USA

Major market indexes registered significant losses for the fourth consecutive week, highlighting April 2022 as the worst month for the markets since March 2020. The S&P 500 is still in correction territory, losing 8.8% in the last month, and being down approximately 14% from its January all-time highs. Once again technology stocks led the sell-off, as demonstrated by the technology-heavy Nasdaq Composite that remains in bear market territory after notching its worst monthly performance since October 2008, closing at -4.5% on Friday, for an overall -13.3% this month.

Multiple earnings misses of companies that have an enormous weight on markets were the main drivers of such performances, as future growth fears arise. Amazon and Google reported weak results, with the former’s first quarterly loss since 2015 (even though it was largely influenced by a $7.6bn loss on its investment in the electric vehicle maker Rivian), and the latter’s revenue miss, arising mainly from YouTube advertisement slow-down. Even Apple declined on earnings despite its record revenue, as investors are concerned about the cautious guidance due to supply chain issues.

Interestingly, a vast majority of the sectors represented in the S&P 500 have fallen from their top back to around pre-pandemic levels, with the exception of technology and energy. Nonetheless, these two sectors are experiencing completely different situations in recent months.

Sources: BSIC, Yahoo Finance

With respect to economic data, first quarter GDP contracted 1.4% versus expectations of a 1.1% growth, largely affected by falling inventory investments and a deteriorating trade balance. However, it seems early to expect an imminent recession as consumer spending and business investment continue to grow. The core personal consumption index (PCE), a Fed’s favorite to measure inflation, rose to a 40-year high of 6.6%, while the labor market remains extremely tight.

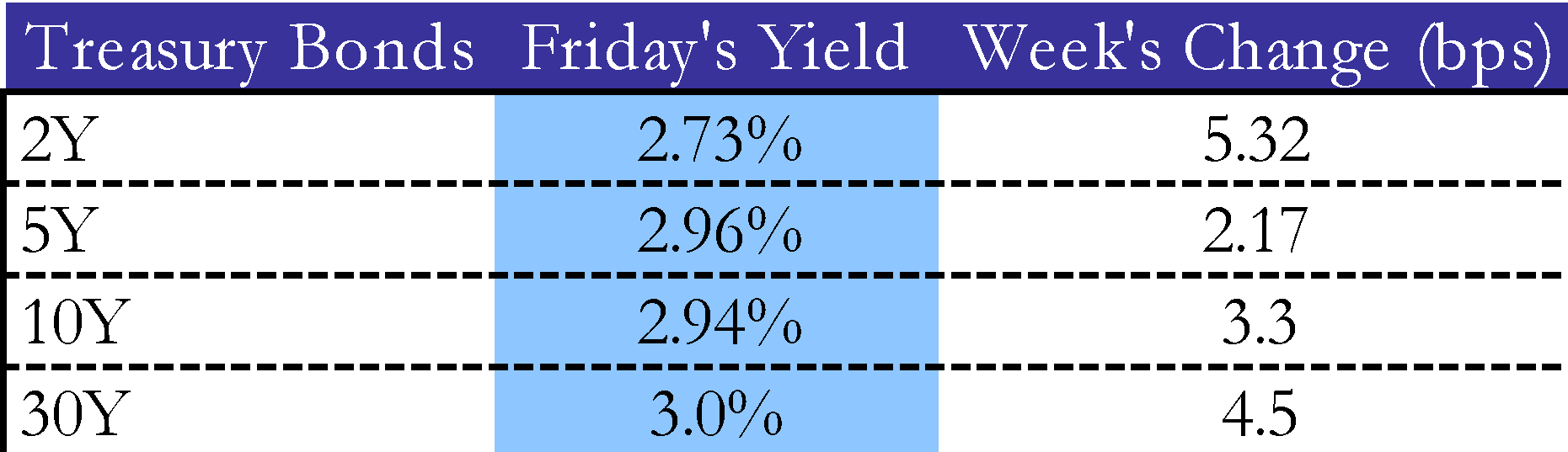

It was almost a neutral week for the 10-year US treasury yield, which closed at 2.94. All eyes are on the May 4th Interest Rate decision of the Federal Reserve, with Fed funds futures that are pricing in a 50bps hike. The possibility of a 75bp hike in June or July should not be excluded; however, the Fed will probably present a less aggressive proposal as a consequence of the first quarter GDP numbers. The timing of the route to the “neutral” level of monetary policy described by Powell is still uncertain, with analysts identifying this neutral rate between 2.25 and 2.5%.

Sources: BSIC, Yahoo Finance

To conclude with fixed income: cash outflows from municipal bond portfolios continue as the market underperforms US treasuries, and investment-grade corporate bonds have traded lower, affected by geopolitics, consumer confidence and earnings.

Europe and UK

The week started with the positive news of President Macron being re-elected for another five-year term on Sunday, after concerns of far-right nationalist Marine Le Pen growing popularity. This contest was of great importance as a different outcome could have brought tension in the western countries’ alliance.

The European Union is currently working on a new package of sanctions against Russia, which should include an oil embargo to target the country’s revenues while trying to minimize the inflationary effects. A fundamental turning point has been Thursday’s news from Germany, as the country is now ready to stop buying Russian oil. Germany had already impressively slashed its dependence on Russian supplies from a 35% pre-war level to 12%, and German officials have now lifted their opposition to an oil ban after reaching a new deal with Poland (it will allow Germany to import from other global suppliers through the Polish port of Gdansk).

In addition, the European economy’s expansion slowed in the first quarter of 2022, recording a 0.2% growth which was clearly affected by Russia’s invasion of Ukraine and its consequences on commodity prices. As of April, Inflation has reached 7.5%, its highest level since the launch of the euro.

European stocks held up better compared to U.S. markets, with the STOXX Europe 600 Index that slid 0.64% for the week. Major indexes recorded mixed performances with the German DAX, the French CAC 40 and Italy’s FTSE MIB closing slightly negative, while the UK’s FTSE 100 gained 0.3%.

Sources: BSIC, Yahoo Finance

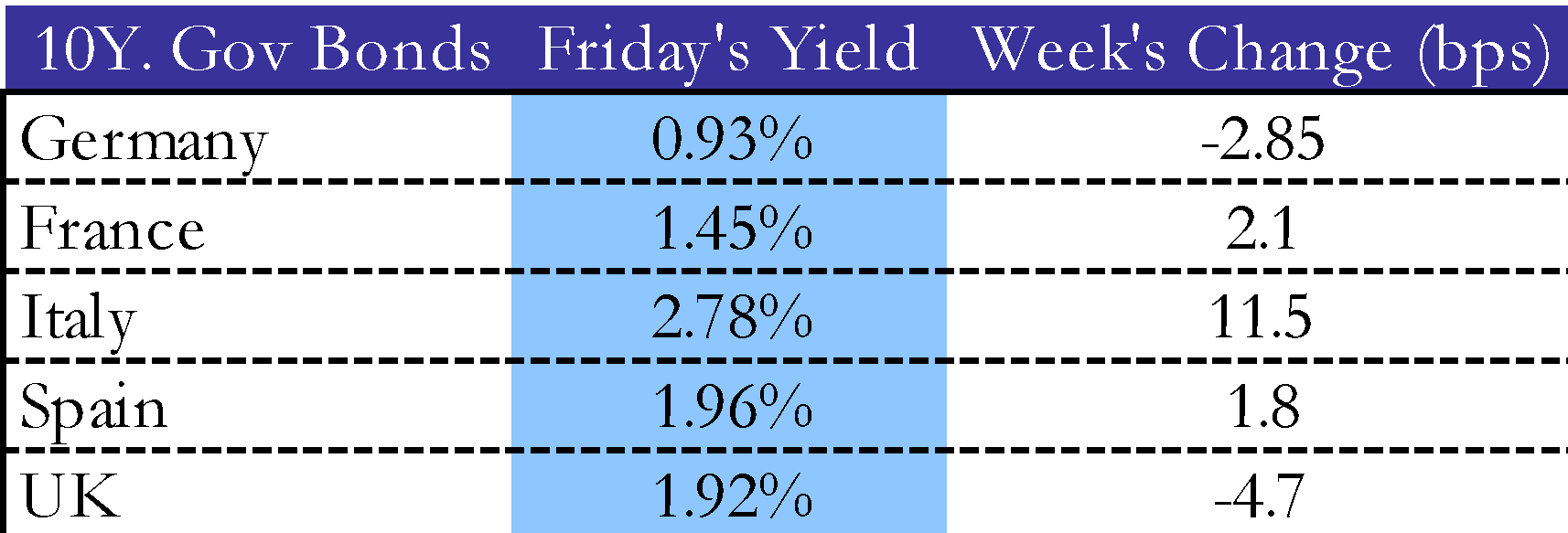

Increasing demand for high-quality government bonds led to a decline in Germany and UK’s yields, as economic growth weakens. The European Central Bank remains determined to tackle inflation more gradually than the U.S. Federal Reserve, even though markets are pricing a possible hike as soon as July. This rate hike would be the ECB’s first in the last decade. Nonetheless, markets’ expectations of the deposit rate approaching positive territory by the end of this year from -0.5% still leave the European Central Bank far behind the Fed’s schedule.

While the US Federal reserve is planning to start reducing its $9tn balance sheet in June, the ECB is not planning to intervene before late 2024. President Lagarde sustains that the weight of energy prices on European inflation justifies a different approach from that of the Fed, allowing for a softer policy shift.

Sources: BSIC, Yahoo Finance

Rest of the world

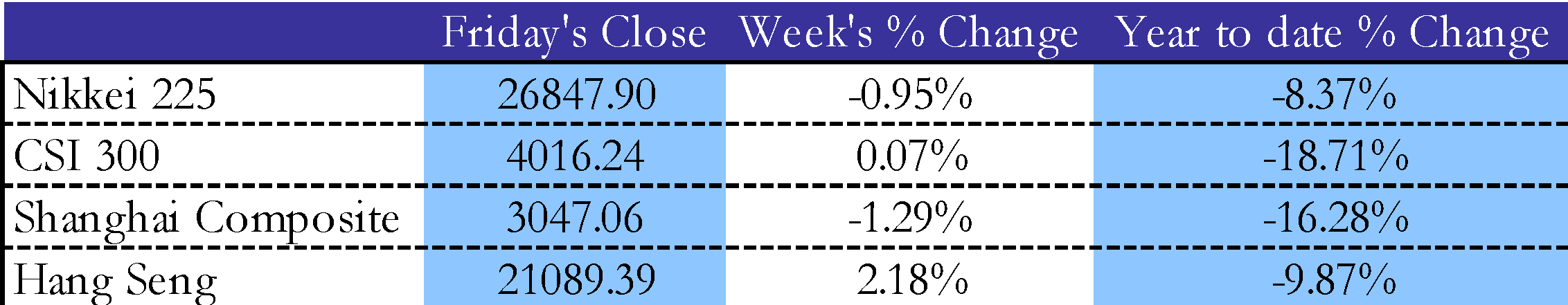

The Bank of Japan maintained its dovish stance during April’s meeting, with interest rates that will remain at their near-zero levels and asset purchases set to continue. The BoJ’s expansionary focus was reinforced by the announcement of a daily fixed rate bond buying program instead of the previous ad hoc basis. Consequently, Japanese 10-year yields further declined to 0.21%. Despite the yen being at its 20-year lows versus the U.S. dollar, the Bank of Japan continues to act in the opposite direction with respect to other major central banks.

The BoJ also increased its forecasts for inflation and lowered its economic growth outlook due to increasing commodity prices and the weakening of foreign economies. The government announced a $48.5bn package to moderate the impact of prices on consumers and companies.

As for China, concerns about the economic impact of President Xi Jinping’s zero-tolerance covid policy continue: the count of manufacturers warning of uncertain growth outlooks and supply chain disruptions is accumulating, while some residential areas are slowly reopening. However, major indexes closed the week on mixed performances.

On Friday, the Politburo (Central Political Bureau of the communist party of China) promised a series of measures to boost economic stimulus in order to reach the economic growth target for the year of 5.5%, which however remains unlikely considering the current global scenario. The commitment is oriented toward infrastructure construction, domestic demand, jobs, and tax cuts. In the meantime, foreign investments continue to decline, with the Chinese yuan under pressure.

Sources: BSIC, Yahoo Finance

Brazil’s Bovespa and Mexico’s IPC index continue to fall with inflation readings of respectively 11.3% and 7.5% year-over-year. Brazil’s inflation rose by less than forecasted according to recent month-over-month data, but still accounted for the steepest increase in the last 27 years for the period, with the strengthening of the dollar that is raising import prices. What’s more, global bottlenecks will probably worsen the situation in the coming months. Mexico’s inflation is at a two-decade high too. The government is set to release a plan to moderate basic goods prices on May 4, aiming at an approximate 20% cut.

Interestingly, on Wednesday, Brazil became the first South American country to launch a Bitcoin law that would provide the government with the necessary power to prevent the use of cryptocurrencies for money laundering and other illegal activities.

Turkey’s central bank continues with its cheap borrowing policy, completely disconnected from the rest of the world. While the Lira remains stable, inflation is out of control, surging to a year-over-year 61.1% high, which is three times the initial estimate.

Sources: BSIC, Yahoo Finance

FX and commodities

This week the dollar has shown enormous strength with respect to all major currencies. There are multiple causes that account for this scenario. The USD is mainly benefitting from the hawkish Fed as Treasury yields and real rates rise. In addition, the dollar is getting a safe haven bid with Treasuries (i.e., it is expected to retain or increase its value during a market turbulence) due to concerns about global growth. It should also be considered the current weakness of the euro, as the Russia-Ukraine conflict persists, and the ECB remains behind the Fed in raising rates. Finally, the yen continues to be under pressure, and also China’s yuan weakens as the covid outbreak spreads. All these reasons are contributing to the US dollar index hitting a twenty-year high.

Both WTI Crude Oil and Brent Crude Oil closed the week above $100 per barrel, recovering from Monday’s losses and continuing to trade in tighter price ranges. Gold has fallen this month as geopolitical risks and inflation concerns were countered by the Federal Reserve’s monetary tightening.

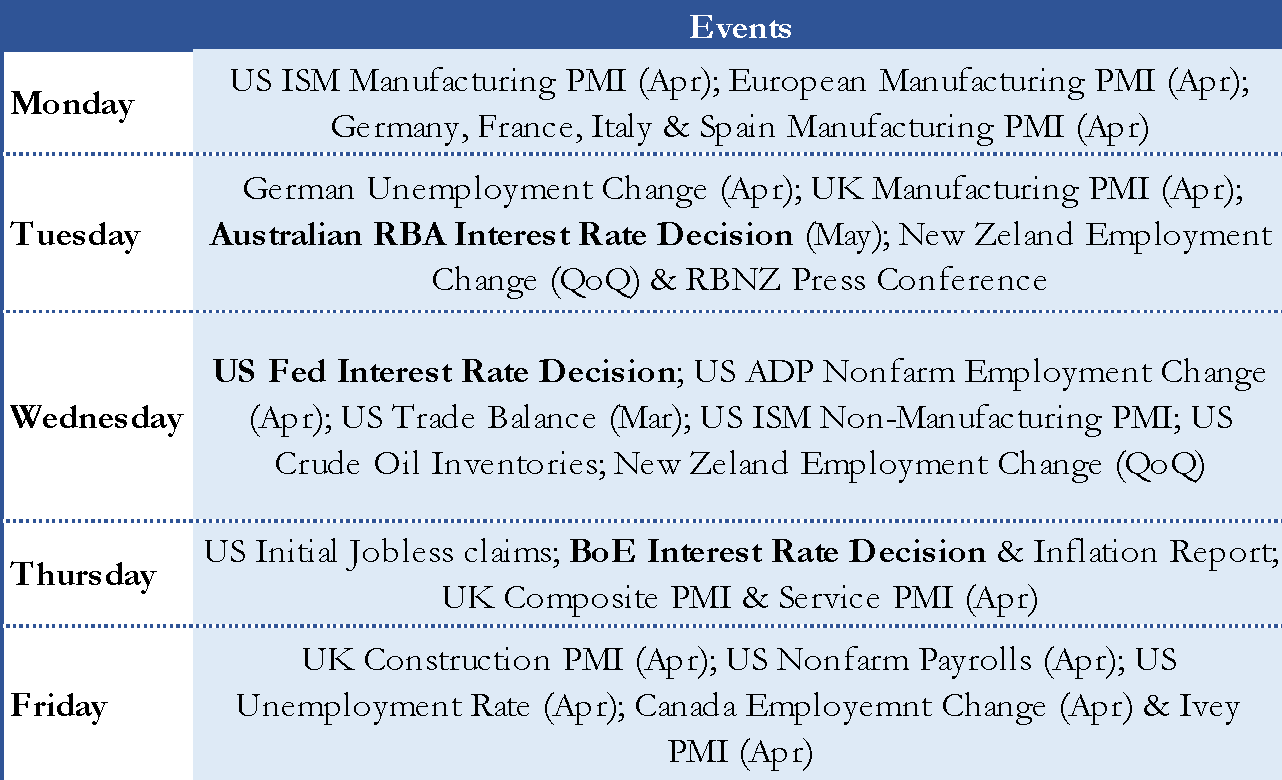

Next week main events

Next week investors will be paying close attention to the three crucial meetings of the U.S., U.K., and Australia’s central banks, where their interest rate decisions will be announced. In particular, an unexpected decision of the Federal Reserve would obviously have significant impacts on global markets: current Fed funds futures are pricing 50bp hikes, as a consequence of recent commentary from Fed officials. In addition, we also have the release of several manufacturing PMIs, which measure the activity level of purchasing managers in the manufacturing sector and represent a leading indicator of economic performance.

Source: BSIC, tradingeconomics

0 Comments