Johnson & Johnson and its Competitors

Johnson & Johnson (J&J) [NYSE: JNJ] is a US-based multinational healthcare corporation operating along its two segments Innovative Medicine and MedTech. Today (as of April 18th, 2024), the firm has a market capitalization of $351.2bn. In 2023, J&J recorded revenues of $85.2bn, of which $54.8bn and $30.4bn can be attributed to Innovative Medicine and MedTech, respectively. The Innovative Medicine segment operates within the areas of immunology, infectious diseases, neuroscience, oncology, cardiovascular and metabolism and pulmonary hypertension. The MedTech segment comprises a broad portfolio of products in the fields of interventional solutions, orthopaedics, surgery, and vision. J&J’s main competitors are arguably Merck & Co. (Merck) [NYSE: MRK] and Pfizer [NYSE: PFE], each with competitive advantages in different fields and differing focusses within healthcare.

US-based Merck is run via its two business segments Pharmaceuticals and Animal Health. The Pharmaceuticals segment is focused on human pharmaceutical products in areas such as oncology, hospital acute care, immunology, neuroscience, virology, cardiovascular, and diabetes. Merck’s Animal Health segment offers veterinarians, farmers, pet owners, and governments a wide portfolio of veterinary medicines, vaccines, and health management solutions and services. Pfizer, also US-based, conducts business within their segments Biopharma and Business Innovation. Biopharma encompasses all of Pfizer’s prescription drug products. It is divided into sub-segments such as Primary Care, Specialty Care, and Oncology. The products range from treatments for cardiovascular diseases, migraines, and women’s health to vaccines for infectious diseases. Newly established in 2023, Business Innovation is Pfizer’s operating segment and includes the firm’s contract development, manufacturing organisation, supply of specialty active pharmaceutical ingredients and provision of strategic guidance and end-to-end R&D services to select innovative biotech companies.

While all three competitors have robust drug pipelines, each of them displays a distinct focus. J&J’s pipeline includes a total of 98 programs as of July 20, 2023. It spans multiple therapeutic areas, with a significant focus on oncology. Notable drugs in development include AKEEGA (niraparib/abiraterone) for prostate cancer, ERLEADA (apalutamide) for high-risk prostate cancer, and DARZALEX (daratumumab) for multiple myeloma. Pfizer’s pipeline records a total of 112 candidates as of January 30, 2024. Its focus areas include vaccines, oncology, inflammation & immunology, and internal medicine. Some of the drugs in Phase 3 trials are for indications like lupus and breast cancer metastatic.

Pfizer’s oncology pipeline is particularly strong, with a variety of biologics, small molecules, immunotherapies, and biosimilars in development. Merck’s pipeline features over 80 programs in Phase 2 and more than 30 programs in Phase 3 as of February 23, 2024. Their therapeutic areas include oncology, respiratory, endocrinology, and antiviral treatments. Key drugs under review include gefapixant (MK-7264) for cough and KEYTRUDA (MK-3475) for various types of cancer. Merck also has a strong presence in antiviral research, with multiple programs in late-stage development for HIV-1 infection. Among the drugs mentioned, Merck’s KEYTRUDA stands out due to its already proven track record and its expanding indications for various types of cancer. As Merck’s patent for KEYTRUDA is expiring in 2028, drug producers working on the development of biosimilars (generic versions of biologic drugs) to KEYTRUDA are likely to benefit. However, neither J&J nor Pfizer are known to enact in such. Still, given that Pfizer has a dedicated division for biosimilars while J&J has had negative experiences in the form of settlement payments for lawsuits, Pfizer might have an edge over J&J in exploiting the patent expiry. Companies that have explicitly announced developing or launching KEYTRUDA biosimilars include NeuClone Pharmaceuticals and Samsung Bioepis.

The Sub Verticals within Healthcare

The overall healthcare industry can be split in two broad fields. First, healthcare equipment and services, comprising medical supplies, equipment, and services, such as hospitals and various medical firms. Second, pharmaceuticals, biotechnology, and related life sciences, mostly made up of industrial medical production and research firms. The healthcare equipment sector encompasses a wide range of products, from facemasks to surgical robots. Within the field of medical equipment, medical technology (MedTech) is increasingly playing a greater role. MedTech comprises healthcare products, services, and solutions that use technology to improve medical care and patient outcomes. This sector includes devices, software, and equipment designed to diagnose, monitor, treat, and manage medical conditions and diseases. Examples of MedTech products include diagnostic imaging systems, wearable health monitors, robotic surgery systems, and telemedicine platforms. The MedTech field plays a crucial role in advancing medical research, improving clinical procedures, and enhancing the quality and efficiency of healthcare. Due to the technological advancement within the recent years, especially in artificial intelligence (AI), MedTech is among the most promising fields within healthcare. Within the field of pharmaceuticals and biotechnology companies manufacture and sell drugs. However, while pharmaceuticals are manufactured using chemicals, biotechnology drugs use living organisms called biologics. Moreover, both are regulated differently due to distinct production processes.

Johnson & Johnson’s Bankruptcy Scandal

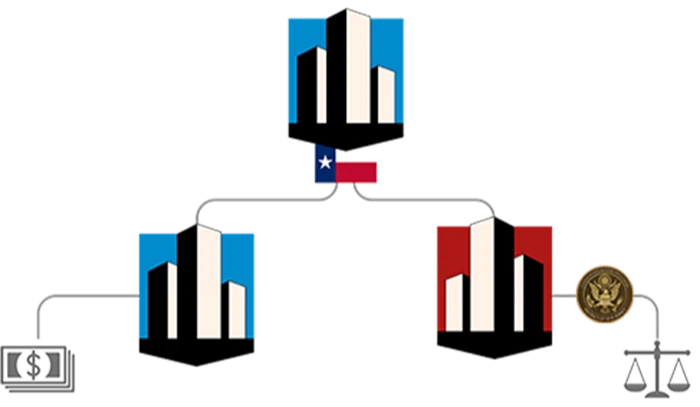

J&J has faced tens of thousands of lawsuits alleging that talc in its iconic baby powder and other products caused cancer. As a response, the healthcare giant attempted a “Texas two-step” bankruptcy manoeuvre, creating a subsidiary (LTL Management) to offload the talc liabilities and then filing for Chapter 11 bankruptcy. “Texas two-step bankruptcy involves using Texas’ divisive merger statute to split a company (including specific assets and liabilities) in two and thereby creating a subsidiary (a company owned by the original company, the so-called parent). Thereafter, the subsidiary files for Chapter 11 bankruptcy, which is most commonly used in restructuring distressed companies granting it more freedom to continue operation with no set liability limit or required income. The company may even move to a more favourable jurisdiction. As a consequence of filing for bankruptcy, the litigation process is put on hold and the parent company is not restricted in its pay-out policy (see depiction below).

Source: The Financial Times

This move was invalidated by an appeals court, which ruled that the subsidiary was not in financial distress and could not use the bankruptcy system to resolve the lawsuits. J&J agreed to pay $8.9bn to settle the claims, a significant increase from its original offer of $2bn before the bankruptcy scandal. About 60,000 talc claimants have agreed to the proposal. Despite the legal challenges and settlements, J&J has reiterated that its talc products are safe and do not cause cancer. Still, the distribution of the talc-based baby powder was stopped in the US in 2020. Consequently, production was announced to be ended globally. In 2023, J&J sold its consumer segment altogether and thereby shifted its focus to Innovative Medicine and MedTech.

The Headwinds & Tailwinds for the Healthcare Industry

The healthcare industry strongly depends on regulations. In the US, Biden’s Inflation Reduction Act (IRA) impacted the healthcare industry in three major ways. First, the “Medicare Direct Negotiation Provision” grants Medicare, a US health insurance program for elderly people and people with disabilities, among others, authority to negotiate prices for drugs with the producers directly. Second, the “Medicare Part D redesign” sets a cap to the price of out-of-pocket drugs at $2,000 per year ($35 per month for insulin). Third, the “Price Inflation Rebate” penalises drug manufacturers that raise the price of drugs covered under Medicare at a higher rate than change in Consumer Price Index for Urban Consumers (CPI-u). Another regulation that could come into force is the concept of march-in rights, allowing the government to “march in” and license patents arising from federally funded research to third parties if the patent holder is not making the benefits of the patent reasonably accessible to the public. The Biden administration has been considering this policy to address drug prices that are significantly higher than in other countries. This could lead to the government intervening in the market if a drug’s price is deemed excessive and not justified by the need for recovery of research costs. All the above restrict the market-based pricing abilities of healthcare companies operating in the US.

Following the pandemic, several regulatory changes impacted the healthcare industry in the EU. These include regulations such as the Clinical Trials Regulation (CTR), Medical Devices Regulation (MDR), In Vitro Diagnostic Regulation (IVDR), and the Artificial Intelligence (AI) Act. First, the CTR aims to harmonize the regulatory framework for conducting clinical trials throughout the EU. It introduces a single set of rules, replacing the inconsistent national rules created by the Clinical Trials Directive (CTD). This should streamline the approval process for clinical trials and encourage more research within the EU. Second, the MDR and IVDR introduce more stringent requirements for medical devices and in vitro diagnostics to “ensure a high level of health and safety”. They emphasize clinical evidence and post-market surveillance, which may increase the time and cost associated with bringing new devices to market. The IVDR, which came into force on May 26, 2022, replaces the IVD Directive and affects clinical trials that enrol diagnostic tests under this new regulation. Third, the AI Act aims to regulate the use of AI, including in medical devices. It defines mandatory requirements for the design and development of AI systems. Medical devices with AI components will need to comply with this act in addition to other relevant EU legislation. The act might affect compliance for products with AI components, posing challenges for conformity assessments. Moreover, it is most likely to restrict freedom of technology and thus innovation.

What is more, there is a global trend towards more stringent antitrust enforcement in the healthcare industry, with authorities closely monitoring M&A activity, price-fixing, market allocation, and other anticompetitive practices. Finally, VC investments play a great role in healthcare, especially when it comes to innovation. VC investments in healthcare peaked in 2021 due to the ongoing response to the COVID-19 pandemic and a surge in healthtech innovations. In 2022, VC investments began to experience a downturn from the highs of 2021. In 2023, a notable decline in VC investments in healthcare continued, reflecting broader economic pressures and a shift in investor focus on sustainability and efficiency in the investments. Early predictions for 2024 suggest that investments are stabilizing, with an emerging focus on new healthcare technologies and models, such as AI-driven solutions and longevity medicine, which may drive future investment trends.

What 2023 Meant for Healthcare

Despite several headwinds such as high interest rates, regulatory scrutiny, and macroeconomic uncertainty, which resulted in a decrease in both deal volume and value compared to 2022, M&A activity in the healthcare industry remained solid. Overall, worldwide healthcare transaction volume declined 13% from 2022 levels; nevertheless, this comparator period was a record year for health services deal volumes. 2023 volumes remain indeed at nearly twice the average annual levels seen from 2018 through 2020. Furthermore, deal total values dropped by approximately 40% (1) in 2023 compared to 2022, despite the fact that the sector continued to record a high number of megadeals. Lastly, since the end of 2021, the industry-wide EV/EBITDA multiples have been continuously declining. The average multiple for health services subsectors as of December 31, 2023, was 13.0x, compared to 13.8x and 15.9x, respectively, as of December 31, 2022, and December 31, 2021.

However, the sector turned out to be resilient, with its M&A activity declining significantly less than other industries. This is mostly due to the presence of innovative companies that can drive value, garnering significant investor interest. One significant trend was the move toward introducing the new AI technology in the healthcare companies’ operations by acquiring AI businesses. The potential advantages of AI, such as accelerating and decreasing the cost of drug discovery and development or even discovering whole new medications beyond the scope of conventional approaches, are considerable, even though the technology and applications of AI are still in its infancy. The most active sectors include pharma and life sciences, where deal volumes climbed by 2% but values jumped by 22% because of the rise in announced megadeals (transactions valued at more than $5bn) from 6 to 11 between 2022 and 2023.

In 2023, several industry-shaping deals occurred. Pfizer’s $43bn acquisition of Seagen [NASDAQ: SGEN], a global biotechnology company involved in the production and distribution of transformative cancer medicines, announced on 13th March 2023, is one of the largest. With this transaction the leading US-based company aimed to improve its expansion in the field of Oncology, which is believed by the management to be one of the main drivers for the firm’s growth. With the addition of Seagen, Pfizer’s Oncology pipeline doubled in size with 60 programs covering a variety of modalities such as ADCs, small compounds, bio specifics and other immunotherapies. Other significant deals include Bristol Myers Squibb [NYSE: BMY] $14bn buyout of Boston-based Karuna Therapeutics [NASDAQ: KRTX] announced in December 2023, mostly driven by the former’s interest in Karuna’s potentially ground breaking schizophrenia asset, and Merck [NYSE: MRK] $10bn acquisition of Prometheus Biosciences [NYSE: RXDX], revealed in April, with the main rationale being Merck’s expansion in immunology and diversification of its portfolio. Finally, AbbVie’s $10.1bn takeover of ImmunoGen is another noteworthy transaction. This acquisition was marked by a significant deal premium of almost 95%, primarily because it was strategically relevant for the acquirer since it allowed them to access the solid tumour market.

Due to this relatively high activity in this sector, advising on healthcare deals accounted for a significant portion of revenues for several investment banks, with a total of $1.2bn in fees collected. The top three banks by revenues in this industry in 2023 were J.P. Morgan [NYSE: JPM] (3rd place), Goldman Sachs [NYSE: GS] (2nd place) and the New-York based boutique Centerview Partners (1st place). Last year, Centerview completely dominated the healthcare advisory business, advising on several megadeals including Seagen/Pfizer ($43bn), Prometheus/Merck ($11bn), Oak Street/CVS ($3bn), Bellus/GSK ($2bn), CinCor/AstraZeneca ($2bn), ChiesiAmryt ($2bn), and Amerisource/OneOncology ($2bn). Some of the partners at the firm covering the sector include Richard Girling, formerly Merrill Lynch’s global head of healthcare investment banking, Andrew Rymer, Goldman’s former healthcare M&A chief, and Michael Muntner, former co-head of Credit Suisse’s healthcare group in the Americas. Eric Tokat, another partner of this division who joined Centerview in 2009 along with a group from Merrill Lynch that specialized in pharmaceutical and biotech companies, emerged as one of the top advisers on Wall Street and was appointed cohead of the investment banking division in April 2023 after the transaction spree.

The Johnson & Johnson Strategy

After having introduced the industry dynamics and relevant transactions, in this paragraph we will focus on Johnson & Johnson’s plans to grow, the firm’s recent transactions and how it differentiates from competitors. The company’s key distinguishing feature is its primary emphasis on the high-growth MedTech industry, where it is engaged in the production and distribution of robotic assisted solutions as well as engineered and intelligent treatments. The firm’s MedTech product portfolio includes orthopedic devices, surgical and interventional solutions, and eye health components. In Q1 2024, this segment generated sales of $7.8bn (out of total revenues of $21bn), up 4% YoY, showing the significant and constantly growing company’s concentration in this business.

A pivotal moment for the company’s expansion in the MedTech industry is represented by the $16.6bn acquisition of the New Jersey-based cardiovascular technology group Abiomed [NASDAQ: ABMD], announced in November 2022. Joaquin Duato, J&J’s chief executive, highlighted that this acquisition represented an important step in the firm’s commitment to expand in MedTech: “We have committed to enhancing our position in MedTech by entering high-growth segments. The addition of Abiomed provides a strategic platform to advance breakthrough treatments in cardiovascular disease and helps more patients around the world while driving value for our shareholders.” Abiomed’s principal product is the Impella heart pump, the world’s smallest heart pump used to sustain blood flow during high-risk protected percutaneous coronary procedures. Impella also received approval by the US Food and Drug Administration.

In December 2023, J&J held a conference with the investor community at the New York Stock Exchange to present the company’s overall strategy, broad and substantial Innovative Medicine and MedTech pipelines, and long-term financial prospects. According to Duanto “Science and technology will advance human health more in the next decade than it has in the last century, leading to more effective and personalized treatment, earlier intervention, and smarter, less invasive healthcare.” The company expects an expansion in the MedTech sector through its differentiated pipeline and geographic expansion. The markets where the company will mostly focus include interventional cardiovascular, robotics and digital. J&J also expects operational sales in the higher range of its markets to climb 5-7% by 2027, with new items accounting for one-third of sales in 2027. Furthermore, Peter Menziuso, company group chairman, analysed the IOL market (Intraocular Lens – artificial lens implanted in the eye during cataract and glaucoma surgeries), one of the major segments of J&J’s MedTech division, stating that: “The patient need in this category is high and continues to grow and the IOL market is valued at $3 billion today and is projected to grow 5 percent to 7 percent annually. There is a significant opportunity for us to grow the global IOL market.”

Finally, a few weeks ago (April 5th, 2024), J&J announced another deal in the MedTech sector, concerning the acquisition of the US-based medical device maker Shockwave Medical for $13.1bn. The deal will be financed through a combination of debt and cash on hand coming from the spin-off of its consumer health arm in 2021. J&J will pay a premium of approx. 3% over the closing share price of the announcement date and expects that the deal will reduce its adjusted earnings per share by 10% this year. The acquisition, which has been defined by Joaquin Duato as “a unique opportunity to accelerate our impact in cardiovascular intervention”, gives J&J access to a device that uses shockwaves to break down calcified plaque in heart vessels.

Outlook

High barriers to entry and established players make the healthcare industry a difficult one to navigate and when all the big players are heading in one direction, it begs the question: What do they know that others don’t? Our hypothesis on Johnson & Johnson is that they have been caught unprepared to ride the biotech wave that took the sector by storm in 2023 and thus chose an alternative method to try and keep up with its competitors. Focusing on MedTech has proved a successful endeavour thus far allowing the company to purchase interesting companies at very cheap valuations thanks to the unsaturated nature of that market. Furthermore, we hypothesize that Johnson & Johnson executives are trying to avoid competition with other big players and not participate in bidding wars for biotech and life sciences assets that often get purchased at steep premiums. After the Biden administration took a strong position in the sector, biotech might have been viewed as riskier and thus discouraged Johnson & Johnson from pursuing large transactions in an uncertain space going forward. Saying that, biotech does promise to be one of the fastest growing sectors of healthcare as drug pipelines improve and the industry consolidates. Pfizer, having one of the strongest pipelines looks the most promising from a drug point of view and with Merck’s Keytruda generating $25bn in sales in 2023 expiring relatively soon this could lead to a shift of power within the healthcare sector. For J&J to stick with its spending spree within the medical devices space, we think an interesting possible acquisition could be the Swiss American company Alcon [NYSE: ALC]. Having been spun out of Novartis [NYSE: NVS] in 2019, the company has a robust set of products focusing particularly on eye care. Other than their set of therapies focused on glaucoma they are also a large player within the laser eye surgery market which could prove useful moving forward if there is a generational increase of people undergoing this procedure. Overall, although the stock has suffered being down 6% YTD, we believe that by differentiating itself from its main competitors Johnson & Johnson could have a strong business outlook over the next couple of years.

0 Comments