Today we are living in a period of ultra-low and in many cases negative interest rates. This has been caused by strong expansionary policies by most central banks, especially in developed countries. In fact, in Japan and Eurozone central bank deposit rates are negative, in the UK and other European countries they are practically zero and the Fed funds rate is set at 0.25%-0.5%. In addition, massive QE programs have depressed yields on sovereign and investment-grade corporate bonds to a near zero or, in some cases, negative territory.

In such an economic environment, investors, be they mutual funds, pension funds or insurance companies, have started to look for alternative sources of yield. For instance, the US stock market has recently touched record highs (S&P 500 is at 2145). Moreover, the spread between High Yield bond market and governments bond has reached a historical minimum (around 400 bps). This is worrying many investors that a bubble is rising in the markets.

In addition, more and more funds have been poured into alternative investment vehicles such as Private Equity and Hedge funds. In fact, both Private Equity firms and Hedge Funds base their performance on total return, thus the judgement of their performance is not related to a benchmark but to the objectives laid out by the fund itself. In theory, they should provide high returns despite the market conditions (this is true particularly for Hedge Funds). For their services, both types of funds charge quite high fees: the most common structure is a 2% management fee and a 20% performance fee. The big question: is it a good strategy to invest in Alternative funds? Do they actually have had a superior return with respect to “usual” investments? Are they worth the fees they ask?

If we analyze the average returns for the industry, we see that the return in 2014 was around 20% for Private Equity firms and 9.3% for Hedge Funds, while the S&P 500 increased 13.56%. While Private Equity companies outperformed the S&P 500 and met investors’ expectations, according to a Preqin survey, Hedge Funds have lagged behind.

In 2015, both industries performed worse than in 2014: PE had returns around 13% and a lackluster 1.97% for Hedge Funds, against a 2.45% return from the S&P 500. This has triggered a massive withdrawal from Hedge Funds, causing many to fail and shut down. While the situation is better for Private Equity companies, there seems to be some trouble on the horizon as well. This can be observed from the fact that, despite a good level of capital raising, the level of “Dry Powder” (the amount of money that has not been invested) has an upward trend; this is probably due to the high valuation of stocks, which makes difficult for PE firms to achieve the desired IRR from the investments.

Source: BSIC

Source: BSIC

Now, we will focus on a subsector of both Private Equity and Hedge Fund business, which is Distressed Investment.

Funds operating in distressed investment invest in securities issued by companies in distress or in actual bankruptcy: buying at very low prices and betting that they are going to receive a good return if the company turns around or liquidates. In the first case, the value of the bonds increases due to the decreased risk of the firm. If such a strategy is particularly successful, it is not uncommon to see even 200% returns on single bets. In the second case, the fund thinks that in case of liquidation, the assets may be worth more than the price of the company’s bonds, thus making money on higher recovery rates than expected. There are two basic strategies:

- Buy bonds to participate in the negotiations with the goal of influencing the outcome;

- Buy debt at very low prices and then convert it into equity in order to decrease the level of leverage and restart operations as usual, this strategy is usually called loan to own.

How does this subcategory perform in comparison with “traditional” Private Equity firms and Hedge Funds?

The overall performance has been mixed in previous years: ranging from 16.85% in 2013 to -10% in 2015. This year, the Barclays index for distressed debt funds is up for 7.39%, adjourned at 21/09; thus, it seems to have rebounded.

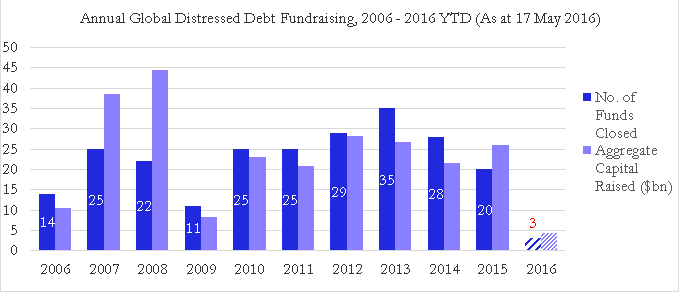

Despite the volatile performance, fundraising by distressed investment funds is increasing (reaching more than 26$bn in 2015). The likely cause for investors’ interest is the high number of non-performing loans in banks’ balance sheets, due to the difficult situation of the world economy. Thus, it is likely that investors want to exploit this situation, relying on the skills of fund managers.

Source: BSIC

Source: BSIC

Why are investors so eager to put their money in these vehicles which have shown quite volatile returns and require high fees for their, sometimes, less-than-stellar performance?

Historically, distressed debt funds have performed well during times of economic downturns, probably thanks to their ability to discern companies that have a future despite being in distress from those which do not. In addition, investors are so yield-starved that they accept more risk for returns that are higher than what conventional fixed income investment may offer.

Source: BSIC

Source: BSIC

In the chart we notice that the number of funds closed to new investments in 2015 was lower than in the previous 5 years, in fact only 20 funds stopped accepting inflows. On the other hand, it seems that, on average, the new funds were larger than in previous years as the amount of inflows climbed at the 2012 level of 28$bn.

This shift to alternative investments may be a great source of returns for investors, though it poses unquestionable risks; actually it is very difficult to do an in-depth analysis of this market, since many transactions are private and there are quite few public data available. In the future, we will continue to cover this market and provide a more accurate analysis of the risk-return tradeoff that distressed investment offers.

[edmc id= 4053]Download as PDF[/edmc]

0 Comments