth of central bank policy decisions), implies that the model may have a tendency to overfit within those narrower intervals. Consequently, these results should be approached with caution, as they may not provide a reliable basis for making systematic assessments or drawing substantial conclusions.

Conclusion

In summary, even when employing conservative modeling approaches such as a single regression analysis, it becomes evident that the notion of gold as a dependable asset for conveying insights into monetary policy decisions, and perhaps even broader macroeconomic considerations concerning a specific country, is largely dispelled. This phenomenon is likely attributed to the fact that gold, being a globally traded commodity, exhibits an inherently erratic response to isolated shocks within a specific country. Its principal drivers of returns likely reside in factors that extend beyond the purview of this article’s analysis.

TAGS: Gold, Monetary Policy, Interest Rates, Anti-Cyclical

0 Comments