Introduction

The mid-term elections are general elections which are held approximately at the mid-point of every US president’s 4-year term. This year they will be held on November 8th. Mid-term elections serve to select which party will take 33 or 34 out of the 100 seats in the US Senate, and all 435 seats in the US House of Representatives.

Mid-term elections are often key to policy certainty, as they determine whether the president will be backed by congress, thus if his policies will be passed or vetoed, as Republican and Democrat policies often differ and conflict with each other. Currently, the Democratic Party is in office, represented by President Biden. If Democrats take both the House and the Senate (what in the political jargon is called a Unified Government), stocks benefiting from the Build Back Better program could rise. If Republicans take both the House and the Senate, we could see a period of legislative gridlock, as policies from either party will not be passed. This outcome could have the opposite effect on the stocks benefitting from a Democrat victory. However, given the current situation, it is likely that political variables will have a negligible effect on the markets.

The latest polls and the consensus of projections have revealed that Republicans are likely to re-take control of the House, which is today narrowly under Democratic control (220/212), with three vacant seats. In contrast, it is predicted that Democrats will hold on to the Senate, which is currently split 50/50 leading to a divided government. These predictions are supported by the statistic that the party of a newly elected President has only gained seats twice in the last century, and in very particular years: 2002 and 1934, which followed the events of 9/11 and the Great Depression.

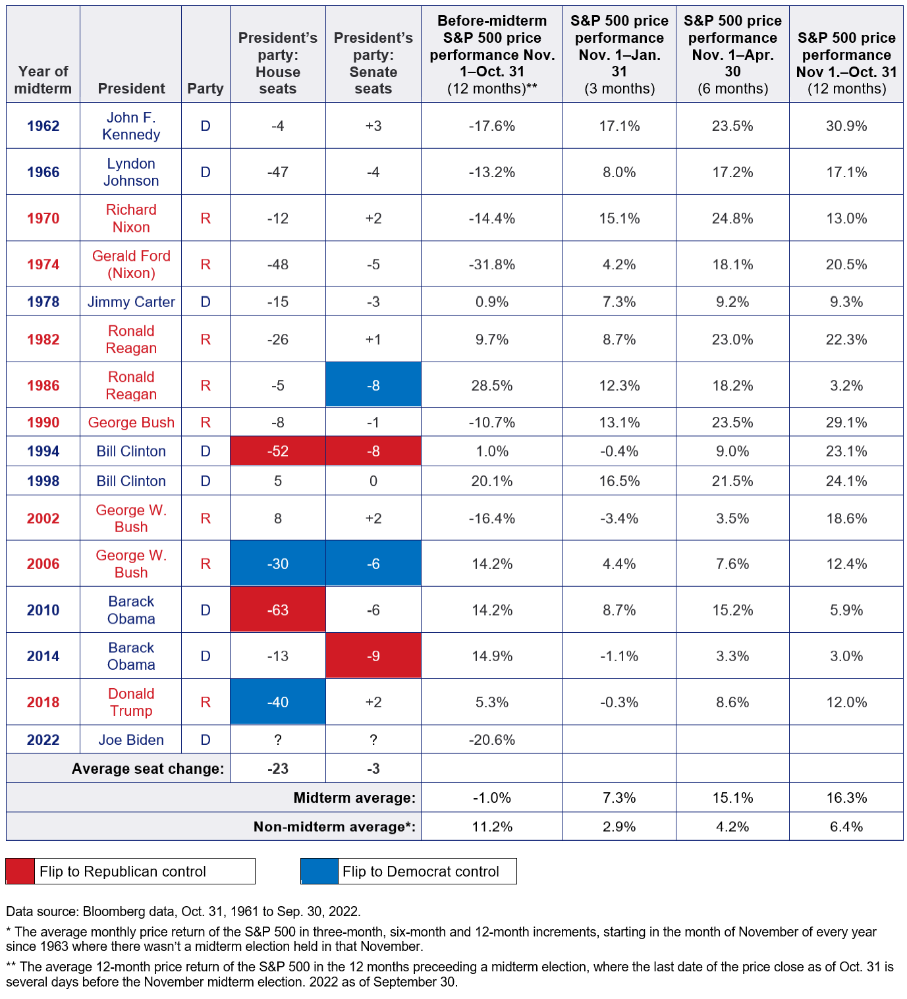

Historical Stock Market Performance Pre- and Post- Mid-Term Elections

Source: US Bank

If anomaly figures from the 1960s and 1970s, times shaped by high unemployment and inflation, are taken out of consideration from the table above, almost no relationship can be seen between mid-term elections, their results, and stock market performance. However, what can be retrieved from the table, is that in the last 40 years, the returns of the S&P 500 in the 12 months of pre- and post-mid-term elections have been 8.08% and 13.97%, respectively. The reason for the historical underperformance could be that leading up to elections, future fiscal policy is uncertain. This comes as a result of the potential leadership and representation changes that can occur in the country after elections. Overall, this environment causes investor sentiment to plunge, thus making the S&P 500 underperform. Normally, after an election, policy direction is clearer and investor sentiment picks back up, resulting in a better performance in the 12 months after mid-term elections. This phenomenon helps explain also why on average, markets in mid-term election years have been the most volatile in a presidential cycle for the last century.

On the other hand, three out of the four past mid-term elections (which have all resulted in split governments) have been characterized by better market performance in the twelve months before the election than the twelve months after the election. This supports the view that the performance of the market is affected much more by the overall socioeconomic environment, rather than policy uncertainty. This theory is also supported by this year’s election pre-electoral market performance, which is at historically low levels and is a result of the environment the economy is experiencing.

Historical Stock Market Performance Based on Congress Control

Another variable which could be analyzed to predict how the market will move after these mid-term elections is the combination of representatives which make up the government. In the table below, showing for how many years split or unified Governments have ruled, it is visible that unified governments, produce the highest return with Republican governments having edged Democrats by 2.4% since the year 1901. The current situation, with a Democrat President, is a historically favorable one in many ways. The weighted average of the returns of the possible government combinations with a Democrat president is 11.51%, which is 4.41% higher than the weighted average of the combinations possible with Republican presidents (7.1%).

These figures cannot be used to predict the movement of the market in the next 12 months, as each outcome does not have an equal chance, and because of many global socioeconomic events which are characterizing our economy. However, polls are suggesting that Republicans will take at least one of the bodies of Congress during the upcoming elections; this seems to be a historically good combination for markets, in fact, the two best performances happened under a Democrat President and a unified Republican Congress (13%), and under a split Congress (13.6%).

Source: Bocconi Students Investment Club

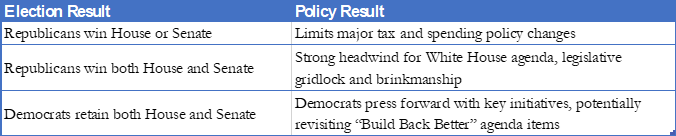

As mentioned, mid-term election results can have a large impact on the legislative policy path in Washington. Possible election outcomes this fall include the Republicans regaining control of both the House and the Senate, Republicans winning either the House or Senate but not both, and Democrats retaining control of both houses, which would be a material divergence based on historical precedent.

Potential outcome #1: Republicans gain control of both the House and Senate

Should Republicans win both the House and Senate, legislative gridlock and a more limited range of tax policy are likely. This means that tax increases, legislation on tech companies, fossil fuel regulations and further bills on climate or the environment are all likely to be off the table for the foreseeable future. A Republican-controlled House and Senate would likely enact only must-pass legislation such as government funding or a national defense authorization act, posing challenges to plans such as the Biden Administration’s recent student loan debt relief plan. In addition, while a Republican sweep of Congress could cloud the outlook for any healthcare legislation or Medicare for All, it does not necessarily mean that the recently passed Inflation Reduction Act is likely to be repealed.

Potential outcome #2: Divided government, Republicans take control of the House, Democrats retain control of the Senate

This outcome is likely to be the least consequential for markets. A divided government epitomizes the checks and balances system. A divided government would not be likely to pass any legislation that falls too far from the center of the political spectrum. This means that major legislative packages aimed at higher taxes for individuals or corporations, for example, would likely be off the table for at least the next two years. However, a divided government would also mean that any fiscal rescue package in the event of an economic downturn would also be less likely. It is difficult to expect a divided government outcome to be a market mover, at least not in the near term.

Potential outcome #3: Democrats retain control of both the House and the Senate

A potential Democrat victory retaining control of both houses of Congress is not the most likely outcome in prediction markets. However, it is no longer as remote a possibility as the scenario appeared in June when markets predicted a 90% chance Republicans would retake the House and 75% odds of recapturing the Senate. A Democrat sweep result would represent a historical outlier event (only once in the past 15 midterm elections) and turn attention back toward a potentially more sweeping policy agenda. This scenario re-opens the potential for a fuller range of policy outcomes, these include additional fiscal stimulus for expanded access to healthcare and housing aid, as well as increased support for lower-income families and children. These spending priorities could lead to revived tax proposals aimed at high earners, who narrowly avoided increases to individual income taxes, capital gains taxes and other wealth-related taxes earlier this year. In addition, Democrats could intensify regulatory scrutiny of the financial and technology industries, likely increasing businesses’ compliance costs and weighing on their stocks in the near term.

Source: Bocconi Students Investment Club

Republicans gain control of both the House and Senate – Where to focus on

Republicans plan to push for expanded domestic energy production if they take the majority and will try to use voter frustration over high gasoline prices to get the Biden administration to go along. The House Energy and Commerce Committee will look to boost the development of hydrogen projects, streamline permitting and development of nuclear power plants, and accelerate approval for liquefied natural gas export facilities. Those measures, if enacted, would benefit companies such as nuclear operator Southern Co. (SO), uranium miners Cameco Co. (CCJ), small modular reactor maker NuScale Power Corp.(SMR), and liquefied natural gas exporter Cheniere Energy, Inc.(LNG). This would also benefit drillers like Halliburton Co.(HAL) and oil producers such as Exxon Mobil Corp. (XOM). Opposingly, Republicans are already scrutinizing hundreds of billions of dollars in lending authority that Biden’s Inflation Reduction Act gave to the Energy Department. Meanwhile, carmakers’ desire for an additional $7 billion in spending on electric vehicle charging stations, favored by companies like General Motors Co. (GE) and Ford Motor Co.(F), is likely to be ignored by GOP lawmakers.

With a Republican Congress, Silicon Valley would be spared from legislation aimed at anti-competitive behavior by tech companies such as Apple Inc. (AAPL), Amazon.com Inc. (AMZN) and Alphabet Inc.’s Google (GOOGL). The bill has sponsors in both parties and has been cleared by key House and Senate committees, yet the tech industry has helped to stall the measure’s progress with a campaign that has topped $100 million.

Hospitals, insurers and pharmaceutical benefit managers face the prospect of tough new regulations pushed by a Republican Congress, with the possible support from Democrats and the Biden administration. GOP lawmakers have promised to beef up requirements that hospitals post their prices online and lower drug costs by targeting drug industry middlemen known as pharmaceutical benefit managers. Three pharmaceutical managers make up more than two-thirds of the total US market: Express Scripts Inc., CVS Health Corp. (CVS) and OptumRx Inc. At the same time, HCA Healthcare Inc. (HCA) and Tenet Healthcare Corp.(THC) are hospital companies that may be affected. Many Democrats remain frustrated by the limited nature of the drug price negotiation provisions for Medicare in the Inflation Reduction Act, with just 10 drugs coming under negotiation in 2026. Expanding that power is unlikely under GOP control. Johnson & Johnson (JNJ), Pfizer Inc. (PFE) and Eli Lilly & Co.(LLY) have products that Medicare spends heavily on.

In addition, the next Congress will need to pass a five-year Farm Bill governing direct agricultural subsidies, crop insurance, food stamps and conservation programs. The 2018 farm bill authorized $428 billion in spending over five years. Renewing the farm bill, a pillar of domestic agribusiness could be more difficult under GOP control since some conservatives want to see farm subsidies cut while maintaining spending. The GOP has previously targeted nutrition programs over eligibility requirements and conservation programs. Food stamps help boost sales of groceries at retail chains such as Walmart (WMT) and Kroger Co.(KR) by providing low-income recipients with a way of buying more food. Direct federal government payments are a significant contributor to farm profits, accounting for between 18% and 48% of annual net US farm income, according to the US Agriculture Department. The extra income for farmers helps boost sales for seed, pesticide, fertilizer, and equipment providers benefitting companies such as The Mosaic Co. (MOS) and Deere & Co. (DE). It also reduces costs for major grain buyers such as Archer-Daniels-Midland Co. (ADM) and meat and poultry processors such as Tyson Foods Inc. (TSN).

Divided government – Bipartisan Cooperation

Even in a more divided government, there could be room for bipartisan cooperation on several key policy priorities, with the potential to create new opportunities and risks for investors over the next two years or more.

As the war in Europe continues, there could be bipartisan agreement on potential hikes in federal military spending, as the U.S. seeks to catch up with foreign adversaries. From 2000 to 2020, China boosted annual defense spending by 513%, while U.S. spending rose just 64%, spurring the Biden administration to cite Chinese military growth as a new benchmark for future U.S. military spending. However, Republicans have complained that the Biden administration underfunds weapons systems, and the party will be under pressure to ensure that the military’s budget keeps pace with inflation. There could be opportunities for the biggest US defense contractors including Lockheed Martin Corp.(LMT), Raytheon Co.(RTX) and General Dynamics Corp. (GD).

Cybersecurity threats from foreign countries are growing substantially. It is reasonable to expect federal spending on cybersecurity to increase over time as cyber-related threats mount, creating a bullish environment for cybersecurity stock, such as Crowdstrike Holdings (CRWD), Fortinet (FTNT) and Palo Alto Networks (PANW).

Lastly, concerns about inflation-fueling supply disruptions are adding momentum to a broader trend of returning manufacturing to the United States. Federal efforts to strengthen domestic production, such as investments in the U.S. semiconductor industry, are expected to grow. In 2022 and 2023 alone, capital investment in U.S. factories is expected to increase by 7.5%. U.S. semiconductor companies could benefit from federal legislation that would incentivize more manufacturing at home, boosting companies such as Intel Corp. (INTC), Texas Instruments Inc. (TXN) and Micron Technology Inc. (MU).

Risks

Even if you correctly predict the outcome, the investment implications are far from certain. Although one party may control both the executive and legislative branches, numerous factors may limit the scope of what that party will be able to accomplish. Both domestic and economic factors, as well as external geopolitical factors, may arise to derail the attention of the controlling party. It can also be especially precarious to project the exact timing of when that party will be able to enact new legislation and then how quickly that related spending will occur. For example, following the 2020 elections, it took one and a half years for the Democrats to pass legislation that boosted spending on renewable energy. Once it was clear that this legislation would pass, the stocks of companies focused on renewable energy immediately rose.

0 Comments